Happy Sunday, everyone!

The markets might be closed, but your inbox never sleeps. We’re back again with an exciting installment of our Deep Dive series. This is our first deep dive in a while, but we are looking to do this on a more consistent basis, as we’ve been busy staffing up our team with analysts, interns, and – our favorite – AI agents.

As a refresher on our Deep Dives, this is a series where we break down businesses in a fun and interesting way. We’ll dive into the history, metrics, business model, and opportunity of companies doing cool things and changing the game. Think of it like an investment memo but made public.

This week, we will be breaking down Pacaso, a luxury real estate startup that wants to make second-home ownership as seamless as booking an Airbnb… if Airbnb let you co-own a multimillion-dollar villa in Napa or Marbella. The business is targeting a $1.3 trillion market opportunity, and its leadership team has folks with experience at industry giants such as Zillow, Re/Max, Visa, and Tripadvisor. Since inception, the company has racked up $110 million in gross profits and is on a roll. It’s no wonder why investors are lining up to invest in Pacaso as a private company like New Yorkers line up for the hottest smash burger spot or trendiest restaurants.

It’s an interesting story that seems to follow the earlier years of industry disruptors such as Airbnb, Uber, and Lyft that have gone on to become multi-billion dollar publicly-traded companies. Pacaso has similar grand ambitions and has reserved the ticker “$PCSO” for a possible future listing on the Nasdaq.

Pacaso is offering everyday investors the opportunity to invest in the platform’s growth and vision, alongside the major VCs and the founders for the first time. So far, over 10,000 investors have joined them. If you’d like to join Pacaso on their mission to disrupt a $1.3 trillion market, now’s your time. Check them out here. Invest by September 18th.

And with that… let’s get into it.

What is Pacaso?

In the wake of a pandemic that reshaped where and how people want to live, a new type of real estate company emerged with Silicon Valley swagger and Zillow DNA. Its pitch was simple: you don’t need to buy all of your second home, just the part you’ll actually use. That company is Pacaso, a real estate co-ownership platform that allows multiple buyers to purchase shares of a high-end home in prime vacation destinations.

Pacaso offers actual real estate asset ownership, and if you want to sell your share in a few years, you’re able to do so and get your pro-rata share of the gain (assuming you’re selling it at a profit, that is).

“For luxury buyers, co-ownership offers a more convenient and hassle-free experience… Pacaso handles everything from design and property management to finding local vendors like cleaners and landscapers. This allows buyers to simply show up, relax, and enjoy their vacation home.”

Origins: From Zillow to Fractional Real Estate

Pacaso was launched in October 2020 by Spencer Rascoff, the co-founder and former CEO of Zillow, and Austin Allison, who had previously sold his startup dotloop to Zillow in 2015.

In 2014, Austin Allison and his wife bought a second home in Lake Tahoe, a lifelong dream but a significant financial stretch at the time. The only way they could make it work was to rent it out when they were not using it. The stress and hassle of managing a rental to pay the mortgage was burdensome. Austin wondered if there could be an easier way to own a second home… This idea stuck with him in the years that followed.

Driven by ambition, Austin founded his first company, dotloop, a service that simplified the buying/selling process by digitizing the document and signature process. The business took off and eventually caught the attention of Zillow executives. In 2015, Zillow announced that it was acquiring dotloop for $108M and would result in Austin serving as a Zillow executive.

Austin’s sale of dotloop was an overwhelming success, but he always wished everyday investors could have shared in it. That’s ultimately why he has decided to open the opportunity to invest in Pacaso to the public.

Austin eventually left Zillow and began brainstorming ideas for startups that would combine their shared passions for real estate, travel, and tech innovation. They ultimately landed on the idea of what is now Pacaso, with the goal of making second home ownership simpler and more affordable.

Their insight on the market opportunity was sharp: luxury second homes are rarely used (on average just 5–6 weeks a year), yet they tie up massive amounts of capital and sit idle most of the time. What if there were a more efficient way to own and enjoy them?

The team moved fast and within months of launch, Pacaso was already operating in several markets, a feat made possible by strong investor demand and tailwinds from the post-COVID migration to leisure-first lifestyles.

The pair decided on the name “Pacaso” as a nod to Pablo Picasso, the famous artist who inspired them through his revolutionary thinking and art that challenged 20th-century conventions.

How It Works: The Pacaso Playbook

At its core, Pacaso’s model is based on fractional ownership.

Here’s how it works:

Pacaso purchases a luxury home through a dedicated LLC and sells up to eight membership interests (each representing 1/8 ownership).

Each owner is able to schedule time at the home, all managed through Pacaso’s proprietary scheduling app. Owners are NOT able to generate rental income from their share, as Pacaso homes are not rented.

Pacaso furnishes, maintains, and manages the property, handling everything from landscaping, to Wi-Fi, and even fresh towels, which eases the burden of upkeep.

Owners pay a service fee upfront, plus ongoing management fees, which adds to Pacaso’s recurring revenue

Shareholders can vote on items like material requests (upgrading living room electronics, for example)

Owners are even able to finance the purchase, paying 30% down.

From there, the company manages any resales (another way it can capture revenue) any time an owner wants to sell

So Pacaso makes it easy to BUY a share of a home. What about when you want to SELL your share?

Selling a home can be a pain-in-the-ass for one person, let alone a property shared by as many as seven others! Pacaso facilitates the whole process.

Just like a traditional real estate agent, the team helps determine the fair market price, assists in marketing to potential buyers, and is involved along the way to make a resale possible. It’s worth noting that other owners retain a right of first refusal whenever one of the owners expresses interest in selling their stake.

Another consideration of the resale market is that Pacaso’s co-ownership model is relatively new and the resale process for this type of transaction isn’t as developed as traditional real estate. Nevertheless, the high demand for luxury homes in desirable locations helps offset this.

Pacaso’s Offerings

The company’s marketplace is simple and showcases all the vacation homes currently under contract or “hot” homes they are considering adding to the ecosystem. Pacaso currently offers properties in 40 core markets across four countries.

Prices are quoted in 1/8th ownership slugs, so you can easily see how much you would pay for your share of the home. If you’re interested in learning more about a property, you can fill out a quick form and a member of the Pacaso team will provide you with more info and guide you through the process.

The company launched their Estate Collection last year, aimed at affluent homeowners who can purchase their 1/8th share starting at $1 million each. The Estate Collection includes the most luxurious homes in the platform’s portfolio, located in highly-desirable destinations like Napa, Aspen, Malibu, and Jackson Hole.

Pacaso began with domestic properties in the US and is steadily expanding its international footprint, with eight homes in Cabo San Lucas, Mexico, and a variety of homes in Europe. They are also partnering with a UK lender to help continue the company’s global growth.

“International expansion is creating a lot of opportunities for us to expand into other markets, with our initial focus being in Europe and the Caribbean as well as Mexico and Latin America,” Austin Allison said recently in an interview with Morning Brew.

Interested in investing in Pacaso? Get started by clicking the button below!

Industry Tailwinds

The company is going after a $1.3 TRILLION serviceable market in the United States, so the opportunity is up for grabs. But the company has grander ambitions, with plans to capture global market share further down the road.

According to a 2024 trend report from Coldwell Banker, a whopping 40% of wealthy Americans plan on buying second (or even third) homes within the next year, and that number rises to two-thirds within the next five years. Those in the market are finding a way to pay for them, including co-ownership.

Big Capital, Bigger Ambitions

Pacaso’s pitch wasn’t just appealing to homeowners, it also wooed some of the most reputable names in venture capital. To date, the company has raised over $280M in equity to fund and fuel its business.

Now, Pacaso is offering everyday investors the opportunity to invest in the platform’s growth and vision, alongside the major VCs and the founders.

Since the launch of this fundraising campaign, over 10,000 investors have invested over $49M in aggregate.

In an interview with Morning Brew, Austin Allison said:

“we believe in democratizing access – that is the core of our mission and vision. We democratize access to luxury vacation homes. And we have so many people interested in investing in Pacaso (the company) that when we learned it was possible to democratize access to our investment round, it seemed like a no-brainer for us to make the opportunity available to the public.”

If you’re interested in investing in Pacaso, check out their fundraising campaign here.

This fundraise will allow Pacaso to expand their property footprint, and go towards improving their product, engineering, and home operations.

Competition & The Road Ahead

While Pacaso is the most visible player in its space, it’s not alone.

Competitors like Kocomo, Ember, and even legacy hotel companies are circling the concept of fractional real estate. But Pacaso’s first-mover advantage, brand awareness, and tech platform give it a defensible moat for now.

The business has strong momentum and recently eclipsed $1 billion in cumulative gross real estate value & fees transacted.

Looking ahead, the company is eyeing international expansion (Costa Rica, Italy, Mexico, the Caribbean).

The key to Pacaso’s success is balancing three key pillars:

Bringing the concept to market

Homeowner satisfaction and delivering an exceptional product.

Capital access to continue growing responsibly

Conclusion: Tech’s Bid to Rewrite the Vacation Home

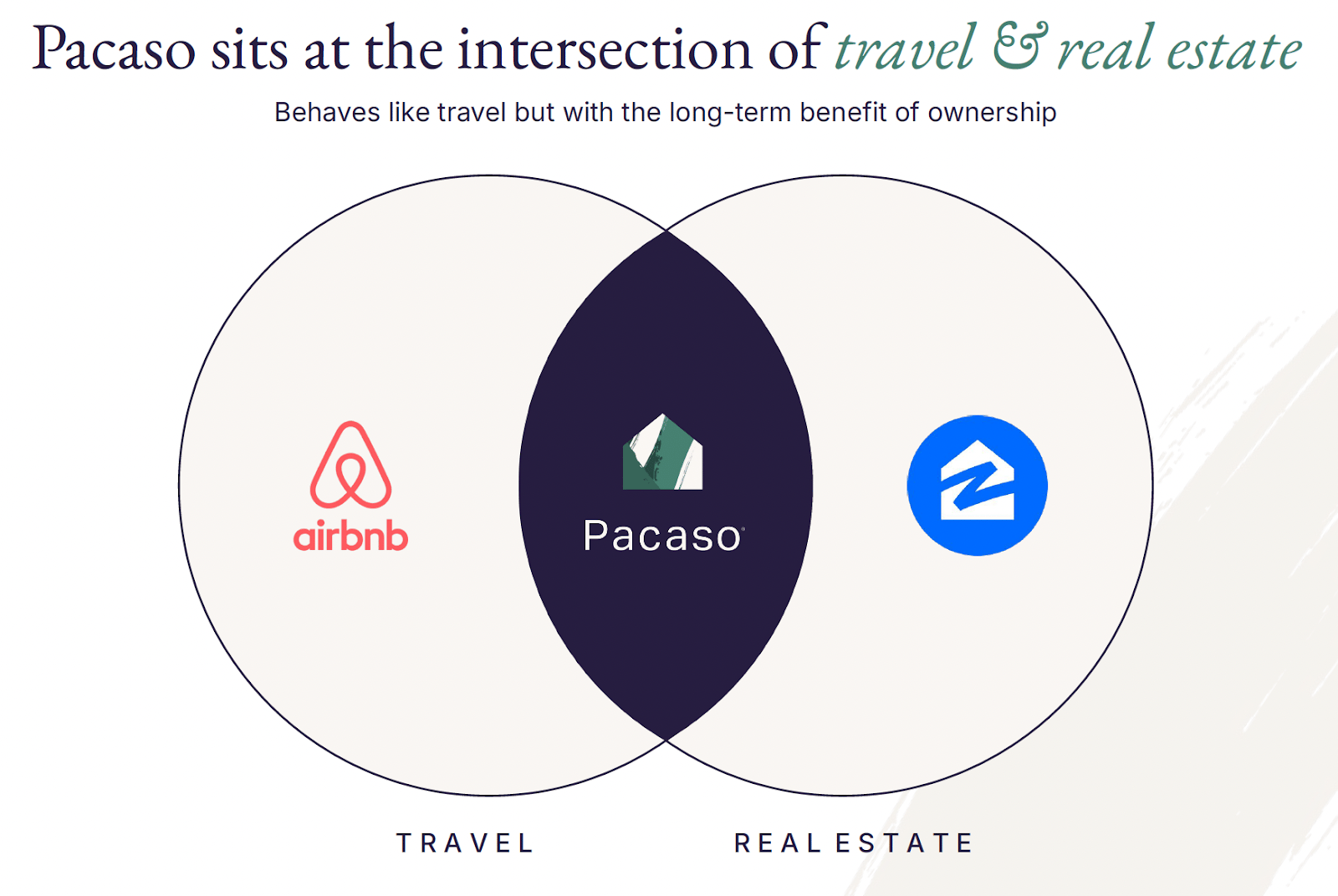

Pacaso sits at the intersection of real estate, fintech, and luxury lifestyle.

It’s a bold experiment in rethinking ownership: one part Zillow and one part Airbnb.

If it succeeds, it could redefine how affluent Americans (and eventually Europeans) think about second homes. The homes are beautiful, the value prop is abundantly clear, and the business model is improving.

If you’d like to join Pacaso on their mission to disrupt a $1.3 trillion market, now’s your time. Check them out here and join 10,000 investors before their investment window closes on Thursday, Sept 18.

Until next time!

Best,

Lit

—

Disclosure: Pacaso is offering securities through the use of an Offering Statement that has been qualified by the Securities and Exchange Commission under Tier II of Regulation A. A copy of the Final Offering Circular that forms a part of the Offering Statement may be obtained from: invest.pacaso.com