Together with

Good Morning,

Tesla shares dropped 9% following news of potential layoffs, Clubhouse is laying off staff members too, Frontier offered a $250M breakup fee in the Spirit deal, Walmart is opening new fulfillment centers, FC Barcelona may sell TV ad rights to BofA, and bitcoin miners are selling the dip.

ICYMI: Jack Raines will be writing a weekly Exec Sum opinion piece every Saturday. Check out his first article, covering Tesla's return-to-office mandate and possible layoffs, here.

Let's dive in.

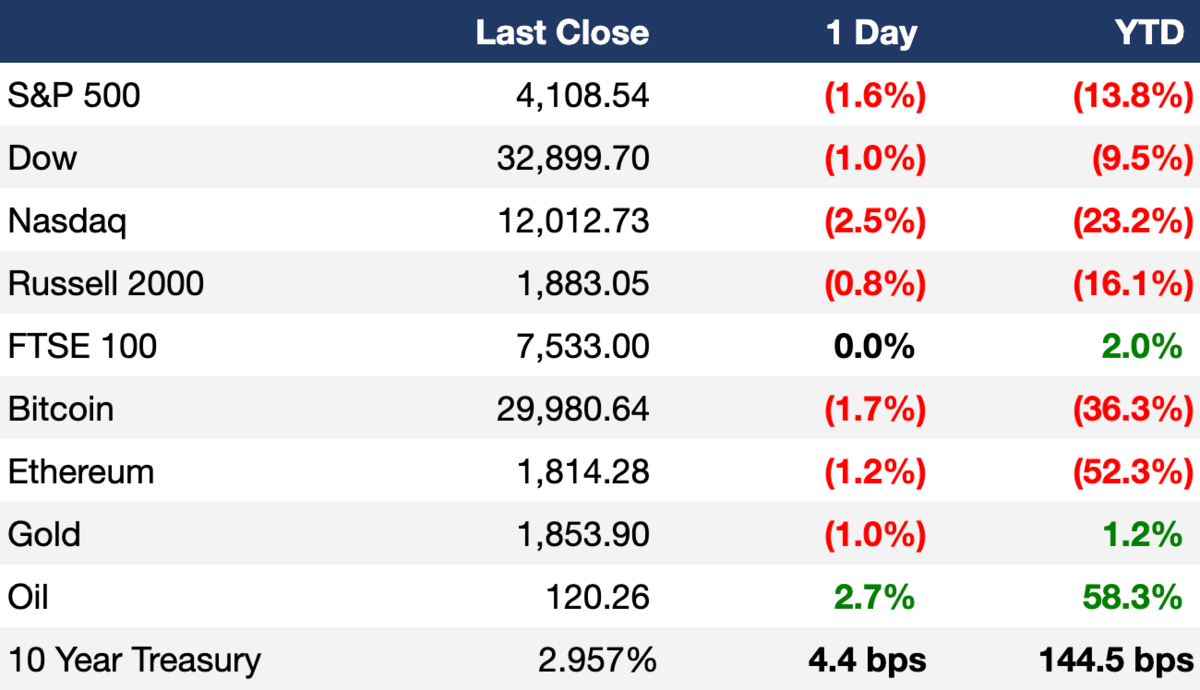

Before The Bell

As of 6/3/2022 market close.

If you want to learn more about crypto trading strategies and the world of DeFi, check out our Foot Guns newsletter.

Markets

US stocks slid Friday, reversing hopes of a positive week for the major averages with all three closing in the red following a stronger-than-expected jobs report

Nonfarm payrolls added 390K jobs last month (vs 328K expected)

Average hourly earnings rose 0.3% in May, slightly less than the 0.4% estimate

Earnings

What we’re watching today:

Mon: GitLab

Thursday DocuSign

Full calendar here

Headline Roundup

Audio app Clubhouse lays off staff as strategy shifts (BBG)

Co-head of Citi’s Chicago office departing for Jefferies (BBG)

Frontier offers $250M break-up fee in Spirit Airlines deal (RT)

US lobbies UK to reconsider Chinese chip factory deal (WSJ)

Tesla shares dip 9%+ on Elon Musk’s plans to cut workforce (CNBC)

Walmart to open high-tech fulfillment centers to ship online orders fast (CNBC)

Abbott says it’s restarting baby formula production in Michigan (BBG)

Allianz takes $430M profit hit in retreat from Russia (BBG)

FC Barcelona in talks to sell TV rights to BofA, confidential says (BBG)

‘Tiger King’ star Doc Antle to face money laundering charges (BBG)

Bitcoin miners are selling tokens as prices linger near lows (BBG)

Musk deal for Twitter dodges lengthy US antitrust review (RT)

Individual income tax payments on pace to reach record level (WSJ)

White House postpones Biden’s trips to Saudi Arabia and Israel (CNBC)

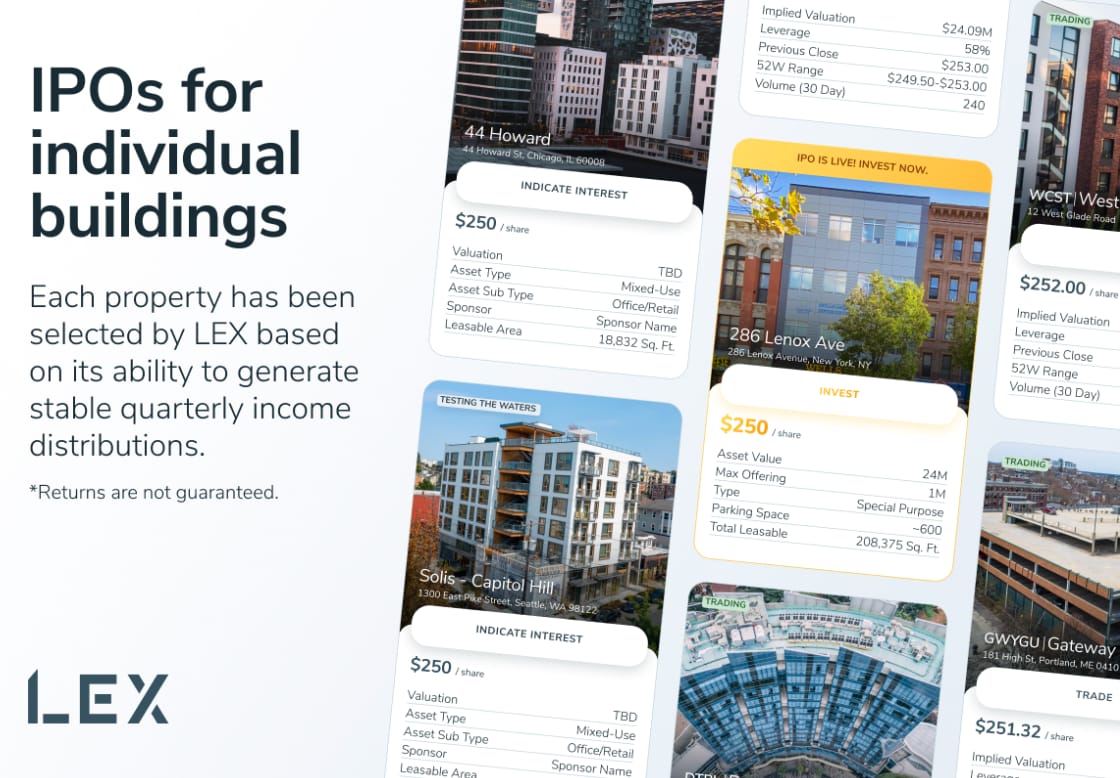

A Message From Lex

JUST BECAUSE THE S&P IS FALLING DOESN’T MEAN YOUR PORTFOLIO SHOULD

War, inflation, interest rates, and a million other variables make stocks volatile. Luckily, a building is still a building. Commercial real estate is your answer to hedging inflation and diversifying your portfolio. That’s why we're excited about LEX.

Truth is, the best deals in real estate are hard to find, unless you shorted Russian stocks all the way to accreditation (legend) and now you have access. Even then, you’ve got scarce deals, crowdfunding, or REITs to pick from…until LEX.

LEX IPOs buildings so you can get in the game.

By taking buildings public, LEX has created a way for you to invest in marquee commercial real estate. Build a portfolio by picking the buildings you want to invest in. Each building gets a ticker and trades like your other stocks.

The best part? As a shareholder, you can get paid dividends flowing from the rent paid by the tenants. You can also earn tax advantaged passive income and trade without lockups.

Check out LEX’s live assets in New York City and upcoming IPO in Seattle.

Deal Flow

M&A / Investments

VC

Traveloka, Southeast Asia’s biggest online travel startup, is close to raising $200M+ from new investors after ending SPAC merger talks (BBG)

South Korean AI chip maker Rebellion raised a $50M Series A led by Temasek’s Pavilion Capital, Korean Development Bank, and others (TC)

Agtech robotics firm Farmwise raised a $45M Series B led by Fall Line Capital and Middleland Capital (TC)

Reco, a startup preventing data leakage, raised a $30M Series A led by Insight Partners and Zeev Ventures (TC)

Hourly.io, a worker’s comp and payroll startup, raised a $27M Series A led by Glilot Capital Partners (PRN)

Intercity bus network company Kolors raised $26M in funding, including a $20M Series A led by UP.Partners (PRN)

Pluto, a free investing platform that makes it easier for traders to incorporate systematic investing strategies, raised a $4M seed round led by at.inc’s NadavEylath (PRN)

IPO / Direct Listings / Issuances / Block Trades

Banco BAI, Angola’s biggest lender, raised $94M in the African nation’s first-ever IPO (BBG)

Debt

Nigeria shelved plans to raise ~$950M selling overseas bonds due to unfavorable market (BBG)

Fundraising

Bosch's VC arm announced a $295M fifth fund aimed at ‘improving quality of life and conserving resources’ (TC)

Crypto Corner

Exec's Picks

A diversified portfolio is the best way to navigate volatile markets, but diversification is more than owning several different stocks. True diversification is across multiple asset classes. Franchises provide passive income from cash-flow positive businesses, and FranShares gives anyone access to this asset class. Invest in your first franchise here!

Over the weekend, The Information's Erin Woo dropped a bombshell article breaking down Bolt's fundraising woes and operational challenges. Check it out here.

The Hiring Block

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We've got 40+ jobs spanning IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

Meme Cleanser

Catch the latest episode of our Big Swinging Decks podcast, presented by CoinFLEX.US, on Spotify, Apple, and YouTube 🤝