Together with

Good Morning,

UMich eliminated DEI, middle market M&A is a bright spot in the recent dealmaking slowdown, Deloitte emerged as the biggest loser from DOGE cuts, Zuckerberg is trying to enlist Trump to fight EU regulations, OpenAI closed on the largest private tech funding round ever, and NYSE Texas debuted with its first listing.

Specialized AI tools are emerging as the leaders for alternative investments workflows which is why BlueFlame AI is ahead of the curve. Check out their platform and how BlueFlame AI can serve your firm's specific needs!

Let's dive in.

Before The Bell

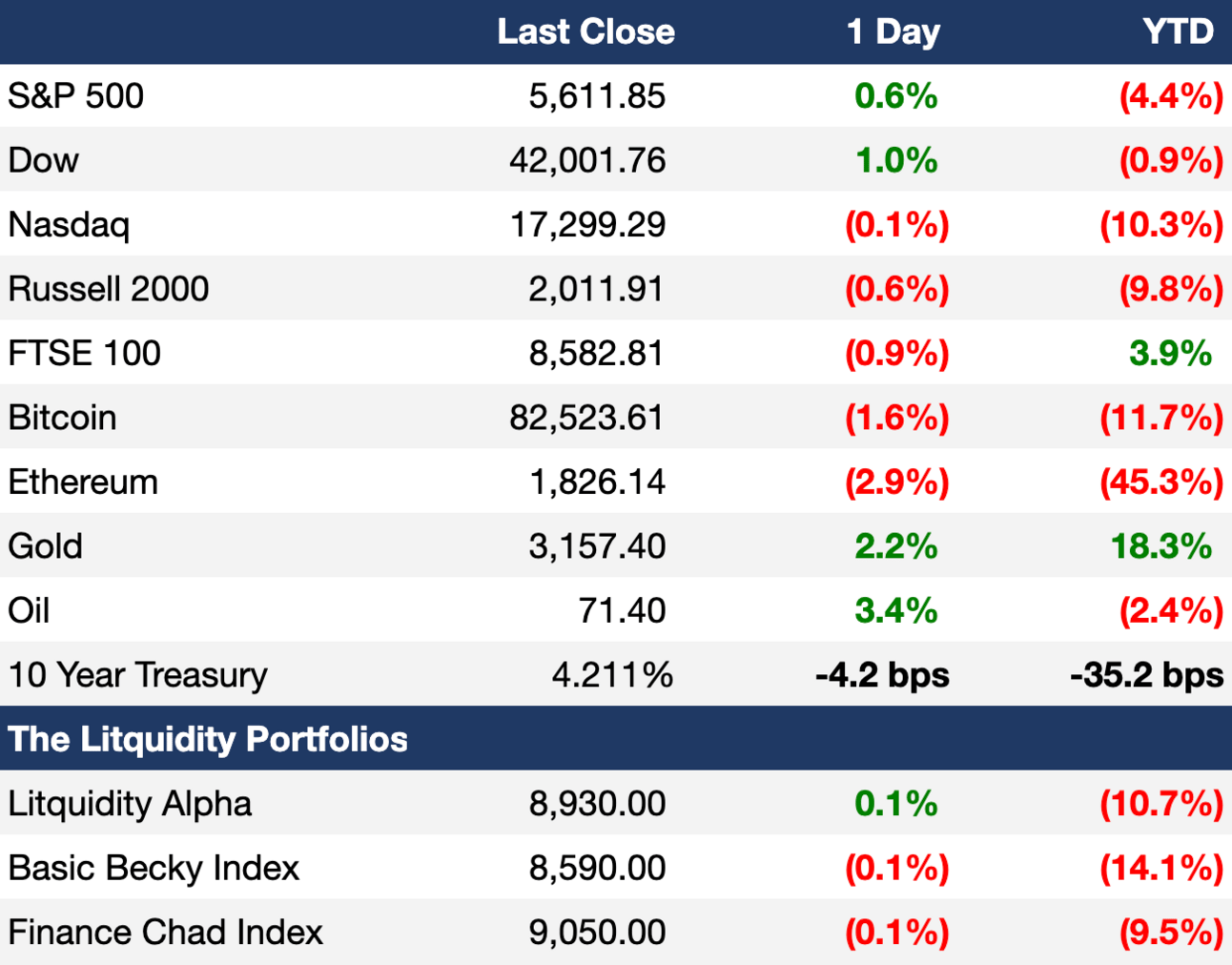

As of 3/31/2025 market close.

Click here to learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks clawed back losses to end yesterday higher as traders braced for imminent tariff announcements

S&P briefly dipped 10% below its February ATH

S&P and Nasdaq logged their worst months since December 2022

S&P and Nasdaq posted their worst quarters since 2022

'Magnificent 7' stocks fell 16% in Q1

KBW Bank index fell 3.9% in Q1 in its worst run since SVB's collapse in March 2023

Correlations among S&P 500 firms is near the lowest level in 25 years

Europe's Stoxx 600 fell 1.5% to its lowest since January

Germany's DAX is up 11% for its best quarter since early 2023

Japan's Nikkei 225 slid 4% to hit its lowest since the August selloff

The index fell 11% in Q1 in its worst quarter since Covid

The index is down 16% from its July ATH

Brazil's Ibovespa index is up 18% for its best Q1 since 2022 after slumping 30% in 2024

Munis lost 2% last month in their worst comparative performance versus US Treasuries since Covid; an index of US Treasuries was flat in March

Ukraine dollar bonds fell to four-month lows on setbacks to peace efforts

Oil surged on fears of Russia oil sanctions

Gold hit another ATH, capping its best quarter since 1986

Swedish krona rose 10% versus dollar and 6% versus euro in Q1 in its best quarter since 2010

FX options volume surged to a record as investors juggle tariff risks

Earnings

What we're watching this week:

Wednesday: BlackBerry

Thursday: GUESS

Full calendar here

Headline Roundup

Fed officials are cautious on rates amid tariff-related inflation risks (RT)

Australia held rates steady at 4.1% (WSJ)

China manufacturing hit a 12-month high (RT)

'Frustration and fatigue' hits stock traders amid imminent tariffs (BBG)

NYSE Texas debuted with Trump Media as first listing (BBG)

Hedge funds sold techs stocks at the highest levels in five years (RT)

Middle market and pharma deals are leading M&A boom (WSJ)

Secondary sales dominated VC exits last year (TT)

Japan corporate bond sales hit a record high last year (BBG)

Foreigners accounted for 90% of South Korea shorts as ban lifted (BBG)

Deloitte is the biggest loser from DOGE cuts (FT)

US set up a new office to manage CHIPS Act and speed up investments (RT)

South Korea president vetoed bill to raise boards' accountability to shareholders (BBG)

Banks face off with investors over 'pre-hedging' trade rules (BBG)

China banks rush to write off bad property loans to boost economy (BBG)

UBS named Americas CIO Solita Marcelli as head of global investment management (RT)

Zuckerberg tries to enlist Trump in fight against EU rulings (WSJ)

Jane Street plans to rapidly expand Hong Kong office space (RT)

Apple and Elon Musk clash over satellite expansion plans (WSJ)

Intel's new CEO asked customers to be 'brutally honest' (RT)

US will review Harvard's $9B of federal contracts (WSJ)

University of Michigan eliminated DEI (BBG)

A Message from BlueFlame

AI for Every Stage of Your Investment Journey

BlueFlame AI empowers investment teams to evaluate more opportunities with deeper insights, accelerate due diligence while identifying hidden risks, and drive superior value creation throughout the investment lifecycle.

Pre-acquisition: Evaluate more targets with greater precision. Strengthen initial investment theses and evaluation approaches with deeper market insights and competitive intelligence.

Deal transaction: Accelerate due diligence by intelligently surfacing critical risks and opportunities. Strengthen negotiating positions through sophisticated information analysis and scenario modeling.

Post-acquisition: Drive faster value creation by automating repetitive tasks/workflows and increasing operational efficiency. Maximize exit value by optimizing timing and buyer targeting through pattern recognition across market signals.

Learn more about how BlueFlame AI supports investment teams here.

Deal Flow

M&A / Investments

$20B-listed chipmaker GlobalFoundries and Taiwan's $18B-listed United Microelectronics are exploring a merger

Medical devices maker Becton Dickinson is exploring a sale, spinoff or RMT of its $21B life sciences unit, with talks including Thermo Fisher Scientific, Danaher, Waters Corporation, Qiagen, Revvity, and PE firms

Mortgage fintech Rocket will acquire mortgage servicing giant Mr. Cooper in a $9.4B all-stock deal

Brookfield is nearing a deal to acquire Colonial Pipeline, the largest US fuel transportation system, for $9B including debt

Asian investment firm Boyu Capital is nearing a $4B-$5B deal for Chinese retailer Beijing Hualian's luxury SKP malls

A consortium including EQT offered to take Swedish cloud accounting software firm Fortnox private in a $4.5B deal

Chemicals giant DuPont is exploring a sale of its protective fabrics manufacturers Nomex and Kevlar brands for ~$2B

Singapore SWFs Temasek and GIC will acquire a significant minority stake in Australian clinical tested Novotech from TPG at an over $1.9B valuation

Norway SWF Norges Bank will acquire a 49% stake in two North Sea wind projects from German energy giant RWE for ~$1.5B

BlackRock-owned Global Infrastructure Partners is set to acquire 70% of Brazilian mining giant Vale's Brazilian renewable energy business Alianca Energia for $1B

The CEO of British luxury car maker Aston Martin is open to taking the company private, citing its 'severely undervalued' $840M market cap

Tokyo Gas and Castleton Commodities International will acquire a 70% stake in a Texas shale gas development from Chevron for $525M

Indian conglomerate ITC agreed to acquire Aditya Birla Real Estate's pulp and paper business for $410M

California-based regional lender Mechanics Bank proposed a $300M buyout of peer HomeStreet

US energy company Sempra is weighing a sale of natural gas assets, including a Mexican fuel distributor and a minority stake in its LNG business

Carlyle and Vitol-backed Varo Energy agreed to acquire Scandinavian refiner Preem

Logistics giant DHL agreed to acquire US pharmaceutical logistics firm Cryopdp

VC

OpenAI raised $40B at a $300B valuation in a round led by SoftBank

French animal health firm Ceva Santé Animale raised $5.95B at a $10B valuation in a funding round from L'Oréal-related family office Téthys Invest, Canada's PSP, and others

Isomorphic Labs, the AI drug-discovery platform that was spun out of Google's DeepMind, raised a $600M round led by Thrive Capital

AI-powered cybersecurity firm ReliaQuest raised $500M at a $3.4B valuation in a round led by EQT, KKR and FTV Capital

Phoenix Service Partners, a service company specializing in high-horsepower, low-emission natural gas compression, raised $350M led by SCF Partners

Vigloo, a destination for immersive short-form dramas, raised $86M in funding from Krafton

Chip startup Retym raised a $75M Series D led by Spark Capital

Novarc Technologies, an AI robotics startup focused on automated welding solutions, raised a $50M Series B led by Export Development Canada

GridPoint, an energy management technology startup, raised $45M in funding led by Marunouchi Innovation Partners

Infinite Uptime, a startup enhancing manufacturing intelligence, raised $35M in funding led by Avataar Ventures

Tomorro, a French startup specializing in AI-powered contract management, raised a $27M round led by XAnge and Acton Capital

Worth, a fintech platform for onboarding and underwriting workflow automation, raised a $25M round led by TTV Capital

Persefoni, a sustainability management SaaS and AI platform, raised a $23M Series C extension from TPG Rise, Rice Investment Group, and others

Data management platform Gable raised a $20M Series A led by Crane Venture Partners

InfiniLink, an Egyptian semiconductor startup specializing in advanced optical data connectivity chips for AI-driven data centers, raised $10M in funding led by MediaTek and Sukna Ventures

German AI startup Voize raised a $9M seed round led by HV Capital

Ribbon, a voice AI recruitment platform, raised $8M in funding led by Radical Ventures

3D scanning startup Covision Media raised a $5.4M seed round led by CDP Venture Capital

LeakZon, an Israeli provider of solutions for water loss management, raised a $5M Series A led by Peal Holdings

AI-based healthcare platform elea raised a $4.3M round from Fly Ventures and Giant Ventures

Sourcetable, a startup building the world's first AI-powered self-driving spreadsheet, raised a $4.3M seed round led by Bee Partners

IPO / Direct Listings / Issuances / Block Trades

South Korea's regulator asked Hanwha Aerospace for rationale behind plans to raise $2.46B in equity amid a historic 3000% stock rally

Renault and Nissan agreed to cut their cross-ownership to 10%, enabling Nissan to sell one-third of its Renault stake and potentially raise $746M

US news network Newsmax surged 735% in its trading debut for a $10.7B market cap after raising $75M in an IPO, marking the strongest first-day performance since 2022

Debt

SoftBank is seeking a $16.5B loan to help fund AI investments in US

Apollo, KKR, and Balbec Capital advanced to the next bidding round for Spain's CaixaBank's $650M non-performing mortgage portfolio

Berkshire Hathaway hired Bank of America and Mizuho for plans to sell yen bonds in global markets

Bankruptcy / Restructuring / Distressed

A US bankruptcy judge rejected Johnson & Johnson's $10B proposal to end tens of thousands of cancer lawsuits, its third failed bankruptcy deal

PE-backed restaurant chain Hooters filed for Chapter 11 bankruptcy with plans for a founder-led buyout

Troubled UK utility Thames Water picked KKR as a potential owner to lead it out of crisis

A group of creditors including Cheyne Capital, Man Group, Contrarian Capital and St James's Place sued to reverse distressed debt investor Redwood Capital's takeover of Hunkemöller, one of Europe's largest lingerie brands, in latest creditor-on-creditor violence in Europe

Fundraising

Oaktree plans to raise $4B for its fourth special situations fund

Canadian O&G-focused PE firm Waterous Energy Fund closed its third PE fund with $1B

UK PE firm Queen's Park Equity closed its second PE fund with ~$400M

German asset manager Golding Capital Partners closed its first PE impact FOF with $125M

Apple-supplier Foxconn is forming a $100M early-stage VC in US

US-based King Street Capital and UK-based Lumyna Investments launched a new Luxembourg-domiciled evergreen private credit fund

Australian investment manager HMC Capital plans to launch a closed-end PE fund

Crypto Sum Snapshot

One in four S&P 500 firms is expected to hold Bitcoin by 2030

Coinbase stock sees worst quarter Since FTX collapse as crypto slides

Strategy acquired $1.9B worth of Bitcoin, its largest purchase YTD

Trump family partnered with Hut 8 to launch American Bitcoin, a venture focused on Bitcoin mining and strategic Bitcoin reserve development

Check out our Crypto Sum newsletter for the full stories on everything crypto!

Exec’s Picks

Alt Managers, stop wasting your time managing vendors, contracts, invoices, and expense allocations manually in Excel. StavPay automates and streamlines this process and now has over 100 clients with $2.2T AUM leveraging the system daily. Get more details at stavpay.com and schedule a demo today.

Ben Carlson wrote another great piece reminding us that the stock market is ALWAYS changing.

BlackRock CEO Larry Fink recently published his annual letter to shareholders, offering an optimistic and reassuring tone calling for calm amid uncertainty and reminding market participants that we have always figured things out. Read his full letter here.

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting firm established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, credit, and investment banking.

We're currently seeking talent for some incredible roles. Head over to Litney Partners to drop your resume / create your profile and we'd love to get in touch!

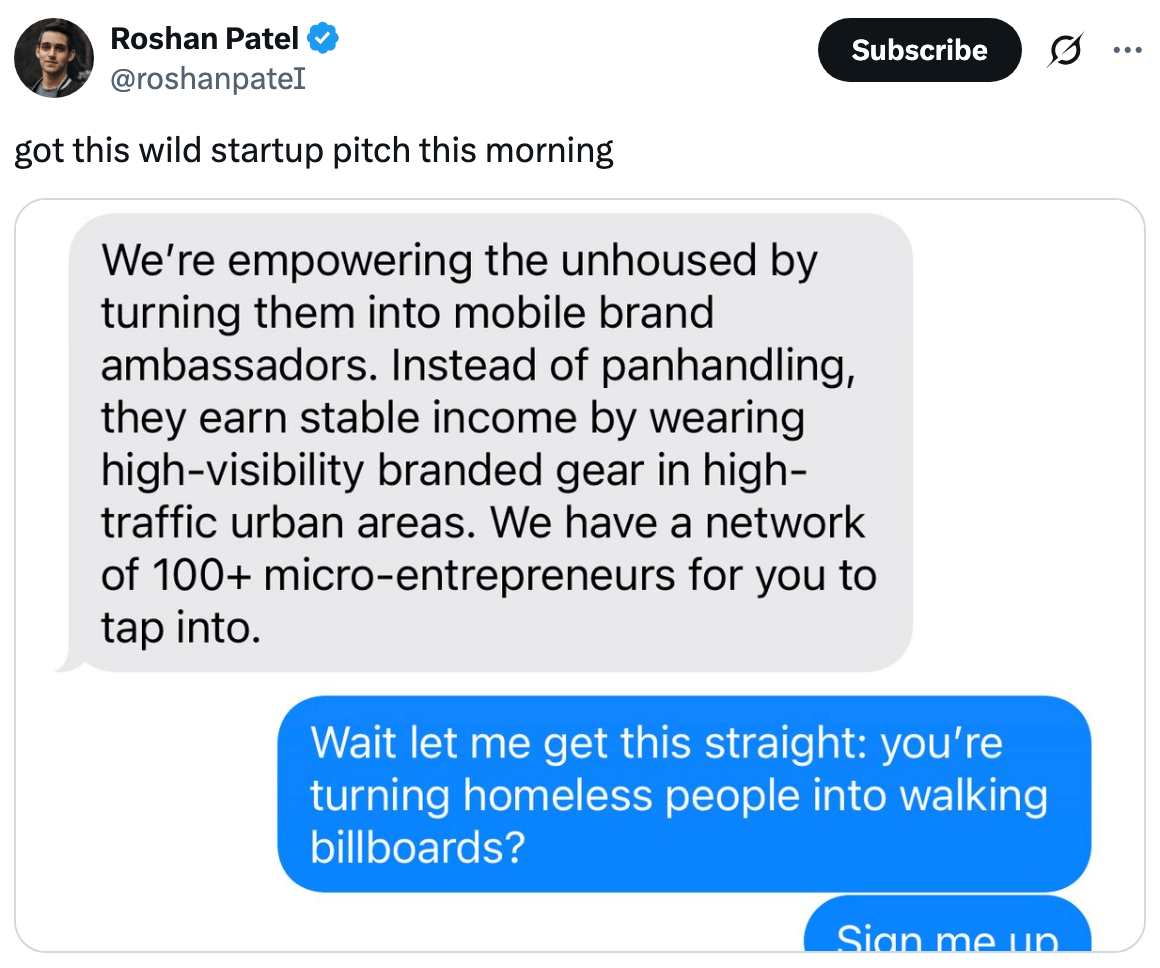

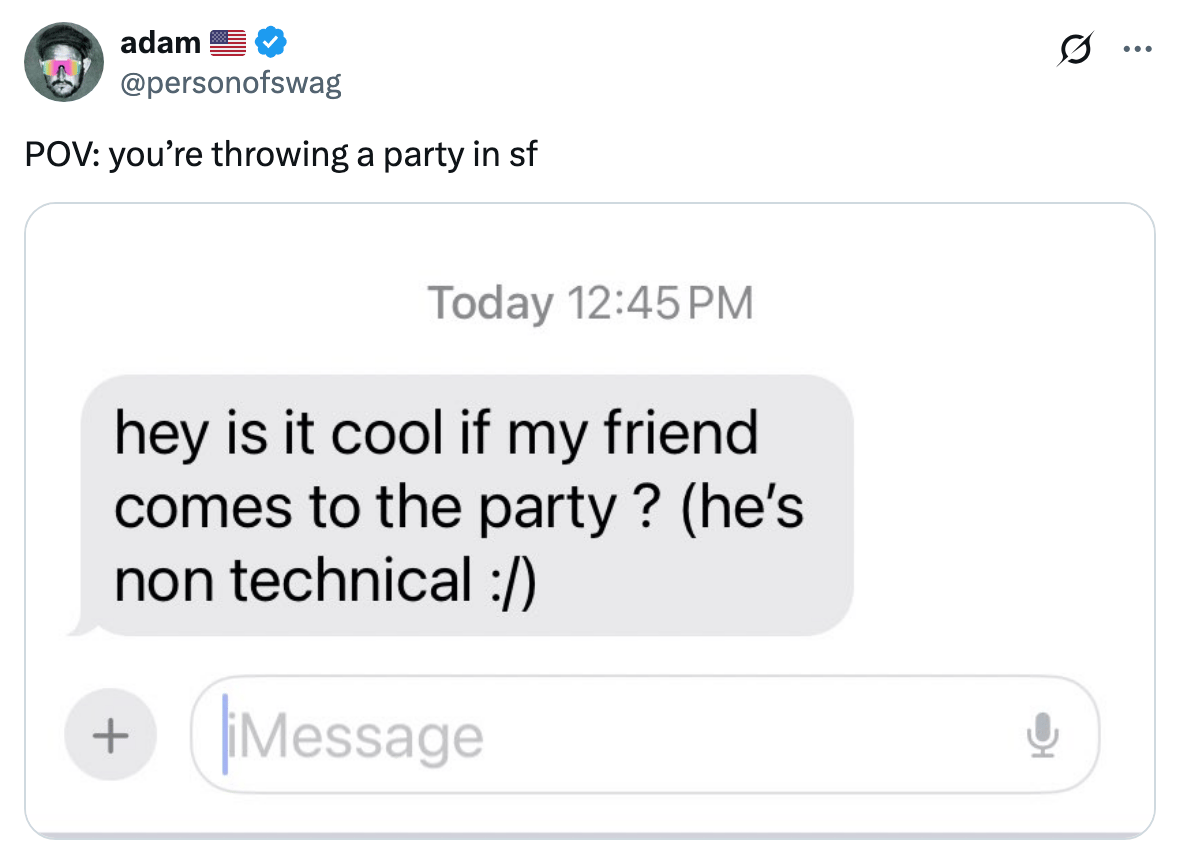

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.