Together with

Good Morning,

Happy President's Day. Hope y'all are enjoying the long weekend. We'll keep this edition brief!

Meta is launching a paid verification subscription on Instagram and Facebook, Goldman and BofA expect three Fed rate hikes, China eased overseas IPO rules, Nestle predicts that food prices will continue to rise, Amazon ordered employees back in the office 3x per week, and Stripe needs to raise $4B.

Wine is more than just a beverage, it can also be an investment. Diversify your portfolio with investments in fine wine and rare spirits through today's sponsor, Vint.

Let's dive in.

Before The Bell

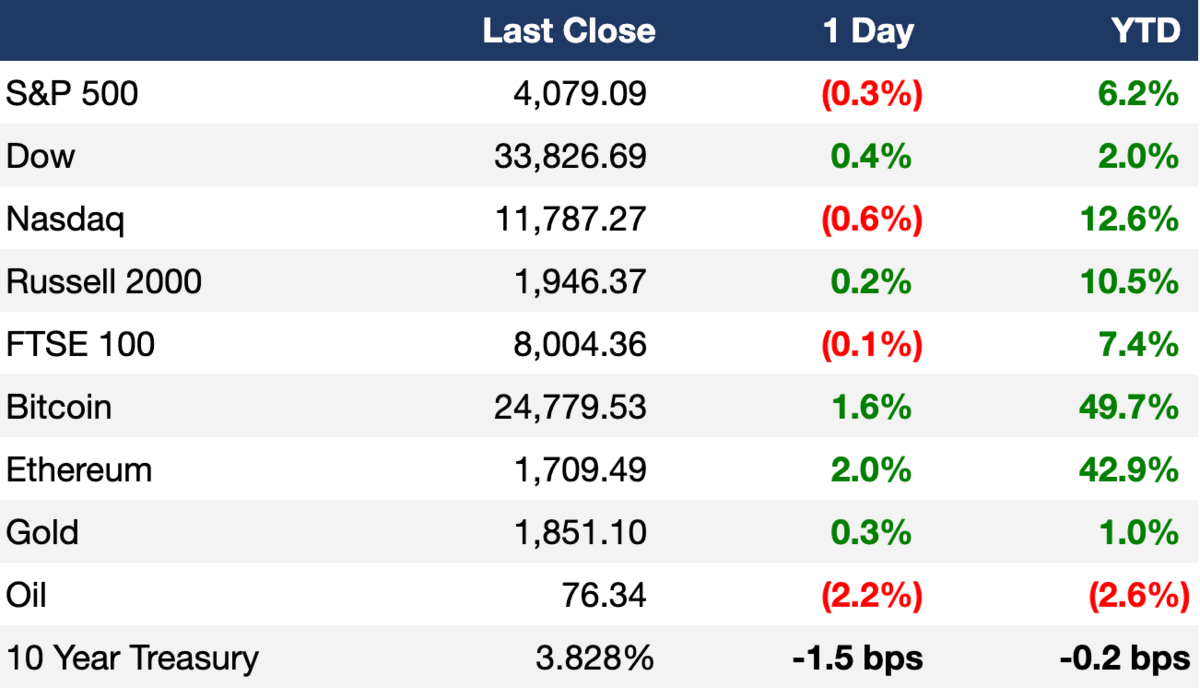

Markets

US stocks ended mixed on Friday as high inflation and a rebound in rates continued to weigh on investor sentiment

The S&P and Dow saw their second and third straight weekly declines, respectively

The Nasdaq ended the week up

10Y and 2Y US Treasury yields hit their highest levels since November

The dollar is up 3% MTD after falling 11.2% from 20 year highs in September

US stock and bond markets are closed today in observance of Presidents' Day

Earnings

What we're watching this week:

Tuesday: Walmart, Home Depot, Coinbase, Public Storage

Wednesday: Nvidia, eBay, TJX, Bumble

Thursday: Alibaba, Wayfair, Carvana

Full calendar here

Headline Roundup

Goldman and BofA expect three Fed rate hikes this year for a 5.25%-5.5% target (RT)

US bond funds saw their first weekly outflow in six weeks (RT)

US import prices dropped for a seventh straight month in January (RT)

Hedge funds' short-covering of tech bets is second biggest in a decade (RT)

Ten firms that went public in 2020/2021 have already agreed to go private (WSJ)

China eased overseas IPO rules (BBG)

Dollar funding for Chinese start-ups fell nearly 75% last year (FT)

South Korean PE firms are expected to raise a record $14B in blind funds this year (PN)

World Bank may free up $4B in lending capacity per year (RT)

Goldman Sachs plans to deploy 25% of its $5.2B growth fund in India and developed Asia-Pacific markets (BBG)

Nestle predicts food prices will continue to rise (AX)

Amazon ordered employees back to office three days/week (CNBC)

Stripe needs $4B by 2024 to cover a pre-IPO ESOP restructuring tax withholding bill (TI)

Meta will test a $12/month subscription service (RT)

SoftBank's Arm China profit dropped over 90% in 2022 (RT)

Index funds now own more of Tesla than Musk (FT)

Musk closed two of three Twitter India offices (BBG)

Credit Suisse's Singapore CEO will depart the bank (RT)

CIBC will pay $770M to PE firm Cerberus to resolve a 2008-related lawsuit (RT)

US property prices are overvalued by $121B-$237B based on flood risk (AX)

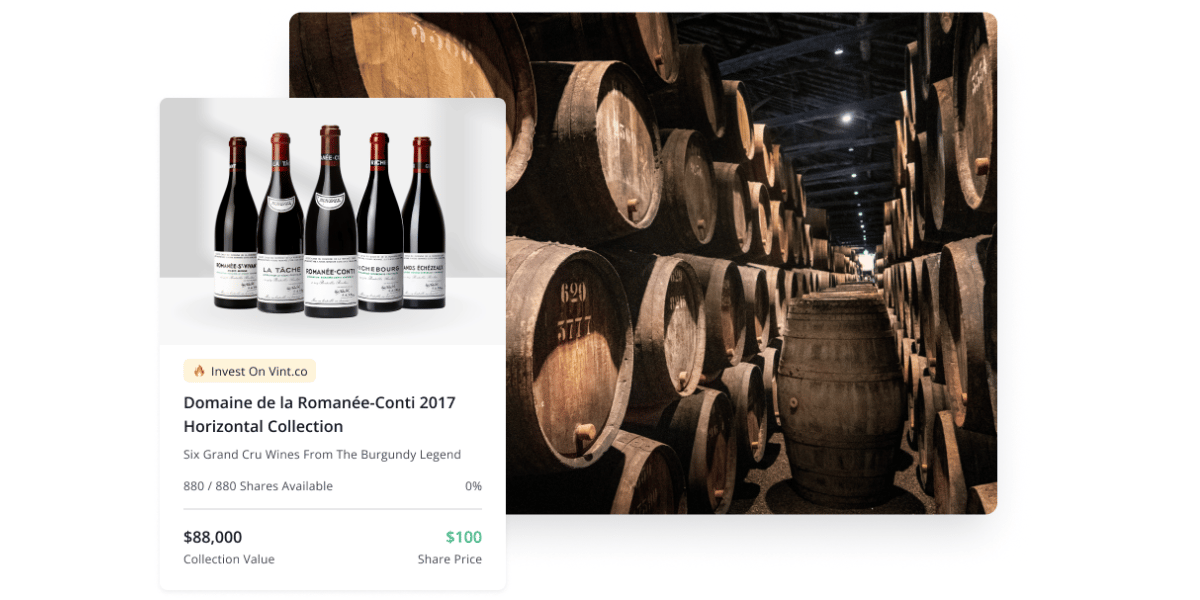

A Message From Vint

Fine Wine & Spirits Investing:

This Presidents Day, let’s explore one of our founding father’s favorite asset classes, Fine Wine. Thomas Jefferson was notorious for having an expensive taste; this included his wine, which he stored in his impressive and well-documented cellar at Monticello.

He didn’t get through all of it, though. A 1787 vintage Chateau Lafite owned by Jefferson sold at auction in 1985 for over $150K; talk about a return.

Fine wine investing is no longer just for presidents and billionaires, though. Vint offers SEC-Qualified offerings of fine wine and rare spirits to accredited and unaccredited investors. Providing diversification across an asset class and portfolio.

In 2022, Vint’s exits returned 28.3% on a net annualized basis across multiple sales*.

*View Vint.co/disclaimer for full disclaimer

Deal Flow

M&A / Investments

Self-storage properties operator Life Storage rejected an $11B offer from bigger rival Public Storage (RT)

UK chemical giant INEOS and US HF Elliott Investment Management submitted bids for Premier League team Manchester United, whose owners are seeking an $8.4B+ valuation (RT)

Tesla is weighing a takeover of battery-metals miner Sigma Lithium, which has a $3B+ market value (BBG)

UK retailer Tesco is planning to sell its Tesco Bank business which could be worth over $1.2B (SKY)

Germany-owned energy firm Uniper will take a $4.2B hit on its Russian division Unipro after failing to sell to a Russian buyer (FT)

Automotive supplier Motherson agreed to buy French car parts maker Faurecia's SAS Cockpit Modules in a $577.5M deal (RT)

Australian logistics software maker WiseTech Global will acquire US-based intermodal rail solutions provider Blume Global for $414M (RT)

Santander Asset Management is among parties interested in acquiring UK asset manager abrdn's PE unit which could be valued at ~$300M (RT)

Power generator and distributor Central Puerto bought Italian utility Enel's stake in two Argentina thermal generation plants for $102M total (BBG)

Indian automotive components maker Minda acquired a 15.70% stake in rival Pricol for $48.3M (RT)

Ghana's state-owned Minerals Income Investment Fund is in talks to invest up to $30M in Atlantic Lithium (RT)

Investment firm 777 Partners is considering buying a stake in English soccer team Everton FC (BBG)

Singapore lender DBS is considering raising its stake in Shenzhen Rural Commercial Bank amid the bank's plans to IPO in the next few years (BBG)

Airline Air France-KLM’s CEO reiterated interest in Portugal’s soon to be privatized carrier TAP (RT)

Japan's Sumitomo and Osaka Gas put UK water supplier SES Water up for sale (FT)

VC

Autonomous cargo drone airline Dronamics raised a $40M pre-Series A from Founders Factory, Speedinvest, Eleven Capital, and the Strategic Development Fund (TC)

Web3 gaming startup Unagi raised a $5M seed round led by Sisu Game Ventures (TC)

Mad Rabbit, a clean and natural tattoo skincare brand, raised $4M in funding from Mark Cuban, Acronym Venture Capital and more (BP)

COMMUNITYx, a women-owned startup building an app to connect people around the world to causes they care about, raised a $2M seed round led by the Fearless Fund (BW)

IPO / Direct Listings / Issuances / Block Trades

BMC Software, a tech firm owned by KKR, hired Goldman Sachs for a 2023 IPO which could value the firm at up to $15B (BBG)

Online fashion group Shein expects revenue to more than double to $60B by 2025 as it plans for a 2023 IPO (FT)

Bain Capital picked Goldman Sachs, UBS and Barrenjoey for its IPO of airline Virgin Australia in what could be Australia's biggest listing this year (BBG)

Apollo-owned Italian gambling company Lottomatica plans to IPO in Milan as early as April (RT)

SPAC

Infrastructure construction firm Southland merged with Legato Merger Corp. II in an $810M deal (GNW)

Debt

Egypt will start investor meetings for its debut Islamic-bond sale (BBG)

Bankruptcy / Restructuring

Jorge Paulo Lemann, Carlos Sicupira, and Marcel Telles, the billionaire trio of investors in bankrupt Brazilian retailer Americanas, offered $1.3B in fresh funding, just 45% of what creditors are demanding (BBG)

Fundraising

Arkansas Public Employees' Retirement is looking to commit up to $575M to PE fund-of-funds managers in 2023 (PI)

African innovation hub Co-Creation Hub launched a $15M accelerator to support Nigerian / Kenyan edtech startups (TC)

Apollo Global Management and Goldman Sachs Asset Management are preparing to launch private credit funds aimed at wealthy European investors (BBG)

Crypto Corner

Binance.US confirmed that a trading firm managed by CEO Changpeng Zhao operated on its platform (RT)

Binance's stablecoin saw ~$2.5B in outflows last week amid regulatory crackdown (RT)

Binance is considering ending relationships with US partners as crypto crackdown escalates (BBG)

Chicago-based Jump Crypto made $1.28B from Do Kwon’s doomed Terra ecosystem (CD)

Ex-FTX exec Nishad Singh plans to plead guilty to fraud (BBG)

NFT marketplace OpenSea will temporarily eliminate its marketplace fee (CD)

Ex-NBA star Paul Pierce will pay over $1.4M to settle illegal crypto promotion charges (RT)

Exec's Picks

So you want a new watch, but there are just too many choices. Rolex? Patek? Leather strap? Metal? What dial color? Figuring out your perfect watch is hard, but Bezel makes it easy. Bezel is the most trusted marketplace for buying and selling luxury watches, and their Concierge Team will help you filter through 3,000+ models to find the perfect piece for you. Get your next watch here.

Bloomberg's Emily Chang wrote a good piece on "The Extraordinary Exit of the Women of Silicon Valley."

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.