Together with

Good Morning,

Real estate services became the latest AI Grim Reaper victim, the software selloff is disrupting some M&A and IPO deals, carve-outs may be the big theme for 2026 M&A, CME plans to launch rare earth futures, Bill Ackman took a huge stake in Meta, and Musk reorganized xAI after six of twelve co-founders departed in the past year.

Mizuho published some insightful findings on the late-2025 biotech comeback and outlook for the sector ahead. Read it here.

Let's dive in.

Before The Bell

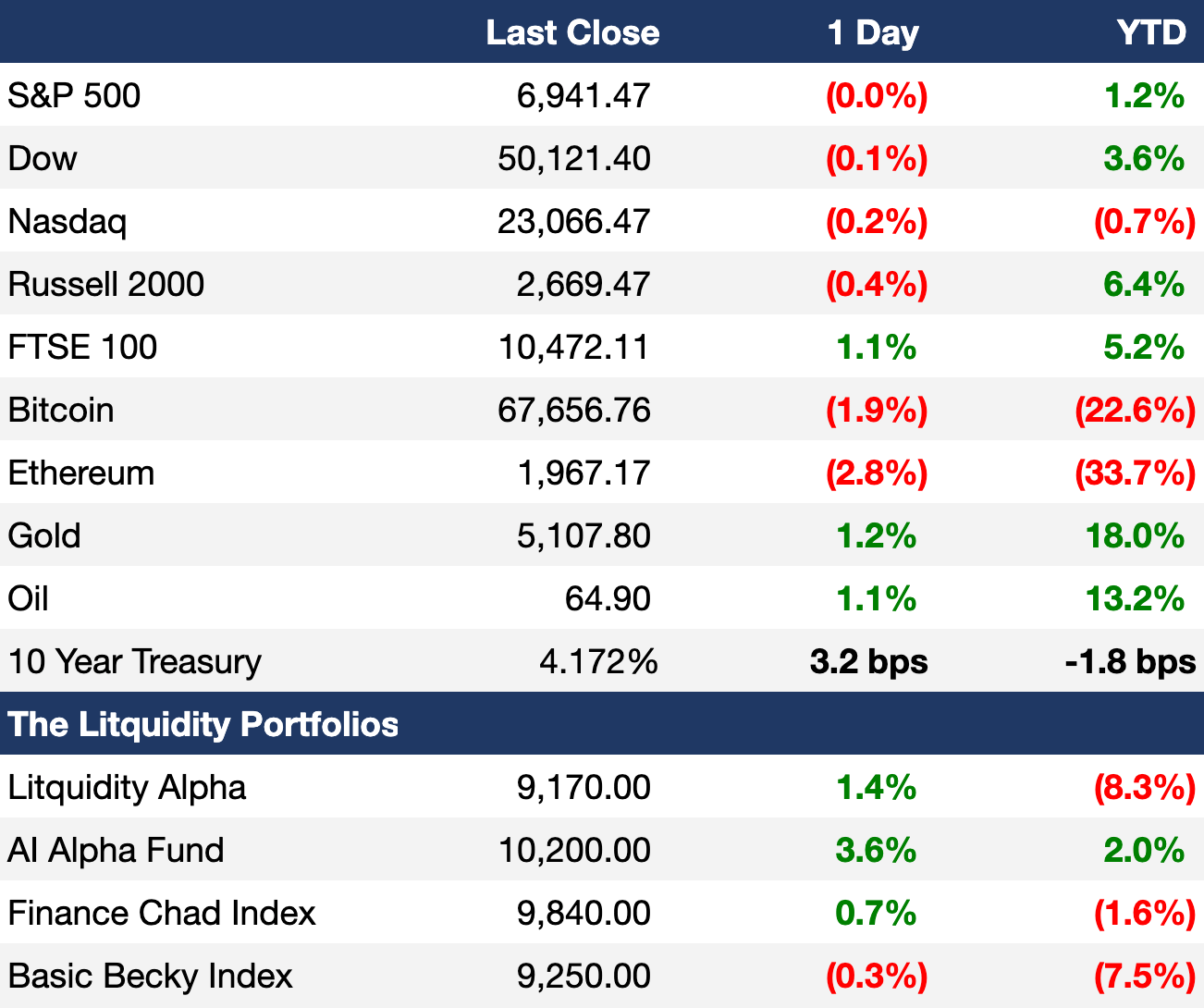

As of 2/11/2026 market close.

Learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks closed flat yesterday as traders digested a solid jobs report

UK's FTSE 100 hit a fresh ATH

US 10Y yield hit a five-week low

Earnings

McDonald's beat Q4 earnings and revenue estimates as its value strategy won back customers and pushed US same-store sales growth to 6.8% (CNBC)

Shopify beat Q4 revenue estimates on record spending in 2025 but missed on earnings and guided lower margins due to investments in AI (CNBC)

AppLovin issued a Q4 beat-and-raise with revenue surging 66% on strong demand for its advertising services and AI powered tools (YH)

Cisco beat Q2 earnings and revenue estimates, but issued a tepid margin forecast due to increasing costs from a memory-chip shortage (CNBC)

Kraft Heinz beat Q4 earnings estimates but missed on revenue and halted plans to split the business for a $600M turnaround instead as challenges look 'fixable and within control' (CNBC)

What we're watching this week:

Today: Coinbase, Brookfield, Rivian, DraftKings, Applied Materials

Friday: Moderna, Wendy's

Full calendar here

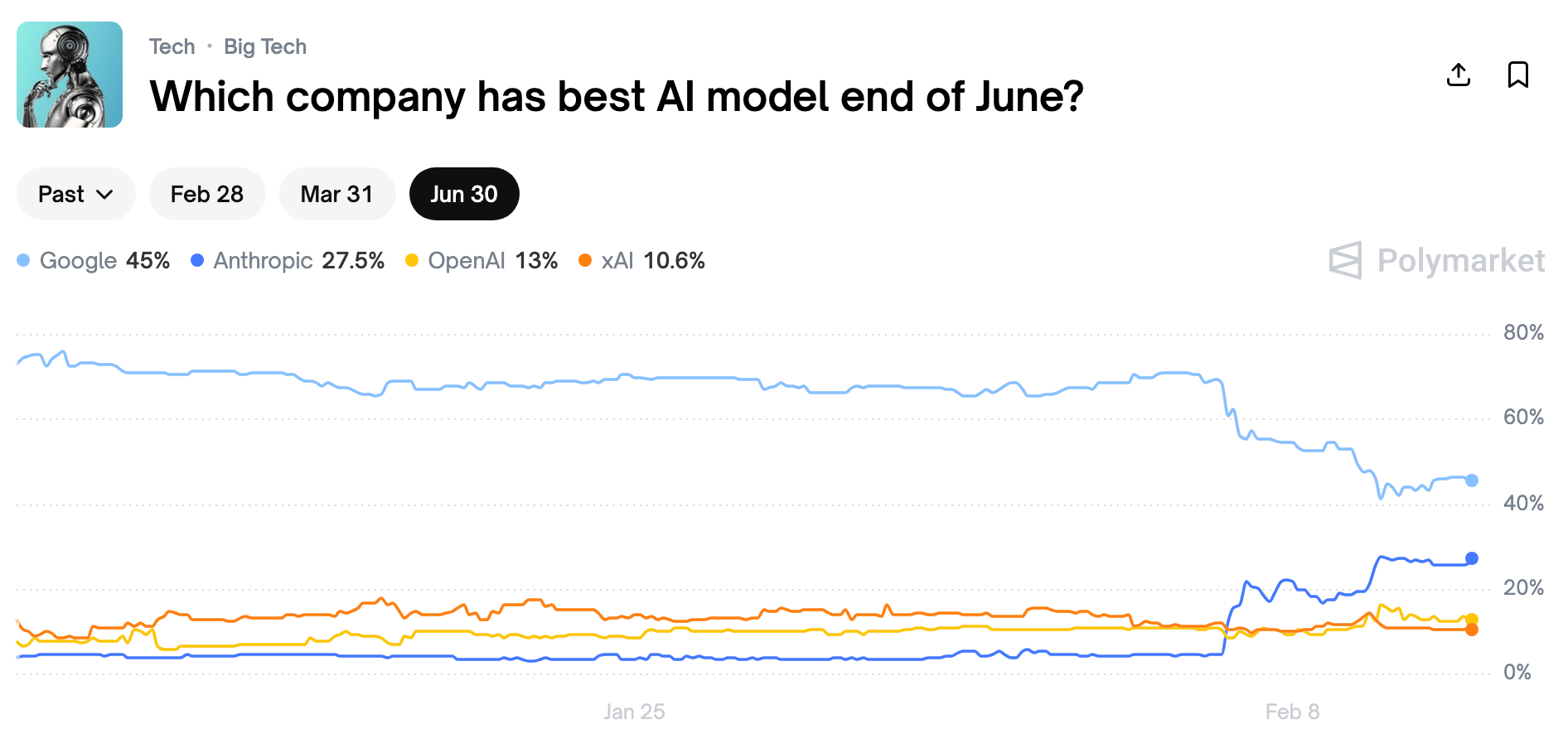

Prediction Markets

"Ok Claude, predict the winner accurately."

Trade event contracts on Polymarket, the world's largest prediction market.

Headline Roundup

US is weighing quitting the USMCA trade pact from 2019 (BBG)

US January budget deficit fell to $95B (RT)

US unemployment fell to 4.3% in strong jobs report (CNBC)

US firms confront K-shape economy as wealthy lift spending (RT)

Carve-outs will take center stage in M&A this year (BBG)

Software selloff is disrupting some M&A and IPO deals (RT)

Thoma Bravo seeks software bargains in ongoing 'SaaSpocalypse' (BBG)

Real estate services stocks sink in latest 'AI scare trade' (BBG)

PE-backed firms are deferring loan payments at a higher rate (BBG)

AI race mints Aaa rating for Compass Datacenters in an industry first (BBG)

UK firms chase pound bond sales after Google's bumper deal (BBG)

Morgan Stanley raised CEO Ted Pick's pay by 32% to $45M (RT)

CME plans to launch rare earth futures (RT)

Musk overhauled xAI leadership after mass co-founder exodus (TC)

Mistral revenue hit $400M as Europe seeks AI independence (FT)

BMPS board member resigned after insider trading allegations (FT)

US colleges received $5B from foreign sources in 2025 (BBG)

Columbia admitted to admitting Epstein's girlfriend via 'irregular' process (BBG)

Trump-Netanyahu meeting ended with no agreement on Iran (FT)

A Message from Mizuho

Biotech is making money again. After a volatile year – for the markets broadly and biotech specifically – the sector had an extraordinary comeback, outperforming the S&P 500 and broader market index, and closing out 2025 with its best annual returns since the Covid-19 pandemic.

Considering biotech was a massive underperformer for much of 2025 only to roar back in the last few months begs the question: is the sector borrowing gains from 2026? And if the recovery persists, will the sector stay measured? The broader fundamentals suggest the recovery may have legs, but investors should keep their eyes on several key market dynamics.

Deal Flow

M&A / Strategic

$30B-listed Kraft Heinz halted plans to split into two

SoftBank-backed AI-powered contracting software firm Icertis is exploring a sale at a $5B valuation

Singapore SWF GIC is considering a sale of its 80% stake in a European data center JV in potential deal at a $2.4B valuation, including debt

Building products distributor QXO agreed to buy construction products firm Kodiak Building from PE firm Court Square in a $2.25B cash-and-stock deal

China's Dajia Insurance Group is seeking to sell the famed Waldorf Astoria hotel in NYC, months after it reopened following a $2B acquisition and an eight-year $6B renovation

Energy tech giant Baker Hughes is exploring a $1.5B sale of its Waygate Technologies unit

German exchange operator Deutsche Boerse agreed to buy General Atlantic's remaining 20% stake in index provider ISS STOXX for $1.3B

UK REIT LondonMetric expressed interest in acquiring $617M-listed peer Picton Property Income

Hong Kong-based apparel manufacturer Epic Group is exploring a stake sale at a $500M valuation

Sports-focused PE firm Sportsology Capital Partners acquired a minority stake in MLB team Texas Rangers

VC

UK AI chip startup Olix raised $220M at a $1B valuation led by Hummingbird Ventures

Humanoid-robot maker Apptronik raised a $935M Series A at a $5.3B valuation from Google, Mercedes, B Capital, and others

Inertial-confinement fusion startup Inertia Enterprises raised a $450M Series A round led by Bessemer Venture Partners

Ignium, a defense-focused merchant provider of weapons-system subsystems, raised a $300M round from Albion River and others

Secrets and NHI security startup GitGuardian raised a $50M Series C led by Insight Partners

Inference Research, an AI-native quant trading startup, raised a $20M seed round led by Avenir Group

Integrate, a secure defense collaboration platform, raised a $17M Series A led by FPV Ventures

Meridian, an AI-powered financial-modeling spreadsheet startup, raised a $17M seed round at a $100M valuation from a16z, Litquidity Ventures, and others

Avenia, a fintech infrastructure startup for cross-border payments and stablecoins, raised a $17M Series A from Quona, Fluent Ventures, and others

Voice-AI platform Simple AI raised a $14M seed round led by First Harmonic

Spectrum-intelligence defense tech startup Tenna Systems raised a $13.5M seed round led by Costanoa

Stablecoin payments platform Levl raised a $7M seed round led by Galaxy Ventures

Mozart AI, a UK AI music-creation platform, raised a $6M seed round led by Balderton Capital

Get real-time updates on any startup, VC, or sector on Fundable.

IPO / Direct Listings / Issuances / Block Trades

Activist hedge fund Elliott built a stake in $50B-listed London Stock Exchange Group

Bill Ackman's hedge fund Pershing Square took a $2B stake in $1.7T-listed Meta and exited Nike, Chipotle, and Hilton

Energy infrastructure services firm Solv Energy raised $512M at a $5B valuation in an IPO

Portuguese insurer Fidelidade is eyeing a Portugal IPO at an over $3.6B valuation

Blue Owl Capital-owned data center company STACK Infrastructure is seeking a $2.1B loan

Global events and PR firm Richard Attias & Associates is weighing an IPO at a $1B valuation

Korean travel app Myrealtrip is planning a 2027 Korea IPO at an over $1B valuation

Indian solar module maker Goldi Solar is weighing a $350M India IPO

Japanese crypto treasury firm Metaplanet is set to raise $137M in a share sale to pay down debt and buy more Bitcoin

Pakistan gas station operator and transporter Sitara Petroleum is seeking to raise $11.4M in a Pakistan IPO

Debt

Bolivia is in talks to raise $3.3B from the IMF

PIMCO agreed to anchor $2.8B in senior debt financing to back CVC-backed Global Sport Group's broader $4.1B capital structure adjustments

Slovakia attracted a record $10.2B in orders for a $2.4B benchmark bond sale

China sold $2B of yuan bonds in Hong Kong with YTMs at the lowest since 2013

Gambling firm Bally's Corporation raised $1.1B in private credit from Ares, King Street, and TPG Credit

Blackstone sold a $1B private credit CLO at the tightest level this year

UK utility Anglian Water sold a $477M pound senior secured bond

UK retailer Marks & Spencer sold a $411M pound bond

Bankruptcy / Restructuring / Distressed

Lenders to French supermarket giant Casino Group proposed a takeover plan that would slash debt and wipe out equity and inject $1.44B of fresh capital

Ukraine's state energy company Naftogaz is sounding out restructuring advisors on an $825M bond due July amid Russian attacks on its assets

Funds / Secondaries

Blackstone folded its hedge fund seeder unit into its wider $60B hedge fund business

Oaktree raised $2.4B for a targeted $4B fourth corporate special situations fund

Blue Owl raised $3B for its debut strategic equity and secondaries fund

Finland residential landlord Kojamo acquired a 60-unit residential rental portfolio from Finland pension fund Varma in a $1.1B deal

LatAm investment firm Patria Investments plans to raise $500M for a new LatAm-focused private credit fund

French VC Elaia raised $142M for its targeted $355M fifth Digital Venture Fund to back pre-seed to Series B European B2B tech startups

EQT launched its second Asia MM fund

Crypto Sum Snapshot

Crypto lender BlockFills suspended withdrawals on faltering Bitcoin price

Bitcoin's 24/7 trading risk spikes while Wall Street sleeps

ETF issuers press ahead with crypto funds despite selloff

Crypto Sum compiles the most important stories on everything crypto. Read it here.

Exec’s Picks

ICYMI, we published a deep dive on one of Wall Street's most-trusted VDR providers, DFIN. Their overhauled VDR product is making waves for its leading UX, optimization, and speed and we broke down the key aspects of why it's making lives easier for dealmakers everywhere. Read it here.

With the release of 3M more Epstein documents, it's a good time to revisit Bloomberg's December investigation into Epstein's deep financial ties on Wall Street. Hedge funds, brokerages, billionaires, and more.

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting firm established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, credit, and investment banking.

We're currently seeking talent for some incredible roles. Head over to Litney Partners to drop your resume / create your profile and we'd love to get in touch!

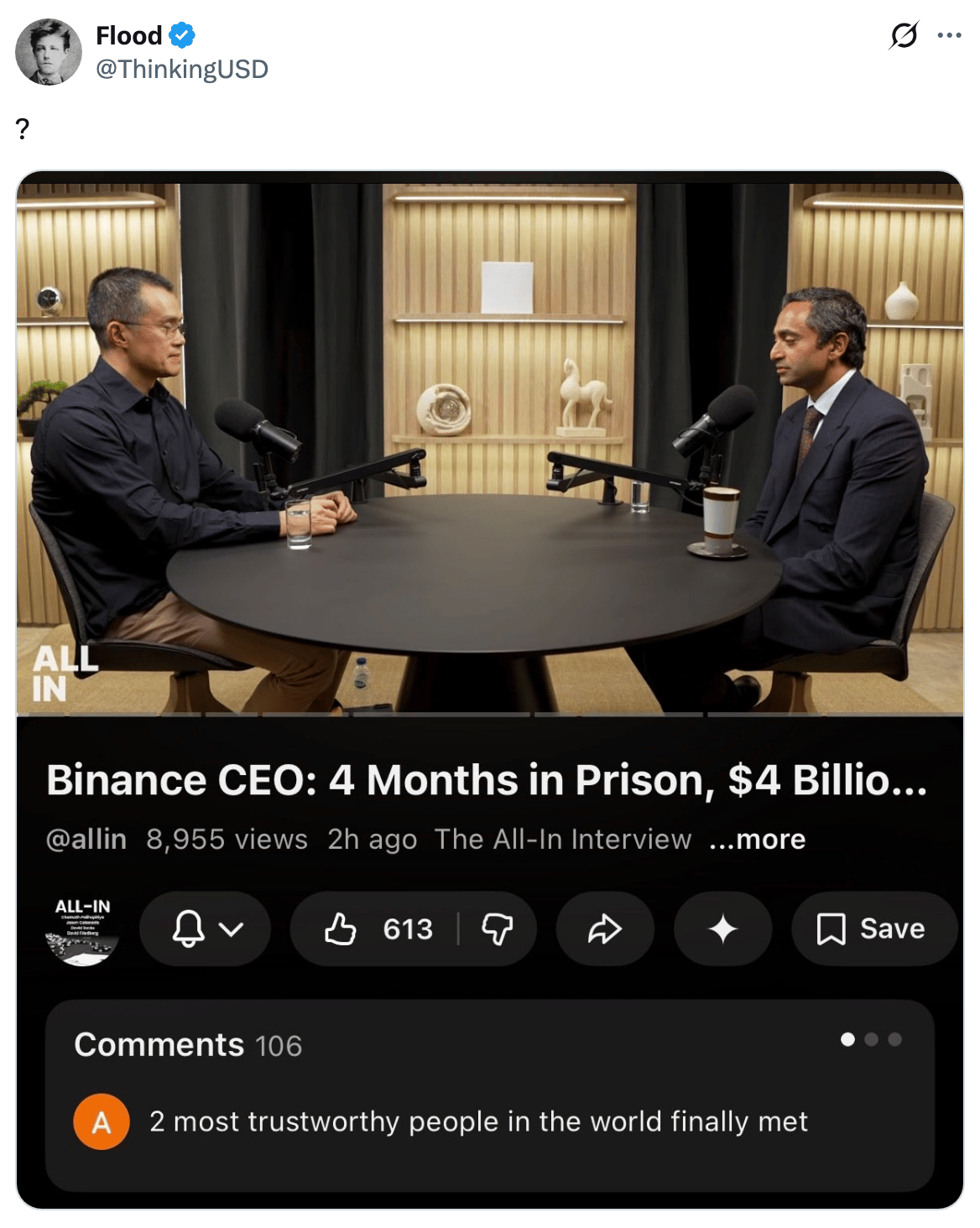

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.