Together with

Good Morning,

Goldman is raising its first Asia-focused PE fund, investors are skeptical of BlackRock's private market ETF ambitions, hedge funds are dumping software stocks at record pace, and Trump's VP pick has an impressive VC background.

Hear from the largest names in finance on where the industry is headed and the solutions they're using to scale faster, only on Plaid Effects.

Let’s dive in.

Before The Bell

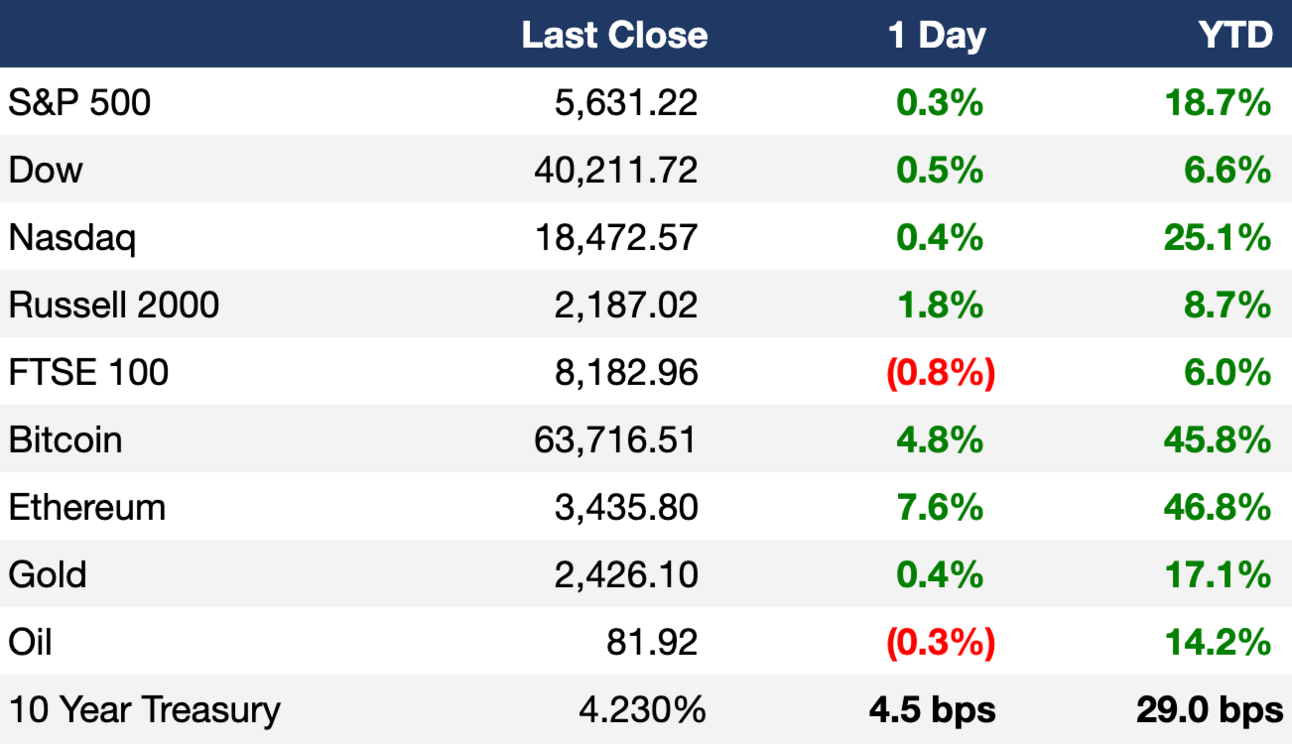

As of 07/15/2024 market close.

Markets

US stocks continued to rally on growing bets of a Trump re-election

Russell 2000 saw its best four-day rally since June 2020 to hit its highest since December 2021

US 2Y-10Y yield curve inversion hit 23 bps, the lowest since January

US 2Y-30Y yield curve briefly un-inverted for the first time since January

Mexican peso slipped 1.3% versus the dollar

Argentine peso rose 8.1% in parallel markets after government intervention

Bitcoin surged to a two-week high on Trump reelection sights

Earnings

Goldman Sachs beat Q2 analyst estimates on a 150% YoY jump in profit thanks to strength in fixed income trading and a rebound in IB (CNBC)

BlackRock AUM hit a record $10.65T in Q2 thanks to rising asset values and ETF inflows, while total revenue rose 8% YoY (RT)

What we're watching this week:

Today: Bank of America, Morgan Stanley, UnitedHealth

Wednesday: ASML, United Airlines, Johnson & Johnson

Thursday: TSMC, Netflix, Domino's

Friday: American Express

Full calendar here

Headline Roundup

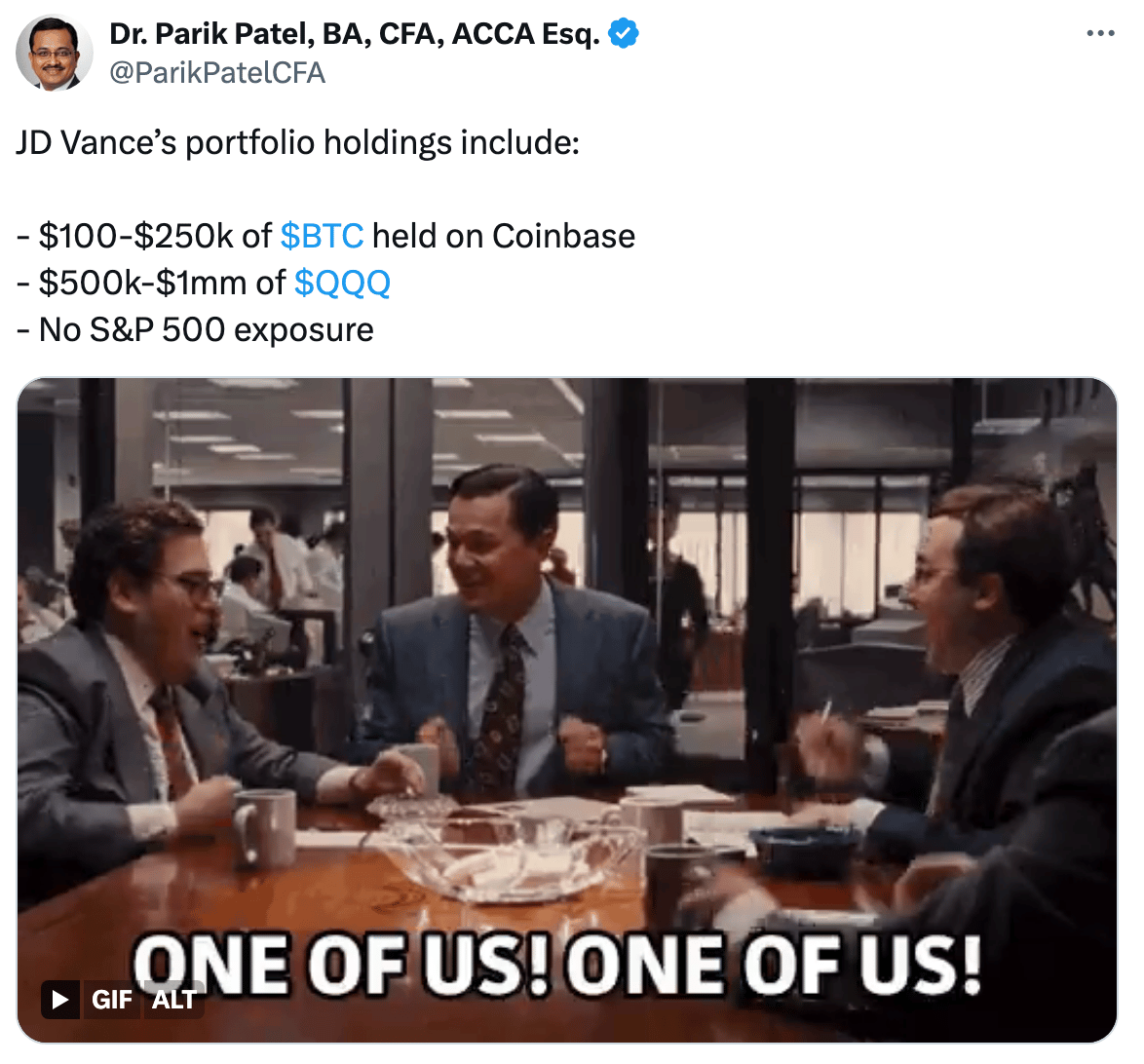

Trump's running mate JD Vance is a former venture capitalist (QZ)

J Pow signaled rate cuts, but declines to say when (WSJ)

Big banks are being buoyed by Wall Street's comeback (WSJ)

China Q2 GDP grew 4.7% YoY, below forecast (RT)

PE dividend recaps fell 90% in H2 2023 (FT)

BlackRock's private market ETF ambitions are drawing skepticism (FT)

Hedge fund exposure to software stocks hit new multi-year lows (RT)

Hedge funds are causing an increase in European stock volatility (RT)

Goldman named new heads of India IB and Hong Kong coverage (RT)

Canadian firms keep investments in check despite rate cut view (RT)

Investment bosses call for 'radical' Isa overhaul to boost UK equities (FT)

Stripe hit a $70B valuation in Sequoia share deal (BBG)

Salesforce, Intuit and UiPath become latest tech names to cut jobs (BBG)

European cannabis start-ups are looking to US for IPO plans (FT)

Hugo Boss joined Burberry in warning on consumer spending (WSJ)

US sunbelt sees jump in evictions (WSJ)

Ken Griffin donated $20M to Republican fundraising committees (FT)

Elon Musk to give $45M a month to a Pro-Trump Super PAC (BBG)

New York's Ivy League social clubs are desperate for members (WSJ)

A Message From Plaid

How do you scale faster with fintech?

You will hear from some of Plaid's most influential customers including:

Emilie Choi (President and Chief Operating Officer at Coinbase) - where crypto is headed next

Trevor Nies (Senior Vice President, Global Head of Digital Strategy at Adyen) - the rise of "pay by bank"

Les Whiting (Chief Financial Services Officer at H&R Block) - expansion of mobile banking

Whether you’re a fintech founder, a senior executive, or a mid-level developer, Plaid Effects will cover what’s important to your success – from the internet's fastest onboarding, lowering payment costs, fraud prevention to good old fashioned revenue growth.

Deal Flow

M&A / Investments

Macy's ended talks with Arkhouse Management and Brigade Capital over their $6.9B buyout offer (RT)

A consortium of Russian investors will acquire majority of Russian tech firm Yandex's businesses in a ~$5.4B cash and stock deal, ending foreign ownership (RT)

KKR is considering a ~$3B sale of machinery maker Kito Crosby (BBG)

US steelmaker Cleveland-Cliffs agreed to buy Canadian peer Stelco for $2.8B in cash and stock (BBG)

SWFs Mubadala and QIA led a $600M investment in PE firm I Squared Capital's full-service trailer lessor Transportation Equipment Network (BBG)

Temasek-owned asset manager Seviora plans to buy a minority stake in private credit fund ADM Capital (BBG)

Airbus and Thales are in early stage talks to merge some of their space activities (FT)

Hong Kong VC C Capital will merge with Swiss-listed investment firm Youngtimers (BBG)

VC

Halo Industries, a laser manufacturing technology platform for the chip industry, raised an $80M Series B led by USIT (BW)

Standard Bots, a startup specializing in robotics automation, raised a $63M round led by General Catalyst (FN)

Partior, a unified ledger-based interbank rails for real-time clearing and settlement, raised a $60M+ Series B led by Peak XV Partners (FN)

44.01, a climate startup eliminating CO2 permanently, raised a $37M Series A led by Equinor Ventures (EU)

Portable EV charging platform Solus Power raised a $28M round from Petra Equity Partners (FN)

Naked Energy, a UK solar thermal and solar PVT startup, raised a $20M Series B led by E.ON EIS (EU)

Alvys, a logistics and supply chain management platform, raised a $20.5M Series A led by Titanium Ventures (PRN)

Adaptive, a platform automating construction payments, raised a $19M Series A led by Emergence Capital (TC)

Belgian legal AI platform LegalFly raised a $16.2M Series A led by Notion Capital (EU)

Caliza, a LatAm startup conducting real-time money transfers via stablecoins, raised an $8.5M round led by Initialized (TC)

Digital asset management platform Haruko raised a $6M Series A led by White Star Capital and MMC Ventures (EU)

Instinct Digital, a cloud-based investment reporting platform, raised a $6.3M Series A led by AlbionVC (EU)

Jacobi Robotics, an AI-powered motion planning technology for robotics, raised a $5M seed round led by Moxxie Ventures (FN)

IPO / Direct Listings / Issuances / Block Trades

Saudi Arabia's PIF selected JPMorgan, Bank of America, and SNB Capital for the ~$1B IPO of Saudi's largest medical procurement firm Nupco (BBG)

Select Medical-unit Concentra is seeking to raise up to $585M at a $3.3B valuation in a US IPO (RT)

KKR-backed OneStream Software is seeking to raise up to $466M at a $4.4B valuation in its US IPO (RT)

Debt

Bankruptcy / Restructuring

Fundraising

Crypto Corner

Exec’s Picks

The ARK Venture Fund is taking an asset class once reserved for the accredited, ultra-rich and making it available to all US investors. Gain exposure to a portfolio comprising names like SpaceX, OpenAI, and Epic Games with as little as $500. Learn more and invest today.

Financial Services Recruiting 💼

If you're currently a junior banker looking to break into the buy side, lateral to another investment bank, or consider new paths amid changing market dynamics, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, debt funds, and investment banking.

To get started, simply head over to Litney Partners and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter