Together with

Good Morning,

Could not have time an island vacation at a worse (or better time). Stocks rallied hard in the afternoon as investors realized that it literally can't get any worse, Russia's stock market got drilled, Elon and Kimbal Musk are having problems with the SEC, Biden and the West roll out heavy sanctions against Russia, Ukraine's official Twitter account is winning the internet, and Ken Griffin is pulling out of his Melvin Capital investment.

Stocks have been volatile af all 2022, and there has never been a better time to diversify your portfolio. If you want to diversify your investments through franchises, check out today's sponsor: Franshares.

For those who missed it, here are the results of our investment banking comp survey. As more firms continue to announce year-end figures, we'd love to get more data points to help provide y'all with the most comprehensive report out there. Pls help us by dropping details here (all info will remain anonymous). Shoutout to Matt Levine for the mention in his Money Stuff newsletter earlier this week.

Let's dive in.

Before The Bell

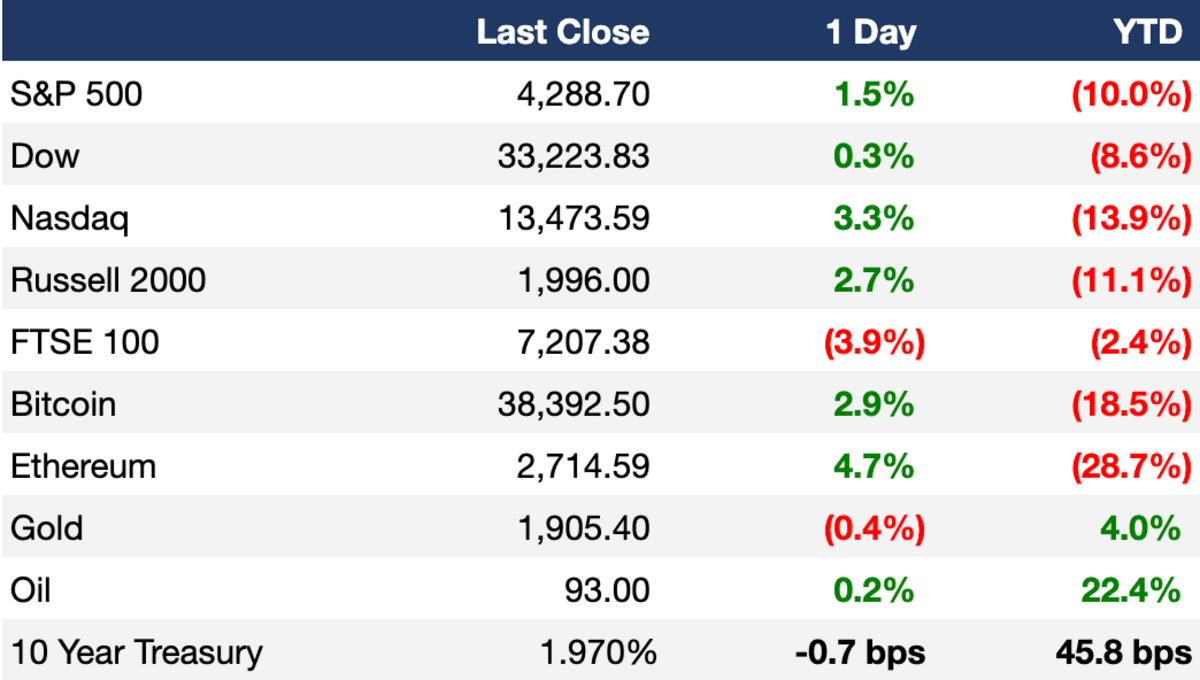

As of 2/24/2022 market close.

If you want to learn more about crypto trading strategies and the world of DeFi, check out our Foot Guns newsletter.

Markets

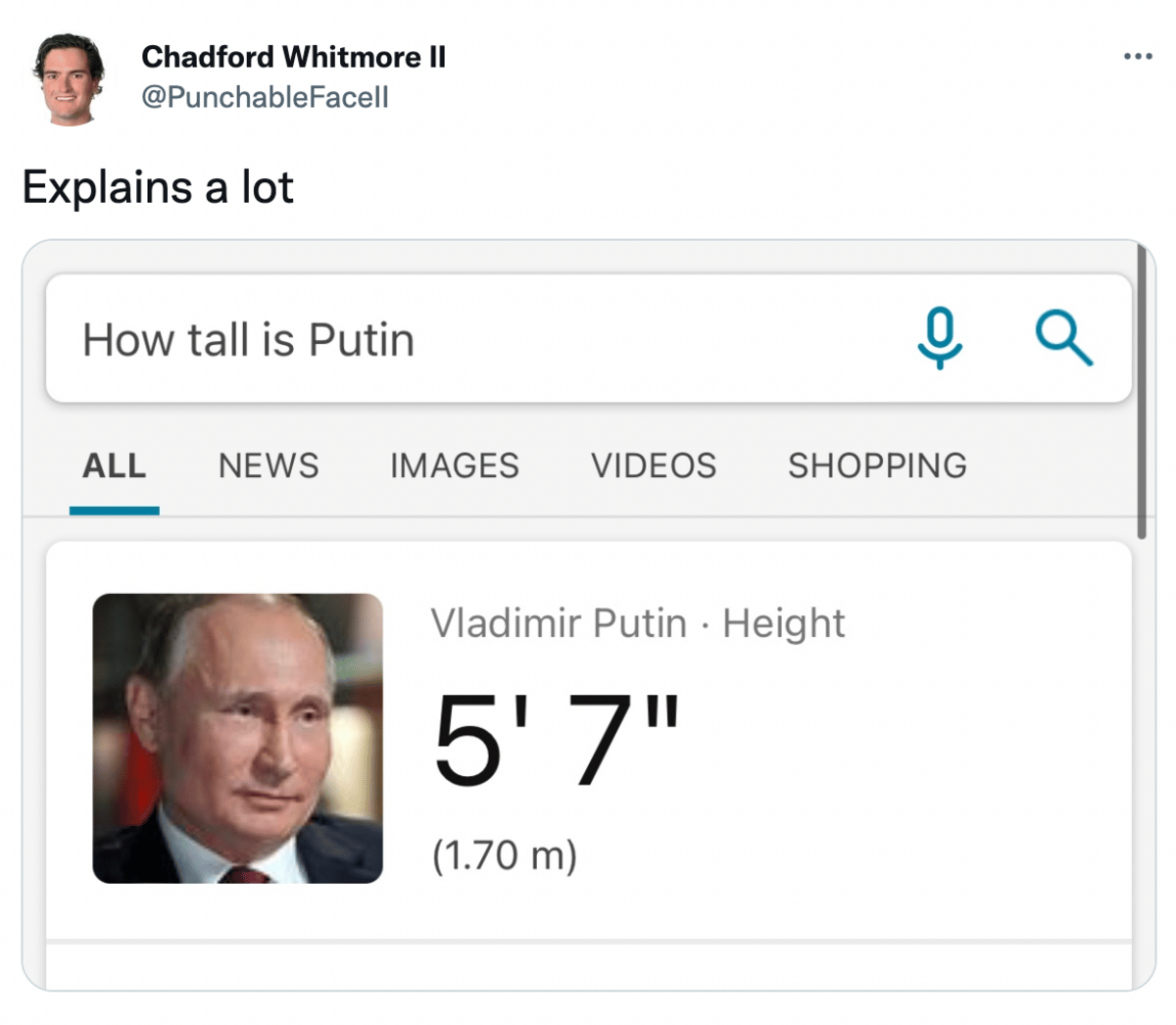

US equities had a wild reaction to Russia’s invasion of Ukraine, with the S&P tanking 2.6%+ in the morning before rallying in the afternoon to close up 1.5% in the green

The Nasdaq had even wilder price action, dropping almost 3.5% before closing up 3.3%

The VanEck Russia ETF fell 19% yesterday

Despite the rally, the S&P is still in correction territory and the Nasdaq is in bear market territory, down 10% and 20% respectively, from recent highs

Investors will be keeping an eye on developments in Ukraine in the final day of a volatile trading week

Earnings

Moderna beat on both Q4 top- and bottom-line estimates and increased its 2022 guidance for Covid vaccine sales by $2B (CNBC)

Beyond Meat shares dropped almost 10% after reporting a wider-than-expected loss for Q4 and shrinking quarterly revenue; the CEO said the company expects to ‘substantially moderate’ the growth of operating expenses (CNBC)

Etsy shares popped 20%+ after Q4 earnings and revenue beat consensus estimates (CNBC)

What we’re watching today: Dell

Full calendar here

Headline Roundup

Biden ramps up Russia sanctions as West fears fall of Kyiv (BBG)

Ken Griffin’s Citadel is pulling back most of its $2B Melvin Capital investment (BBG)

Judge rejects Elon Musk’s attempt to bring SEC before the court (CNBC)

Taiwan throws its weight behind US-led sanctions on Russia (BBG)

Justice Department sues to block UnitedHealth’s planned buy of Change Healthcare (WSJ)

Chipmakers downplay fears Ukraine crisis will worsen shortages (BBG)

Google faces sanctions dilemma with pro-Russia Youtube channels (BBG)

Biden spares Russia’s crucial energy exports from sanctions (BBG)

EU leaders give green light to sanctions package (AP)

US leveraged loan prices sink to 10-month low (BBG)

UBS triggers margin calls as Russia bond values cut to zero (BBG)

Mitsubishi Chemical CEO says Japan’s chemical companies need to merge to survive (BBG)

A Message From FranShares

Shaq made a lot of money in his NBA career, sure. But his balance sheet has fully blossomed in his post-hoops career thanks to the power of franchises (thanks 24 Hour Fitness, Auntie Annes, and Five Guys). The industrial logic of franchises is crystal clear — skip the whole “product-market fit” question and get to the “making money” part. Plus, you get to avoid the market volatility of covid/Russia/inflation/anything else that moves stocks 10% a week.

The only issue? With an average startup cost between $100,000-$300,000, they require some serious commitment to get involved with – until now.

Thanks to FranShares, investing in the franchise game is now accessible to savvy investors everywhere. The FranShares platform makes it super-simple to invest in franchises and generate wallet-stuffing passive income.

Start cashing in on your distributions after the ramp-up period

Franshares aims to generate returns of 16% - 22% on high-quality and vetted assets

Pay zero management fees

Feel like channeling your inner Shaq? Get the full scoop on FranShares here:

Deal Flow

M&A / Investments

Healthcare Trust of America, which owns and operates medical-office buildings around the US, is in advanced talks to combine with smaller rival Healthcare Realty Trust, in a deal that could create a company worth $10B+ (WSJ)

Resolution Life agreed to buy Asian insurance firm AIA’s Australian superannuation and investments business, which transfers $5.8B in funds under management (BBG)

Online auto dealer Carvana agreed to buy used-car auction business ADESA US for $2.2B (WSJ)

Global Infrastructure Partners is in talks to buy $2B LatAm renewables firm Atlas (BBG)

CPI Property Group agreed to buy a majority stake in real-estate player Immofinanz (BBG)

Saudi National Bank studying potential acquisitions in Europe, Asia for $82B bank (BBG)

VC

Insight Partners raised its 12th fund at $20B+ (PRN)

Camber Creek, a venture capital firm focused on real estate tech, raised $325M for their fourth fund (PRN)

Fosun RZ Capital, a VC firm originated in China, raised a $300M+ RMB-dominated fund (PRN)

Analytics engineering startup dbt Labs raised a $222M Series D at a $4.2B valuation led by Altimeter (PRN)

Headless commerce startup fabric raised a $140M Series C at a ~$1.5B valuation led by SoftBank (PRN)

Digital healthcare platform MediBuddy raised a $125M Series C from Quadria Capital and Lightrock India (PRN)

Aspen Power Partners, a distributed generation platform focused on decarbonization, raised $120M in funding led by Ultra Capital, Redball Power, a global Swiss asset manager, and more (BW)

Climate tech and environmental assessment startup Project Canary raised a $111M Series B led by Insight Partners (PRN)

Scipher Medicine, an immunology startup matching patients with the most effective therapy, raised a $110M round led by Cowen Healthcare Investments (BW)

Red Sift, an integrated cloud email security and brand protection platform, raised a $54M Series B led by Highland Europe (BW)

AnyRoad, an experience relationship management platform, raised a $47M Series B led by BlackRock (PRN)

Sports and entertainment startup Wave Sports + Entertainment raised a $27M Series B led by TZP Group (BW)

Promise, a flexible payment platform for utility bills, raised a $25M Series B led by The General Partnership (TC)

Avanti Software, a Canadian payroll and HR software company, raised $25M in debt / equity led by Round13 Capital (BW)

Standard Metrics, a financial collaboration platform for private capital markets, raised a $23.7M Series A led by 8VC (PRN)

OpenComp, a provider of compensation intelligence solutions, raised a $20M Series A led by K5 Global and JP Morgan (BW)

Ember, a real estate proptech startup, raised $17.4M in financing led by Peter Thiel (PRN)

Depict.ai, a startup building an e-commerce product recommendation platform, raised a $17M Series A led by Tiger Global (TC)

Siteline, a billing solutions startup for commercial trade contractors, raised an $15M Series A led by Menlo Ventures (BW)

Kubernetes development platform Okteto raised a $15M Series A led by Two Sigma Ventures (TC)

NayaPay, a Pakistani messaging and payment app, raised a $13M seed round led by Zayn Capital (TC)

EV charging software provider ev.energy extended its Series A to $12.8M led by ArcTern Ventures (PRN)

Sweater, a fintech company building the first fully-managed VC fund open to everyday investors, raised a $12M seed round co-led by Motivate VC and Akuna Capital, with participation from many angel investors, including Litquidity (ayyy) (GN)

Edtech startup Tutored Teachers raised a $10M Series A led by GSV Ventures (PRN)

HUBUC, a Barcelona-based embedded finance API startup, raised a $10M seed round led by WndrCo and Runa Capital (TC)

De La Calle, a brand selling fermented fruit juice, raised a $7M growth round led by KarpReilly, HERE Studio, and DrinkPAK (PRN)

Good Loop, a view-to-donate ad platform, raised a $6.1M Series A led by Quaestus Capital Management (TC)

Cortina, a marketplace platform that allows business to expand beyond their core products without taking inventory risk, raised a $6M seed round led by Point72 Ventures (PRN)

IPO / Direct Listings / Issuances / Block Trades

Private equity firm L Catterton Hires Goldman Sachs, Morgan Stanley for possible summer IPO that could value it at $3B (WSJ)

SPAC

Foxo Technologies, whose AI and genetics technology is used to underwrite life insurance, agreed to merge with Delwinds Insurance Acquisition Corp in a $369M deal (BBG)

Crypto Corner

Exec's Picks

Yesterday, Morgan Housel wrote a great piece about the difference between experience and knowledge. Whether it is achieving success or losing 30% of our money, you can't "teach" certain experiences. Check out Now You Get It here.

Jack Raines published an article about how incentives drive everything, and poorly designed financial incentives can create dangerous outcomes. Check out Perverse Incentives here.

Per Ukraine's Twitter account, here is the link for those wanting to donate to help in their fight against Russia.

The Hiring Block

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We've got 40+ jobs spanning IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

Meme Cleanser

Catch the latest episode of our Big Swinging Decks podcast on Spotify and Apple Music 🤝