Together with

Good Morning,

Silver Lake is pursuing the biggest LBO ever, Blackstone repriced a private credit deal at the tightest spread ever, Chamath raised $300M for his SPAC comeback, hedge fund stars are hiring agents to negotiate pay packages, and White men are making a comeback in corporate America.

The Wharton Online-Wall Street Prep Private Equity Certificate Program is back for the fall. Level up your PE skillset in the globally acclaimed Private Equity Certificate Program and save $300 with our Litquidity discount.

Let's dive in.

Before The Bell

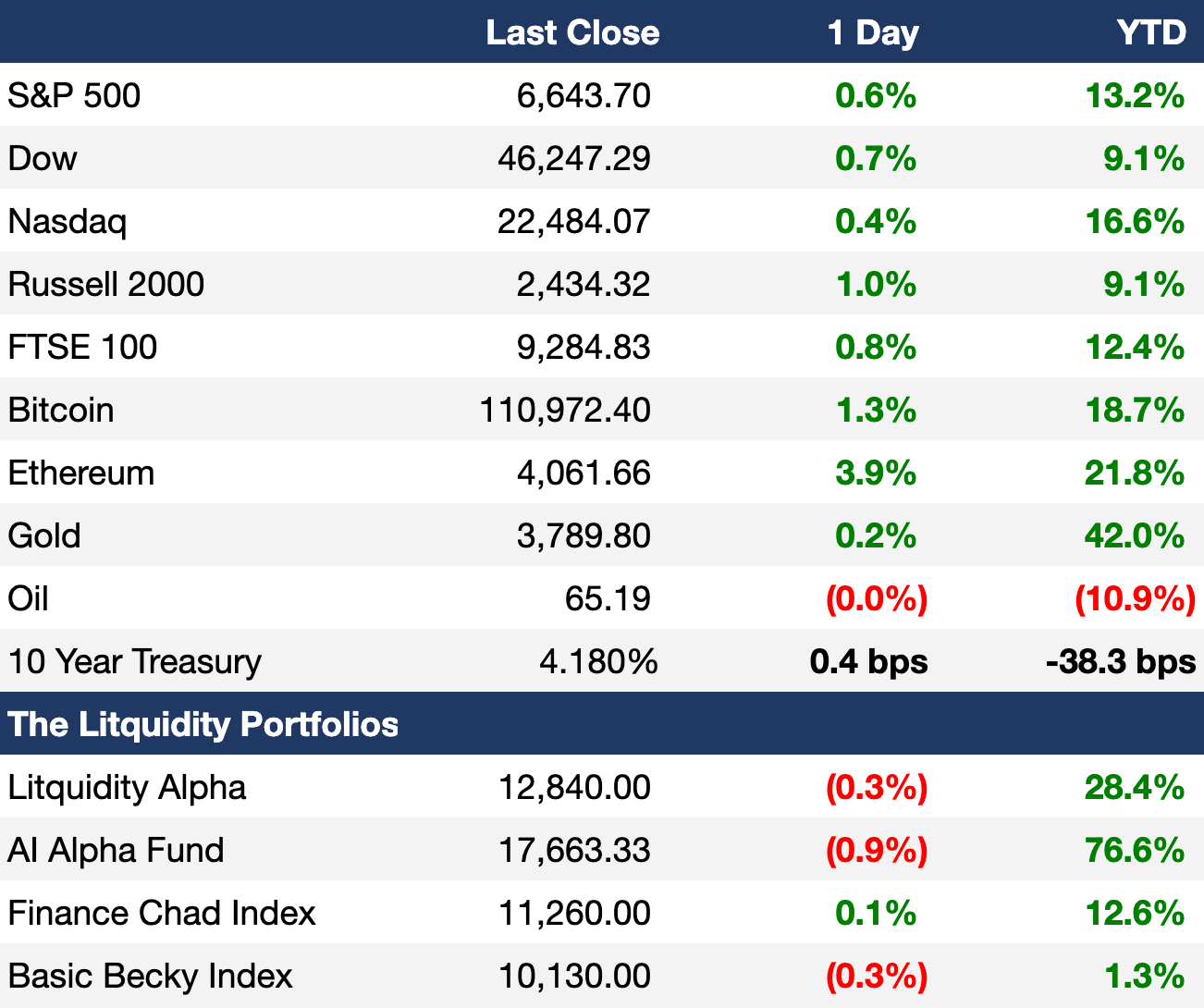

As of 9/26/2025 market close.

Click here to learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks rose on Friday as investors digested fresh inflation data

All three major indexes snapped three-day losing streaks

Cryptocurrencies shed $300B in market cap last week in the worst selloff since June

Earnings

What we're watching this week:

Today: Jefferies, Carnival

Tuesday: Nike

Full calendar here

Prediction Markets

Kalshi markets are so efficient that even sports books are trying to copy them. Check out WSJ's report on how Kalshi is shaking up sports prediction markets.

Headline Roundup

'Magnificent 7' is losing relevance in evolving AI industry (BBG)

Hedge fund manager is lurking around Drake's house to pump a stock (BBG)

Hedge fund stars are hiring agents to negotiate pay packages (WSJ)

Echoes of 2007 are getting louder (BBG)

US 100% pharma tariffs won't apply to EU and Japan (BBG)

Fed-favorite PCE index rose 2.7% YoY (CNBC)

US consumer sentiment fell to a four-month low on income concerns (BBG)

PE fundraising rush prompts fears of European sector shake-out (FT)

Brookfield's CEO said there should be 4k fewer PE firms (BBG)

EM private credit is on course for its biggest year ever (BBG)

Global equity funds saw net inflows for the first time in three weeks (RT)

Sam Altman met with UAE president to discuss AI collaboration (RT)

Apple built ChatGPT-rival Veritas to revamp Siri (BBG)

Facebook and Instagram will launch paid versions in UK (BBG)

Amazon exec leading AGI development stepped down (RT)

Ex-Salomon Brothers bond trader was charged with sex trafficking (BBG)

NYC mayor Eric Adams exited NYC mayoral race (BBG)

A Message from Wharton Online

Learn the Playbook Behind PE Deal-Making

Discover how elite PE firms source, structure, and execute deals—and apply the same frameworks to your career.

The Private Equity Certificate Program from Wharton Online + Wall Street Prep gives you the tools and connections to do just that:

Learn from Wharton faculty and senior execs at firms like Carlyle, Blackstone, and KKR

Apply deal skills through real-world case studies

Earn a globally recognized certificate from Wharton Online

Join a community of 5k+ finance professionals that continues to share insight and opportunities long after the program ends

Save $300 with code LITQUIDITY. Program starts Oct. 6. Learn more.

Deal Flow

M&A / Investments

PE firms Silver Lake and Affinity Partners and Saudi SWF PIF are in talks to take-private video-game maker Electronic Arts for $50B in what could be the largest LBO ever

Chinese tech giant ByteDance will retain ownership of TikTok's US business operations in the $14B US-China deal

Occidental Petroleum is in talks to sell its OxyChem petrochemical unit for $10B

TA Associates-backed MRI Software is weighing a sale or IPO at a $10B valuation

Swiss nutrition products firm DSM-Firmenich re-invited Apollo to join bidding against CVC for its animal nutrition and health unit, which could fetch $3.2B

South Korea's DB Insurance agreed to acquire US specialty insurer Fortegra Group for $1.65B

Dutch tech investor Prosus-backed OLX Group will buy French online auto trader La Centrale for $1.3B cash

UK energy supplier Ovo Energy is exploring a stake sale in software spinout Kaluza at a $1B valuation

Pharma giant Abbott Laboratories will acquire several assets of New Zealand's Synlait Milk for $177M

Media broadcasting group MFE-MediaForEurope is in talks to acquire a stake in Portuguese media company Impresa

Danish biotech Genmab is in advanced talks to acquire Dutch cancer drugmaker Merus

VC

Galactic Energy Aerospace Technology, a Chinese reusable-rocket startup, raised a $336M Series D led by Beijing Commercial Spaceflight

Swimming pool cleaning robot maker Xingmai Innovation raised a $140M Series A led by Dragonball Capital

Indian ice cream brand Hocco raised a $13M round led by Sauce.vc

Raiku, a Solana infrastructure startup enabling predictable blockspace, raised an $11.25M seed round led by Pantera Capital

Load Stations, an AI-driven EV-charging software operator, raised a $5.2M round led by Ncity

IPO / Direct Listings / Issuances / Block Trades

Japan's Sony Financial Group will debut in Japan at a $6.7B market cap after being spun off from Sony, which will focus on its entertainment and image sensor units

Scandinavian financial services firms NOBA raised $807M in a Sweden IPO that was 20x oversubscribed

KKR-backed Indian seeds producer Advanta is seeking to raise $500M at a $4B valuation in an India IPO

Brookfield-backed North American natural gas storage platform Rockpoint Gas Storage is seeking to raise $347M at a $2.1B valuation in a Canada IPO

Angola's lender BFA raised $240M in the nation's largest-ever IPO

Google Ventures-backed insurance platform Ethos filed for an IPO

Canadian media giant and Toronto Raptors-owner Rogers Communications is weighing an IPO or stake sale amid investor interest

US asset manager Capital Group acquired a 3% stake in $33B-listed German utility RWE

SPAC

SPAC King Chamath's American Exceptionalism Acquisition Corp. raised $300M in its IPO to target AI, energy, defense, and crypto

Tom Lee's FutureCrest Acquisition raised $250M in its IPO to target AI and other tech companies

Debt

EU is discussing providing Ukraine with a $164B in loans using frozen Bank of Russia assets

Lenders Blackstone, Blue Owl, and Ares repriced $2.65B in private credit for Permira-owned website builder Squarespace at a 375 bps premium, the lowest spread ever for a PE-backed private credit deal

Algeria plans to raise $2.3B in its first-ever sovereign Islamic bond sale

Car maker Jaguar Land Rover received a $26B loan guarantee from UK

Bankruptcy / Restructuring / Distressed

Argentine investor group Emes bought $400M of InterCement's debt, which has been in bankruptcy protection since December

Kering-owned Italian luxury fashion house Valentino is in talks with creditors after breaching terms of its debt

Solar firm Pine Gate Renewables is negotiating a debt restructuring that may be executed through Chapter 11

Apollo sidestepped the backlist meant to prevent certain investors from shorting collapsed automotive parts supplier First Brands' debt

Fundraising / Secondaries

General Atlantic Credit raised $2.1B for its latest private credit fund

Norway's SWF NBIM committed $1.5B to Brookfield's second transition fund

Specialized investment firm HighVista Strategies raised $425M for a multi-asset continuation vehicle comprising seven VC LP stakes

The PE arm of French asset management giant Amundi raised $333M for a third fund targeting 'megatrends'

VC Touring Capital raised $330M for its debut fund to invest in growth-stage software

Crypto investor Theta Capital is seeking to raise $200M for its fifth blockchain FOF

Sports and media business veteran Matt Rizzetta launched PE firm Underdog Global Partners to invest in sports, real estate, and media IP

Two ex-Inflexion and Houlihan Lokey execs debuted UK PE firm Goldenpeak

Africa-focused credit investor Kessner Capital Management launched a new private credit fund

Crypto Sum Snapshot

Only 54% of new crypto investors bought Bitcoin

Deutsche Bank predicts Bitcoin on central bank balance sheets by 2030

Crypto Sum summarizes the most important stories on crypto daily. Read it here.

Exec’s Picks

Over 70% of startup employees abandon their stock options, in large part because they lack the cash to exercise. Vested is now preparing to support these employees at scale. Click here to listen to their CEO discuss this fascinating market, and the company's innovative investment approach.

White men are making a comeback in America's boardrooms. Read about it here.

Finance & Startup Recruiting 💼

Litney Partners

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting venture between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm), Litney Partners places talent at leading firms in PE, hedge funds, VC, growth, credit, IB, and fintech and is currently recruiting for some incredible roles. Head over to our website to drop your resume and we'd love to get in touch!

Next Play

If you're down bad, realizing finance isn't for you, and want to explore the world of startups (BizOps, chief of staff, strategic finance, etc.), fill out this form. Next Play will reach out to schedule a 1:1 video call if they think they can help as your own, personal startup matchmaker. They've grown their community to over 50k talented professionals and have deep relationships across the tech ecosystem.

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.