Together with

Good Morning,

Palantir is prioritizing high school grads, Michael Burry broke a two-year silence with fresh bubble warnings, a solo VC with no office made $1B from Navan's IPO, First Brands' bankruptcy is reviving creditor-on-creditor violence, and Korean chicken stocks soared after Jensen Huang was spotted dining at a Seoul chicken chain.

Holiday season means it's time for a wardrobe upgrade…and what better way than to start with some fresh pairs of amberjacks.

Let's dive in.

Before The Bell

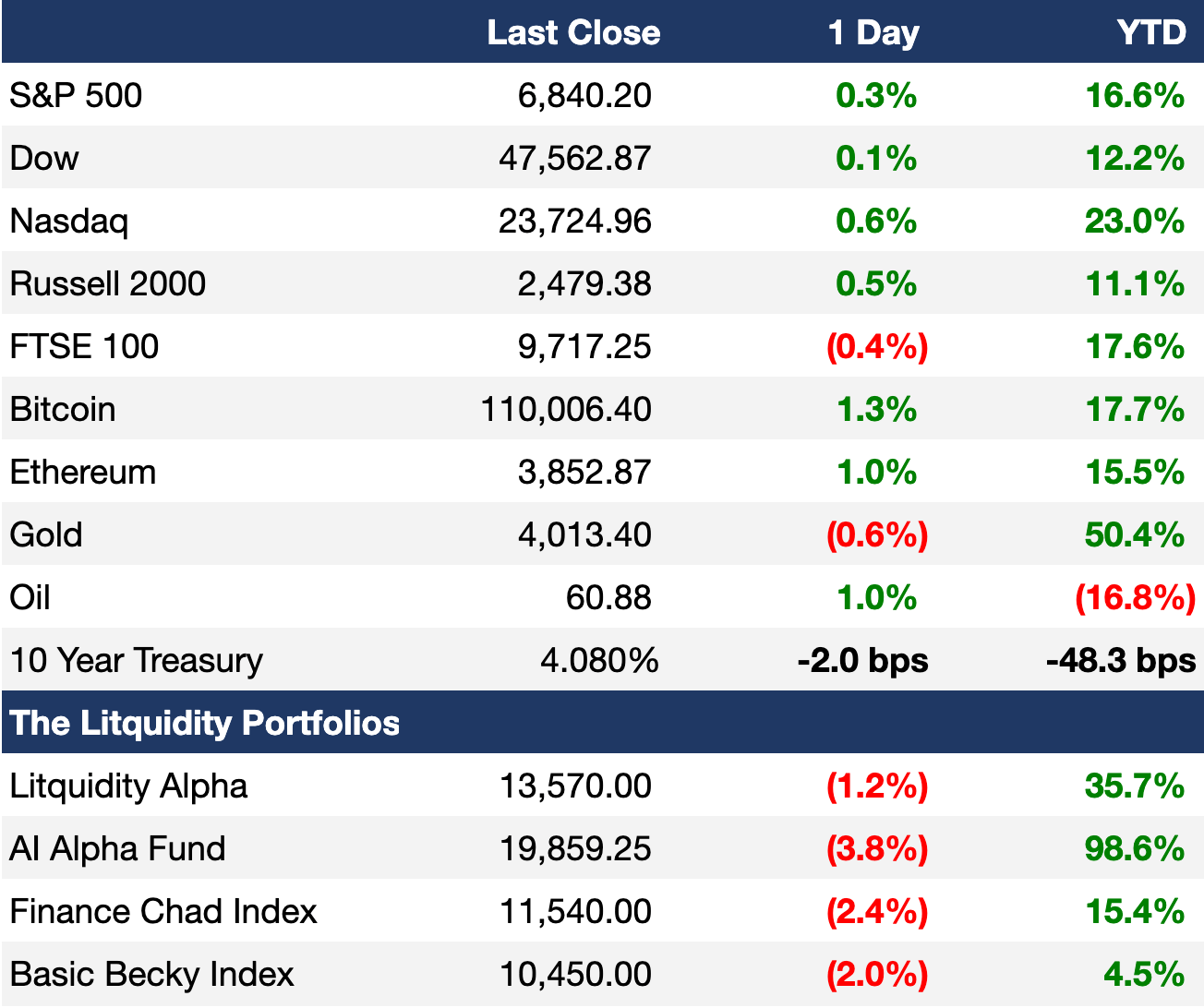

As of 10/31/2025 market close.

Click here to learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks rose on Friday on the back of strong tech earnings

S&P posted a sixth-straight monthly gain for its best win streak since 2021

Nasdaq posted a seven-straight monthly gain for its best win streak since 2018

Japan's Nikkei 225 index gained 14% in its best month in 35 years

MSCI EM stocks index posted a ten-month win streak, its best since 1993

South Korea's KOSPI index rallied to another ATH, now up 71% YTD

Saudi Arabia’s Tadawul index fell 1% by the most since September on delays to capital market reforms

South Africa's JSE index gained for an eighth-straight month for its best streak since 2013

UK bonds had their best month in two years amid BoE easing

Dollar had its second-best month YTD

EM-developed FX correlation is at a four-year high

Earnings

Berkshire Hathaway beat Q3 earnings and revenue estimates driven by a surge in insurance underwriting income, while cash holdings rose to a record $382B after offloading another $6B of stock; Buffett will step down as CEO at year-end with Greg Abel set to succeed (CNBC)

ExxonMobil beat Q3 earnings estimates but missed on revenue as record output from Guyana and the Permian Basin offset lower oil prices (CNBC)

Chevron beat Q3 earnings and revenue estimates as record production boosted by its Hess acquisition offset lower prices and higher costs (CNBC)

AbbVie issued a Q3 beat-and-raise on strong demand for treatments including Botox but warned that US seeking steeper Medicare drug price reductions may pressure margins on certain products (RT)

Carlyle forecast a pickup in dealmaking for Q4 after a fall in fee-related earnings and dealmaking proceeds in PE offset growth in other areas; AUM at its AlpInvest FOF unit grew 22% (RT)

What we're watching this week:

Today: Palantir

Tuesday: AMD, Uber, Shopify, Spotify, Supermicro, Pfizer, Beyond Meat

Wednesday: Novo Nordisk, Robinhood, McDonald's, AppLovin, Qualcomm

Thursday: Warner Bros. Discovery, Airbnb, DraftKings, Opendoor, MP Materials

Friday: Six Flags, Wendy's

Full calendar here

Prediction Markets

No Government November.

Headline Roundup

Korean chicken stocks soared after Jensen Huang was spotted dining at fried chicken chain (BBG)

Palantir is hiring high school grads (WSJ)

Michael Burry raised bubble warnings in first Tweet since 2023 (BBG)

AI rally and volatility define stock run since Trump's return (BBG)

AI frenzy has haunted house owner eyeing data center conversion (BBG)

US plays nice with Asian allies stung by repeated threats (BBG)

US and Canada will not restart trade talks despite Canada apology (RT)

US is pushing for wider global dollar adoption (FT)

ECB held rates steady at 2% (CNBC)

US bank M&A surges as Trump regulators race through approvals (FT)

EQT CEO says PE zombie firms will pile up in next decade (FT)

Private credit's rising pile of 'bad PIK' points to default woes (BBG)

Big Tech earnings reveal cracks in case for massive AI spending (BBG)

Investors eye quick-twitch quant strategies to handle volatility (BBG)

Green stocks are surging despite Trump's attacks (BBG)

Hedge funds flee bearish oil bets after US sanctions Russia (BBG)

India's IPO engine runs hot despite some soft debuts (WSJ)

London becomes 'quant' powerhouse as traders rake in revenues (FT)

Blackstone's credit assets hit $100B (BBG)

Australia's SWF is up 14% YoY (BBG)

Cloud is closing in on YouTube as Alphabet's No. 2 revenue driver (RT)

Solo GP Oren Zeev made $1B from Navan IPO (CNBC)

Credit blowups in Brazil are scuttling corporate bond deals (BBG)

Bessent says high interest rates may have caused housing recession (RT)

OPEC+ paused oil output hikes beyond December amid glut fears (RT)

Wall Street boom will reduce New York budget deficit by $3B (BBG)

JPMorgan flagged Epstein suspicions in 2002 (WSJ)

Trump stirs global alarm with pledge to restart nuclear testing (FT)

A Message from amberjack

Rated #1 Best Overall Dress Shoes

Cooler weather means it's time to upgrade your dress shoes, and there's no better place to look than amberjack.

Amberjack is the modern footwear brand started by execs from Adidas, Cole Haan, and McKinsey. They've created the world's most advanced dress shoes, made with proprietary athletic materials that deliver incredible comfort and A-grade leather vertically sourced from one of the world's leading tanneries.

They've been featured in Forbes, GQ, and Wall Street Journal and Men's Health named them the most comfortable business casual shoe of 2024. They're also running a buy 3 get 1 free promo this week – get yours while the collection lasts!

Deal Flow

M&A / Investments

French telecom giant Orange agreed to buy out the remaining 50% stake in its Spanish JV MasOrange for $4.9B

Crypto exchange Coinbase is in late-stage talks to acquire stablecoin infrastructure startup BVNK for $2B

Mexican silver and gold miner Fresnillo agreed to buy Canada's Probe Gold in a $560M cash deal

A consortium of investors led by JPMorgan agreed to invest $90M in a second financing round for the Texas Stock Exchange

Innocap Investment Management, a dedicated managed account platform for institutional investors, raised a strategic growth investment from Bain Capital

Select VC deals

Axonic Insurance, a global annuity and insurance platform, raised a $210M equity round led by LuminArx Capital Management

EnduroSat, a European startup building small satellites, raised a $104M round from Riot Ventures, GV, Lux Capital, and more

Recess, a relaxation beverage startup, raised a $30M Series B led by CAVU Consumer Partners

AI and energy infrastructure startup Emerald AI raised an $18M seed extension led by Lowercarbon Capital

Altrove, a French deeptech using AI to produce sustainable alternatives to rare earths. raised a $10M seed round led by Alven

Adam, a startup building a viral text-to-3D tool, raised a $4.1M seed round led by TQ Ventures

Cephia, a startup using AI and meta-materials to build new sensors, raised a $4M seed round led by Radiant Opto-Electronics Corporation

Access real-time data on every VC, startup, or sector. Try Fundable.

IPO / Direct Listings / Issuances / Block Trades

Indian conglomerate Adani Enterprises plans to raise $2.8B in a rights issue

$36B-listed Chinese EV maker Seres raised $1.8B in its Hong Kong listing

SoftBank-backed Indian eyewear retailer Lenskart Solutions raised $820M at a $7.9B valuation in its India IPO

PayPal-backed digital payments provider Pine Labs is seeking to raise $440M at a $2.9B valuation in its India IPO

Regional lender Central Bank is seeking to raise $426M at a $5.7B valuation in a rare US bank IPO

Debt

Blackstone will back insurance underwriter The Fidelis Partnership's new syndicate on UK insurance giant Lloyd's of London

Bankruptcy / Restructuring / Distressed

A group of lenders to bankrupt auto parts supplier First Brands accused the firm of 'widespread fraud' and are seeking to end part of its bankruptcy

Gigaclear, a heavily indebted UK broadband provider, launched a sale process as investors and creditors including NatWest, Lloyds, and the National Wealth Fund try to resolve a $1.3B debt pile

German Fiber network firm Deutsche Glasfaser engaged lenders to restructure debt after plans to raise $578M in preferred equity stalled

A consortium of banks including Crédit Agricole, ING, SMBC, and BNP Paribas hired FTI Consulting as advisor over concerns that petrochemical giant Braskem's restructuring talks may affect payments on a recently-tapped revolver

Fundraising / Secondaries

CVC-backed Global Sport Group, the world's biggest PE sports business, is searching for new investments after launching at a $10.5B valuation

Ares raised $1.5B for a debut healthcare lending fund

Kuwait's pension fund PIFSS is in talks with multiple leading PE firms about resuming deployments

Brookfield will launch a global PE fund strategy for retail investors

Crypto Sum Snapshot

Ex-FTX president Brett Harrison called crypto leverage trading a 'major problem' amid launch of new perpetual futures exchange for traditional assets

Coinbase holds edge in US crypto race even as rivals' IPOs reshape landscape

November could be new October for US crypto ETFs amid government shutdown

Crypto Sum compiles the most important stories on everything crypto. Read it here.

Upcoming Events ⛳️

The Litquidity × NEXUS Capital Cup – November, $100k in prizes

Spots are filling up fast for the inaugural Litquidity × NEXUS Capital Cup this November-December in NYC! Grab a golf buddy to get $250 in DraftKings bet credit and a three month membership while you compete for a $100k pot and a shot at glory. This is an absolute no-brainer and essentially a free option to compete for some sick prizes. All made possible through our wonderful sponsors!

Or simply show up for the vibes and indulge in $100 worth of free drink credits among a curated crowd.

Exec’s Picks

WSJ published some insightful charts for tech investors following Mag 7 earnings.

Bloomberg Odd Lots sat down with Hudson River Trading's head of AI research Iain Dunning to discuss how HRT actually uses AI, including for short-term price predictions.

Finance & Startup Recruiting 💼

Litney Partners

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting venture between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm), Litney Partners places talent at leading firms in PE, hedge funds, VC, growth, credit, IB, and fintech and is currently recruiting for some incredible roles. Head over to our website to drop your resume and we'd love to get in touch!

Next Play

If you're down bad, realizing finance isn't for you, and want to explore the world of startups (BizOps, chief of staff, strategic finance, etc.), fill out this form. Next Play will reach out to schedule a 1:1 video call if they think they can help as your own, personal startup matchmaker. They've grown their community to over 50k talented professionals and have deep relationships across the tech ecosystem.

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.