Together with

Good Morning,

US intends to acquire Greenland, US struck an oil deal with Venezuela, PE management fees hit a record low, Saudi Arabia will open its stock market to all foreign investors, a bond trader placed the biggest fed funds futures bet ever, and wealth managers are seeing a ridiculous rush to invest in Venezuela.

Upgrade your dealmaking and investment workflows this year with Blueflame's specialized AI platform for finance. See how Blueflame can serve your firm's specific needs.

Let's dive in.

Before The Bell

As of 1/6/2026 market close.

Learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks continued to rally on broad tech and geo-political optimism

Small-caps Russell 2000 is leading the rally YTD

Data center-cooling stocks dropped over 5% and memory stocks soared ~10% after Jensen Huang's CES speech

Sandisk is up 855% since spinning off last year to become S&P 500's best-performing stock for 2025 and 2026

EM stocks hit a fresh ATH despite global political uncertainty while Asia stocks notched their best-ever start to a year

Venezuela stocks are up ~70% YTD

Korea's KOSPI index is up 8% YTD

Traders boosted Taiwan stock leverage to the highest since 2008

EM dollar bond risk premiums sunk to 250 bps to a thirteen-year low

Gold rose closer to its ATH

Silver surged closer to its ATH for a 170% YoY gain

Copper surged to a fresh ATH

Cotton surged to a two-month high

Earnings

What we're watching this week:

Today: Jefferies, Constellation Brands

Full calendar here

Prediction Markets

Re-inventing the hostile takeover from first principles

Trade your prediction on US foreign policy this year on Polymarket

Headline Roundup

Marco Rubio told Congress US plans to buy Greenland (NYT)

Venezuela will give 50M bbl to US (CNBC)

Rush to invest in Venezuela is 'nuts' (BBG)

Venezuela bond rally belies complex $150B creditor and political web (RT)

Two-thirds of regional Fed banks voted against a December rate cut (RT)

Korean stocks' world-beating rally is just a start (BBG)

A trader placed the biggest-ever fed funds futures bet (BBG)

PE firms launch delayed recruiting drive after summer outcry (FT)

PE firms are expected to unleash middle-market M&A deals (RT)

PE management fees hit record low 1.6% last year (CNBC)

Private markets fundraising hit a record $1.4T last year on credit rush (AW)

Regulators globally are softening capital rules for banks (RT)

Goldman Sachs topped global M&A rankings with $1.5T in deals (RT)

Teucrium filed for a 'Venezuela Exposure' ETF (BBG)

Saudi Arabia will open financial market to all foreign investors (BBG)

Hong Kong developers sold $750M of luxury homes in two weeks (BBG)

A Message from Blueflame

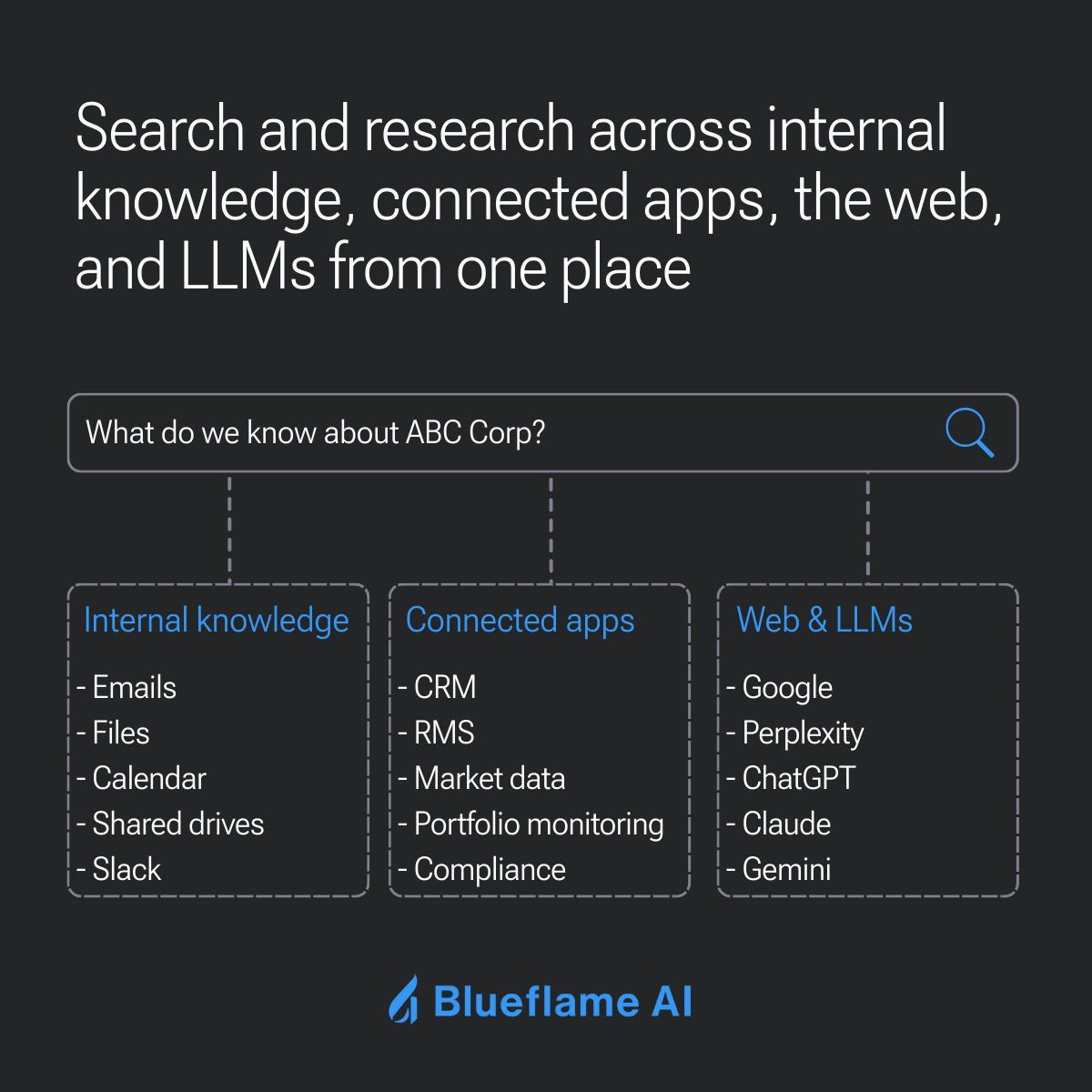

Investment decisions hinge on having the full picture, but critical details often hide in plain sight.

That's why we built Global Search: to help investment firms not only find information faster but also uncover insights they didn’t even know they had.

Global Search is already helping Blueflame users reduce research time and surface insights they’d otherwise miss. A few real-world examples:

Build company summaries using deal notes, CRM records, emails, and public data

Reference historical deals to inform comps, memos, or diligence workflows

Search firm-wide knowledge for everything related to a sector or theme

Prepare for LP meetings with relationship-specific insights and internal context

With one interface for firm knowledge, connected apps, LLMs, and the web, Blueflame helps dealmakers and investment firms go deeper—and move faster—without sacrificing accuracy.

Deal Flow

M&A / Investments

Regional lender Comerica's shareholders approved a $10.9B sale to rival Fifth Third Bank

European PE firm Hg agreed to take-private financial software maker OneStream at a $6.4B equity value, representing a 30% premium

Beverage giant AB InBev agreed to re-acquire a 49.9% stake in its US metal container plants from a consortium of investors led by Apollo in a $3B deal

Japanese pharma firm Hisamitsu agreed to go private in a $2.9B MBO, representing a 35% premium

KKR, Warburg Pincus, and EQT are among bidders vying to acquire Southeast Asian school operator XCL Education from TPG at a potential $2B valuation

Eyewear firm STAAR Surgical plans to reject Swiss rival Alcon's $1.6B take-private offer

Eli Lilly is in advanced talks to acquire inflammation-focused biotech Ventyx Biosciences for over $1B, representing an 82% premium

KKR will acquire sports-focused PE firm Arctos Partners for $1B

TPG acquired a majority stake in homebuilder Lennar's multifamily development and investment management platform, committing an additional $1B in the business

Self-driving tech company Mobileye agreed to acquire Israeli startup Mentee Robotics in a $900M cash-and-stock deal

Pharma giant Amgen acquired cancer drug developer Dark Blue Therapeutics in an $840M deal

AI chipmaker Marvell agreed to buy networking equipment provider XConn Technologies in a $540M deal

TPG will acquire a 6.5% stake in retirement annuity provider Jackson Financial for $500M as part of a deal to manage $20B in assets

Consulting firm Accenture agreed to buy UK AI data crunching startup Faculty

Singapore delivery platform Grab acquired Chinese AI robotics firm Intermove

Europe's KBC Securities and Van Lanschot Kempen IB agreed to combine their equities businesses into a 50-50 JV

VC

Musk's xAI raised a $20B Series E at a reported $230B valuation from Valor Equity Partners, StepStone Group, Fidelity, and SWF QIA

Crowdsourced AI benchmarking startup LMArena raised a $150M Series A at a $1.7B valuation led by Felicis and UC Investments

Distributed quantum computing startup Photonic raised a $130M round led by Planet First Partners

Semiconductor services startup GS Microelectronics raised a $35 million Series B led by Maverick Silicon

Qualinx, a European developer of ultra-low-power GNSS chips, raised a $23M led by Invest-NL

HabitTrade, an Aussie trading-infrastructure and tokenized-equity brokerage, raised a $10M Series A led by Newborn Town

AI-powered private-markets lender Pluto raised an $8.6M seed round from Motive Ventures, Portage, Apollo, Hamilton Lane, and others

European Industrial data platform United Manufacturing Hub raised a $5.8M round led by KOMPAS VC

Get real-time updates on any startup, VC, or sector. Try Fundable.

IPO / Direct Listings / Issuances / Block Trades

Social media and chat platform Discord filed confidentially for an IPO; the firm was last valued at $15B in 2021

Freenet-backed German streaming platform Waipu.TV selected Citigroup and Berenberg for a Germany IPO that could fetch a $1.8B valuation

SPAC / SPV

Israeli EV battery company StoreDot will merge with Andretti Acquisition Corp. II in an $880M deal

Debt

Israel raised $6B in a eurobond sale

Cable telecom company Charter is selling $1.75B of bonds

Six Flags Entertainment is seeking to raise $1B in a junk bond sale

Bankruptcy / Restructuring / Distressed

NYC asked a bankruptcy judge to delay a Chapter 11 auction of Pinnacle Group's rent-stabilized apartments, citing need for more time to evaluate a proposed $451M deal to Summit Properties USA and explore alternatives

Fundraising / Secondaries

Credit investor Monroe Capital raised $6.1B for for its fifth lower MM private credit fund

MM PE firm Lindsay Goldberg raised $4.9B for its sixth flagship fund

PE FOF Banner Ridge Partners raised $4.2B for its sixth PE secondaries fund

Goldman Sachs's European private credit strategy raised a $350M commitment from Danish pension Industriens

VC Morpheus raised $100M for a targeted $150M third fund (ALT)

Crypto Sum Snapshot

Morgan Stanley filed for Bitcoin and Solana ETFs

Bitcoin faithful still missing despite recovery to $90k

Crypto Sum compiles the most important stories on everything crypto. Read it here.

Exec’s Picks

Watch Jensen Huang's keynote address at CES 2026, including all the comments that sent certain sectors on a wild ride.

Amy Arnott shared eight important market lessons from 2025.

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting firm established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, credit, and investment banking.

We're currently seeking talent for some incredible roles. Head over to Litney Partners to drop your resume / create your profile and we'd love to get in touch!

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.