Together with

Good Morning,

The Fed cut rates for the first time this year, Kash Patel fueled a Krispy Kreme stock rally, Wharton will launch a program in quant finance, Gen Z credit scores are taking a hit, and college students are getting increasingly competitive about landing internships.

Plaid's latest guide gives a step-by-step breakdown on how to integrate cash flow data into lending processes. No more relying on just credit scores. Get it here.

Let's dive in.

Before The Bell

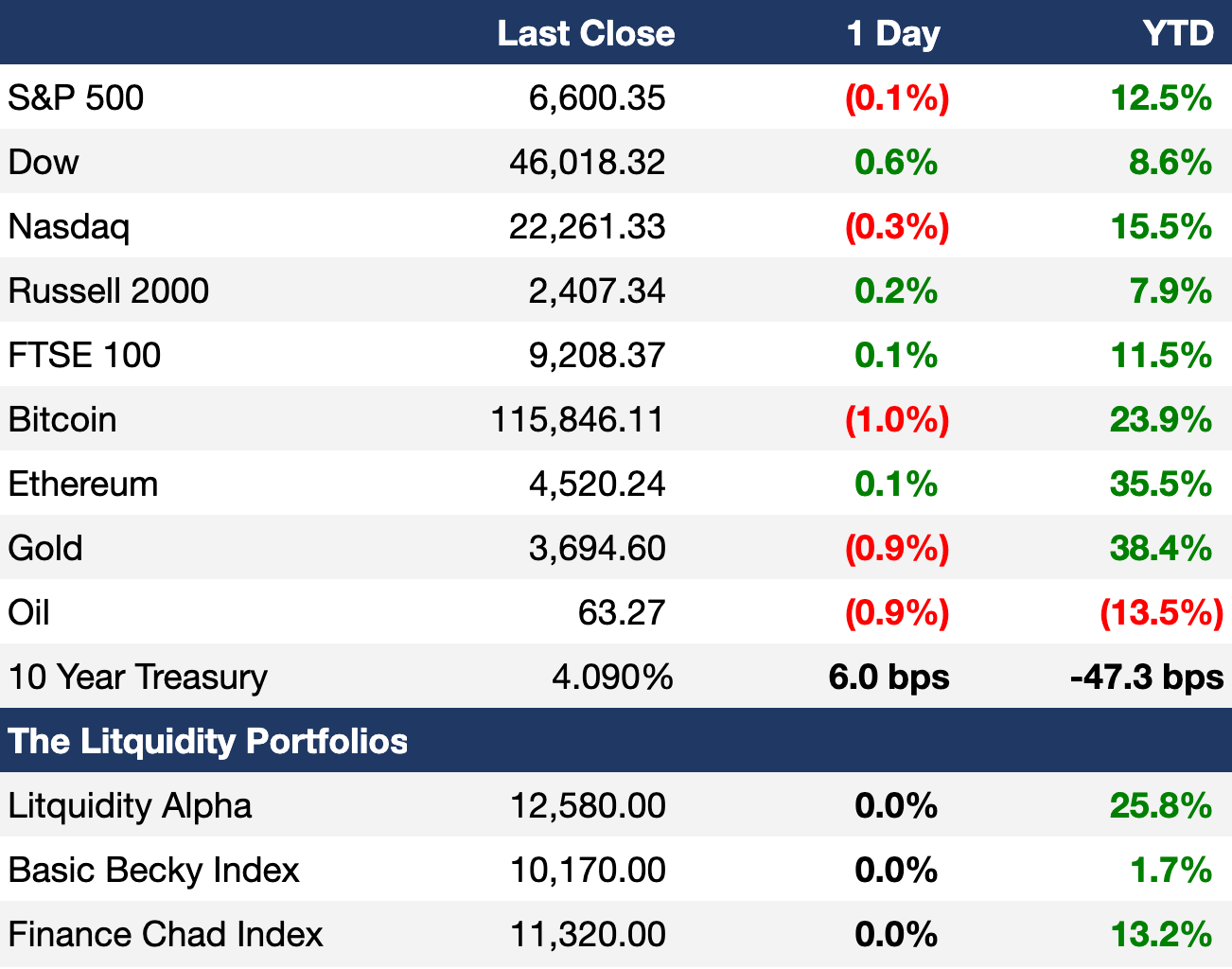

As of 9/17/2025 market close.

Click here to learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks closed mixed in a volatile session yesterday as traders digested the Fed's first rate cut of the year

All-country MSCI ACWI index hit a new ATH

Israel's TA-35 Index fell for a sixth-straight day for its worst streak in 18 months

The index is down 5% after rallying 30% YTD to record highs

Earnings

General Mills beat Q2 earnings estimates but maintained its FY outlook amid cautious consumer spending amid economic uncertainty; the firm outlined value-seeking and plans for significant investment in innovation, new products, and brand campaigns to drive long-term growth (BBG)

Cracker Barrel slumped 10% despite beating Q4 earnings estimates as it projected a decline in revenue and guest traffic following its rebrand controversy (CNBC)

Bullish swung to a profit in its first public earnings on a 35% trading volume surge and strong engagement; the firm guided for a strong Q3 (WSJ)

What we're watching this week:

Today: FedEx, Darden Restaurants

Full calendar here

J Pow adopted a surprisingly dovish stance after yesterday's rate cut.

Headline Roundup

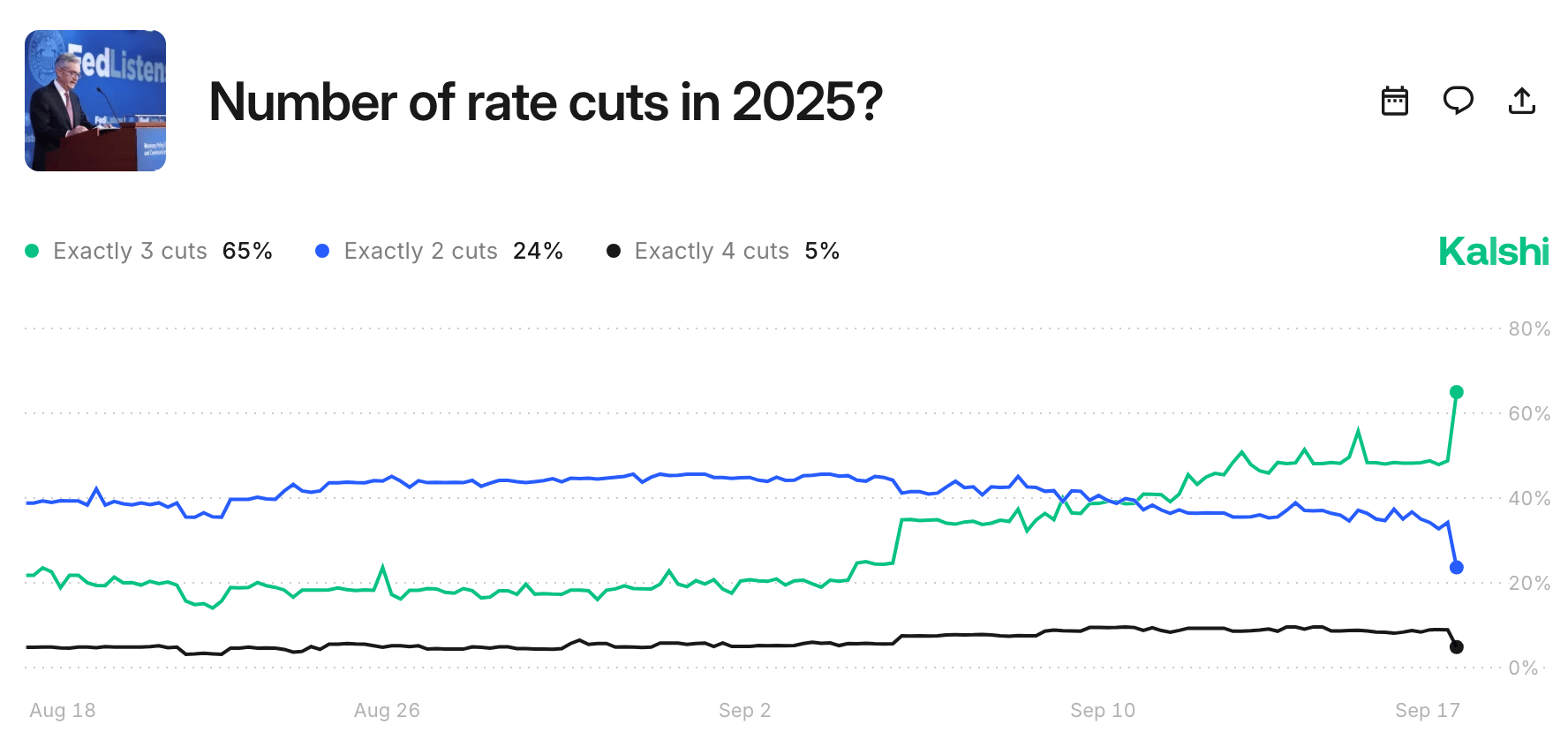

Fed cut rates by 25 bps to 4%-4.25% and signaled two more this year (CNBC)

J Pow says jobs market is no longer very solid (BBG)

Lone dissent shows J Pow kept Fed united amid Trump pressure (BBG)

Investors say Trump pressure on Fed may steepen yield curve (RT)

Fed 'third mandate' forces bond traders to rethink age-old rules (BBG)

Bond King Jeff Gundlach called Fed's 25 bps rate cut 'the right move' (RT)

SOFR jumped to 4.51% to the highest level this year (BBG)

SEC revoked ban on mandatory shareholder arbitration in IPOs (RT)

BlackRock is increasing exposure to US stocks (BBG)

Foreign investors are rushing to hedge dollar volatility (FT)

Oracle sparks bubble talk with stock price in dot-com territory (BBG)

Krispy Kreme stock rallied after Kash Patel called it a buy (BBG)

BofA CEO says he is not leaving in short term (RT)

CVC stepped up succession planning ahead of next fundraising (FT)

SWF ADIA maintained PE allocation target and will focus on tech (RT)

China banks amped up $10T bond bet just as market peaked (BBG)

PwC UK cuts jobs as revenue growth flattens (FT)

BofA raised US minimum hourly wage to $25 / hour (RT)

US senators demanded Wells Fargo welcome employee unions (RT)

UPenn Wharton will launch a grad program in quant finance (BBG)

Gen Z led biggest drop in FICO scored since 2008 (BBG)

Key lawmakers are wary of US-China TikTok deal (BBG)

China banned tech firms from buying Nvidia AI chips (FT)

DeepMind and OpenAI won gold at 'coding Olympics' (FT)

Ben & Jerry's founder quit after Unilever 'silenced' activism (BBG)

15% of college sophomores applied to internships in freshman year (BBG)

Disney pulled 'Jimmy Kimmel Live' after comments on Charlie Kirk (BBG)

A Message from Plaid

Cash (flow) rules everything around me

If cash is king, then cash flow data is the royal court – tracking income stability, debt, savings, spending patterns while the king just looks regal (not a bad gig).

But guess what? That data does nothing for your business unless you put it to work. Fret not, though, because that's where Plaid comes in. Their free step-by-step guide shows you how to integrate cash flow data into your lending process so you can approve more qualified applicants without taking on more risk.

Deal Flow

M&A / Investments

Finnish elevator company Kone is exploring a potential bid for Advent and Cinven-backed rival TK Elevator; the firm was last valued in 2020 at $20.4B

Abu Dhabi's state-owned oil giant ADNOC dropped its $19B takeover of Australian natural gas producer Santos

Blackstone and TPG revived their interest in acquiring medical device maker Hologic after a previous $16B offer was rejected

Authentic Brands and CVC expressed interest in acquiring $4B-listed German sportswear brand Puma

Deutsche Bank's asset manager DWS is preparing a $2.4B sale of data centre business NorthC

Rithm Capital agreed to acquire NYC and SF office landlord Paramount Group for $1.6B at a 38% premium

European PE firm Keensight Capital agreed to acquire a majority stake in orthobiologic product maker Isto Biologics from Thompson Street Capital Partners for $1B

Chinese pay-as-you-go gym chain Supermonkey is considering options including a stake sale; the firm was last valued at $1B in 2021

PE firm TA Associates delayed its $1B majority stake sale in Indian health supplements maker OmniActive Health Technologies due to tariff concerns

Qatar SWF QIA acquired a $500M stake in Canadian copper miner Ivanhoe Mines

Connecticut is considering a rare move to offer pension funds to acquire a minority stake in WNBA team Connecticut Sun to keep the team in the state

VC

AI inference startup Groq raised a $750M round at a $6.9B post-money valuation led by Disruptive

AI network infrastructure startup Upscale AI raised a $100M+ seed round led by Mayfield and Maverick Silicon

AI-enabled lending marketplace Splash Financial raised a $70M Series C led by Grand Oaks Capital

Imagine Pediatrics, a pediatric medical group with virtual and in-home care, raised a $67M Series B led by Oak HC/FT, Optum Ventures, and Rubicon Founders

Tabs, an AI-native revenue platform, raised a $55M Series B led by Lightspeed Venture Partners

European Agentic AI platform EvoluteIQ raised $53M in minority growth capital from Baird Capital

Arch, a startup simplifying private market investing, raised a $52M Series B led by Oak HC/FT

Omnea, an AI-native procurement and intake orchestration platform, raised a $50M Series B led by Insight Partners and Khosla Ventures

Bria, a visual GenAI platform-as-a-service startup, raised a $40M Series B extension led by Red Dot Capital

Turnout, an AI-powered consumer service that reimagines how Americans navigate complex government and financial processes, raised a $21M seed round led by Shine Capital and LGVP

German AI compliance platform Kertos raised a $16.5M Series A led by Portage

Mueon, a semiconductor-based systems for AI and hyperscale computing, raised a $15.5M seed round led by Intel Capital

Envive AI, an AI-powered intelligent layer for digital commerce, raised a $15M Series A led by Fuse VC

Mavryk Network, a layer-1 blockchain for real-world asset tokenization, raised $10M in a strategic investment led by MultiBank Group

F2 AI, an AI platform for private markets investors, raised a $10M round from NFX, Left Lane Capital, Y Combinator, and others

Developer tools startup Blacksmith raised a $10M Series A led by Google Ventures

GridStrong, an all-in-one platform for automating electric grid compliance and operations, raised a $10M seed round led by Congruent Ventures

Suena Energy, an energy trading platform for renewable energy and storage, raised an $9.5M Series A led by Eneco Ventures

Kreios Space, a Spanish space tech startup, raised an $9.5M seed round led by the NATO Innovation Fund and JOIN Capital

Iris Finance, an AI-native platform for companies that sell physical products, raised a $6.2M seed round led by Glasswing Ventures

Icarus Robotics, a startup building robots to perform 'warehouse work' in space, raised a $6.1M seed round led by Soma Capital and Xtal

Robot safety sensor startup Sonair raised a $6M round from Scale Capital, Investinor, and ProVenture

Airbuds, a music social network, raised a $5M round from Seven Seven Six

CreatorDB, a company building vertical AI infrastructure for the influencer marketing ecosystem, raised a $4.67M Series A led by Acorn Pacific Ventures

Vibranium Labs, a startup building 'Vibe AI' to help anticipate and prevent critical incidents, raised a $4.6M seed round led by Calibrate Ventures and Mirae Asset

IPO / Direct Listings / Issuances / Block Trades

Hellman & Friedman-backed security services firm Verisure filed to raise $3.7B in Sweden in what would be Europe's largest IPO since 2022

German online broker Trade Republic is exploring a $1.2B stock sale

European PE firm EQT is considering raising $1B in a US IPO of waste management firm Reworld

Three Indian user-car startups CARS24 Services, CarDekho, and Spinny are in early talks with banks to potentially raise a combined $1B in India IPOs

Ticket reseller StubHub raised $800M at an $8.6B valuation in an IPO priced at a mid-range

Five Point-backed WaterBridge Infrastructure jumped 14% in its trading debut after raising $634M at a $2.3B valuation in an IPO priced at the top of a range

Strava, the popular fitness tracking platform last valued at $2.2B, is looking to hire banks for a US IPO

Activist Elliott took a $2B stake in HR software giant Workday

Foods giant Del Monte is considering raising $800 million in equity to pare debt

Brookfield-backed natural gas storage platform Rockpoint Gas Storage is weighing a Canada IPO

EQT is weighing a US IPO of student transportation company First Student

South African insurer Momentum Group is considering an IPO of its Indian venture with conglomerate Birla

Debt

South Africa is considering tapping the eurobond market after it repaid a $2B bond this week.

Hong Kong's Hang Seng Bank is seeking to sell a $1B property loan portfolio backed by assets of Hong Kong developers Emperor International and Tai Hung Fai Enterprise

JPMorgan and Nomura are leading a $710M debt package to back Bain Capital's $1B acquisition of Dutch technology services company HSO from Carlyle

Health tech firm Aledade is seeking a $500M asset-backed loan from Ares to boost liquidity

Bankruptcy / Restructuring / Distressed

Creditors across US are scrambling to stake their claim to assets of collapsed subprime auto lender Tricolor Holdings

Vervent is set to take over servicing Tricolor's portfolio of consumer car loans in its Chapter 7 liquidation

Liquidators of collapsed Chinese developer Evergrande are seeking receivership of ex-CEO Xia Haijun and his ex-wife's assets

Fundraising / Secondaries

Abu Dhabi's $1T SWF ADIA is recalibrating its 12%-17% PE target to capture growth in secondaries

European PE firm Nordic Capital raised $6B for its targeted $12B twelfth flagship buyout fund

Quant hedge fund D.E. Shaw is raising $5B for a new non-quant strategy to bet across stocks and credit globally

European private credit manager LCM Partners raised $4.5B for its fifth credit opportunities fund

Private markets investor HarbourVest closed its third infrastructure secondaries fund with $865M, short of its $1B target

Blue Owl Capital raised $850M for its first interval fund providing individual investors access to alternative credit

True Ventures is seeking up to $400M in their latest double fundraise

Standard Chartered's VC arm SC Ventures is planning a $250M digital asset fund

VC firm BNVT Capital launched its debut $150M fund to invest in AI-first and technology-driven companies solving humanity's most pressing challenges

US International Development Finance Corporation and Ukraine launched a $150M JV fund to invest in Ukraine mineral projects

Crypto Sum Snapshot

Wall Street turns hedge funds' favorite basis trade into ETF bait

SEC approved faster way for exchanges to list Bitcoin and gold ETPs

UK proposed exempting crypto firms from 'integrity' and other rules

Subscribe to our free Crypto Sum newsletter for the full stories on everything crypto.

Exec’s Picks

I recently published a Deep Dive into Pacaso, a startup at the intersection of real estate and travel. Founded by former Zillow execs, Pacaso is redefining second-home ownership in a $1.3T market and is currently raising from a range of investors. My piece breaks down their business model, industry, vision and fundraising efforts. Read it here.

The best time to start investing is always right now. Check out Callie Cox's insightful take on the same.

Connect with the Community 🥂

My events company Palm & Park is hosting the first-ever Litquidity x NEXUS Indoor Golf Classic this November-December in NYC! It's going to be an afternoon of competitive play, networking, drinks, and wins among NYC's top finance, tech, and investing pros and we'd love for you to show! Bring your team of four or simply show up for the vibes. Team registration here. General admission tickets here.

Internship Opportunities 💼

Litquidity is expanding its team to scale content across social media, newsletters, and web. We are looking for a handful of college interns who are smart, driven, resourceful, funny, and especially interested in financial markets. Reach out if you're interested and we'd love to get in touch. We are actively hiring!

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.