Together with

Good Morning,

Record-high stock markets, record deal flow, Minnesota fraud, ICE protests, Venezuela, Iran, Greenland, and California's billionaire exodus are just some of the situations being monitored this week.

Almost forgot J Pow, who is under federal criminal investigation.

Is this the year your startup finally starts signing customers? Join Vanta on January 15th for a live demo on automating compliance stacks to have it serving as a deal accelerator, not a blocker. Register here.

Let's dive in.

Before The Bell

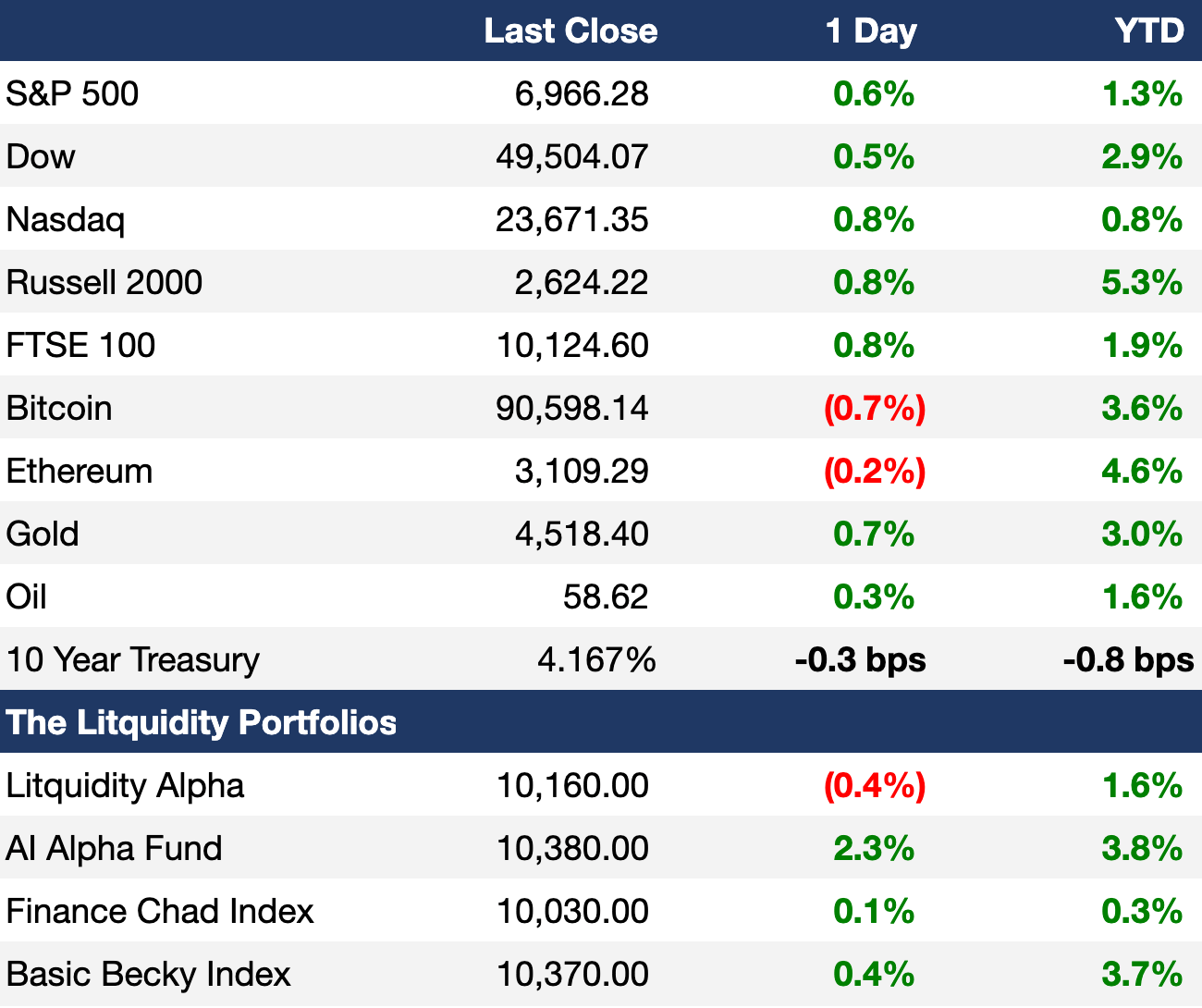

As of 1/9/2026 market close.

Learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks rose on Friday as traders digested mid jobs data and Trump's $200B mortgage bond push

S&P and Dow hit fresh ATHs

Housing-linked stocks surged

Apple fell for an eighth day for its worst losing streak since 1991

Europe's Stoxx 600 hit a fresh ATH

Korea's KOSPI index is already up 10% YTD to extend its historic run

US 2Y-10Y yield spread hit a nine-month high

Traders slashed all January rate cut bets and priced in two 25 bps cuts for 2026, with the first in July

EM sovereign dollar debt premium fell to the lowest since 2013

Gold hit a fresh ATH

Earnings

What we're watching this week:

Tuesday: JPMorgan, Delta Airlines

Wednesday: Wells Fargo, Citigroup, Bank of America, Infosys

Thursday: TSMC, BlackRock, Goldman Sachs, Morgan Stanley

Friday: State Street, PNC

Full calendar here

Prediction Markets

It's a good week to monitor the situation

Trade your predictions on Polymarket

Headline Roundup

US launched a criminal investigation into J Pow (CNBC)

Hedge funds get ready for the 'Donroe Doctrine' trade (WSJ)

US may lift more Venezuela sanctions (RT)

Banks eye Venezuela investment with JPMorgan at an advantage (RT)

Banks are competing for Rio Tinto-Glencore's $200B merger mandate (RT)

US is investigating money transfer firms and banks amid Minnesota fraud (RT)

US can easily cover any SCOTUS tariff refunds (RT)

US unemployment rate fell to 4.4% on moderate jobs growth (CNBC)

Trump tweeted unpublished jobs data twelve hours before BLS release (BBG)

'Mag 7' stock market dominance is showing signs of cracking (BBG)

JPMorgan sees rising risks driving M&A surge (RT)

Healthcare firms are set for M&A spree as drug patents expire (FT)

Four law firms controlled 60% of M&A principal deal value in 2025 (LW)

Big hedge funds delivered solid gains in 2025 (RT)

US corporate bond sales hit $95B in the busiest week since Covid (FT)

EM sovereign debt sales hit a record $44B YTD (BBG)

Retail investors bought $10B of US stocks YTD (BBG)

Gold investors stay bullish after historic 2025 (BBG)

More bonds are on the brink of junk (BBG)

China AI leaders warn of widening gap with US after $1B IPO week (BBG)

Texas PE firm Stronghold countersued Elliott (BBG)

UK PE firms sharply increase use of offshore funds (FT)

Apollo is searching for a new Europe head (FT)

KKR COO Ryan Stork stepped down (BBG)

Nvidia hired its first-ever CMO (WSJ)

US household wealth rose to a record $181T in Q3 (BBG)

Billionaires ramp up California exits amid threat of wealth tax (BBG)

'Target schools' are back on the priority list for recruiters (WSJ)

Trump called for a 10% cap on credit card interest rates (WSJ)

A Message from Vanta

Turn Compliance Into a Deal Accelerator: Join Live on Jan 15

Ready to turn compliance into a deal accelerator, not a blocker? Vanta's Agentic Trust Platform helps fast-moving startups and security teams get audit-ready fast and stay continuously compliant.

Join the live demo to learn how Vanta can help you:

Automate evidence, policies, and remediation across SOC 2, ISO 27001, HIPAA, HITRUST, ISO 42001, and more

Build real security foundations, not check-the-box fixes

Show credibility faster with a public Trust Center and AI-powered questionnaires

Keep engineers focused with guided workflows and developer-native automation

Deal Flow

M&A / Investments

A consortium led by infrastructure investor I Squared Capital dropped its $4B pursuit of German media group Ströer's core advertising business

Budget airline Allegiant agreed to acquire peer Sun Country in a $1.5B cash-and-stock deal at a 20% premium

OpenAI and SoftBank jointly invested $1B in digital infrastructure and energy company SB Energy

Australian energy storage firm Akaysha Energy is considering selling a significant minority stake at a $1B valuation

VC

Stablecoin payments startup Rain raised a $250M Series C round at a $1.95B valuation led by ICONIQ Ventures

Israeli cybersecurity startup Torq raised a $140M Series D at a $1.2B valuation led by Merlin Ventures

AI cloud provider Lambda is reportedly raising a $350M round led by Mubadala

AI-native insurance carrier Corgi raised a $108M seed and Series A led by Y Combinator, Kindred Ventures, Glade Brook, and others

bit.bio, a human-cell programming startup, raised a $50M Series C led by M&G Investments

Narrative-intelligence startup Blackbird.AI secured a $28M funding round from Ten Eleven Ventures, Dorilton Ventures, and others

Connected safety platform startup Canopy raised a $22M Series B co-led by 111° West Capital and ACME Capital

Outcome-based pricing platform Paid.ai raised a $21.6M seed round

Gene-editing startup Aurora Therapeutics raised a $16M seed round from Menlo Ventures

Legend, a DeFi wallet platform, raised a $15M first funding round from a16z and Coinbase Ventures

Cloudforce, an AI infrastructure startup for education and healthcare, raised a $10M Series A led by Owl Ventures

European fashion-overstock marketplace Smatch raised an $8.5M seed round led by Transition VC, 42Cap, and 10x Founders

Industrial AI startup Spector.ai raised a $6.7M funding round led by IvyCap Ventures

Access the complete VC deal flow on Fundable.

IPO / Direct Listings / Issuances / Block Trades

$30B-listed Chinese industrial robot maker Inovance is considering a dual listing in Hong Kong

PE firm Advent picked banks to lead a US IPO of Austrian power equipment maker Innio at a $15B valuation

Apax Partners and Warburg Pincus-backed Dutch telecoms group Odido is considering launching a $1.2B IPO

Construction equipment rental firm EquipmentShare.com plans to market its $1B IPO this week

Alphabet-backed AI-enabled fleet management software firm Motive plans to market its $600M IPO this week

Brazilian fintech Agibank's US IPO is facing setbacks on regulatory concerns; the firm was valued at $1.7B in late-2024

Star Capital-backed German defense technology firm Vincorion is seeking to raise over $350M at a $1.75B valuation in a Germany IPO

Lilly-backed cancer biotech Aktis raised $318M at a $1.4B valuation in its IPO

Fitness tracking app Strava confidentially filed for an IPO

Bain Capital-owned furniture retailer Bob's Discount Furniture filed for an IPO

EQT-backed school bus operator First Student selected banks for an IPO

Data center electrical equipment maker Forgent filed for an IPO

Cancer biotech Eikon Therapeutics filed for an IPO

Hair-growth pill maker Veradermics filed for an IPO

'Big Short' investor Michael Burry bought put options on Oracle

Debt

A consortium of banks led by Bank of America and UBS kicked off a $1.8B leveraged loan sale to back Lone Star's $3.8B buyout of plastic-parts and equipment maker Hillenbrand as part of a bigger $3.1B debt package

Ghana is seeking to raise $935M in its first domestic infrastructure bond sale

PE-backed broker/dealer roll-up Osaic is raising $750M for a refinancing

Capitol Meridian Partners and Stellex Capital Management raised $400M in private credit from Adams Street Partners to fund their acquisition of military gear unit Beaufort from UK survival tech firm Survitec

Indian telecoms giant Vodafone Idea is considering raising debt to boost growth

Bankruptcy / Restructuring / Distressed

A creditor committee including Fidelity, Morgan Stanley Investment Management, and Greylock Capital is ready to begin talks on restructuring $60B in defaulted Venezuelan bonds

Bankrupt auto parts supplier First Brands' sued their founder's brother Edward James and largest creditor Onset Financial for fraud

Distressed Chinese developer Vanke is preparing to default and restructure at authorities' request to avoid a total debt failure

Struggling luxury retailer Saks is set to file for Chapter 11 bankruptcy

Summit Properties acquired Pinnacle's bankrupt NYC apartment portfolio after a judge rejected NYC's delay request

Senegal's dollar bonds surged after Senegal ruled out a debt restructuring

Fundraising / Secondaries

a16z raised $15B across its fifth growth fund, second American Dynamism fund, second apps fund, second infrastructure fund, fifth bio+healthcare fund, and other strategies in its biggest fundraising hall ever, taking 18% of all VC fundraising of 2025

PE firm Parthenon Capital is raising a $1.7B CV to extend ownership of credit rating firm Kroll Bond Rating Agency

Canadian PE firm Onex raised a $1.6B CV for edtech firm PowerSchool, insurance claims administrator Sedgwick, and HVAC group Fidelity from Neuberger Berman, Apollo's S3, SWF GIC, and StepStone Group

Singaporean PE firm RRJ Capital raised $1.1B for a debut private credit fund focused on APAC

Hedge fund Davidson Kempner raised over $1.1B for its second asset-backed private credit fund

MM healthcare and tech PE firm Eir Partners raised $1B for its third fund

Growth equity investor Guidepost raised $520M for its fourth flagship fund

French pharma firm Servier launched Servier Ventures, a biotech-focused VC fund with $230M

Commodities hedge fund Conductor Capital will wind down

Crypto Sum Snapshot

Coinbase boosted lobbying efforts as crypto bill moves to Senate markup

BNY launched tokenized deposits in digital assets expansion

Digital euro is 'only defense' against deepening US control of money

Crypto Sum compiles the most important stories on everything crypto. Read it here.

Exec’s Picks

Bloomberg published a short piece on the sentiment in Greenland, straight from the source.

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and PE through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.