Together with

Good Morning,

Zuck launched his Twitter competitor: Threads (Give the Exec Sum team a follow at Litquidity and Jack_Raines 🤝), Fed minutes revealed more rate hikes ahead, BofA increased its dividend by 9% after a Fed stress test, UPS and Teamsters accused each other of walking away from contract talks, and ChatGPT showed its first decline in traffic since its launch.

Let’s dive in.

Before The Bell

As of 7/5/2023 market close.

Markets

All three major US indexes fell slightly yesterday as investors digested the Fed’s meeting minutes which pointed to further rate hikes

Hong Kong’s Hang Seng index led losses in the Eastern hemisphere, tumbling 3%+ in response to the Fed's minutes

Earnings

What we're watching this week:

Today: Levi Strauss

Friday: AZZ, Urban One

Full calendar here

Headline Roundup

Fed minutes reveal more rate hikes ahead, but at a slower pace (CNBC)

China named a new central bank chief (FT)

US new-vehicle sales rose 13% in H1 (WSJ)

Chinese rush to buy Hong Kong insurance and dollars as confidence declines (RT)

Meta launched 'Twitter Killer' Threads app (RT)

Bank of America increased dividend by 9% after Fed stress test (RT)

Illumina faces record fine over $8B acquisition of Grail without EU approval (FT)

JetBlue will end alliance with American to save Spirit merger deal (RT)

Saudi Arabia set to launch multibillion-dollar sports investment group (FT)

UPS, Teamsters accuse each other of walking away from contract talks (RT)

Airlines struggled ahead of July Fourth weekend (CNBC)

China's metal export curbs reignite global companies' hunt for stable suppliers (RT)

ChatGPT's explosive growth shows first decline in traffic since launch (RT)

Major League Pickleball names new CEO, COO to capitalize on surging popularity (RT)

Tuesday was the hottest day ever (WP)

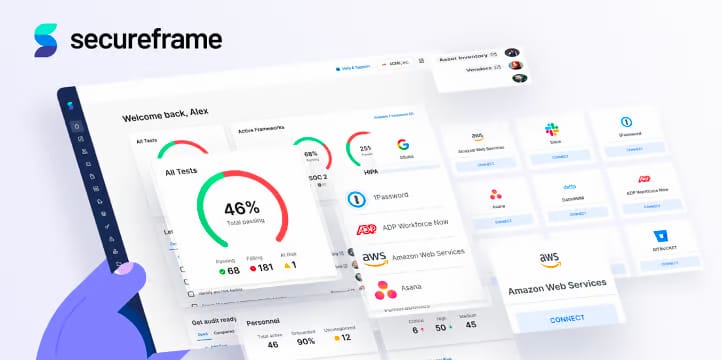

A Message From Secureframe

Get SOC 2 in weeks not months.

Let Secureframe unblock opportunities and accelerate your sales cycle without the need to invest in new resources or overburden your team.

From comprehensive compliance policy templates to over 150 integrations with your core technology services, the Secureframe platform significantly increases the speed with which organizations can confidently begin a SOC 2 audit, without increasing overhead or slowing your team down.

Deal Flow

M&A / Investments

Life insurance company American Equity Investment Life Holding accepted Brookfield Reinsurance’s $4.3B cash and stock takeover bid (BBG)

Teva Pharmaceutical Industries is weighing options for its active ingredients business, including a possible sale that would potentially value the business at $2B (BBG)

Turkey is negotiating with Gulf Arab countries to sell operating rights for Alsancak Port in the Aegean city of Izmir; it previously almost sold for $1.3B to a JV between Hutchinson Port Holdings and Global Yatirim (BBG)

Family-owned food giant Mars will buy Kevin's Natural Foods, which values the PE-backed company at almost $800M (RT)

Oilfield services company Patterson-UTI Energy will buy privately held Ulterra Drilling Technologies from affiliates of Blackstone Energy Partners for $370M cash and $426M stock (RT)

PE firm ArcLight Capital Partners will buy Duke Energy’s commercial distributed generation business in a $364M deal (RT)

Aster DM Healthcare confirmed its discussions with PE firm Fajr Capital to sell a majority stake in its Gulf business (RT)

Advent-owned NielsenIQ gained conditional EU approval to acquire German market research firm GfK if GfK sells its consumer panel business (RT)

Grains merchant Bunge and Chevron acquired Argentina-based agricultural product company Chacraservicios to expand their renewable energy footprint (RT)

VC

Indian online pharmacy startup PharmEasy plans to raise $300M in a new funding round at a 90% markdown from its $5.6B valuation (TC)

Munich-based smart fitness startup EGYM raised a $225M Series F led by Affinity Partners (TC)

Clinical-stage biotech K36 Therapeutics raised a $70M Series B led by Nextech Invest (CB)

Health tech startup Neko Health raised a $65M Series A round led by Lakestar (TC)

French accounting startup Dougs raised $16.4M in its first funding round from Expedition Growth Capital (TC)

Twitter rival Bluesky raised an $8M seed round led by Neo (TC)

API infrastructure company Speakeasy raised a $7.6M seed round led by GV (FN)

Quantum computing software startup Quantagonia raised $4.7M in funding from Tensor Ventures and others (FN)

Immersive Fox, a startup specializing in AI-generated videos, raised a $3.6M seed round from Redseed VC, Monte Carlo Capital, and Altair (FN)

IPO / Direct Listings / Issuances / Block Trades

Romanian energy producer Hidroelectrica's IPO was a ‘historic success,’ pricing the company at $10.3B (RT)

Thyssenkrupp’s Nucera hydrogen unit is set to be valued at $2.75B in its IPO and will begin trading on Friday (BBG)

Greece is planning to IPO a 30% stake in Athens International Airport in early 2024 (BBG)

The Middle East’s top broadcaster MBC Group is planning to meet with investors for a potential IPO in Saudi Arabia (BBG)

Debt

UK sold ~$5B in two-year gilts at a 5.688% yield, the highest two-year borrowing cost since 1998 (FT)

The telecom unit of SoftBank sold $831M in bonds following similar bond deals from real estate firm Mitsui Fudosan and agri equipment firm Kubota Corp. (BBG)

Canada's Sun Life Financial raised $500M through the issuance of sustainable bonds (FG)

Tidewater sold $250M in bonds to fund its $580M acquisition of 37 PSVs from Solstad Offshore (MS)

Bankruptcy / Restructuring

Defaulted developer Shimao Group Holdings failed to find a buyer for a $1.8B project at a forced auction, even at a heavy discount (BBG)

Billionaire Cameron Winklevoss, the cofounder of crypto platform Gemini Trust, gave a best and final offer for digital asset lender Genesis Global Holdco’s bankruptcy restructuring (BBG)

Fundraising

Altas Partners closed its third PE fund Altas Partners Holding III at $4B to invest in and grow businesses in the healthcare, business services and specialized industrial sectors (PB)

Brazilian asset manager Root Capital plans to raise $400M for a Brazil distressed fund (BBG)

Vertex Ventures raised $200M for its third fund to invest in life science and medical technologies (SP)

Japanease pharma firm Chugai raised $200M for a corporate VC fund to invest in drug discovery start-ups (SP)

Crypto Corner

Exec’s Picks

Mike Isaac covered everything you need to know about Instagram’s new text-based app, Threads, in this NYT piece (and give Litquidity a follow while you’re there).

Neil Dutta explained why Wall Street’s Doomsday pessimists were wrong about the economy.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter