Together with

Good Morning,

Credit Suisse is paying some junior banker bonuses in installments (a new low), J Pow said inflation is easing but interest rates will likely continue to rise, US junk bonds are trading at an average of 7.97%, UK managers suffered record $60B net outflows in 2022, SEC is considering requiring audited financial statements from private companies, retail investors are loading up on small-cap AI firms, and Wells Fargo will pay $300M to settle with shareholders over auto insurance disclosures.

Looking to diversify your portfolio with private credit investments? Check out today's sponsor, Percent.

Let's dive in.

Before The Bell

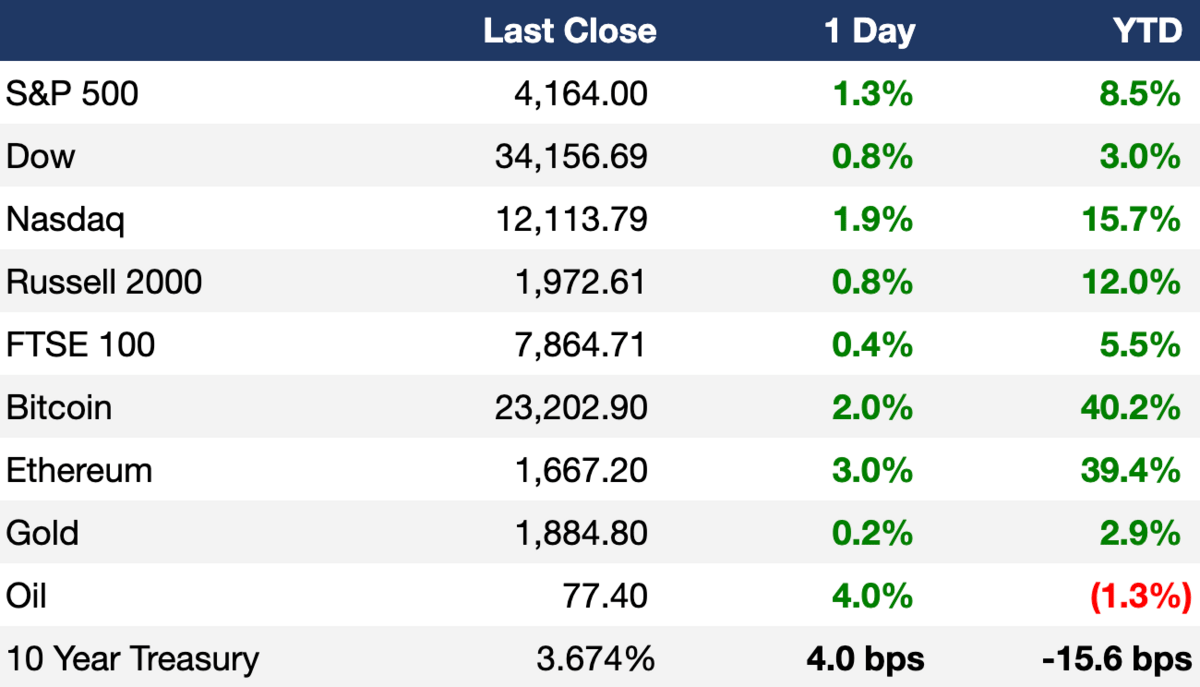

Markets

US stocks ticked up to recover Monday's losses after J Pow seemed less hawkish than expected in a speech yesterday

J Pow expects the Fed to raise rates more than expected following January's jobs report but doubled down on remarks that disinflation has begun

Oil surged over 3%

The dollar slipped from one-month highs

Earnings

KKR's Q4 net income dropped 84% YoY on asset sale declines in its PE portfolio and lower transaction fees in its capital markets division; their stock rose 5.2% (WSJ)

BP beat Q4 earnings estimates on a record $27.7B annual profit (alike major peers) on record high operations reliability and lowest production costs in 16 years; their stock rose 8.4% (CNBC)

Chipotle missed on Q4 EPS and revenue estimates as their price hikes are beginning to alienate customers (CNBC)

What we're watching this week:

Today: Uber, Robinhood, Walt Disney, Yum! Brands

Thursday: PepsiCo, PayPal

Full calendar here

Headline Roundup

J Pow said inflation is starting to ease, but interest rates still likely to rise (CNBC)

US junk bonds are trading at an average of 7.97% in sign of rally (FT)

US trade gap widened in December to a record 2022 high (RT)

Post-QE bond losses become rising reality for central banks (RT)

UK asset managers suffered record $60B net outflows in 2022 (FT)

Japan made record FX interventions in October to support the yen (RT)

SEC mulls requiring private companies to provide audited financial statements (AX)

Retail investors are piling into small-cap AI firms (RT)

Adani Enterprises' shares rallied 15% after some Adani firms reported profits (WSJ)

Adani Group is considering an independent review amid Hidenburg's report (RT)

Political party-aligned NANC and KRUZ ETFs debuted on the market yesterday (FT)

Microsoft is packing Bing and Edge with AI in challenge to Google (RT)

Meta asks many managers to get back to making things or leave (BBG)

Credit Suisse tells some bankers bonuses will be in installments (BBG)

Carlyle Group's fundraising slowed sharply last year while it was hunting for a new CEO (FT)

Microsoft will make ChatGPT tech available for other companies to customize (CNBC)

Wells Fargo will pay $300M to settle with shareholders over auto insurance disclosures (RT)

Boeing will cut ~2k corporate jobs this year (AP)

Zoom cut ~1.3k employees or 15% of its workforce (ZM)

Super Bowl's betting blitz is expected to hit $16B (WSJ)

Turkey / Syria earthquake death toll has topped 7.9k (AX)

A Message From Percent

Diversify Your Stocks with Private Credit

You don’t need us to tell you that 2022 was a bad year for public markets. The S&P fell 20% year over year while U.S. bond investors had the worst-ever year on record(1). After a year of taking losses, it’s time to evaluate asset allocation.

Where can investors find growth? Private credit offers an alternative. Because this asset class comprises privately negotiated, non-bank loans, deals can command much higher interest rates and offer largely uncorrelated returns vs. traditional assets.

And with Percent, they’re easy to find and compare. Their private credit marketplace provides accredited investors with access to a wealth of high yield (up to 20% APY), short duration offerings available with investment minimums as low as $500.

Percent boasts a proven track record in alternative investments to diversify your portfolio and help you see green, even while other markets flash red.

Delve into the world of private credit. Exec Sum readers can earn up to $500 on your first investment with Percent.

Deal Flow

M&A / Investments

Carlyle is in talks to buy healthcare technology firm Coviti for ~$15B (BBG)

CVS Health is nearing an agreement to buy primary care center network Oak Street Health for ~$10.5B (WSJ)

Retail bank Santander agreed to buy the 3.76% of shares it does not own of its Mexican business at a $8.65B valuation, in a step towards its delisting (RT)

Spirit Airlines expects US antitrust regulators to decide whether to allow it to proceed with its $3.8B merger with Jetblue Airways in the ‘next 30 days or so’ (RT)

PE firm Platinum Equity is exploring the sale of Jostens, a maker of mementos including yearbooks and professional sports championship rings, which it bought for ~$1.3B in 2018 (BBG)

Cement maker Holcim agreed to buy US roofing systems manufacturer Duro-Last in a $1.29B deal (RT)

A group of investors led by India-based media conglomerate Sun Group is trying to lure ‘tech billionaires and Hollywood types’ to join its bid for media company Forbes at an $800M valuation (AX)

Digital media company Penske Media agreed to invest $100M of primary capital at a $500M valuation in Vox Media, the digital media holding company whose titles include New York Magazine, Eater, and The Verge (AX)

Insurance company Metlife’s investment arm agreed to buy US private credit manager Raven Capital Management, which has $2.1B AUM (RT)

Canada-based cryptocurrency mining firm Hut 8 Mining agreed to merge with US rival Bitcoin Corp (RT)

VC

Home services platform Jobber raised a $100M Series D led by General Atlantic (TC)

Atmosphere, a streaming TV platform for businesses, raised a $65M Series D at a $1B valuation led by Sageview Capital, Valor Equity Partners, and S3 Ventures (BW)

Garuda Therapeutics, a startup creating off-the-shelf blood stem cell therapies, raised a $62M Series B led by Northpond Ventures, OrbiMed Advisors, and others (BW)

Zeitview, a startup using drones to capture air / ground data, raised a $55M round led by Valor Equity Partners (TC)

Customer experience automation startup Ushur raised a $50M Series C led by Third Point Ventures (TC)

Fabric8Labs, an electrochemical additive manufacturing company, raised a $50M Series B led by NEA (PRN)

The Messenger, a media startup founded by Jimmy Finkelstein, raised a $50M round (AX)

Evonetix, a synthetic biology company bringing semiconductor tech to DNA synthesis, raised a $24M Series B extension led by Foresite Capital (BW)

Therma, a cooling intelligence platform combating food / energy waste, raised a $19M Series A led by Zero Infinity Partners (PRN)

Conquest Planning, a financial planning platform, raised a $17.9M Series A led by Fidelity International Strategic Ventures (BW)

Plastic recycling startup Recycleye raised a $17M Series A led by DCVC (TC)

Flox, a startup making it easier for devs to use Nix (an open source tool for creating reproducible builds / deployments), raised a $16.5M Series A led by NEA (TC)

Open-source ML platform MindsDB raised a $16.5M Series A from Benchmark (PRN)

Vehicle payments platform Car IQ raised a $15M Series B extension led by Forte Ventures (PRN)

Moderne, a startup automating code migration / mediation for large software systems, raised a $15M Series A led by Intel Capital (BW)

Techtouch, a digital adoption platform provider in Japan, raised a $13.6M round led by DNX Ventures (PRN)

London-based proptech startup LandTech received a $12M investment from CIBC Innovation Banking (BW)

Opscura, an industrial control system cybersecurity startup, raised a $9.4M Series A led by Anzu Partners (BW)

Rembrand, an AI startup embedding photo-realistic products into digital videos, raised an $8M seed round led by Greycroft and UTA.VC (PRN)

Wisor AI, a freight booking software solution, raised an $8M seed round led by Team8 (BW)

Asset-Map, a financial advice engagement experience for financial professionals, raised a $6M Series B led by RGAx and SixThirty (BW)

ROAR Organic, an organic hydration brand, raised a $6M round from existing investors (BW)

Gameball, a CRM platform for consumer brands, raised a $3.5M seed round from 500 Global, P1 Ventures, Launch Africa, and others (TC)

PixCap, a no-code web-based 3D design tool, raised a $2.8M seed round led by Sequoia Capital India and Southeast Asia’s accelerator Surge (TC)

Omnichain liquidity platform Cedro Finance raised a $1.5M pre-seed round led by Shima Capital (BW)

Canadian healthtech startup The Rounds raised a $1.2M Series A extension from Panoramic Ventures and Invest Nova Scotia, closing the round at $5M (PRN)

IPO / Direct Listings / Issuances / Block Trades

Softbank-owned UK semiconductor firm Arm is committed to a 2023 stock market float (RT)

Debt

Bankruptcy / Restructuring

Crypto conglomerate Digital Currency Group began selling shares in its cryptocurrency funds at a steep discount, as it seeks to pay back creditors of its bankrupt lending arm Genesis (FT)

Fundraising

Goldman Sachs Asset Management raised $5.2B for a direct private markets fund to invests in high-growth businesses in the largest growth funds of its kind (RT)

GV, the VC backed by Alphabet, raised $500M for its European fund (TC)

VC firm Partech raised $263M for its $300M Partech Africa II fund, making it the largest Africa-focused fund yet (TC)

Workday, a cloud applications company for finance and HR, announced a $250M expansion of its Workday Ventures fund (PRN)

Crypto Corner

Fintech Revolut debuted crypto staking (CT)

Institutional traders are shifting attention from blockchain to AI (DC)

A US judge rejected a proposal to modify SBF's bail conditions despite bilateral agreement (RT)

A Turkish rock star and a charity organization teamed up to establish a crypto donation wallet for earthquake support (TB)

Exec's Picks

Given the recent earthquakes in Turkey and Syria, we're sharing links to charity donations through the MSF and Save the Children. Please help spread the word and donate if you can! Many thx.

Eight Sleep is a high-tech smart bed system that has taken Silicon Valley by storm. With a built-in heating and cooling system, multiple foam layers to deliver comfort, and analytics tracking to help you optimize your sleep and recovery, Eight Sleep is the complete package. Upgrade your mattress game here, and use code "LIT" at checkout for $200 off the pod mattress and $150 off the mattress cover. I've been sleeping on Eight Sleep for months and it has truly been a game changer.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.