Together with

Good Morning,

Nvidia volatility surpassed Bitcoin's, a divided BoE cut rates, hedge fund allocation to China hit a five-year low, Google is hoarding Nvidia chips for YC-backed startups, and the 9/11 mastermind will avoid the death penalty.

ARK Venture Fund recently opened to all US investors, offering exposure to startups like SpaceX and OpenAI. Check out their portfolio and see how you can invest today.

Let’s dive in.

Before The Bell

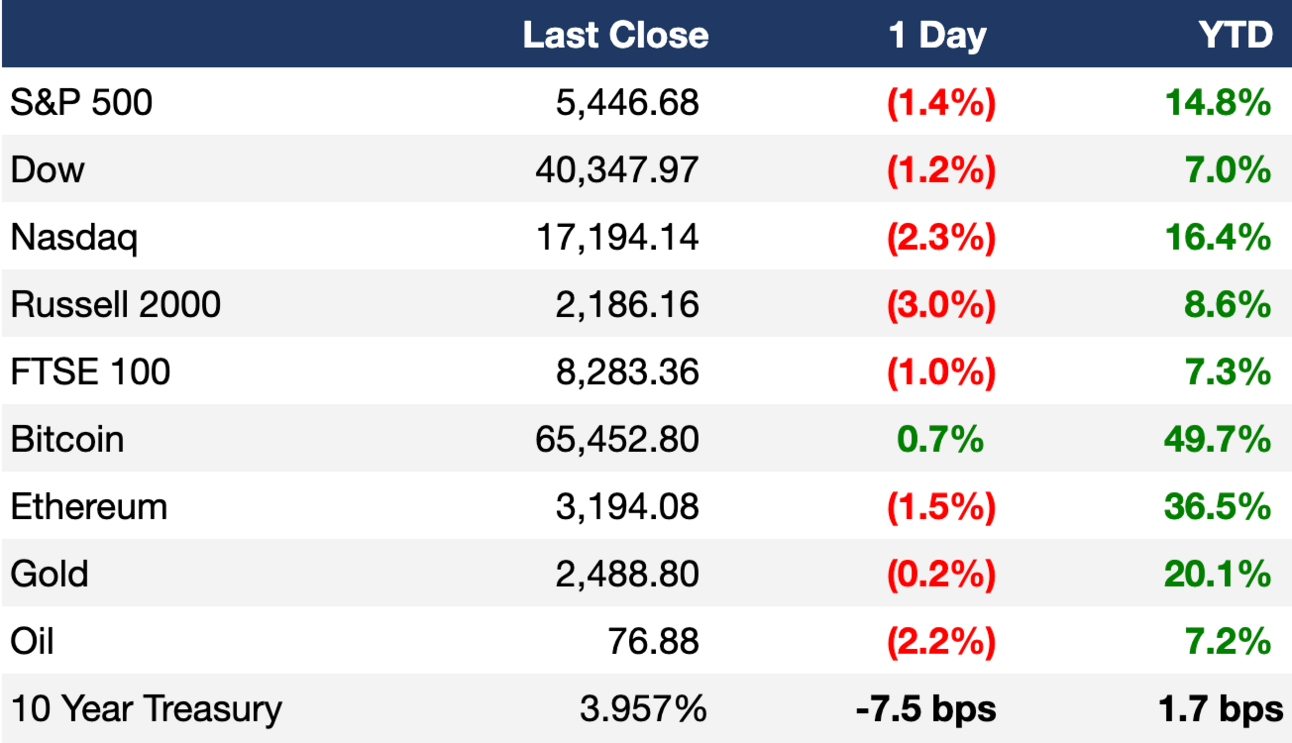

As of 08/01/2024 market close.

Markets

US stocks tumbled yesterday as fresh economic data ignited recession fears

Russell 2000 suffered its worst day since February

Philadelphia Semiconductor index dropped 7.1% in its worst day since Covid

VIX touched its highest level YTD

Japan led Asian shares lower, with Nikkei 225 plunging to its lowest since February

US 10Y yield tumbled to its lowest since February

US 2Y yield slid to its lowest since May 2023

China 7Y yield fell below 2% for the first time ever

Nvidia's 30-day implied volatility surpassed Bitcoin and Ether

Earnings

Apple beat Q3 EPS estimates with a 5% rise in revenue, though Chinese sales declined due to competition from local rivals (CNBC)

Amazon beat Q2 EPS estimates but missed on revenue and issued weak Q3 guidance as sluggish retail growth offset strength in cloud and ads; shares fell 7% (CNBC)

Intel plunged 20% after missing on Q2 EPS and revenue and Q3 guidance amid AI cost and competition struggles, suspended dividends, and mega layoff plans (CNBC)

Coinbase beat Q1 EPS and revenue estimates on a 139% YoY increase in transaction revenue as trading volumes roared back to life thanks to a crypto euphoria (RT)

Apollo Global fell 7% after reporting flat Q2 net income as losses from interest rate hedges offset record gains in fees (RT)

What we're watching this week:

Today: ExxonMobil, Chevron

Full calendar here

Headline Roundup

BoE cut rates for the first time since Covid (FT)

Weak US economic data triggered recession fears (WSJ)

Hedge fund allocation to China hit a five-year low (RT)

Japan stocks see biggest weekly foreign outflow in ten months (RT)

US is investigating Nvidia over antitrust complaints (TI)

FTC will probe elevated grocery prices (RT)

US households invested in mutual funds rose to over 50% in 2023 (FT)

GPB Capital co-founders were found guilty of ponzi-like fraud (WSJ)

Google Cloud is hoarding Nvidia chips for YC-backed startups (TC)

Elliott's activist offer would allow Starbucks CEO to stay (CNBC)

UK charged four Glencore ex-execs over corruption (FT)

Shell's CEO says Europe’s energy crisis is over (FT)

DraftKings will implement a customer surcharge in high-tax states (BBG)

Spirit is laying off hundreds of pilots (WSJ)

Big Law is rallying behind Kamala Harris (FT)

9/11 mastermind will avoid death penalty in US plea deal (AP)

A Message From ARK Invest

The ARK Venture Fund is taking an asset class once reserved for the accredited, ultra-rich and making it available to all US investors.

ARK offers investment exposure to companies like SpaceX, OpenAI, Anthropic, Discord, and more! See the portfolio here.

You can invest in the ARK Venture Fund (ARKVX) for as little as a $500 minimum initial investment.

All US self-directed investors can download the SoFi or Titan app and invest in the ARK Venture Fund (ARKVX) now.

Deal Flow

M&A / Investments

PE firms TowerBrook Capital Partners and CD&R will take private hospital revenue cycle management firm R1 RCM in an $8.9B cash deal (BBG)

BNP Paribas is in exclusive talks with French insurer AXA's asset management unit for $5.5B (BBG)

Saudi-owned agri investor SALIC is in talks to acquire the remaining 65% stake in Temasek-owned Olam's agricultural products business it doesn't already own (WSJ)

Brookfield agreed to acquire nVent Electric's heating cables business for $1.7B cash (BBG)

CD&R is exploring a sale of card maker American Greetings for $1.5B, including debt (RT)

Infrastructure engineering firm Arcosa will acquire the construction materials business of Stavola for $1.2B cash (BW)

Japan's Otsuka Pharmaceutical will acquire for US drugmaker Jnana Therapeutics in a $1.1B deal (RT)

Marketing firm Outbrain will acquire telecom Altice International's video advertising platform Teads in a $1B deal (BBG)

23andMe CEO Anne Wojcicki offered to buyout the firm for ~$200M cash (BBG)

Hedge fund tycoon Paul Marshall is in advanced talks to acquire the Spectator magazine for ~$127M (FT)

Reddit will acquire GenAI ad startup Memorable AI (BBG)

Covariant, a maker of AI software for industrial robots, received takeover interest from Amazon (BBG)

BharCap Partners agreed to acquire a majority stake in fintech Electronic Merchant Systems from founder Jim Weiland (BBG)

VC

Protect AI, an AI/ML security company, raised a $60M Series B led by Evolution Equity Partners (BW)

Proptech startup MYNE raised a $44M Series A led by Limestone Capital (EU)

Axle Energy, a startup integrating renewable energy sources into grids, raised a $9M seed round led by Accel (TC)

Financial management platform Bourgeois Boheme raised a $7.2M seed round led by Graphit Lifestyle (EU)

Bee, a life admin wearable assistant, raised a $7M seed round led by Exor (FN)

SAF startup Sora Fuel raised a $6M seed round led by The Engine Ventures (BW)

When, an AI-powered offboarding solution, raised a $4.6M seed round led by B Capital (FN)

Heeyo, an AI chatbot and interactive platform for children, raised a $3.5M seed round from OpenAI Startup Fund, Alexa Fund, Pear VC, and more (TC)

IPO / Direct Listings / Issuances / Block Trades

Indian e-scooter maker Ola Electric drew $2B in bids for its $734M local IPO (RT)

Indian retailer FirstCry is seeking to raise $500M at a $2.9B valuation in a local IPO (RT)

Cerebras Systems, an AI chip maker, confidentially filed for a US IPO (BBG)

British Airways parent IAG abandoned plans to buy Air Europa (BBG)

Debt

Deutsche Bank and RBC are preparing a $4.5B debt package to help fund TowerBrook Capital and CD&R’s LBO of R1 RCM (BBG)

Deutsche Bank is seeking to sell a $1B US CRE loan portfolio (BBG)

A consortium of Canadian indigenous communities is preparing a $720M bond offering to fund a stake purchase in TC Energy's natural gas pipeline system (BBG)

UK grocery tech company Ocado sold $576M in bonds to address upcoming maturities (BBG)

Fundraising

Crypto Corner

A crypto exec is pushing for industry support of Kamala Harris (CD)

Exec’s Picks

WSJ published an insightful piece on the top cities where college graduates are still getting hired.

Financial Services Recruiting 💼

If you're currently a junior banker looking to break into the buy side, lateral to another investment bank, or consider new paths amid changing market dynamics, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, debt funds, and investment banking.

To get started, simply head over to Litney Partners and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter