Together with

Good Morning,

Four quant firms partnered to take on Citadel Securities, SCOTUS delayed ruling on Trump's tariffs, bondholders sued Oracle for losses tied to AI, McKinsey is asking job candidates to use AI in interviews, Epstein lured victims in exchange for admission to Columbia, and global investors are betting big on China for 2026.

Plaid just released their flagship fintech predictions report for 2026. Read it here.

Let's dive in.

Before The Bell

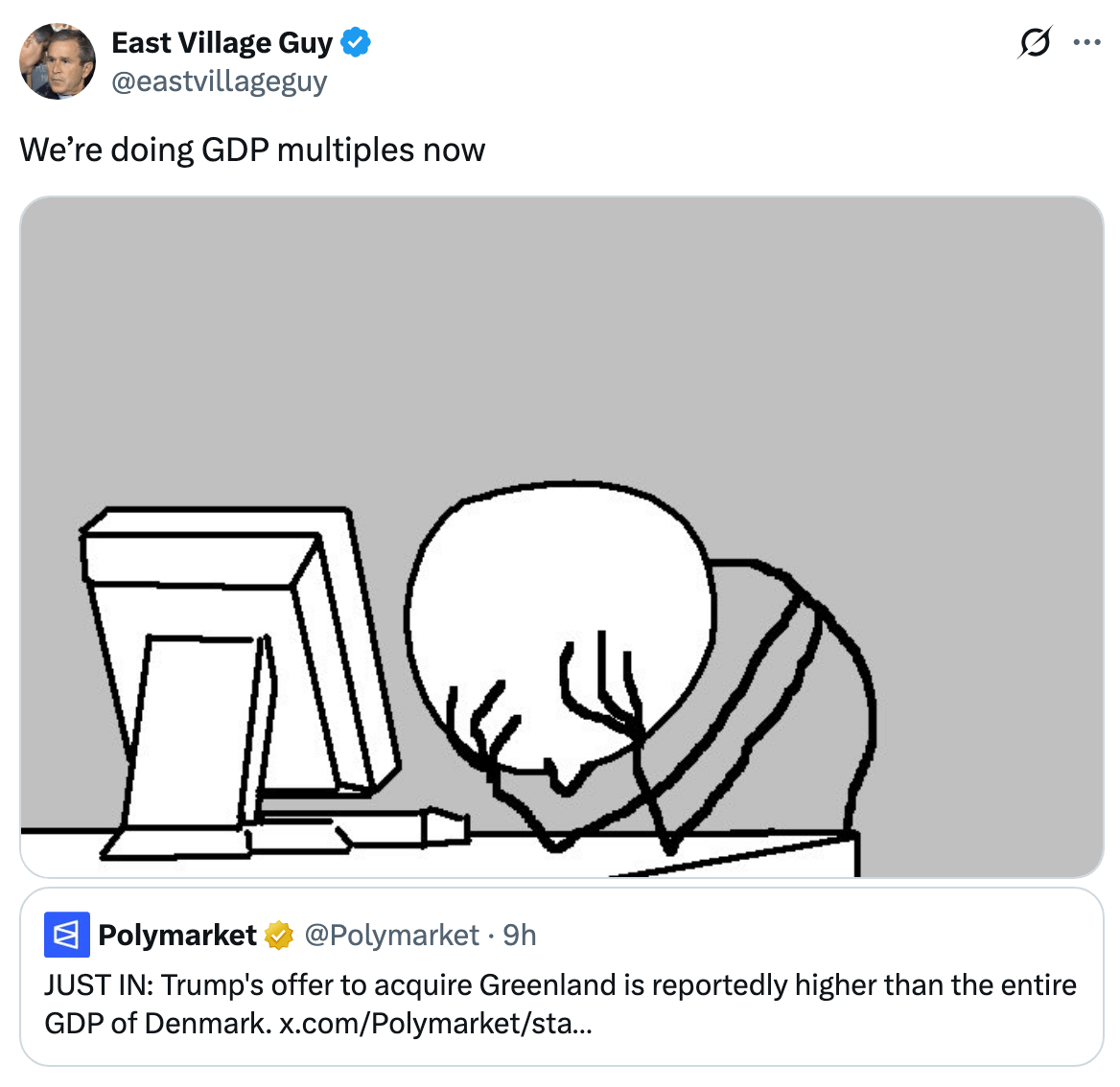

As of 1/14/2026 market close.

Learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks slumped yesterday as mid bank earnings fueled the ongoing rotation from tech to small-caps

S&P posted its first back-to-back decline of the year

Nasdaq had its worst day in a month

Small-caps Russell 2000 beat S&P for a ninth-straight day for its best relative win streak since 1990

Japan's Nikkei 225 index soared 1.5% for a 6.5% YTD gain on political optimism for the fiscally-dovish ruling party

Japan 5Y yield rose past 1.6% to its highest since 2000

Yen fell to its lowest since July 2024

Europe's Stoxx 600 hit an ATH

UK's FTSE 100 hit an ATH

Korea's KOSPI index is vertical

EM stocks index is up 5.5% YTD

US 30Y yield slid below 4.8% to a YTD low

UK 10Y yield fell to 4.34% to a one-year low

Gold, silver, copper, and tin hit fresh ATHs as the blistering metals rally continues

Earnings

Bank of America beat Q4 earnings and revenue estimates as stronger-than-expected net interest income and equities trading offset flat IB fees (CNBC)

Citigroup beat Q4 earnings and revenue estimates on a 35% surge in IB fees and strength in banking, wealth, and institutional services, though net income fell 13% due to a Russia-exit charge (CNBC)

Wells Fargo missed Q4 earnings estimates on $600M severance costs as it cuts headcount to the lowest among peers and aims for growth in capital markets (BBG)

Infosys issued a Q3 beat-and-raise on strong deal wins and financial services demand, offsetting a profit decline from a one-time charge and lifting shares on hopes of an IT sector recovery (RT)

What we're watching this week:

Today: TSMC, BlackRock, Goldman Sachs, Morgan Stanley

Friday: State Street, PNC

Full calendar here

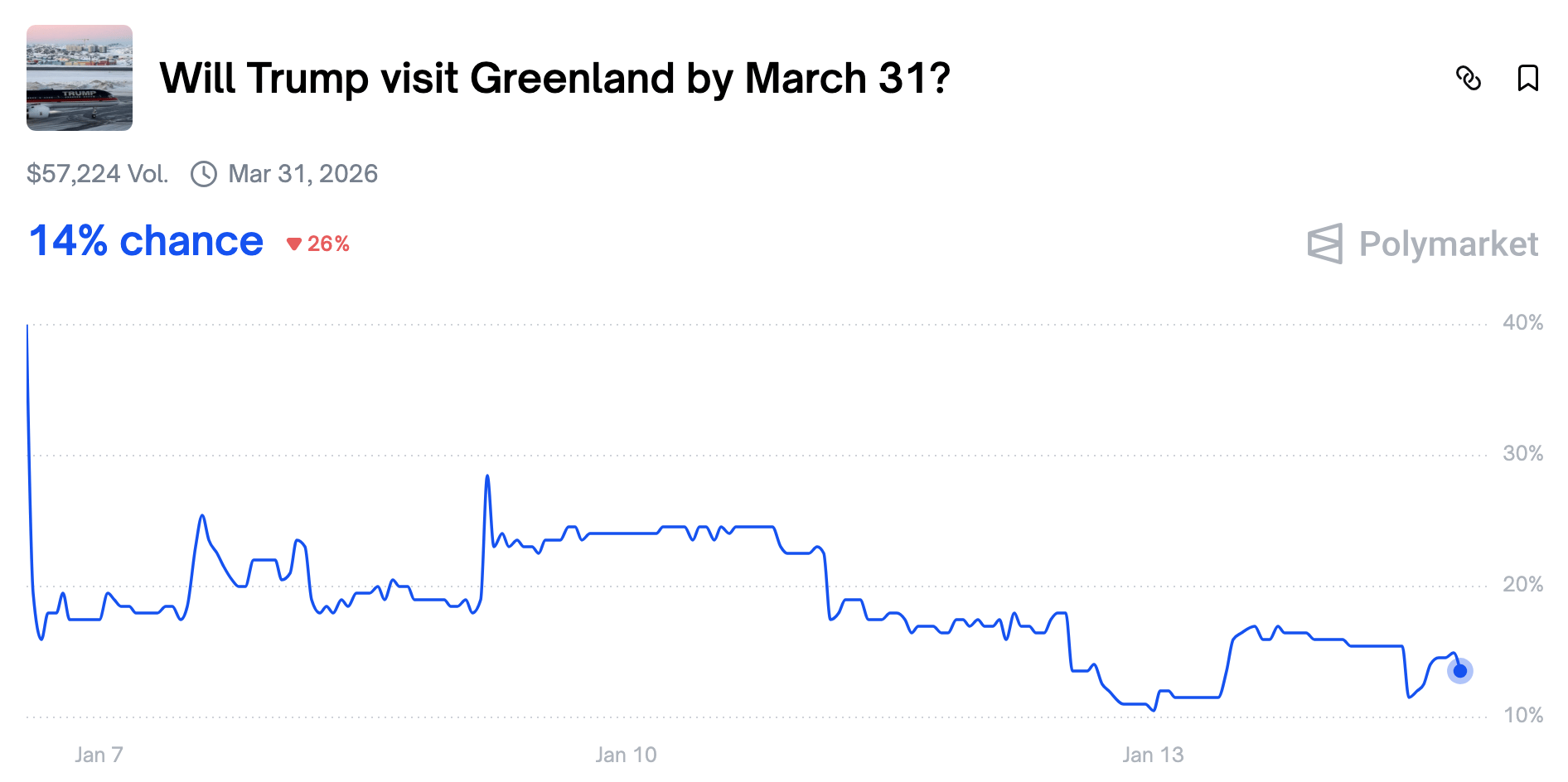

Prediction Markets

A nice little M&A due diligence on-site visit by the MD himself

Track and trade live odds on Polymarket

Headline Roundup

US will not abandon Greenland pursuit after talks (WSJ)

Buying Greenland could cost US $700B (NBC)

US imposed a 25% tariff on some AI chips as part of Nvidia China deal (BBG)

US PPI inflation rose 3% YoY (CNBC)

US retail sales rebounded in Q4 (BBG)

Fed's Beige Book showed economy picking up (BBG)

Wall Street bank profits rose in Q4 amid consumer resilience (RT)

Global investors bet big on China stocks and FX for 2026 (BBG)

Hedge funds held onto crowded Big Tech longs in 2025 (RT)

PIMCO says historic EM rally should last 'for years' (BBG)

Risky borrowers flood market to tap investor hunger for yield (BBG)

Hedge funds drove big gains for prime brokerages and S&T (RT)

Quant traders are hiring talent to wade into prediction markets (FT)

US biotech IPOs fell to a decade-low with investors eyeing a rebound (RT)

Bondholders sued Oracle for losses tied to AI CapEx (RT)

Bain Capital named David Gross as sole managing partner (FT)

Airbnb poached Meta's head of GenAI for CTO role (CNBC)

McKinsey is asking job candidates to use AI in interviews (FT)

BP will take a $5B hit on its green energy business (FT)

Musk's Starlink enables Iranians to bypass internet blackout (BBG)

SCOTUS delayed ruling on Trump's tariffs (BBG)

US will pause immigrant visas from 75 countries (BBG)

Epstein promised victims admission and tuition to Columbia and NYU (WSJ)

A Message from Plaid

What's Fintech Got In Store for 2026?

Our New Year's resolution wasn't to start hitting the gym again – it was to stay ahead of the game on every industry trend, tip, and trick to make the most of 2026.

Well, that resolution starts right here, right now, with the latest and greatest from Plaid:

This conversation is basically a cheat code for anyone involved or interested in Fintech. You'll get insight into where everything from AI to open finance is headed in 2026, helping you shape your roadmap for the year ahead.

Unlike your Planet Fitness membership, it's completely free. Hear from a panel of experts including Plaid's co-founder and CEO Zach Perret, Chief Technology Officer Will Robinson, and Credit Product Lead Michelle Young, on what's on deck for 2026. You won't regret it.

Deal Flow

M&A / Investments

Toyota raised its buyout offer for Toyota Industries by 15% to $39B, caving to activist Elliott's demands to sweeten its 'lowball bid'

Real estate tycoon Stephen Ross received offers worth over $15B for NFL's Miami Dolphins; the team was valued at $8B in a minority stake sale in 2024

Coca-Cola abandoned plans to sell coffee chain Costa Coffee chain after offers from TDR Capital and Bain Capital fell below expectations; the firm acquired Costa for $5.1B in 2018

European PE firm EQT is in early talks to take-private gene therapy company Oxford Biomedica in a $1.3B all-cash deal

Investment firm Neuberger Berman will take a $1.2B minority stake in Onex and Ares-backed tax advisory and software provider Ryan at a $7B valuation

KKR will acquire a 50% stake in German utility RWE's Norfolk Vanguard offshore wind projects in UK

Canadian Natural Resources is in talks to buy a portfolio of natural gas properties from Tourmaline Oil Corp for $1B

HSBC is exploring a sale of its Singapore insurance unit, which could fetch over $1B

Mission Produce agreed to merge with rival avocado producer Calavo Growers in a $483M cash-and-stock deal

Canadian miner Northern Graphite formed a $200M JV with Saudi investment firm Al Obeikan to develop and operate a battery anode material facility in Saudi Arabia

Carlyle is considering an equity investment in Kimmeridge Energy-backed LNG firm Commonwealth

Shell and ExxonMobil canceled a proposed deal to sell North Sea natural gas assets to Viaro Energy

Citigroup is considering selling more stakes in its Mexican retail bank Banamex ahead of an IPO

Nigerian energy firm Vaaris agreed to acquire TotalEnergies' 10% stake in Nigerian onshore asset Renaissance JV and three other licenses after a prior sale to Chappal Energies fell through

VC

Quant trading firms Akuna, Belvedere, Optiver, and Virtu invested in new options intermediary Optimal Market Technologies

Robotics software startup Skild AI raised $1.4B Series C a round at a $14B valuation led by SoftBank

Coding startup Temporal Technologies is in advanced talks to raise a round at a $5B valuation led by a16z

AI chip startup Etched.ai raised $500M at a $5B valuation led by Stripes

osapiens, an enterprise sustainability software startup, raised a $100M Series C at a $1B+ valuation led by BlackRock and Temasek JV Decarbonization Partners

AI customer-research startup Listen Labs raised a $69M Series B led by Ribbit Capital

Developer-first cybersecurity platform Aikido Security raised a $60M Series B led by DST Global

AI security startup Depthfirst raised a $40M Series A led by Accel Partners

Quadric, an edge-AI processor IP startup, raised a $30M Series C led by ACCELERATE Fund

Supply-chain visibility startup Tive raised a $20M round led by Lightsmith Group

Edge-platform startup IO River raised a $20M Series A led by Venture Guides and New Era Capital Partners

Project Eleven, a post-quantum digital-asset security startup, raised a $20M Series A led by Castle Island Ventures

SkyFi, a satellite imagery and analytics startup, raised a $12.7M Series A co-led by Buoyant Ventures and IronGate Capital Advisors

Noise, an on-chain attention-market startup, raised a $7.1M seed round led by Paradigm

Powered by Fundable

IPO / Direct Listings / Issuances / Block Trades

$52B-listed Chinese tech giant Baidu is considering upgrading its Hong Kong listing to primary status

European defense giant Czechoslovak Group plans to raise $3.5B at a ~$35B valuation in an Amsterdam IPO

Honeywell-backed quantum computing firm Quantinuum filed for an IPO; the firm was valued at $11B in September

Apax Partners and Warburg Pincus-backed Dutch telecom Odido is set to file for a $1.2B Amsterdam IPO

Brazilian fintech Agibank filed for a $1B US IPO; the startup was last valued at $1.7B in December 2024

Debt

France raised $11.7B in a bond sale despite entering a fiscal 'danger zone'

Banks tightened pricing on $8.5B in leveraged loans for Blackstone and TPG's $18.3B LBO of medical-device maker Hologic

JPMorgan sold $6B of investment-grade bonds to kick off Wall Street banks' Q1 issuances

European PE firm CVC is in talks with BlackRock's HPS to raise $3.15B in debt for its Global Sport Group platform, with Ares and Bain Capital in talks to provide additional equity

Bolivia secured a $4.5B support package from the Inter-American Development Bank to help stabilize the economy

TPG agreed to buy $2.4B of consumer loans from subprime consumer lender OneMain under a forward-flow agreement

Lenders are preparing a $2.3B debt package to support European PE firm Astorg's sale of fund services business IQ-EQ

HSBC is gauging investor demand for a SRT tied to a portfolio of $2.3B of investment-grade corporate loans

Private credit lenders Ares, Golub, Cliffwater, and New Mountain Capital upsized their loan to Global Healthcare Exchange, the healthcare software platform being acquired by Veritas Capital, from $1.3B to $1.6B

Angola will rollover a $1B loan and raise an additional $500M from JPMorgan

Nigeria is seeking to raise a $1B green bond this year

Bankruptcy / Restructuring / Distressed

Luxury retailer Saks Global filed for Chapter 11 bankruptcy and secured $1.75B in DIP financing to keep stores open during restructuring

Goldman Sachs is leading a takeover of historic LA studio lot Radford Studio Center after owner Hackman Capital Partners defaulted on a $1.1B mortgage; the property was last appraised at $1.8B in 2021

Brazilian investor Nelson Tanure surrendered most of his ~20% stake in oil company Prio to repay a loan to UBS

Collapsed subprime auto lender Tricolor's bondholders sued trustee Wilmington Trust for failing to notice the fraud as part of its supervision duties

Funds / Secondaries

Arab Energy Fund aims to boost its PE business by 60% to $12B

Investment firm Sixth Street raised $4.4B for a third European private credit fund

Saudi's Jadwa Investment is seeking to raise $200M for its flagship private credit fund

Disgraced Crispin Odey's UK hedge fund Odey Asset Management will cease trading activities and wind down next month

Crypto Sum Snapshot

Bitcoin ETFs saw the largest inflow since October's crypto crash

Binance's spot crypto trading market share fell to a four-year low

Visa is working to integrate stablecoins into existing payment system

Crypto Sum compiles the most important stories on everything crypto. Read it here.

Exec’s Picks

Evolving consumer habits are driving M&A activity in the consumer sector worldwide. Companies are leveraging acquisitions to follow where the consumer is heading, ensuring they stay aligned with rapidly changing preferences. Charles Gournay, Greenhill Consumer & Retail London, explores how M&A enables companies to achieve faster growth. Hear more.

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.