Together with

Good Morning,

Trump is preparing for his Twitter comeback tour, the US is about to hit its debt ceiling (again), US 30Y mortgage rates hit their lowest point since September, Peter Thiel's Founders Fund cashed out $1.8B on crypto bets last year, Microsoft will lay off 10k employees, Amazon is beginning to lay off 18k, and Citi is bumping up salaries for junior bankers.

Let's dive in.

Before The Bell

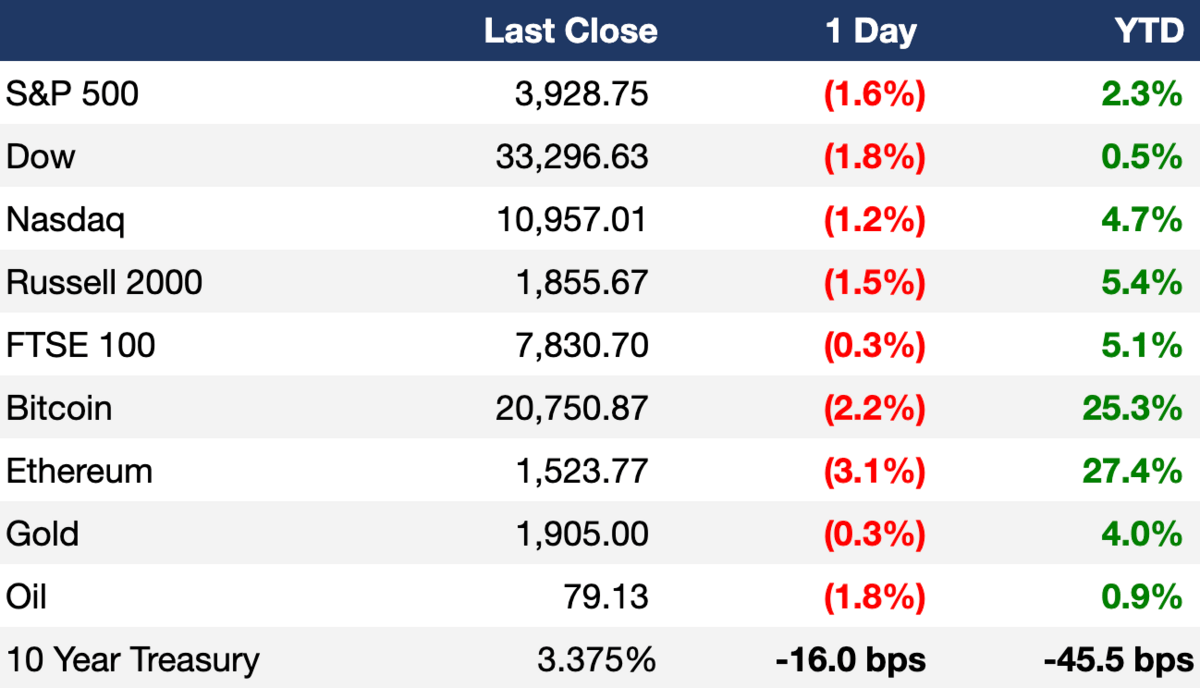

Markets

US stocks tumbled yesterday after economic data showed retail sales and producer prices declined more than expected in December and Fed officials stressed the need to raise rates beyond 5%

The S&P 500 had its worst day in over a month while the Nasdaq snapped a seven-day win streak

US 10Y yield slid to its lowest level since September

Gold is trading near eight-month highs

The dollar index sank to its lowest level since May 31st

Markets are now pricing a 94.3% probability of a 25 bps rate hike on Feb 1st

Earnings

Headline Roundup

US will reach its debt ceiling by today (FRB)

US PPI fell 0.5% in December, down to 6.2% YoY (CNBC)

UK inflation fell for a second straight month to 10.5% YoY in December (WSJ)

US firms are pessimistic about economic growth this year, Fed survey shows (RT)

US 30Y fixed-rate mortgage fell to 6.23% to lowest level since September (RT)

Citigroup hiked pay for junior bankers by up to 15% despite tough year (BBG)

Global bond sales surge to record start of year at $586B (BBG)

Peter Thiel's Founders Fund made $1.8B by exiting eight-year bets on crypto just before the market crashed last year (FT)

Microsoft will lay off 10k employees, close to ~5% of its workforce (AX)

Amazon kicked off round of job cuts affecting 18k people (BBG)

Twitter's daily revenue is down 40% YoY, with 500 advertisers having left (TI)

Credit Suisse's CEO sees money returning to the bank (RT)

A US judge ruled that Robinhood must face customers' lawsuit alleging it hid trading costs (RT)

More Americans are spending more than they make amid high inflation (AX)

Trump is preparing to return to Facebook and Twitter (NBC)

A Message From Naqi

Invest In The Company Reinventing How We Interact With The Digital World

Naqi is the innovative startup that’s developed an earbud capable of controlling all IoT (Internet of Things) devices.

With multiple biosensors to detect microgestures and advanced gyroscopic controls, the earbud is truly hands-free, voice-free, and touch-free.

Naqi can do what companies like Neuralink aim for TODAY, without the need for implants or surgery. And with the IoT market projected to be worth $2.46 trillion by 2029, Naqi is poised to unlock the market by controlling all of these devices.

Learn more and invest in Naqi here.

Deal Flow

M&A / Investments

Canada’s BMO won regulatory approval to purchase BNP Paribas’ US subsidiary Bank of the West in a $16B deal (RT)

Shell USA, a unit of oil company Shell, agreed to buy EV charging network operator Volta in a $169M deal (RT)

Media start-up Semafor is exploring ways to buy back SBF's ~$10M interest in the company (FT)

Oil company Saudi Aramco agreed to buy the trading unit of refiner Motiva Enterprises (BBG)

Gaming chat app Discord agreed to buy teen social networking site Gas (BBG)

German airline Lufthansa offered to buy a minority stake in Italy’s ITA Airways; it did not disclose the size or price of the stake (RT)

PE firm Sycamore Partners and brand manager Authentic Brands are in talks to acquire retailer Bed Bath & Beyond, as the company explores options ahead of a likely bankruptcy filing (CNBC)

Crypto-focused media company CoinDesk has retained Lazard bankers to explore options including a sale (WSJ)

VC

Fashion retailer Shein is in talks to raise up to $3B at a 36% lowered valuation of $64B from existing investors including Mubadala, Sequoia China and General Atlantic (FT)

Pathalys Pharma, a late-stage biopharmaceutical company focused on end-stage kidney disease, raised $150M in secured product financing / equity led by Abingworth (PRN)

Wallapop, a Spanish circular marketplace, raised an $87.4M Series G extension at an $832M valuation led by NAVER and Korelya Capital (TC)

MENA-based BNPL startup Tabby raised a $58M Series B extension at a $660M valuation led by Sequoia Capital India and STV (TC)

Lithium extraction startup Summit raised a $50M Series A-2 led by Evok Innovations and BDC Capital (PRN)

Cloud-based electronics manufacturing platform and marketplace MacroFab raised $42M in growth capital led by Foundry (PRN)

ThriveCart, a startup selling tools to build e-commerce carts, raised a $35M round led by LTV SaaS Growth Fund (TC)

Soil measurement and insights startup EarthOptics raised a $27.6M Series B led by Conti Ventures (PRN)

Quantum Machines, a provider of quantum control solutions, raised $20M in funding (PRN)

Bank account validation and B2B payment security startup nsKnox raised a $17M round led by Link Ventures and Harel Insurance & Finance (BW)

myInterview, a startup building software for smart video interviewing, raised an $11M Series A led by Entrée Capital and Aleph (PRN)

Goldenset Collective, a platform making equity investments in digital creator businesses, raised a $10M seed round led by A.Capital and Lerer Hippeau (PRN)

Axiom Cloud, a startup using software and automation to improve grocery cooling systems, raised a $7.4M Series A led by Blue Bear Capital (PRN)

MarketReader, a market analytics startup that explains price action in real time, raised a $3.1M seed round led by angel investors (BW)

London House Exchange, a UK-based fractional property investment platform, raised $2.96M in funding from Better (BW)

IPO / Direct Listings / Issuances / Block Trades

AI chipmaker Black Sesame Technologies is considering a Hong Kong IPO that could raise ~$200M (BBG)

SPAC

French football team Olympique Lyonnais plans to list in the US via SPAC at a $1.2B valuation (FT)

Neurodegenerative disease-focused Aprinoia Therapeutics will merge with Ross Acquisition Corp. II at a combined ~$320M valuation, including debt (BBG)

Israel Acquisitions Corp. raised $143M in a Nasdaq listing and is looking for an Israeli tech company to merge with (GLB)

Debt

Bankruptcy / Restructuring

Fundraising

Blackstone closed on two new funds: the world's largest secondaries fund Strategic Partners IX at $22.2B, and an inaugural GP-led continuation fund Strategic Partners GP Solutions at $2.7B (BX)

Sequoia Capital raised $195M for its fifth seed fund (TC)

India-based asset manager 360 ONE acquired angels network Mumbai Angels and launched an angel fund and a conventional VC fund worth $160M in total (CQ)

Deal Box, a capital markets advisory and token offering packaging platform, launched a venture arm with plans to invest $125M in web3 startups (TC)

Crypto Corner

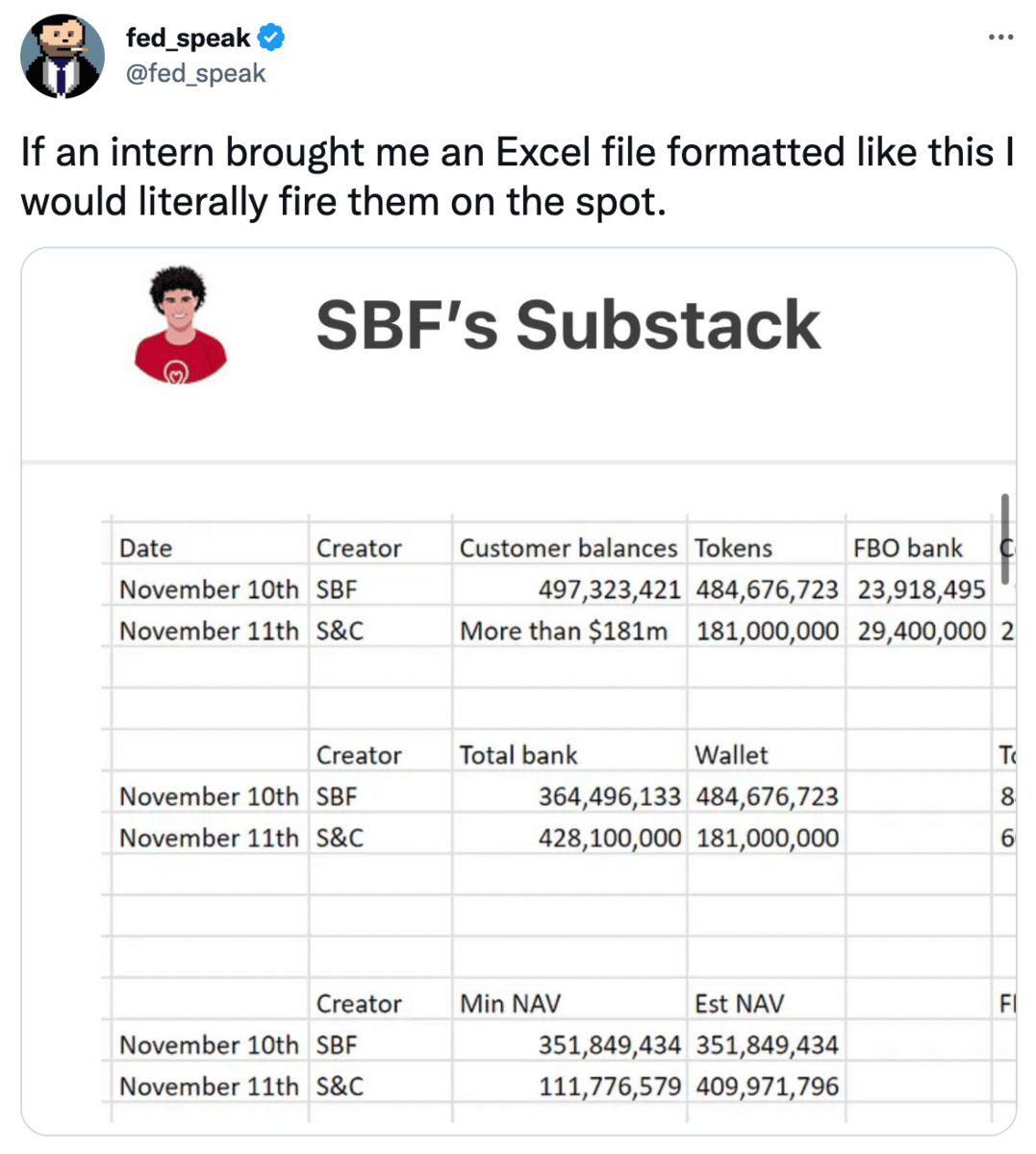

SBF claimed FTX US is solvent and able to repay customer funds, accusing lawyers of being 'misleading' (BI)

Bitcoin surges as investors return to riskier assets (FT)

US arrested the founder of HK-registered crypto exchange Bitzlato for allegedly processing over $700M worth of illicit funds (AX)

Crypto exchange Coinbase will halt Japan operations (RT)

Exec's Picks

For a while, it seemed like NFTs were going to revolutionize art... until they didn't. Vanity Fair covered the rise and fall of NFTs in the art world here.

With the debt ceiling coming up once again, the Fed might have to revisit the idea of minting the $1T platinum coin, according to Financial Times.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

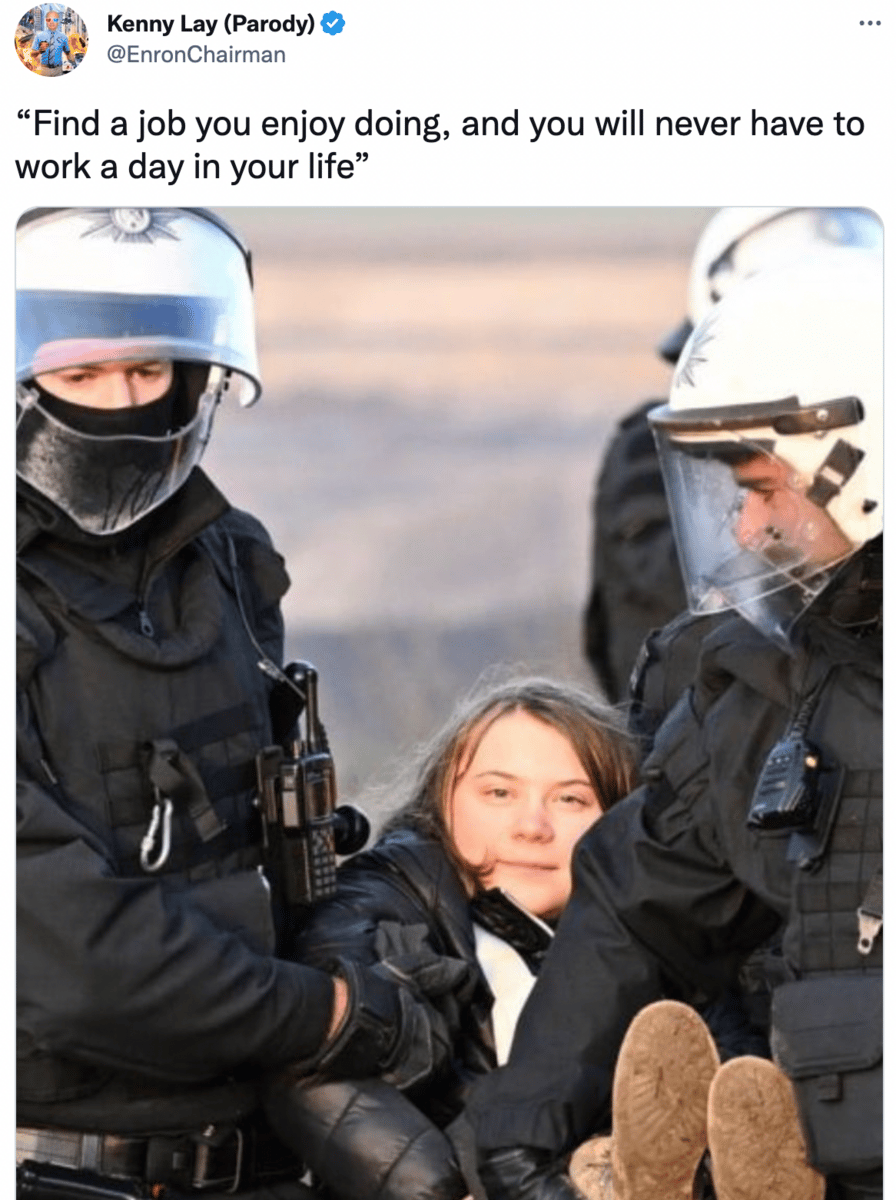

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.