Together with

Good Morning,

China is ensuring AI models are socialist, Colin Kaepernick launched an AI startup, Chinese quant funds are struggling, CrowdStrike may cost Fortune 500 firms over $5B, and US stocks continued to get wrecked.

Sky-high rates and stock market volatility calls for a portfolio rebalance. Gain exposure to private credit with Percent, a highly democratized private credit market for exclusive private credit deals.

Let's dive in.

Before The Bell

As of 07/24/2024 market close.

Markets

US stocks got hammered as investors reacted to disappointing earnings from Big Tech names

S&P snapped its longest streak without a 2% decline since 2007

S&P had its worst day since December 2022

Nasdaq had its worst day since October 2022

Volatility Index (VIX) hit a three-month high

China 2Y-10Y premium widened to the most since 2020 as steepener bets grow

Earnings

IBM beat Q2 EPS and revenue estimates on growth in business tied to AI (CNBC)

Ford tumbled ~12% after widely missing Q2 EPS estimates due to continued warranty costs issues (CNBC)

AT&T jumped ~5% after beating Q2 estimates for wireless subscriber additions on strong demand for higher-priced plans (CNBC)

Chipotle beat Q2 EPS and revenue estimates on an 8.7% increase in foot traffic, defying an industry slowdown (CNBC)

What we're watching this week:

Today: American Airlines

Full calendar here

Headline Roundup

Leveraged tech bets lost 37% after drawing $2B of inflows (BBG)

BoC cut rates by 25 bps for the second-straight month (RT)

Eurozone banks see IB boost but outlook concerns grow (RT)

Fortune 500 firms may see $5.4B in losses tied to CrowdStrike (RT)

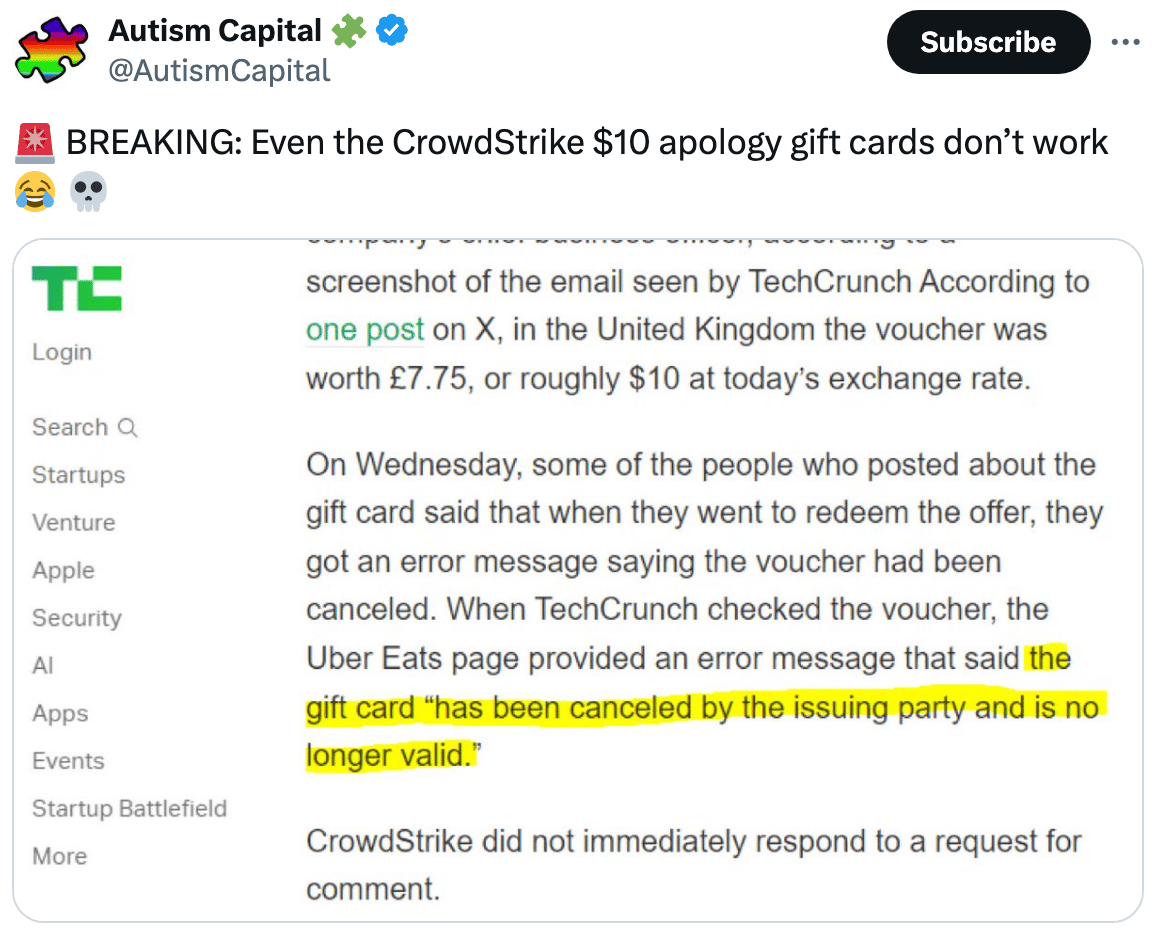

CrowdStrike offered $10 gift cards to clients as an apology (TC)

Secondaries deal flow rose 58% YoY in H1 (WSJ)

Firms are divesting bigger assets as dealmaking recovers (WSJ)

Investors are warming to UK equities (FT)

India is closing in on China as largest emerging market (FT)

China is testing AI models to make sure they're socialist (FT)

China quant funds suffer deep losses in H1 amid crackdown (RT)

China says Taiwanese workers have nothing to fear if law-abiding (RT)

Lackluster LVMH earnings flash warnings for global luxury market (FT)

NBA signed a $77B streaming deal with ESPN, NBC, and Amazon (RT)

Blackstone's mortgage REIT fell 10% on mounting CRE woes (RT)

Luxury home sales continue to surge in otherwise slow market (BBG)

The hottest job market in a generation is over (WSJ)

Bernard Arnault lost more wealth than any billionaire in 2024 (BBG)

A Message From Percent

Private Credit with APY Potential up to 20%

Are you looking to diversify beyond stocks and bonds? Thousands of accredited investors are tapping into the yield potential of private credit investments.

Private credit is a broad category of direct lending that includes corporate loans, asset-based loans and other privately negotiated deals with corporate borrowers.1

Percent has powered over $1bn in deals through their private credit marketplace. On their platform, you can find:

High APY potential: average net APY of 14.08% in Q2 2024

Flexible and shorter durations with most deals maturing in 6-36 months

Recurring cashflow through interest payments, available in most deals

Diversification in lending types across small business loans, merchant cash advances, trade finance, consumer loans and more

1Alternative investments are speculative and possess a high level of risk. No assurance can be given that investors will receive a return of their capital. Investors who cannot afford to lose their entire investment should not invest. Investments in private placements are highly illiquid and investors who cannot hold an investment for an indefinite term should not invest. Private credit investments may be complex and are subject to default risk.

Deal Flow

M&A / Investments

Grains merchant Bunge Global's $8.2B acquisition of Glencore-backed Viterra is set to gain EU approval (BBG)

T-Mobile agreed to invest $4.9B in a JV with KKR to buy fiber-optic internet company Metronet (WSJ)

CD&R and Permira made a $2.4B takeover offer for French cybersecurity firm Exclusive Networks (BBG)

UK events group Informa agreed to take private rival Ascential for ~$1.5B cash (BBG)

Castlelake is mulling a $1B sale for consumer-lending platform Concora Credit (BBG)

Manufacturer Silgan agreed to buy 3i-backed German packaging group Weener Plastics at a $908M EV (WSJ)

IAG's planned $434M takeover of Air Europa may fall through (BBG)

UniCredit agreed to buy Polish banking services provider Vodeno and Belgian digital bank Aion Bank for ~$402M (BBG)

UK consumer goods company Reckitt Benckiser plans to sell some homecare brands and review options for its infant formula business (BBG)

PE firm 21 Invest is considering a sale of Italian eye-care firm Sifi (BBG)

VC

Satellite communications startup Astranis raised a $200M Series D led by a16z (TC)

Vanta, a platform to automate security and compliance, raised a $150M Series C at a $2.45B valuation led by Sequoia (TC)

H55, a Swiss startup specializing in electric aviation tech, raised a $71M Series C from Quebec (FN)

Spanish tour booking platform Exoticca raised a ~$65M Series D led by Quadrille Capital (TC)

Dentist AI startup Pearl raised a $58M Series B led by Left Lane Capital (TC)

Dazz, an AI-based automated cloud security remediation platform, raised a $50M round led by Greylock, Cyberstarts, Insight Partners, and Index Ventures (TC)

Lakera, a Swiss platform to protect LLMs from malice, raised a $20M Series A led by Atomico (TC)

Star Catcher, a space-based energy grid, raised a $12.25M seed round led by Initialized Capital and B Capital (FN)

Splight, an AI startup tackling energy curtailment, raised a $12M seed round led by Noa (PRN)

Uplimit, an AI-powered enterprise learning startup, raised an $11M Series A led by Salesforce Ventures (FN)

Parenting tech platform Joy raised a $10M seed round led by Forerunner (PRN)

Evo Security, a Identity and Access Management solutions for MSPs, raised a $6M Series A led by TechOperators (PRN)

Vijil, a startup building AI agents for enterprises, raised a $6M seed round led by AIStart seed fund and Gradient Ventures (FN)

Open-source LLM testing company Promptfoo raised a $5M seed round led by a16z (FN)

Colin Kaepernick's AI storytelling startup Lumi raised a $4M seed round led 776 (TC)

IPO / Direct Listings / Issuances / Block Trades

Logistics giant Lineage raised $4.4B at an ~$18B valuation in the biggest IPO YTD (BBG)

KKR-backed finance SaaS firm OneStream jumped 34% in its trading debut after its $490M IPO (BBG)

Brazilian utility Equatorial Energia is considering a $450M share sale to help finance its 15% stake purchase of water utility Sabesp (BBG)

SPAC

Bitcoin financial services company Fold will merge with FTAC Emerald Acquisition Corp. in a $365M deal (BW)

Debt

PE-backed Plan B-maker Foundation Consumer Healthcare is seeking $1.5B in private credit to refinance debt (BBG)

Distressed Chinese builders Logan and KWG Group are nearing a $1.3B refinancing for a Hong Kong property loan with investors including PIMCO, Deutsche Bank, and Singapore PE firm RRJ (BBG)

Telecom group Altice took a $1.3B margin loan against its 24.5% stake in BT (FT)

Bankruptcy / Restructuring

Fundraising

Agellus Capital raised $400M for its debut PE fund to invest in essential services (WSJ)

Crypto Corner

Exec’s Picks

The ARK Venture Fund is taking an asset class once reserved for the accredited, ultra-rich and making it available to all US investors. Gain exposure to a portfolio comprising names like SpaceX, OpenAI, and Anthropic with as little as $500. Learn more and invest today.

Financial Services Recruiting 💼

If you're currently a junior banker looking to break into the buy side, lateral to another investment bank, or consider new paths amid changing market dynamics, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, debt funds, and investment banking.

To get started, simply head over to Litney Partners and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter