Together with

Good Morning,

Musk is bringing Vine back, Eurozone inflation hit 10.7% in October, the Great Resignation is cooling off, Biden wants more US oil production and less "windfall profits" (whatever that means), Swiss National Bank lost $143B YTD through September, Twitter will lay off 25% of its staff, Delta pilots voted to authorize a strike, and the FTC ordered Chegg to improve its security.

Let's dive in.

Before The Bell

Markets

All three major US averages closed lower on Monday as investors turned focus to the Fed's policy meeting this week

However, the Dow booked its biggest monthly percentage gain since 1976 and biggest October percentage gain in 100 years

The dollar gained and pound dipped on expectations of another big Fed rate hike

Oil prices fell on expectations that US production could rise

US wheat futures jumped 6% on news of Russia's Black Sea pact withdrawal

Canada's TSX notched its largest monthly gain in nearly two years

Brazil's MSCI index rallied 4% on news of Lula's presidential victory

Earnings

What we're watching this week:

Today: Uber, Airbnb, AMD

Wednesday: Qualcomm, Robinhood, Estee Lauder

Thursday: Peloton, Nikola, Coinbase, Starbucks

Friday: DraftKings

Full calendar here

Headline Roundup

Eurozone inflation hit a record high 10.7% in October, with GDP growth shrinking to 0.2% in Q3 (FT)

The Great Resignation is cooling off (AX)

US oil production is at pre-pandemic highs nearing 12M bpd (RT)

Biden warns oil firms he'll seek tax on 'windfall' profits (BBG)

China’s factory activity fell in October amid frequent Covid outbreaks (CNBC)

Swiss National Bank lost ~$143B in September YTD (RT)

Some eurozone countries eased trading rules for banks that manage their debt to help them cope with market conditions (RT)

JPMorgan estimates that banks will repay between $500-700B of ECB ultra cheap loans next month (RT)

US Russian oil price cap will hit cargoes unloaded after Jan 19 (RT)

Twitter will reportedly lay off 25% of workforce in first round of job cuts (WP)

Credit Suisse unveiled details of its $4B capital raising plan (RT)

iPhone production at major China plant could fall 30% amid Covid curbs (RT)

Delta Air pilots voted to authorize a strike (RT)

Musk instructed Twitter engineers to reboot Vine by end of the year (AX)

JPMorgan is piloting a platform for property managers that automates invoicing and receipt of online rent payments (CNBC)

Senator Chris Murphy called for probe into Saudi Arabia's stake in Twitter (AX)

Sports Betting Is Being Flipped Upside Down

Revolutionary Free Tool Gives Bettors an Edge

As you bet, you create betting data (aka a list of your open and closed bets). Analyzing tens of thousands of people's betting data allows for some pretty amazing things.

You probably bet with a DraftKings, a bookie, FanDuel, or some other website. There's now an app, Juice Reel, that lets you link in any betting account(s) and your bets automatically load in. This free app gives you analytics on yourself like how you've done on straight bets vs parlays vs teasers, what your best/worst/most frequent teams are, a chart on your profitability, and much more - but that's not the best part...

Juice Reel uses the pool of data that the whole Juice Reel Community synced in to give you insights on what the best and worst historical bettors are doing so you can follow winners while simultaneously fading (aka betting against) historical losers at scale. If you're thinking "how much can data really help you win", these guys put out 2 free picks a day to their instagram and are now 193-126.

Juice Reel is exploding in the betting community and I highly recommend this app if you bet on sports -- the fact that it's totally free makes it even better.

Get on Juice Reel right now and start winning with analytics 🤝

Deal Flow

M&A / Investments

Blackstone agreed to buy a majority stake in US industrial firm Emerson Electric’s climate technologies business at a $14B valuation (RT)

Veritas Capital agreed to buy Verisk Analytics’ energy research and consulting unit Wood Mackenzie for $3.1B (RT)

US instrument maker Thermo Fisher agreed to buy British speciality diagnostics firm Binding Site in a $2.6B deal (BBG)

A US judge blocked the merger between book publishers Penguin Random House and Simon & Schuster, citing antitrust concerns in the $2.2B deal (NYT)

Hong Kong-based real estate PE firm Gaw Capital Partners is nearing a deal to buy several Blackstone-owned warehouses in Japan for ~$540M (BBG)

Italian aperitif specialist Campari agreed to buy a 70% stake in US bourbon maker Wilderness Trail Distillery for $420M, with plans to buy the remaining 30% by 2031 (BBG)

Canadian software company Alludo offered to buy Australia’s Nitro Software for ~$320M (RT)

French media conglomerate Mediawan is in talks to buy a significant stake in actor Brad Pitt’s production company Plan B Entertainment (BBG)

Lockheed Martin made a $100M investment in spacecraft manufacturer Terran Orbital; Terran's stock rose 2.3% on the news (CNBC)

Billionaire Tilman Fertitta agreed to buy a 6.9% stake in hotel and casino company Wynn Resorts, boosting shares up 11% (BBG)

Host Hotel & Resorts is in exclusive talks to buy the Four Seasons hotel in Jackson Hole, Wyoming from Chinese insurer Dajia Insurance (BBG)

Blockchain firm Valereum gained approval to buy the Gibraltar Stock Exchange (GSX) and turn it into a gateway to European capital for fledgling firms from Middle East, India, and Africa; terms of deal were not disclosed (RT)

VC

Micro factory startup Bright Machines raised a $132M Series B consisting of $100M in equity led by Eclipse Ventures and $32M in debt led by SVB and Hercules Capital (TC)

Virtual mental health provider Valera Health raised $44.5M in growth equity led by Heritage Group (PRN)

Money Fellows, an Egyptian fintech startup digitizing money circles, raised a $31M Series B led by CommerzVentures, MEVP, and Arzan Venture Capital (TC)

Invygo, a Middle East-based car rental startup, raised a $10M Series A led by MEVP (TC)

Software Defined Automation, a startup offering Industrial-Control-as-a-Service (“ICaaS”) solutions, raised a $10M seed round led by Insight Partners (PRN)

Arnica, a startup improving software supply chain security, raised a $7M seed round led by Joule Ventures and First Rays Venture Partners (TC)

LUMIQ, a data analytics startup focused on the Indian financial services and insurance space, raised a $5.5M Series A led by Info Edge Ventures (PRN)

Topline Pro, a New York-based startup helping home service businesses scale online, raised a $5M seed round led by Bonfire Ventures (TC)

Zebra Labs, a startup helping Chinese celebrities enter the metaverse, raised a $5M round from NetDragon and Sumitomo (TC)

Digital freight matching platform Newtrul raised a $5M round from SignalFire, Flex Capital, and others (PRN)

Nigerian proptech startup SmallSmall raised a $3M seed round ($2M in equity / $1M in debt) from Oyster VC, Asymmetry Ventures, angels, and others (TC)

GoodShip, a startup digitizing contract freight, raised a $2.4M round led by FUSE (BW)

IPO / Direct Listings / Issuances / Block Trades

Dubai private school operator Taaleem is seeking to raise $204M from a Dubai IPO (BBG)

Shares in geospatial and data analytics firm Bayanat surged 241% after raising $171M in its Abu Dhabi IPO (BBG)

Americana Group, the operator of KFC and Pizza Hut restaurants across the Middle East and North Africa, plans to sell a 30% stake in an Abu Dhabi and Riyadh dual listing (BBG)

Debt

Goldman Sachs' private-lending arm and Sixth Street Partners are leading a group of direct lenders providing part of the $5.5B acquisition financing for Blackstone’s purchase of a majority stake in Emerson Electric’s climate tech business (BBG)

Bankruptcy / Restructuring

Movie theater chain Cineworld announced a bankruptcy settlement with its landlords and lenders, clearing way for the chain to borrow an additional $150M and make a $1B debt repayment (RT)

The Stellantis – Guangzhou Automobile Group JV that makes Jeeps in China will file for bankruptcy; the JV has liabilities of 111% of its assets of ~$1B (RT)

Fundraising

Crypto Corner

PE firm Apollo began holding crypto on behalf of clients through a partnership with digital asset platform Anchorage Digital in push to bring crypto to institutional investors (RT)

Crypto exchange Binance is creating an internal team to help Twitter fight bot accounts using blockchain and crypto (DC)

Hong Kong proposed allowing retail investors to trade in crypto and crypto ETFs (RT)

Exec's Picks

🖥️ 💻 You have IB dreams, but the only thing standing in the way is proving that you can crush the technical questions and model. Don't get stuck in the back office because you forgot how to run a DCF model. Use Wall Street Prep to crush that interview and secure the bag. Wall Street Prep offers a complete Financial and Valuation modeling training program, so you can learn financial statement modeling, DCF, Trading and Transaction Comps, M&A, and LBO. Check them out here!

The Hiring Block 💼

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We aim to curate jobs across IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We'll sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

If you're a company looking to hire candidates and want to list a job opening on our board and feature on Exec Sum, click the button below:

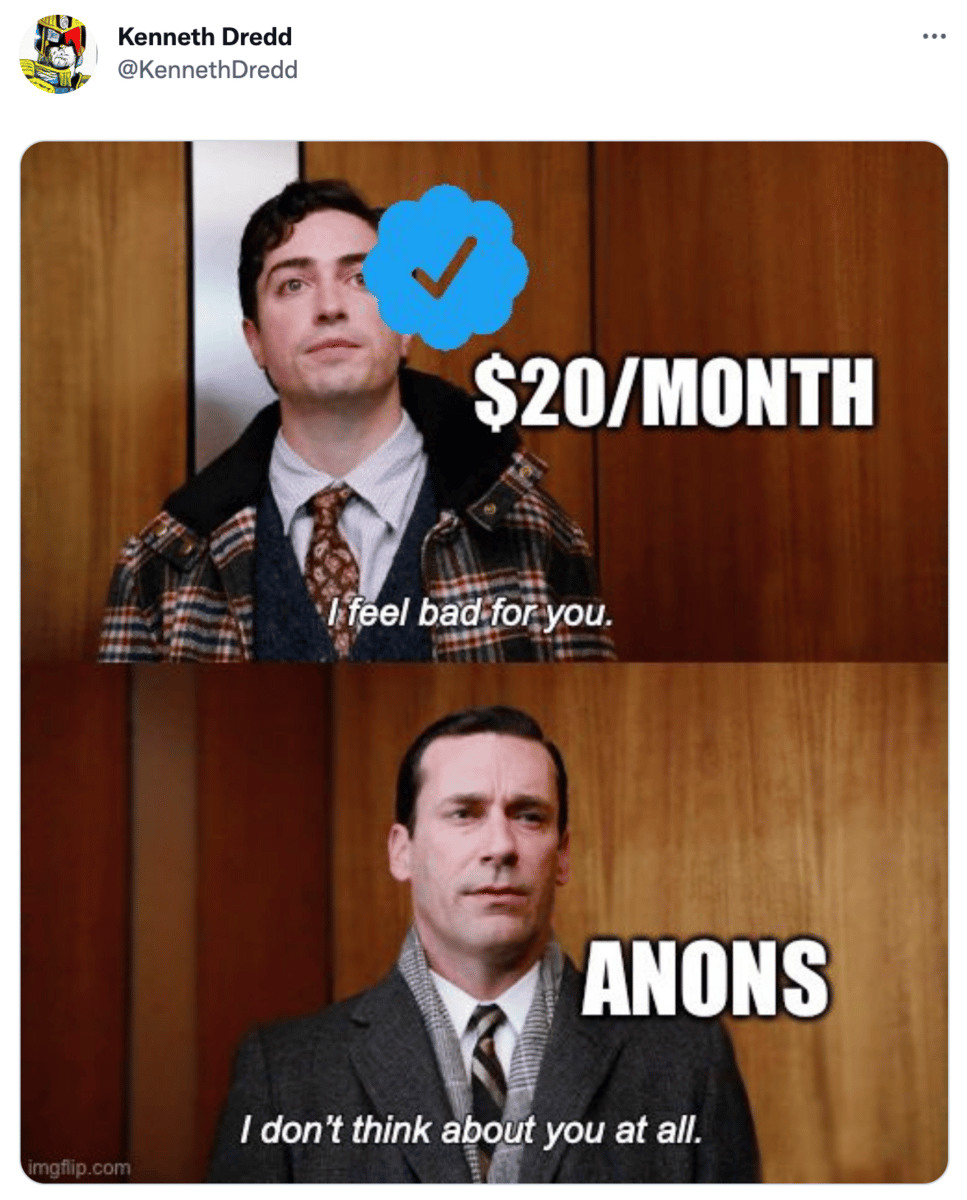

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.