Together with

Good Morning,

Zuck accepted Musk’s challenge to a cage fight, the FTC sued Amazon over ‘manipulative’ enrollment tactics, short bets against US stocks hit their highest level in more than a year, China unveiled a $72B tax break for EVs, and an ex-Goldman banker was convicted of passing insider tips to his squash buddy.

Looking for a resilient asset class to diversify your portfolio? You can invest directly in farmland through today’s sponsor, AcreTrader.

Let’s dive in.

Before The Bell

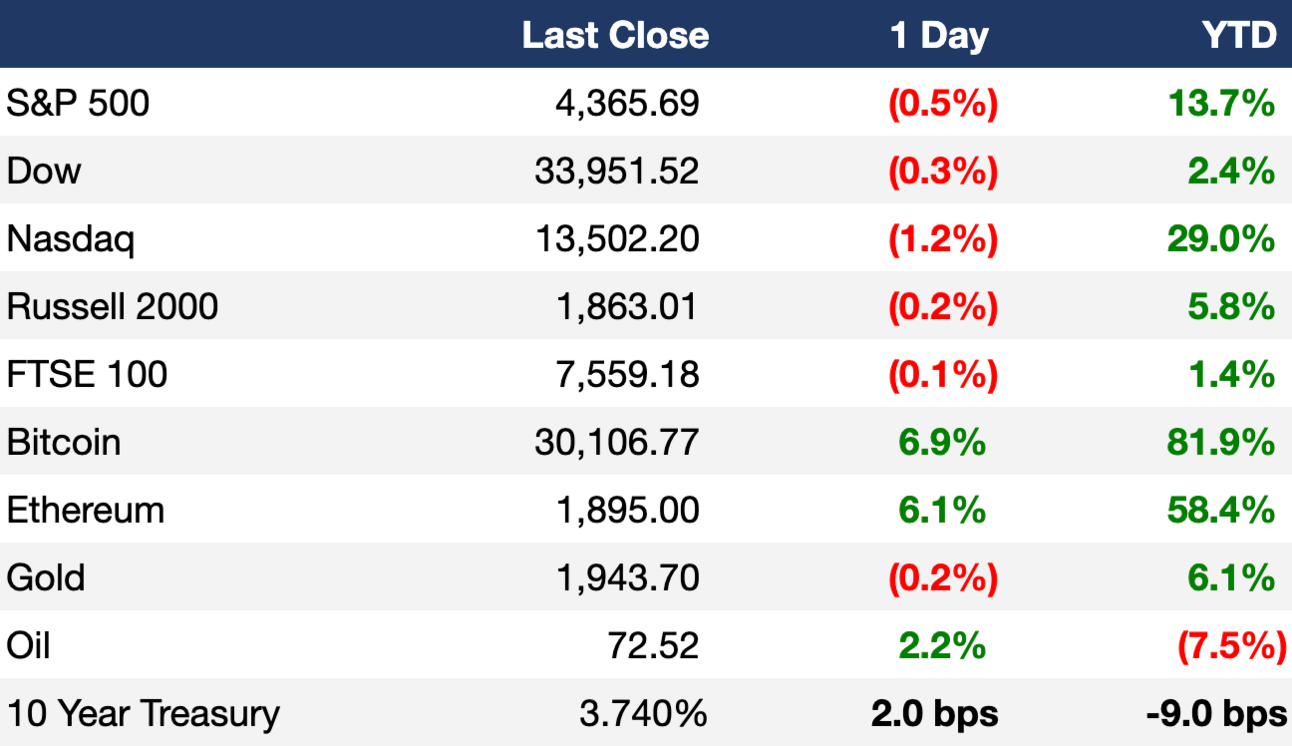

As of 6/21/2023 market close.

Markets

Stocks finished lower as Fed Chair Jerome Powell indicated to Congress there could be more rate hikes this year

All three major US indexes fell for a third-straight day, with the Nasdaq Composite seeing the largest loss and sliding 1.21%

Markets in Hong Kong, mainland China, and Taiwan are closed for a holiday Thursday

Crypto prices surged in the last 24 hours, with bitcoin breaking above the $30K mark for the first time since April 26th

Oil prices gained as US corn and soybean prices raced to multi-month highs, raising expectations that crop shortfalls around the globe could lower biofuels blending and increase oil demand

Earnings

Headline Roundup

Mark Zuckerberg is ready to fight Elon Musk in a cage match (TV)

Chipmaker Intel restructures manufacturing business (RT)

Tech companies including Google gripe about unfair cloud practices (RT)

Singapore central bank fines DBS, Citibank, OCBC, Swiss Life over breaches (RT)

Retail army bets record $1.5B on single stocks in a week (BBG)

Short bets on US stocks hit $1T, most since April 2022 (BBG)

Uber to lay off 200 employees in recruitment division (RT)

SoftBank’s Vision Fund to start job cuts as soon as this week (YF)

China unveils $72B tax break for EVs, other green cars to spur demand (RT)

PGA Tour plans to testify at Senate hearing on LIV merger (CNBC)

JPMorgan commercial bank enters Singapore, Israel in global push (RT)

US companies held hostage by the whims of TikTok (WSJ)

FTC sues Amazon over ‘manipulative’ tactics to enroll users in Prime (WSJ)

US tracked ZTE, Huawei workers at suspected Chinese spy sites in Cuba (WSJ)

Home listings plummet as high mortgage rates tie owners down (BBG)

Ex-Goldman banker convicted of passing insider tips to squash pal-turned-informant (BBG)

A Message From AcreTrader

Dig Into Farmland Investing

Farmland investments historically sprout consistent returns for investors, even during high inflation.

With offerings across dozens of crop types and geographies, AcreTrader makes it easy to invest in farm and timberland assets at accessible minimums without buying the whole farm.

Diversify your portfolio with farmland to help navigate economic headwinds.

Deal Flow

M&A / Investments

International satellite service provider Intelsat has ended $10B merger negotiations with satellite telecom provider SES (RT)

Ontario Municipal Employees Retirement System is purchasing a stake in Maple Leaf Sports & Entertainment, a sports and commercial RE company that owns the Toronto Maple Leafs of the NHL and Toronto Raptors of the NBA, from minority owner Larry Tanenbaum at an $8B valuation (BBG)

Telecom Italia is restarting efforts to sell a minority stake in its enterprise unit potentially valued at over $6.6B (BBG)

Bain Capital is buying a 20% stake in IMS Nanofabrication in a deal that values the Austrian Intel subsidiary at $4.3B (BBG)

Midea Group has dropped its pursuit of $3.9B Electrolux after the Swedish home appliance maker and its top shareholder Investor AB sought regulatory assurances (BBG)

Book publisher Simon & Schuster, whose $2.2B sale to Penguin Random House fell through due to antitrust, has received a buyout bid from Richard Hurowitz backed by Abu Dhabi’s Mubadala (RT)

Blackstone has invested another $1B into clean energy provider Invenergy Renewables Holdings, raising the PE firm’s total investment to $4B (RT)

Japanese telecommunications provider KDDI Corporation is buying Allied Properties Real Estate Investment Trust’s urban datacenter portfolio for $1B (RT)

CVC Capital Partners is considering options including a sale of its significant minority stake in Philippine logistics company Fast Group in a deal that could value the company at ~$1B (BBG)

Bahrain’s state investment fund Mumtalakat is buying $510M worth of McLaren preferred stock and warrants from Saudi Arabia’s PIF and Ares Management (RT)

Swedish bank SEB is buying Lufthansa’s AirPlus payments subsidiary for ~$491M (RT)

Abu Dhabi National Energy Company plans to buy Sustainable Water Solutions Holding Company for $463M (RT)

Brazilian lender Itau Unibanc will acquire a minority stake in a power plant complex owned by energy company Eneva for $210M (RT)

Canal+, a French broadcaster owned by Vivendi, bought a 26.1% stake in over-the-top video streaming service Viu for $200M (BBG)

Rivian acquired Swedish EV route planning app maker Iternio to add to its technology to Rivian pickup trucks and sport utility vehicles (RT)

Egypt's Suez Canal Authority is selling a 20% stake in subsidiary Canal Company for Mooring and Lights (RT)

VC

Aledade, a primary care network, raised a $260M Series F led by Lightspeed Venture Partners (FN)

HighFive Healthcare, a dental partnership organization focused on endodontics and oral surgery, raised $100M in funding from Norwest (PRN)

Patient demand and care access platform DexCare raised a $75M Series C led by ICONIQ Growth (BW)

Volt, an open banking fintech for payments and more, raised a $60M Series B at a $350M+ valuation led by IVP (TC)

Biotherapeutics company Attovia Therapeutics raised a $60M Series A led by Frazier (FN)

Japanese no-code AI platform FLUX raised a $32M Series B led by DNX Ventures (PRN)

Intelligent automation platform System Initiative raised $18M: $3M in seed funding led by Amplify Partners and $15M Series A led by Scale Venture Partners (BW)

Digital healthcare startup Caraway raised a $16.8M Series A led by Maveron and GV (FN)

Healthcare administrative burden startup Outbound AI raised a $16M seed round led by Madrona Venture Group and SpringRock Ventures (BW)

Fero Labs, a manufacturing process optimization software company, raised $15M in funding led by Climate Investment (PRN)

Retail platform Leap raised $15M in funding led by BAM Elevate and Costanoa Ventures (PRN)

Sollis Health, a members-only medical concierge service, raised a $15M extension of its Series A led by Torch Capital, Strand Equity, Arkitekt Ventures, and more (BW)

beehiiv, the newsletter platform powering our very own Exec Sum, raised a $12.5M Series A led by Lightspeed Venture Partners (TC)

Augmenta, a startup automating building design for the construction industry, raised an $11.8M seed extension led by Eclipse (BW)

Electronic court notice management platform ECFX raised $7M in funding led by Growth Street Partners (PRN)

Alvys, a Solana Beach-based provider of a cloud-based transportation management system for small to midsized trucking companies, raised a $6.3M seed round led by Bonfire Ventures (FN)

BetterBrand, a food tech startup known for creating “The Better Bagel,” raised a $6M Series A at a $170M valuation led by Verso Capital (TC)

Altis Labs, a computational imaging company focused on accelerating clinical trials, raised a $6M seed round led by Benchstrength and Debiopharm Innovation Fund (BW)

Cargobot, an international digital freight company, raised a $6M Series A led by BPBI (FN)

Aktos, a startup building a software platform for debt collections agencies, raised a $4.4M seed round led by 8VC and Crew Capital (BW)

IPO / Direct Listings / Issuances / Block Trades

Thyssenkrupp Nucera will be valued at more than $3.3B in its planned IPO (RT)

Abu Dhabi will take a 7% stake and a board seat in Chinese EV maker Nio through a purchase of $739M of newly issued shares (BBG)

Appliance maker Midea is considering a relisting of its German robotics firm Kuka on an Asian stock exchange (BBG)

SPAC

Financials Acquisition Corp. will seek shareholder permission for more time to create a $1.3B insurance undertaking (RT)

Bankruptcy / Restructuring

Fundraising

An Indian climate-focused VC firm Avaana Capital raised $70M in its first funding round to invest in clean energy and climate technology (RT)

Crypto Corner

Bitcoin bonanza on tap if BlackRock ETF approved (RT)

$1.4T investment management company Invesco reapplied for a Bitcoin ETF in conjunction with digital asset firm Galaxy Digital (CD)

Binance.US now only accounts for 1.5% of total weekly trading volume in the US, down from 8.2% at the start of the year (BBG)

The Fed sees payment stablecoins as a form of money and argued for central-bank oversight over stablecoin regulations (CD)

Exec’s Picks

Remember the four-week-old AI startup that raised $100M+ despite not having a working product? Sifted shared their pitch deck here.

Ben Carlson wrote a good piece on how financial advice has evolved over time.

Litney Partners - Financial Recruiting 💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter