Together with

Good Morning,

The ECB has no plans to stop raising rates, US job openings rose by 437k in September, US Treasury sold $979M in Series I bonds, an FCC commissioner said the US should ban TikTok, Elon Musk temporarily dissolved Twitter's board, Tesla will start mass producing Cybertrucks at the end of 2023, and Credit Suisse is pushing ahead with its China expansion.

If you work in fintech or are a fintech investor, you should read Plaid's deep dive into the financial technology landscape.

Let's dive in.

Before The Bell

Markets

US stocks slid yesterday as investors continue to monitor the economic environment and potential Fed actions

The US dollar index slid on expectations of a slower pace of future Fed rate hikes

The Fed is expected to raise rates by 75 bps for a fourth and final time today, followed by a small 50 bps hike in December

Earnings

Uber reported a $1.2B Q3 loss ($512M attributed to equity investment revaluations) but beat revenue estimates with a 72% YoY growth on booming travel, easing lockdowns and shifts in consumer spending, while giving strong Q4 guidance; their stock climbed 12%+ yesterday (CNBC)

Airbnb beat revenue estimates on record high Q3 bookings but expects slightly lower Q4 bookings amid a strong dollar; their stock fell ~7.8% in AH trading (YH)

AMD missed Q3 EPS and revenue estimates yet saw revenue grow by 29% YoY as all four business segments delivered slightly better revenue than AMD expected in its October warning; their shares rose ~4.4% in AH trading (CNBC)

What we're watching this week:

Today: Qualcomm, Robinhood, Estee Lauder

Thursday: Peloton, Nikola, Coinbase, Starbucks

Friday: DraftKings

Full calendar here

Headline Roundup

ECB must keep raising rates even if recession risks rise: ECB President (RT)

US job openings unexpectedly rose by 437k to 10.7M in September (RT)

US manufacturing activity in October grew at slowest pace in nearly 2.5 years, with input prices siding for a seventh straight month (RT)

US Treasury sold a record $979M of Series I bonds on Friday beating a key deadline to lock in historically high rates (CNBC)

UAE and US will partner to spur $100B of investments in clean energy projects (RT)

US banks spent $1B on ransomware payments in 2021, more than double since 2020 (BBG)

JPMorgan launched Life Sciences Private Capital, a healthcare VC practice (WSJ)

An FCC commissioner said US should ban TikTok (AX)

Elon Musk dissolved the entire Twitter board and is now sole director/CEO (WSJ)

Elon Musk wants more paying Twitter users, hinting at $8 / month for verified accounts (WSJ)

Robinhood and Coinbase expect to see higher interest rate income amid Fed rate hikes (RT)

Tesla will start Cybertruck mass production at end of 2023 (RT)

Credit Suisse will push ahead with China expansion after overhaul (RT)

Toyota's Q2 profit tumbled 25% amid chip shortages and surging costs (FT)

Chinese property bonds set record lows as investors lose faith (WSJ)

Taylor Swift currently holds all top 10 spots in Billboard Hot 100 in first ever such feat (CNBC)

Migos rapper Takeoff died in a shooting at age 28 (AX)

NYC employees can now find out how much their colleagues are making in base salary with new salary transparency law in effect (WSJ)

A Message From Plaid

Where is Fintech going and how can companies ride the lightning?

Fun Fact: Fintech adoption has grown 38% in the last 2 years.

Plaid is here with their third annual deep-dive into the financial technology landscape to show you the why.

Through surveying fintech consumers in the US and UK, Plaid explores the hottest trends, and breaks down the impact fintech has had on consumers (spoiler alert: a lot), it covers everything you need to truly understand the financial technology space.

But what makes this year’s version worth the download? Good question. Plaid has…

Used three-year trends to contextualize fintech’s changes and growth amid the crazy ups and downs of COVID, economic uncertainty, and inflation.

Dialed into consumer’s main priorities including privacy and data security

Identified where your business can use fintech to stand out from your competition

For any companies looking to harness the power of fintech and give customers what they want, give it a read here

Deal Flow

M&A / Investments

Johnson & Johnson agreed to buy medical device maker Abiomed for $17.3B (BBG)

Poseidon Acquisition Corp agreed to buy and take private marine and energy asset owner Atlas in a $10.9B deal (RT)

EQT is emerging as the leading bidder to buy a 45% stake in French telecom tower owner TDF at a potential ~$9B valuation (BBG)

Chemicals maker DuPont canceled its $5.2B buyout of engineering materials maker Rogers on failure to obtain timely regulatory clearance (RT)

Global battery maker Contemporary Amperex Technology agreed to buy an almost 25% stake in cobalt maker CMOC for ~$3.7B (BBG)

Packaging firm Sealed Air agreed to buy peer Liquibox for $1.15B (RT)

Indonesia's state-owned phone carrier Telkom is exploring deals for its data center unit at a potential $1B+ valuation (BBG)

Braemar Hotels & Resorts agreed to buy the Four Seasons Scottsdale at Troon North for ~$268M from Dajia Insurance Group (BBG)

China state-owned conglomerate China Merchants is exploring a potential bid for Chinese data center operator Chindata (BBG)

Infant formula manufacturer Perrigo agreed to buy infant formula brand Good Start and a Wisconsin plant that manufactures it from Nestle (RT)

Billionaire Gaylon Lawrence and Carlton McCoy Jr., a managing partner for Lawrence Wine Estates, agreed to buy a majority stake in the Cabernet and Merlot-producing Chateau Lascombes (BBG)

VC

reAlpha, a startup building a digital real estate investing platform, raised $200M in financing from Churchill Real Estate (BW)

German eVTOL startup Volocopter raised a $182M Series E extension led by Neom (TC)

TouchBistro, a restaurant management platform, raised $110M in funding led by Francisco Partners (BW)

Satellite manufacturer Terran Orbital received a $100M investment from Lockheed Martin (TC)

Embedded insurance startup Cover Genius raised a $70M Series D led by Dawn Capital (TC)

Qwick, a staffing platform for the hospitality industry, raised a $40M Series B led by Tritium Partners (PRN)

Samsara Eco, a startup using enzymes to break down plastic into its core molecules, raised a $34.5M Series A led by Breakthrough Victoria, Temasek, Assembly, and more (TC)

MedCrypt, a startup helping secure healthcare IoT devices, raised a $25M Series B led by Intuitive Ventures and J&J Innovation (TC)

MLOps platform Galileo raised an $18M Series A led by Battery Ventures (TC)

AMP, a startup building an energy management platform for e-mobility, raised a $17.3M Series A led by Ecosystem Integrity Fund and Helios Climate Ventures (BW)

Employee benefits platform Fringe raised a $17M round led by Origin Ventures and Felton Group (TC)

Bioelectronic medicine company Boomerang Medical raised a $15M Series A led by Arboretum Ventures and Hatteras Venture Partners (BW)

Rewind, a startup allowing you to search for anything you’ve seen, said, or heard while on your Mac, raised a $10M Series A at a $75M valuation led by a16z (TC)

Digital card and gifting platform Givingli raised a $10M Series A led by Seven Seven Six (TC)

Roots Automation, a startup automating insurance operations, raised a $10M Series A led by MissionOG (PRN)

Retirement planning app Retirable raised a $6M seed round led by Primary (TC)

Metrist, a startup helping tech teams monitor cloud services, raised a $5.5M seed round from Heavybit, Morado Ventures, StatusPage co-founders Scott and Steve Klein, and PagerDuty co-founder Alex Solomon (TC)

Multifamily proptech startup Tour24 raised a $5.5M Series A extension led by 29th Street Ventures (BW)

Decentro, an Indian startup offering banking and payments APIs, raised a $4.7M Series A led by Rapyd Ventures (TC)

Property management startup Travtus raised a $4M seed round led by RET Ventures (BW)

Wellin5, a virtual counseling platform for mental health therapy, raised a $2M seed round from a group of accredited investors (PRN)

IPO / Direct Listings / Issuances / Block Trades

Dubai increased the size of its Emirates Central Cooling Systems IPO by 50%, now seeking to raise up to $543M amid strong investor demand (BBG)

SPAC

Ammunition technology company TV Ammo agreed to merge with Breeze Holdings Acquisition Corp in a $1.21B deal (RT)

Debt

The group of banks led by Morgan Stanley, Bank of America and Barclays that lent $12.7B for Musk's $44B Twitter takeover are preparing to hold the debt until early 2023 (FT)

Fundraising

Domain Capital Group, a private investment management firm, raised a $700M+ private entertainment royalty fund (BW)

Australian VC firm Blackbird Ventures closed the largest ever Australian VC fund at ~$640M to continue focusing on regional tech start-ups (AFR)

Crypto VC firm CoinFund is looking to raise a $250M Seed IV fund, three months after launching a $300M fund to back early-stage blockchain projects (CD)

Consumer industry-focused PE firm L Catterton raised ~$137M for its first ~$275M yuan-denominated fund, as it eyes early-stage investments in China (RT)

Crypto Corner

Crypto financial services firm Galaxy Digital is exploring an up to 20% workforce cut amid market downturn (BBG)

Crypto exchange Binance will use Twitter as a web3 'sandbox' following their $500M investment to help Musk's takeover (CD)

GameStop added web3 gaming NFTs to marketplace with Immutable X network (DC)

Exec's Picks

Technology news continues to cross over into the mainstream, with FAANG hiring freezes, Elon Musk buying Twitter, and celebrities increasingly investing in or launching their own startups. The Information has been a great resource to stay up to speed on insider news that does not get covered by TechCrunch, The Verge, or Bloomberg. Highly recommend a subscription to anyone serious about tech or venture capital. You can check them out here.

Jamie McGeever wrote an interesting column on the increasing "term premium" on bonds now that interest rates are climbing again.

Erin Woo and Becky Peterson have put together an updated Twitter org chart that shows who is rising at the company now that Elon Musk has overhauled the ranks. Check it out here.

The Hiring Block 💼

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We aim to curate jobs across IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We'll sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

If you're a company looking to hire candidates and want to list a job opening on our board and feature on Exec Sum, click the button below:

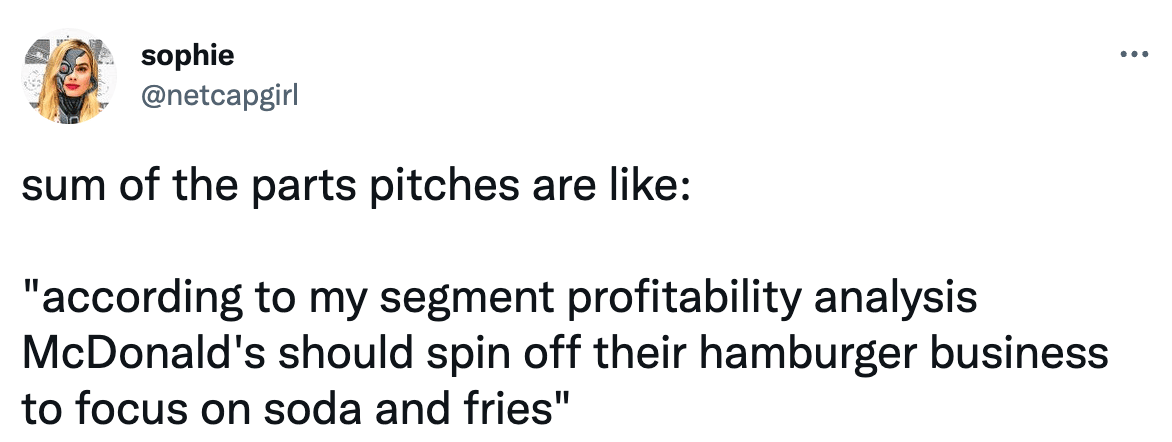

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.