Together with

Good Morning,

The US government shutdown is set to end, Fed officials are divided on rate cuts ahead, and Warren Buffett penned his final letter to shareholders as Berkshire CEO.

Vanta just released data from their comprehensive survey on AI risks in security. See how business leaders around the globe are responding. Read the report.

Let's dive in.

Before The Bell

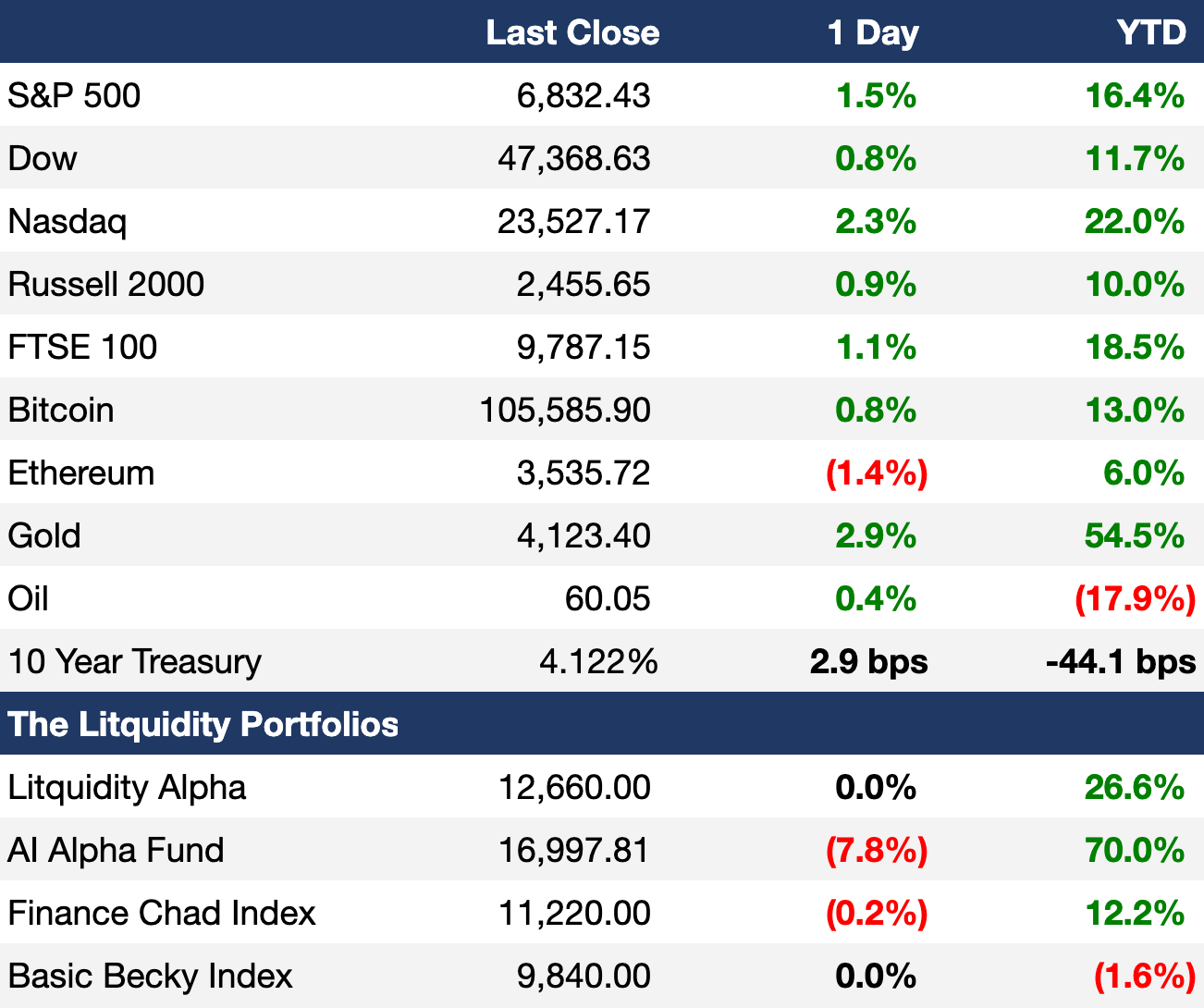

As of 11/10/2025 market close.

Click here to learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stock indexes surged in a rebound rally yesterday after the Senate reached a deal to end the government shutdown

Europe's Stoxx 600 jumped 1.4% in its best day since May

UK’s FTSE 100 hit a fresh ATH

MSCI EM index rose 1.3% in its best day in two weeks

US Treasury CDS spreads ticked lower

5Y CDS spreads declined to 37 bps to the lowest since February

Earnings

CoreWeave beat Q3 revenue estimates as sales more than doubled on new deals with large firms including Meta and OpenAI, though it cut FY guidance due to a customer contract delay (CNBC)

TeraWulf beat Q3 revenue estimates on an 87% increase thanks to rising Bitcoin prices and expanded mining capacity but posted a wider-than-expected loss amid derivative liability revaluations (DC)

Instacart beat Q3 earnings and revenue estimates on 10% sales growth and issued strong guidance under new CEO Chris Rogers as more consumers turned to online grocery delivery (CNBC)

Barrick Mining beat Q3 earnings estimates and raised its dividend and buyback program as higher gold prices boosted profit (BBG)

Occidental Petroleum beat Q3 earnings estimates as higher production helped offset weaker oil prices (RT)

Paramount Skydance missed Q3 revenue estimates but announced plans to invest over $1.5B in programming and target $3B in cost savings, including 1.6k additional job cuts (BBG)

eToro beat Q3 profit estimates with net contribution up 28% as retail investors fueled trading activity (RT)

What we're watching this week:

Today: Nebius, OKLO, Beyond Meat

Wednesday: Circle, Cisco, Tencent

Thursday: Walt Disney, Bitfarms, JD.com, Applied Materials

Friday: Sony

Full calendar here

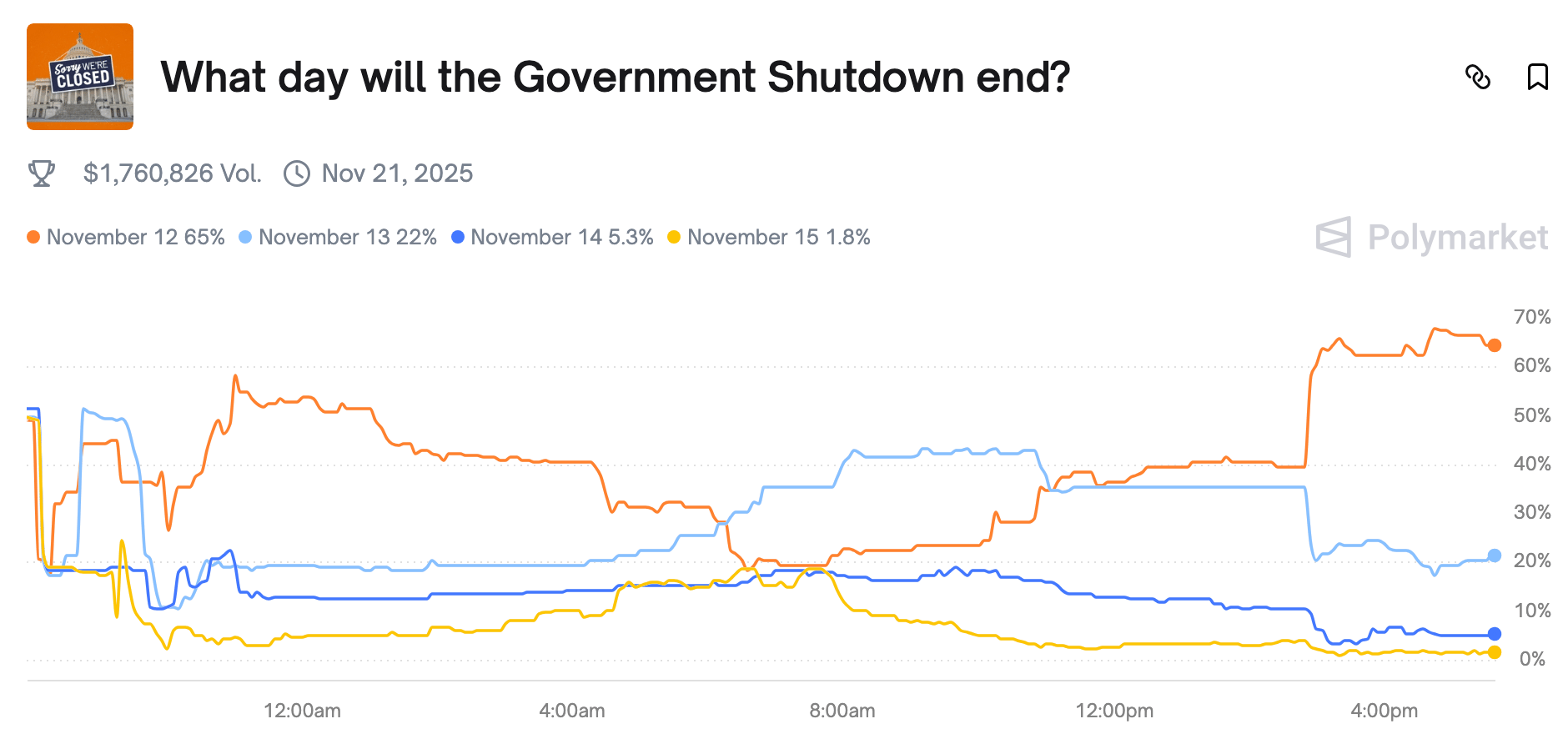

Prediction Markets

The federal government is set to open this week as Congress members head to DC to vote on a bill agreed in the Senate.

Headline Roundup

Longest US government shutdown is set to end this week on Senate deal (RT)

Fed officials are divided over rate cuts ahead (RT)

PE is finding new complex ways to cash out after IPOs (BBG)

Shutdown endgame revives US IPO prospects as year end looms (BBG)

Flip from AI hype to bubble fears spurs options demand (BBG)

Hedge funds cut exposure to consumer stocks to Covid-era lows (RT)

$5T AI data center boom will dip into every debt market (BBG)

Credit fueled most of PE firms' $257B fundraising haul (BBG)

Riskiest CLOs are offering the lowest payouts in five years (BBG)

Retail rally is running out of steam after record streak (RT)

Citadel launched a new stock-picking unit in Europe (WSJ)

Robinhood wants to allow amateur traders to invest in AI startups (FT)

Korea's new bourse considers K-pop tokens to lure more traders (BBG)

Swiss finance shrinks as regulators tighten grip on prized sector (FT)

Europe businesses brace for greater impact from US tariffs in 2026 (RT)

Hong Kong surpassed Japan and Korea in structured notes boom (BBG)

Sterling junk loan issuances hit a record high (BBG)

Australia pension giants add FX risk as offshore assets surpass 50% (BBG)

Proxy firms urged shareholders to oust members of Cracker Barrel's board (RT)

Diageo named turnaround specialist Dave Lewis as new CEO (WSJ)

US law firms saw demand surge in Q3 (RT)

US charged Brian Kahn over $300M collapse of Prophecy hedge fund (BBG)

US employers face mounting lawsuits over retirement fund fees (FT)

A Message from Vanta

State of Trust: AI-driven attacks are getting more sophisticated

AI-driven attacks are getting bigger, faster, and more sophisticated – making risk much more difficult to contain. Without automation to respond quickly to AI threats, teams are forced to react without a plan in place.

This is according to Vanta's newest State of Trust report, which surveyed 3,500 business and IT leaders across the globe.

One big change since last year's report? Teams falling behind AI risks – and spending way more time and energy proving trust than building it.

61% of leaders spend more time proving security rather than improving it

59% note that AI risks outpace their expertise

But 95% say AI is making their security teams more effective

Read the full report to learn how organizations are navigating these changes, and what early adopters are doing to stay ahead.

Deal Flow

M&A / Investments

Industrials manufacturer Parker-Hannifin is in talks to buy automotive and industrial filter manufacturer Filtration from Madison Industries at a potential $9B valuation, including debt

A consortium of PE firm CD&R and German tech firm Koerber, equipment maker GEA, and Italian rival Coesia are among bidders interested in acquiring German packing firm Syntegon from CVC for over $4.6B

BC Partners-backed UK insurance services firm Davies agreed to merge with Canada's SCM Insurance Services to create a $4.3B entity

UK PE firm Permira agreed to take-private UK fund solutions group JTC for $3B, representing a 50% premium

European PE firm Investindustrial agreed to take-private private-label food manufacturer TreeHouse Foods for $2.9B, including debt, at a 40% premium

Apollo acquired a majority stake in Spanish football team Atlético de Madrid in a deal that values the club at $2.5B

$2.2B-listed enterprise AI software provider C3 AI is exploring a sale after founder/CEO Thomas Siebel stepped down due to personal health

Industrials-focused PE firm Arcline agreed to acquire aerospace and defense hardware maker Novaria from KKR in a $2.2B deal

UK telecom and cloud services firm SCG is weighing a sale at a $1B valuation

Video-sharing platform Rumble agreed to acquire German AI infrastructure company Northern Data in a $970M deal

PE firms KKR, TPG, and Warburg Pincus are among bidders interested in acquiring Hong Kong-backed advisory and corporate services firm Acclime for ~$1B

GTCR is moving forward with its $627M all-cash acquisition of medical device coatings maker Surmodics after a US judge struck down an FTC injunction

TS Group, a Singaporean provider of worker dormitories, is considering a majority stake for potentially $385M

Asian PE firm CPE agreed to acquire an 83% stake in Burger King's China unit from Restaurant Brands International and invest $350M

Botswana reiterated plans to acquire a majority stake in diamond producer De Beers from mining giant Anglo American

Shell swapped its stake in the MarramWind North Sea farm with JV partner Scottish Power in exchange for full control of smaller CampionWind project and handed back the latter's lease to Crown Estate Scotland

VC

Legal AI startup Clio raised a $500M Series G at a $5B valuation led by NEA

Majestic Labs, a startup building servers with 1000x the memory capacity of GPUs for AI workloads, emerged from stealth with $100M in funding from Bow Wave Capital, Lux Capital, and others

Drone startup Neros raised a $75M Series B led by Sequoia Capital

Scribe, a startup helping businesses document workflows, raised a $75M Series C at a $1.3B valuation led by StepStone

Gamma, an AI platform presentations, websites, and social media posts, raised a $68M Series B at a $2.1B valuation led by a16z

Vay, a German startup offering remote-controlled rental cars, received $60M in funding from Singaporean tech heavyweight Grab

Enterprise legal AI platform DeepJudge raised a $41.2M Series A led by Felicis

AirOps, a content engineering platform for AI search, raised a $40M Series B led by Greylock

TRIP, a calming drinks brand, raised $40M in funding from Joe Jonas, Alessandra Ambrosio, Paul Wesley, and others

AI sales agent startup 1Mind raised a $30M Series A led by Battery Ventures

Digitail, an AI-powered practice management software for veterinary clinics, raised a $23M Series B led by Five Elms Capital

Evidium, a healthcare AI platform focused on computational medical knowledge and transparent clinical reasoning, raised a $22M Series A led by Health2047 and WGG Partners

SAIA Agrobotics, a Dutch startup developing robotics for greenhouse growing, raised an $11.5M Series A led by Check24

Bonat, a Saudi AI-powered customer engagement platform, raised a $6M Series A led by Tali Ventures

Stay fully up to date on any startup, VC, or sector on Fundable.

IPO / Direct Listings / Issuances / Block Trades

Lor and Rollins Holding are offering to sell $1B in shares of pest control firm Rollins

Canada's CPPIB is seeking to raise $970M in a sale of its 5.4% stake in Portuguese energy company EDP

Partners Group-backed midstream gas company Esentia Energy Development is seeking to raise $610M in a Mexico IPO

SoftBank-backed Asia travel app Klook is seeking to raise $300M-$500M in a US IPO

Nigo's Japanese streetwear firm Human Made is seeking to raise $116M in a Japan IPO

Dubai developer Samana is eyeing an IPO

Debt

Verizon sold $11B of investment-grade bonds to fund its $20B acquisition of Frontier Communications

Defense tech firm MANTECH launched a $2.3B leveraged loan sale to refinance private credit

Barclays raised $1.7B in its first euro AT1 bond sale since 2014

Nashville International Airport plans to raise $1.3B in munis to meet booming growth demand

Deutsche Bank is nearing an SRT deal with the European Investment Fund for a $1.2B portfolio tied to Italian auto loans

Bitcoin miner CleanSpark is seeking to raise $1B in a convertible bond sale

Dubai developer Samana is seeking to sell $300M of iIslamic bonds

UK health insurance provider Bupa Finance is eyeing its first subordinated bond sale since 2021

Bankruptcy / Restructuring / Distressed

Bankrupt auto parts supplier First Brands' ex-CEO Patrick James is seeking to unfreeze assets after being accused of stealing $700M for personal expenses

EQT and Canada's OMERS-owned German fiber network operator Deutsche Glasfaser hired legal adviser to restructure ~$8B of debt with creditors including the EIB

Lender Carlyle took control of UK online retailer The Very Group from the Barclay family

Boutique apartment rental company Sonder is on the brink of a Chapter 7 bankruptcy filing and liquidation after losing a partnership with Marriott International

BlackRock wrote down its private credit loan to Audax Group-backed home improvement firm Renovo Home Partners to 0 after the firm filed to liquidate in Chapter 7 bankruptcy

Senegal Eurobonds plunged after Senegal ruled out restructuring amid a $7B hidden loan scandal that led the IMF to suspend support

Fundraising / Secondaries

Industrials-focused PE firm Arcline raised $6B for its fourth flagship fund

Investment firm Hamilton Lane is seeking to raise over $5.5B for its seventh flagship secondaries fund

Hamilton Lane raised $1.1B for a targeted $1.25B second infrastructure fund

French lower MM PE firm FCDE raised $460M for its third fund

Biotech VC Forbion raised $230M for its debut BioEconomy fund

Glasswing Ventures raised $200M for its third fund to continue investing in frontier tech

VC liquidity specialist Section Partners raised $190M across two funds to continue providing personalized financing solutions to founders and VC backers as well as investing in late-stage VC-backed tech startups

Baltic VC Balnord raised $80M for a targeted $115M debut fund

Crypto Sum Snapshot

Coinbase launched a platform for digital token offerings

Bitcoin traders see more peril after $300B crypto selloff

Ripple Labs wants to take on traditional finance

Crypto Sum compiles the most important stories on everything crypto. Read it here.

Exec’s Picks

Slow Ventures hosted a three-hour 'Etiquette Finishing School' event in SF, teaching founders subtle skills like handshakes, public speaking, office decorum, dressing for the occasion, and cuisine. The event shed light on an often ignored aspect of entrepreneurial success, though Y Combinator CEO Gary Tan did not approve. Read about it here.

Warren Buffett signed off in his final letter to shareholders. Read it here.

Bloomberg published a brief primer on why First Brands' collapse has sparked so many concerns on Wall Street.

On a related (??) note, Tricolor's frantic final days began with a call from JPMorgan. Check out Bloomberg's deep dive into Tricolor's problematic history.

Finance & Startup Recruiting 💼

Litney Partners

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting venture between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm), Litney Partners places talent at leading firms in PE, hedge funds, VC, growth, credit, IB, and fintech and is currently recruiting for some incredible roles. Head over to our website to drop your resume and we'd love to get in touch!

Next Play

If you're down bad, realizing finance isn't for you, and want to explore the world of startups (BizOps, chief of staff, strategic finance, etc.), fill out this form. Next Play will reach out to schedule a 1:1 video call if they think they can help as your own, personal startup matchmaker. They've grown their community to over 50k talented professionals and have deep relationships across the tech ecosystem.

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.