Happy Sunday, everyone!

Hopefully the scaries aren’t hitting too hard right now. The markets might be closed, but your inbox never sleeps.

For the first time in a few months, we are back with another Sunday deep dive. Today we are pumped to profile a software business we’ve been using for over a decade, dating back to when Lit was just an investment banking intern.

This company is one of the leading service providers on Wall Street and is continuing to innovate in this age of rapid technological progress. Today we will be talking about DFIN, one of the biggest and most-trusted virtual data room providers on Wall Street, processing billions in deal documents a year and ensuring bankers have one less thing to worry about when they’re grinding on live deals.

In 2025, we were able to partner with DFIN across a variety of in-person events and look forward to doing more with the team. We thank them for their continued sponsorship and support.

You can check out DFIN here.

Let’s get into it.

🏛️ The Data Room Wars: Why Junior Bankers Are Ditching Shared Drives for DFIN Venue

If you’ve ever been the junior banker on a deal team, you already know the Three Commandments of investment banking:

Move fast

Don’t screw up

Always be available (yes, even between 1-5am)

Global M&A volume rose to $4 TRILLION+ in 2025, one of the highest totals in history, driven by mega-deals across sectors. M&A is poised to re-emerge as a defining engine of corporate strategy in 2026, fueled by rate cuts and pro-business policy shifts.

When factoring in IPOs, spin-offs, carve-outs, restructurings, private credit deals, and other financings, the number balloons significantly. Each of these deals brings with them massive document volumes, distributed across dozens of law firms, sponsors, underwriters, auditors, and regulators. And with massive document volumes, comes massive potential liability from data leaks and cyberattacks targeting financial institutions.

Despite trillions of dollars in global M&A flowing every year, most analysts and associates on Wall Street are still stuck doing one of the most high-stakes tasks in finance (document coordination) using clunky enterprise tools in the age of constantly evolving technology. Wall Street needs to adapt and stay at the forefront of technological innovation to speed up processes, minimize data leaks / fines, and improve the working conditions of the junior bankers.

Here’s the macro backdrop that’s forcing upgrades across Wall Street:

34% of dealmakers say technology adoption + integration is their biggest challenge heading into 2026

25% cite cybersecurity risks as a key challenge

92% of Director level (and above) decision-makers say tech innovation is a significant driver of company strategy and most plan to increase spend on AI, data analytics, cloud, and cybersecurity

Source: DFIN Survey, January 2026

In a world where errors could cost millions, junior bankers need SPEED, BANK-GRADE SECURITY, and RELIABILITY when it matters most. The margin for error is effectively zero so it’s critical to use the best products out there.

💾 Wait… Why Isn’t Google Drive Enough?

Chances are that if you’re reading this, you already work in investment banking or private equity and know why Google Drive or Dropbox aren’t gonna cut it the world of finance. If you’re a recent undergrad or MBA hire, we’ll explain why that’s the case so you can look good in front of your employer.

Sure, Drive and Dropbox are convenient, cheap, and easy-to-use out of the box. But deals on Wall Street operate under a different set of standards:

More security concerns

More risk

More actors

More scrutiny

More compliance

No undo button

With a shared Google Drive, you're relying on a consumer-oriented platform to manage complex tasks (impossible). You need to be able to manage permission rights, redactions, logging, diligence Q&A, watermarking, permissioning, audit trails, reporting & analytics, and secure links.

Drive and Dropbox are better served for marketing decks and shared calendars…

Above all, security is the most important consideration.

This is why investment bankers, PE shops, law firms, and strategic acquirers rely on VDRs (Virtual Data Rooms). They are secure, permission-controlled, and a digital repository used to store and distribute confidential information during high-stakes deals.

They’re purpose-built for fast-paced deal environments, tough regulatory scrutiny, and they’re great for CYA purposes.

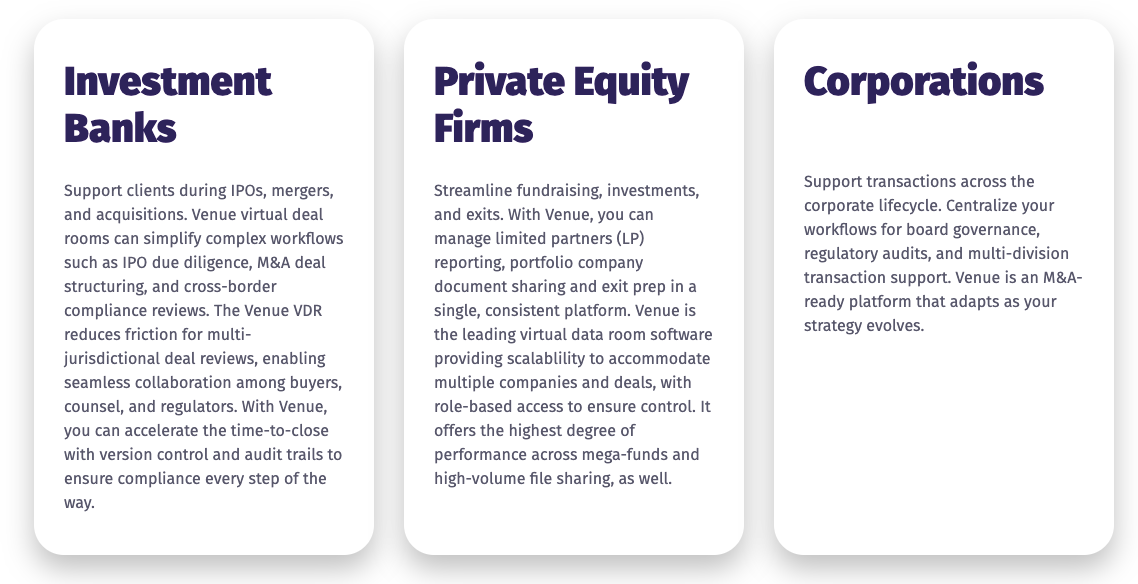

See below for why investment banks, PE firms, and corporations find VDRs useful:

🧨 Enter DFIN Venue: One of the leading VDR products in the market

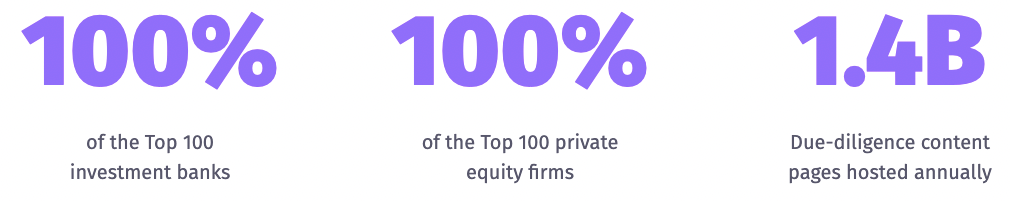

DFIN isn’t a new name in capital markets. They’ve been on earnings calls, IPO filings, proxy statements, and disclosure workflows longer than some VPs have been alive. In fact, they’re used by teams at every major investment bank and private equity firm and host over 1.4 billion due-diligence content pages annually.

Venue (their VDR product) is interesting though, because it has been rebuilt from the ground up, based on direct client input, making it the most modern VDR on the market. What better way to build a product used by deal makers, than to ask them what they really need and care about most?

This has led to a sleek, intuitive platform that makes Venue easy to navigate and (most importantly, imo) the junior bankers’ lives easier. They also have 24/7 expert support in case you’re up grinding at 3am alone in the office with no colleagues to turn to with questions.

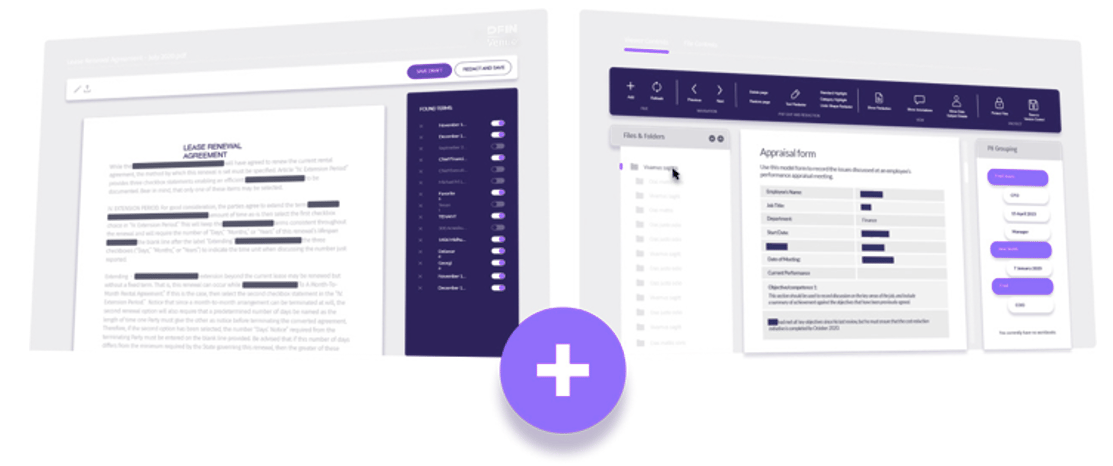

🏗️ Rebuilt From the Ground Up

As mentioned above, Venue was rebuilt with direct client feedback. Not a UI re-skin, but an under-the-hood overhaul. Below is a detailed summary of features that meet the requirements of deal workflows:

Drag-and-drop organization

Instant load speeds

Permissioning by buyer/role/doc class

Watermarking + DRM

Audit trails

Bulk uploads + tagging

Staging areas

Q&A tools

Virtual shredding

Venue leans into speed + control, including:

Tree View + filters for New / Unread / Favorites

Incredibly fast load speeds

Staging before “go-live”

Bank-grade encryption + permissioning

24/7/365 expert support

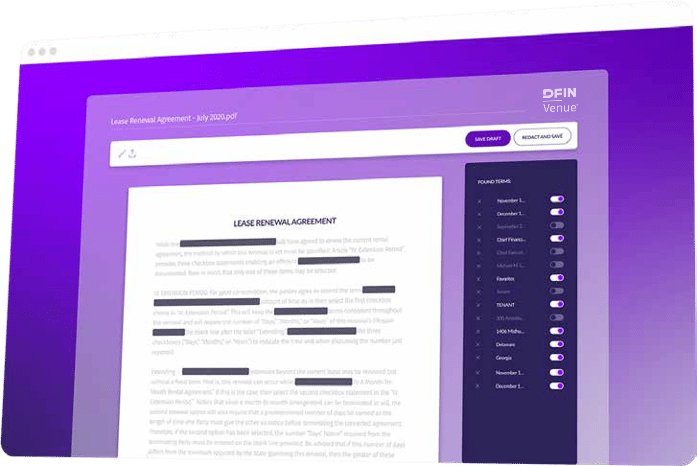

🛡️ Security Is Now Board-Level

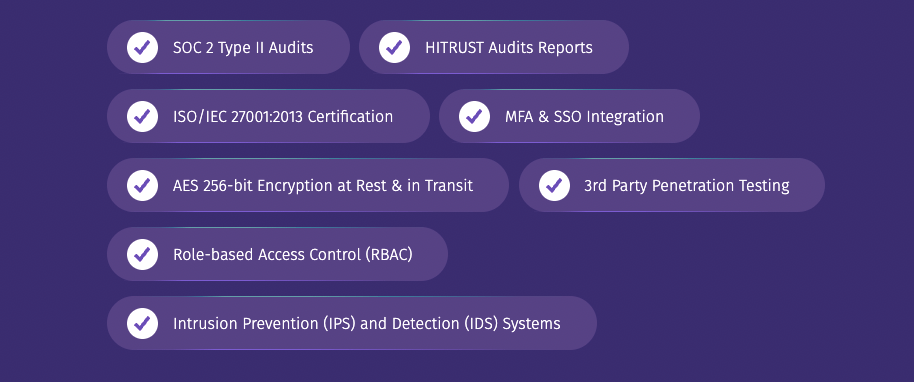

Cybersecurity is now board-level. With leaks, espionage, and regulatory fines in play, the product used to run a deal is a signal of operational maturity.

Bank-grade encryption + role-based permissions + audit logs create a defensible diligence environment.

For the compliance / cyber folks reading this, here is some more info on Venue’s compliance standards:

💼 Why Junior Bankers Care

Junior bankers optimize for:

Speed

Reduced chaos

AND MOST IMPORTANTLY, not getting yelled at

Venue delivers:

Faster load times

Better organization

Human support

Enterprise security

Massive file capacity

Final Take

In a world where cyber risk, complexity, and compliance are scaling faster than the tools juniors are using, upgrading isn’t optional… it is table stakes risk mitigation.

Set the room up right → set yourself up right.

Check out DFIN Venue here and see for yourself why they’re the leading provider of virtual data room software for 100% of top investment banks & private equity firms, hosting over 1.4 BILLION due-diligence content pages annually.

Thanks for reading. We hope you are able to check out DFIN for your next deal and hopefully it’ll save you time and get you some much needed sleep.

Until next time!

Best,

Lit