Together with

Good Morning,

Goldman is planning more layoffs, AI investments are keeping the US economy afloat, Spotify and Netflix are partnering on podcasts, and Wall Street banks posted strong earnings amid newfound life in M&A and capital markets.

Plaid just released their 2025 Fintech Effect report exploring how consumers are raising the bar and what it means for fintech trends ahead. Read it here.

Let's dive in.

Before The Bell

As of 10/14/2025 market close.

Click here to learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks closed mixed yesterday as traders digested escalating US-China trade tensions dovish comments from J Pow

Oil hit a five-month low on glut fears and US-China tensions

Oil futures backwardation narrowed to a 20-month low on mounting glut fears

Dollar hit its highest since August

Earnings

BlackRock beat Q3 earnings and revenue estimates as AUM surged to a record $13.5T, fueled by $170B in ETF inflows, $13B in private markets inflows, and a global market rally; dealmaking activity and a Fed rate cut also boosted fee income and fixed-income ETF demand (RT)

JPMorgan beat Q3 earnings and revenue estimates as profit rose 12% to $14.4B on record trading and strong IB performance amid robust market activity (CNBC)

Goldman Sachs beat Q3 earnings and revenue estimates driven by a 42% jump in IB fees and strong bond trading performance, though equities trading underdelivered (CNBC)

Citigroup beat Q3 earnings and revenue estimates as profit jumped 23% on record results across all businesses; CEO Jane Fraser cited AI and digital investments as key growth drivers (CNBC)

Wells Fargo beat Q3 earnings and revenue estimates as profit rose 9% boosted by strong credit performance and consumer spending; the bank raised its ROTE target to 17%-18% and signaled renewed growth momentum following the Fed's removal of its $2T asset cap (WSJ)

Johnson & Johnson beat Q3 earnings and revenue estimates, raised FY guidance, and announced plans to spinoff its slower-growing orthopedics unit to streamline focus on higher-growth drug and device businesses as the company grapples with tariff and pricing pressures (BBG)

Domino's Pizza beat Q3 earnings and revenue estimates as US same-store sales rose 5% due to promotions and a new stuffed-crust pizza; international same-store sales also grew though management cautioned on macro pressures for Q4 (BBG)

What we're watching this week:

Today: Bank of America, Morgan Stanley, Progressive, ASML

Thursday: Charles Schwab

Friday: State Street, American Express, Truist, Fifth Third Bank

Full calendar here

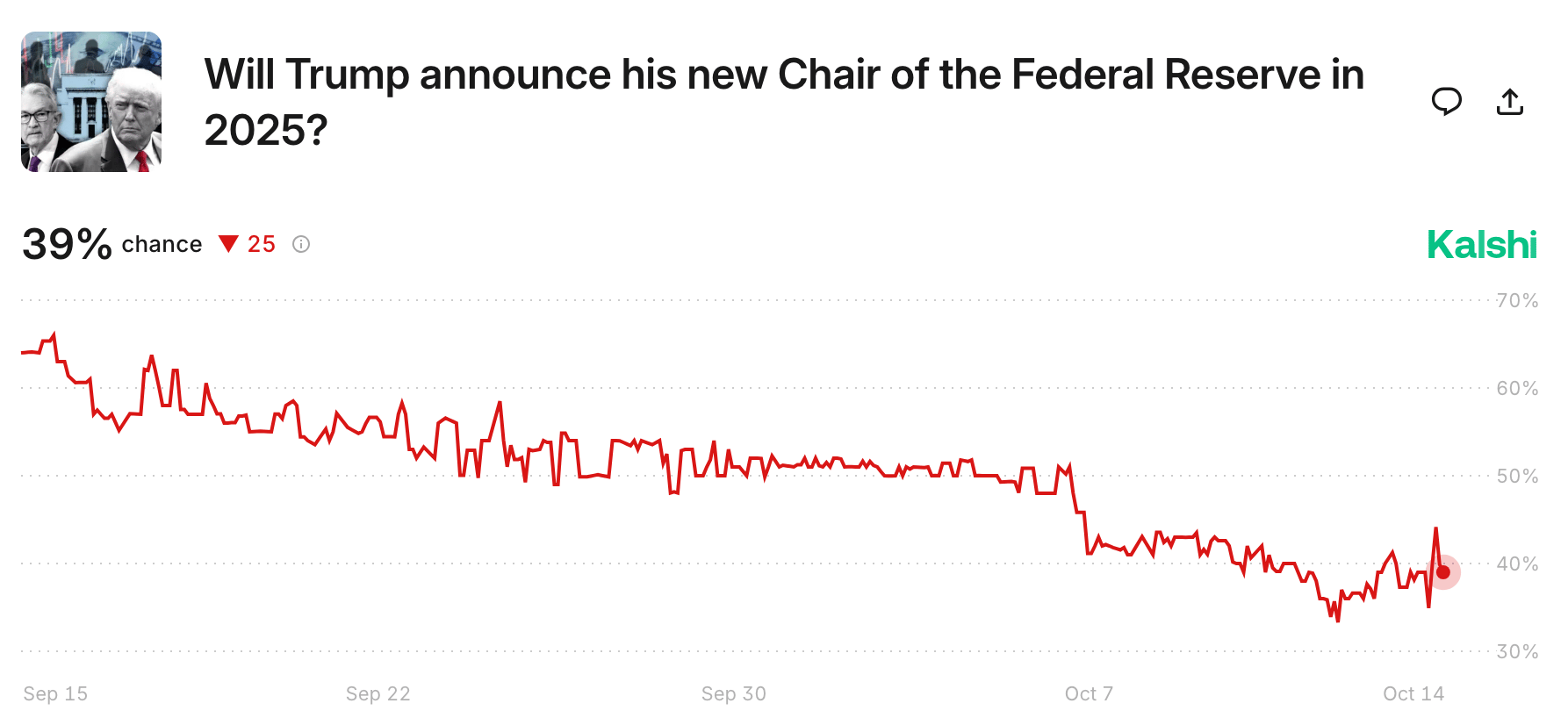

Prediction Markets

Looks like Trump is getting what he wanted…

Headline Roundup

Wall Street is firing on all cylinders (WSJ)

'TACO' trade is back on the menu (BBG)

US-China trade tensions escalated (BBG)

Fed will unveil changes to bank stress tests (BBG)

AI investment boom is shielding US from sharp slowdown (FT)

IMF warned on $4.5T bank exposure to hedge funds and private credit (FT)

US small-business optimism fell to a three-month low (BBG)

Wall Street banks buoyed by dealmaking but warn of asset price bubbles (RT)

Most investors say AI stocks are in a bubble (BBG)

First Brands and Tricolor's collapse are raising fears of credit stress (RT)

Hedge funds pile into rare commodity curve option bets (BBG)

Commodities trading houses brace for 'smaller rewards' in difficult 2025 (FT)

Frontier debt risks 'going dark' amid high costs and creative deals (RT)

Glass Lewis will end benchmark voting recs on proxy issues (FT)

Goldman Sachs is planning more layoffs as AI saves costs (BBG)

Swiss court ruled $20B Credit Suisse bond write-off was unlawful (RT)

LVMH returned to growth as luxury downturn eases (FT)

Spotify and Netflix are partnering on video podcasts (BBG)

GM takes $1.6B charge to scale back EV production (FT)

A Message from Plaid

WTFintech?

Then you need to check out the 2025 Fintech Effect by Plaid.

Plaid partnered with The Harris Poll by surveying 2,000+ fintech consumers to get a pulse on what’s currently working in fintech and which gaps need to be filled for the future.

From exploring the next wave of customers, the latest usage trends, and the future of AI in finance, it covers everything you need to truly understand the fintech space.

But what makes this year's edition worth the download? Good question. Here's a glimpse:

47% of consumers say the loan application process is too confusing → shift to real-time transaction data

77% of consumers say their bank must be able to connect to the apps and services they use → no more app jumping to make payments

57% of consumers expect fintech apps to use AI → AI is shaping the next phase of finance

For anyone looking to grow their business by leveraging fintech and hone in on customer expectations; this report is a must-read.

Deal Flow

M&A / Investments

French telecom carriers Bouygues Telecom, Iliad and Orange made a $19.7B offer to acquire rival SFR from Altice France

US land managers Rayonier and PotlatchDeltic agreed to merge in an $8.2B all-stock deal, including debt, to create the country's second-largest timber company

Dating app Grindr is exploring a potential $3B management-led take-private backed by a $1B debt financing

Japanese semiconductor company Renesas Electronics is exploring a $2B sale of its timing unit with Texas Instruments and Infineon among potential buyers

Apollo submitted a fresh bid to take $1.8B-listed pizza chain Papa John's private

Zara founder Amancio Ortega's family office firm Pontegadea Inversiones agreed to acquire Amazon-leased UK warehouse PLP Knowsley for $108M

Saudi's PIF-owned agri investment holding company SALIC plans to acquire the remaining 20% stake it doesn't already own in the agribusiness unit of Singapore's Olam Group

Brazilian airline Gol will go private as part of a corporate reorganization, months after emerging from US bankruptcy

Top VC picks by Fundable

Lila, an AI startup for science, raised a $115M Series A extension at a $1.3B valuation from Nvidia and others

Finnish health tech startup Oura raised a $900M round at an ~$11B valuation led by Fidelity

AI document intelligence platform Reducto raised a $75M Series B led by a16z

Holiday rental management startup Arbio raised a $36M Series A led by Eurazeo

Basis Theory, an independent payments infrastructure company, raised a $33M Series B led by Costanoa

Ethereum life insurance startup Anthea raised a $22M Series A led by Yunfeng Financial Group

Marble, a youth mental health startup, raised a $15.5M Series A led by Costanoa

FleetWorks, a startup helping small trucking companies move goods, raised a $15M Series A led by First Round Capital and a $2M seed round from Y Combinator, Saga Ventures, and LFX Venture Partners

Clove, a UK startup reshaping the economics of financial advice, raised a $14M pre-seed round led by Accel

Renew, an AI-powered platform for rental housing retention, raised a $12M Series A led by Haymaker Ventures

Epiminds, a marketing OS, raised $6.6M in funding led by Lightspeed Venture Partners

Strawberry, an agentic browser with built-in, personalized AI companions, raised a $6M round led by General Catalyst and EQT Ventures

Autonomous website building platform Flint raised a $5M seed round led by Accel

Crunch Lab, a decentralized network for businesses to leverage ML and AI expertise, raised a $5M round led by Galaxy Ventures and Road Capital

Climate risk and resilience modeling startup Class 3 Technologies raised a $3.5M seed round led by Powerhouse Ventures

Over 60 major VC deals yesterday. Access them here.

IPO / Direct Listings / Issuances / Block Trades

SoftBank-owned digital payment provider PayPay is targeting a $20B valuation in its US IPO

Jeff Bezos' ex-wife MacKenzie Scott sold $12.6B of Amazon shares

$37B-listed Chinese EV maker Seres is gauging investor interest for a Hong Kong listing that may raise $1.5B-$2B

$3B-listed Chinese autonomous driving firm WeRide tapped banks for a a dual primary listing in Hong Kong

Blackstone, Carlyle and Hellman & Friedman-backed medical supplies maker Medline reported $13.5B in H1 revenue ahead of its IPO

Johnson & Johnson will separate its orthopedics business DePuy Synthes

Indian conglomerate Tata's auto unit Tata Motors split into Tata Motors Passenger Vehicles and Tata Motors

Debt

Goldman Sachs sold $10B of investment-grade bonds in its largest issuance in four years

Crypto mining company TeraWulf is selling $3.2B of junk bonds to finance data center expansion

Bankruptcy / Restructuring / Distressed

The real estate unit of Indian conglomerate Adani is seeking court approval to acquire 87 properties from distressed Indian real estate group Sahara as Sahara seeks to repay $2.8B to investors

Talks between Ethiopia and holders of a $1B defaulted bond collapsed

Fundraising / Secondaries

Private credit firm Derby Lane Partners raised $1.8B for its debut credit-focused real-estate fund

Credit investor Plexus Capital raised over $1.3B across its new flagship fund and sophomore PE vehicle

Chicago PE firm Shore Capital Partners raised $850M across its sixth healthcare fund and second search fund to back business graduates from Harvard, Vanderbilt, Northwestern, and others

PE firm Integrum Holdings raised $2.5B for its second fund

Ex-CEO of Commonwealth Care Alliance Chris Palmieri plans to raise $100M VC fund to back young health-tech startups

David Rubenstein's family office Declaration Capital spun out its secondaries firm Hobe Mountain Capital

Private markets manager Fortitude Investment Partners launched an evergreen small cap PE fund

Crypto Sum Snapshot

US seized $15B in Bitcoin from a massive 'pig butchering' scam based in Cambodia

$80B market drawdown is latest test for crypto faithful

Binance increased compensation for customers liquidated in crypto selloff

Americans are losing millions to scammers at crypto ATMs

Crypto Sum compiles the most important stories on everything crypto. Read it here.

Upcoming Events🍻

UpSlide × Litquidity Happy Hour – Week of October 20, NYC & London

Olivia and I are partnering with UpSlide once again for some memorable events in NYC and London this month. We're bringing together the finance community from here and across the pond for drinks, networking, celebrations, and an overall great time. Our previous event together was an absolute blast and we'd love for you to join us this time around!

Powered by Palm & Park

Exec’s Picks

Wharton professor Exequiel Hernandez published a fascinating study finding that immigration restrictions lead to increase in M&A.

Finance & Startup Recruiting 💼

Litney Partners

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting venture between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm), Litney Partners places talent at leading firms in PE, hedge funds, VC, growth, credit, IB, and fintech and is currently recruiting for some incredible roles. Head over to our website to drop your resume and we'd love to get in touch!

Next Play

If you're down bad, realizing finance isn't for you, and want to explore the world of startups (BizOps, chief of staff, strategic finance, etc.), fill out this form. Next Play will reach out to schedule a 1:1 video call if they think they can help as your own, personal startup matchmaker. They've grown their community to over 50k talented professionals and have deep relationships across the tech ecosystem.

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.