Together with

Good Morning,

PE employees are beginning to embrace smaller firms, Oracle CDSs are emerging as the AI bubble hedge, corporate insiders are buying the dip, just two sectors are accounting for all of US job growth, and US stocks tumbled yesterday in a rare rally-reversal that wiped out over $2T in value.

Does your tax advisor return your calls? If not, check out OLarry, a proactive tax advisory service for individuals and businesses with complex taxes.

Let's dive in.

Before The Bell

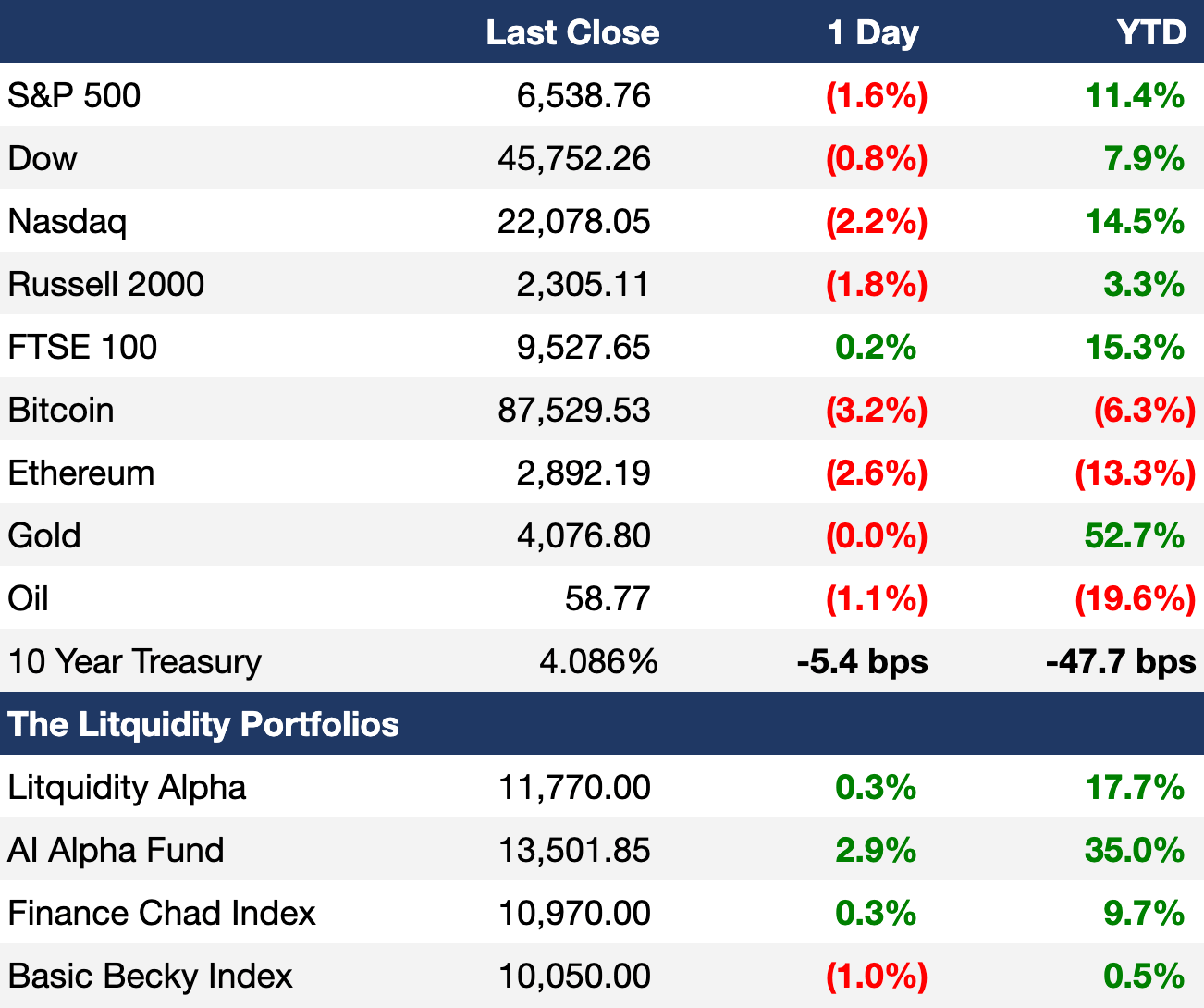

As of 11/20/2025 market close.

Learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks plunged in a stunning market reversal yesterday as optimism from Nvidia's earnings failed to soothe valuation concerns and waning rate cut hopes

All three major indexes saw their biggest intra-day reversals since April

S&P and Dow's 3.4% and 2.3% intraday drops respectively were just their third of such magnitude since 1990

Nasdaq's 4.5% intraday drop was just its second of such size since 1990

Nasdaq-100 implied vol rose above 32 for the first time since April

Traders priced in 60% odds of no Fed rate cut next month

India's Nifty Midcap 100 index hit an ATH after gaining 8% in two months on India rate cut bets

Oracle CDS spreads hit three-year highs

Bitcoin slipped below $87k for the first time since April

Earnings

Walmart issued another beat-and-raise for Q3 on a 27% e-commerce surge and 4.5% same-stores sales growth driven by bargain-seeking customers across all incomes; the firm will switch its listing to Nasdaq with John Furner set to take over as new CEO (CNBC)

Webull smashed Q3 earnings and revenue estimates on record customer assets and steady growth in funded accounts and users (INV)

Gap beat Q3 earnings and revenue estimates as comparable sales rose 5% on its viral 'Better in Denim' campaign, with wealthier shoppers trading down and momentum carrying into Q4 despite weakness at Athleta (CNBC)

Full calendar here

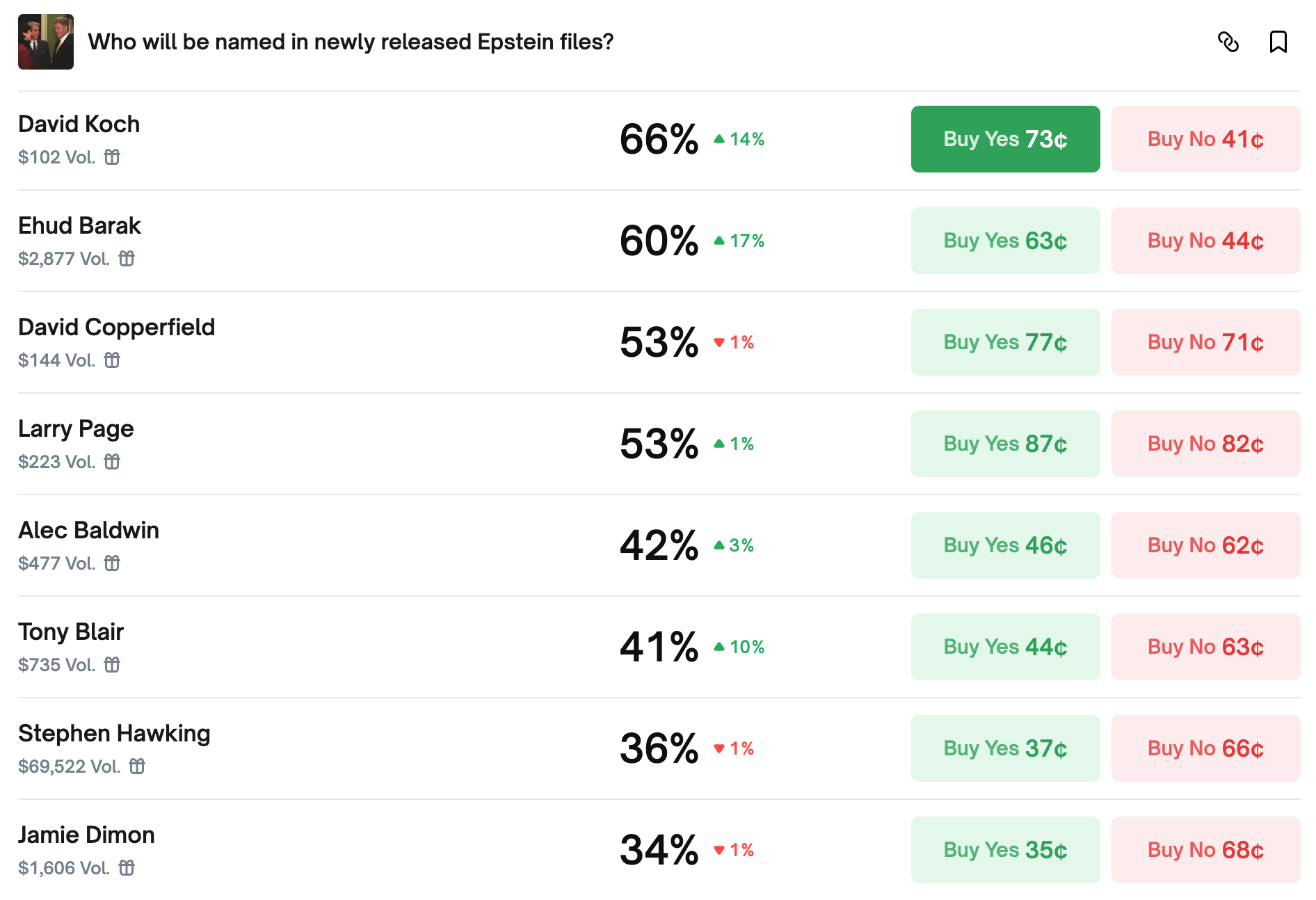

Prediction Markets

Don't let the stock market distract you from the fact that…

Track and trade live odds on Polymarket.

Headline Roundup

PE employees are beginning to embrace smaller firms (WSJ)

Fed officials eye financial stability with next rate decision in doubt (RT)

Fed fractures deepen as Barr signals inflation concern (BBG)

Fed's Cook warns on risk hedge funds pose to $30T Treasury market (FT)

US unemployment rose to 4.4% to the highest in four years (WSJ)

Just two sectors account for 100% of US job growth in 2025 (BBG)

US added 119k jobs in September (BBG)

Corporate insiders are buying the dip at the fastest pace since May (BBG)

Insurance IPOs hit a 20-year high amid tariff-driven chaos (RT)

AI boom brings fresh risks to US markets and more money to M&A (RT)

Oracle CDS market explodes as new AI hedge (BBG)

Old-school ER analysts dive into private markets (BBG)

White House is considering executive order to preempt state AI laws (RT)

BDCs face rising credit-quality pressure into 2026 (BBG)

Asia's FX reserves surged to $8T (BBG)

Major corporations shift listings to Nasdaq amid growing tech focus (RT)

Hong Kong stock rally meets $25B lockup test ahead (BBG)

SEC weighs looser conflict-of-interest rules for Big Four accounting firms (FT)

Jump Trading entered market-making for prediction markets (BBG)

Citigroup announced a broad leadership shake up (WSJ)

HSBC overhauled S&T in bid to become debt powerhouse (BBG)

AIG pulled president job for ex-Lloyd CEO Neal after office romance (BBG)

Starbucks must face shareholder lawsuit over surprise sales decline (RT)

ChatGPT launched group chats (TC)

US charged four men for smuggling Nvidia chips to China (BBG)

China magnet sales to US hit a nine-month high (BBG)

LME will stop running benchmark platinum and palladium auctions (BBG)

World's richest nations are pulling back from global development efforts (RT)

A Message from OLarry

OLarry: Personalized tax support for individuals and businesses with complex tax needs.

Go beyond traditional tax:

Access a level of service previously only accessible by the ultra-high net worth

Providing unlimited year-round access to tax advice and strategy

Combining US-based industry experts and modern technology

Trusted by thousands of individuals and businesses

"Easily the best and most strategic tax convos I've had." -Raj, CEO

Book a free consultation today and get 10% off your first year with code Execsum.

Deal Flow

M&A / Investments

Activist hedge fund Elliott is pressuring $60B-listed Canadian miner Barrick to split its gold and copper operations

Medtech giant Abbott agreed to acquire cancer-screening company Exact Sciences for $21B cash at a 51% premium in the biggest healthcare acquisition in two years

Investors are challenging 3G Capital's $9.4B LBO of footwear brand SKECHERS

South African telecom Vodacom is in talks to acquire part of the Kenya's stake in $9B-listed wireless carrier Safaricom; Vodacom already owns 39.9%

Race car driver and CrowdStrike founder/CEO George Kurtz agreed to acquire a 15% stake in co-owner/CEO Toto Wolff's 30% stake in Mercedes-AMG F1 Team at a $6B valuation

Insurance services firm Asurion is in advanced talks to acquire UK warranty business Domestic & General from European PE firm CVC at a $2.75B valuation

GE-spinoff GE HealthCare Technologies agreed to buy medical imaging software maker Intelerad for $2.3B cash

European PE firm EQT is nearing a deal to acquire a majority stake in European environmental service company Desotec from Blackstone at a $2.3B valuation, including debt

Blackstone is seeking to sell the NEC events center in UK for $1.3B

PE firm TPG agreed to invest $1B in India-based IT firm Tata Consultancy Services to build out AI data centers

Paramount Skydance won the rights to broadcast UK and German Champions League soccer games for ~$1B

Taiwan's E.Sun Financial Holding plans to inject $545M to revive struggling Taiwan life insurer Mercuries Life as part of its acquisition of the firm

Consortium Brand Partners and Eldridge Industries agreed to acquire restaurant chain California Pizza Kitchen for ~$300M

UK consumer goods giants Unilever is considering selling historic UK foods brands including Marmite, Colman's, and Bovril for potentially ~$260M

German airline Lufthansa joined a consortium of investors circling a minority stake in Portugal's state carrier TAP

Indian lenders Emirates NBD India, Kotak Mahindra Bank, and Federal Bank are in talks with Deutsche Bank for its India retail and wealth management unit

Chinese state-backed investment bank CICC will take over brokerages Dongxing Securities and Cinda Securities via share-swaps amid efforts to support China's financial market reforms

China told US its controlling stake in the Greek Port of Piraeus, one of Europe's largest, is not for sale

VC

Multimodal AGI startup Luma AI raised a $900M Series C led by Saudi's HUMAIN

TikTok-owner ByteDence sold $300M of secondary shares at a $480B valuation led by Capital Today

Genspark AI, an autonomous AI workspace platform, raised a $275M Series B at a $1.25B valuation led by Emergence Capital

Hiive Markets, an online share exchange for pre-IPO firms, is raising a Series B at a $650M pre-money valuation by listing itself on its own marketplace

Embodied AI robotics startup Robot Era raised a $140M Series A+ led by Geely Capital

AI design platform Lovart raised a $130M Series B led by Sequoia China and CMC Capital

NestAI, a defense-focused physical AI startup, raised a $115M round co-led by Finland's SWF Tesi and Nokia

Rocket-motor manufacturer Firehawk Aerospace raised a $100M funding round from unnamed VCs

Public-safety AI startup RapidSOS raised a $100M round at a ~$1B valuation led by Apax Digital Funds

Consumer cybersecurity startup Guardio raised an $80M round led by ION Crossover Partners

AI-native social-engineering defense startup Doppel raised a $70M Series C led by Bessemer Venture Partners

Physical AI startup Archetype AI raised a $35M Series A round led by IAG Capital Partners and Hitachi Ventures

Precision-location startup Point One Navigation raised a $35M Series C at a $230M valuation led by Khosla Ventures

Agentic video intelligence startup Vyntelligence raised a $30M Series B round led by Blume Equity and Morgan Stanley's 1GT climate strategy

Numerai, an AI-powered hedge fund that crowdsources trading ideas from anonymous data scientists, raised $30M at a $500M valuation from Paul Tudor Jones, Shine Capital, Union Square Ventures, and university endowments

Stuut Technologies, an AI accounts-receivable automation startup, raised a $29.5M Series A led by a16z

Method Security, an autonomous cyber defense startup, raised a $26 million combined seed and Series A round led by a16z and General Catalyst

Voice-interface startup Wispr AI raised a $25M Series A extension led by Notable Capital

OpenHands, a cloud coding agent platform, raised an $18.8M Series A led by Madrona

NcodiN, a photonic interposer startup, raised an $18M seed round led by MIG Capital

Automat, an AI-driven enterprise workflow automation startup, raised a $15.5M Series A round led by Felicis

Industrial AI startup Aris Machina raised a $10M pre-seed round led by Earlybird Venture Capital

Frontier healthcare AI startup Voio raised an $8.6M seed round from Laude Ventures and The House Fund

AI underwriting startup Pibit.AI raised a $7M Series A round led by Stellaris Venture Partners

Hearvana, a super-human auditory intelligence startup, raised a $6M pre-seed round co-led by SCB 10X and Point72 Ventures

Powered by Fundable.

IPO / Direct Listings / Issuances / Block Trades

Indian asset management JV ICICI Prudential Asset Management is close to securing approval from India's regulator for a $1.1B IPO

South East Asian PE firm Creador-backed Malaysian pharmaceutical chain Big Caring is exploring an IPO at a $4.8B valuation

Italian soccer club Juventus is seeking to raise $113M in a share sale

Debt

JPMorgan, Bank of America, and Citigroup shelved a $20B bailout package to Argentina and are instead discussing a smaller $4B short-term facility

Pharma giant Moderna raised a $1.5B loan from Ares

Palladium Equity-backed food supplier Quirch Foods raised a $1.1B for a refinancing, led by $800M of private credit from Ares and Regions Bank

A Morgan Stanley-led consortium of banks delayed a $590M ABS sale of ServerFarm data center bonds after concerns over ties to Chinese tech giant Alibaba

Canada's HOOPP's real estate financing arm HOOPP Realty Finance is looking to raise $356M in a debut bond offering

Taiwan life insurer Mercuries Life is planning a $100M subordinated dollar bond sale in Singapore

Bankruptcy / Restructuring / Distressed

Lenders Antares, KKR, BlackRock, and Carlyle are set to take control of pallet company 48Forty Solutions in a debt-for-equity swap just one year after lending $1.75B in private credit to support Summit Partners' LBO of the firm

Struggling UK supermarket chain Asda is selling off 24 stores and a distribution center and leasing them back to raise $745M

Fundraising / Secondaries

KKR is seeking to raise $15B for its fifth Asia PE fund with consumer, life sciences, financial services, healthcare, and industrials in focus

Digital infrastructure investment firm DigitalBridge raised $11.7B for its third flagship fund targeting data centers and AI infrastructure

UK PE firm CapVest raised $3.8B for a second continuation fund for radiopharma firm Curium from TPG, ICG, CVC Secondary Partners, Goldman Sachs Asset Management, Ardian, and Lunate at a $7B valuation

Bessemer Venture Partners-linked BVP Forge raised $1B for its second fund dedicated to growth buyout and minority investments

European real estate PE firm Stoneshield Capital is seeking to raise $1.1B for its sixth fund, with plans to raise AUM from $5.7B to $11.5B

UK-focused PE firm Goldenpeak raised $490M for its debut fund

European VC Keen Venture Partners raised $175M for Europe's largest defense technology fund

Watchfire Ventures is seeking to raise $150M for its third flagship fund to continue investing in consumer products, commerce infrastructure software, industrial modernization technology, and tech-enabled services

UK PE firm ICG launched a MM GP-led fund

UK-based RBC BlueBay, the global asset management unit of RBC, is launching its first yen-denominated bond fund

EQT partnered with Deutsche Bank on a semi-liquid PE fund

Crypto Sum Snapshot

Strategy risks losing billions if dropped from major indexes

G20 watchdog says private credit markets and stablecoins need close monitoring

Proposed Bitcoin for America Act would allow tax payments in Bitcoin, which would go towards strategic Bitcoin reserve

Early Bitcoin investor Owen Gunden sold all his Bitcoin for $1.3B

Andrew Tate got liquidated on Hyperliquid amid the crypto crash

Crypto Sum compiles the most important stories on everything crypto. Read it here.

Exec’s Picks

If it's so obviously a bubble, why are companies running so fast to build AI? Check out what M.G. Siegler has to say.

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.