Together with

Good Morning,

Goldman will forgo job cuts after a recovery in IB, Bessent called the Fed's forecasts politically biased, Chinese bankers are charging fees as low as $100, McKinsey banned its China business from consulting on GenAI, and Donald Trump is in the Epstein files.

A team of Zillow execs founded Pacaso to democratize co-ownership of second homes. While they've already raised over $200M from notable VCs, they're inviting individuals to invests in their new growth round. Check out the opportunity.

Let's dive in.

Before The Bell

As of 7/23/2025 market close.

Click here to learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks rallied yesterday as investors digested US-EU and US-Japan trade talks

S&P and Nasdaq hit fresh ATHs

UK's FTSE 100 hit a fresh ATH

Japan's Nikkei 225 and TOPIX indexes surged to new ATHs

Korea's KOSPI index rose to a fresh four-year high inches away from a record

Chinese stocks in Hong Kong rose to a four-year high

EM-US investment grade spreads fell to ~110 bps to the lowest since 2007

Earnings

Alphabet beat Q2 earnings and revenue estimates amid strong and growing demand in cloud products and services and growth in search and advertising despite AI competition; the firm raised its CapEx forecast to continue to expand on its AI strategy (CNBC)

Tesla missed Q2 earnings and revenue estimates on a second-straight quarterly revenue drop amid political backlash against Musk, higher tariff costs, and expiration of federal EV tax credits; the firm forecast a 'rough' few quarters ahead (CNBC)

AT&T beat Q2 earnings and revenue estimates on strong growth in wireless phone subscribers driven by perks and incentives, though the firm reiterated a FY profit forecast that fell short of estimates (BBG)

IBM beat Q2 earnings and revenue estimates despite a miss in software sales as clients reprioritized their spend to the hardware; the firm is also optimistic about M&A and sees few concerns from the trade war and DOGE (CNBC)

Chipotle met Q2 earnings estimates but missed on revenue and cut its FY same-store sales growth forecast to flat amid a 4.9% drop in traffic and 4% drop in same-store sales (CNBC)

General Dynamics beat Q2 earnings and revenue estimates on strong results in its marine and aerospace segments, though contract cancellations weighed on combat systems revenue (RT)

Deutsche Bank beat Q2 earnings estimates despite mixed results in IB amid an M&A slump and a hit from a rising euro, as falling litigation costs boosted profits to its highest since 2007 (RT)

What we're watching this week:

Today: American Airlines, Intel, Blackstone, Honeywell

Friday: Booz Allen Hamilton

Full calendar here

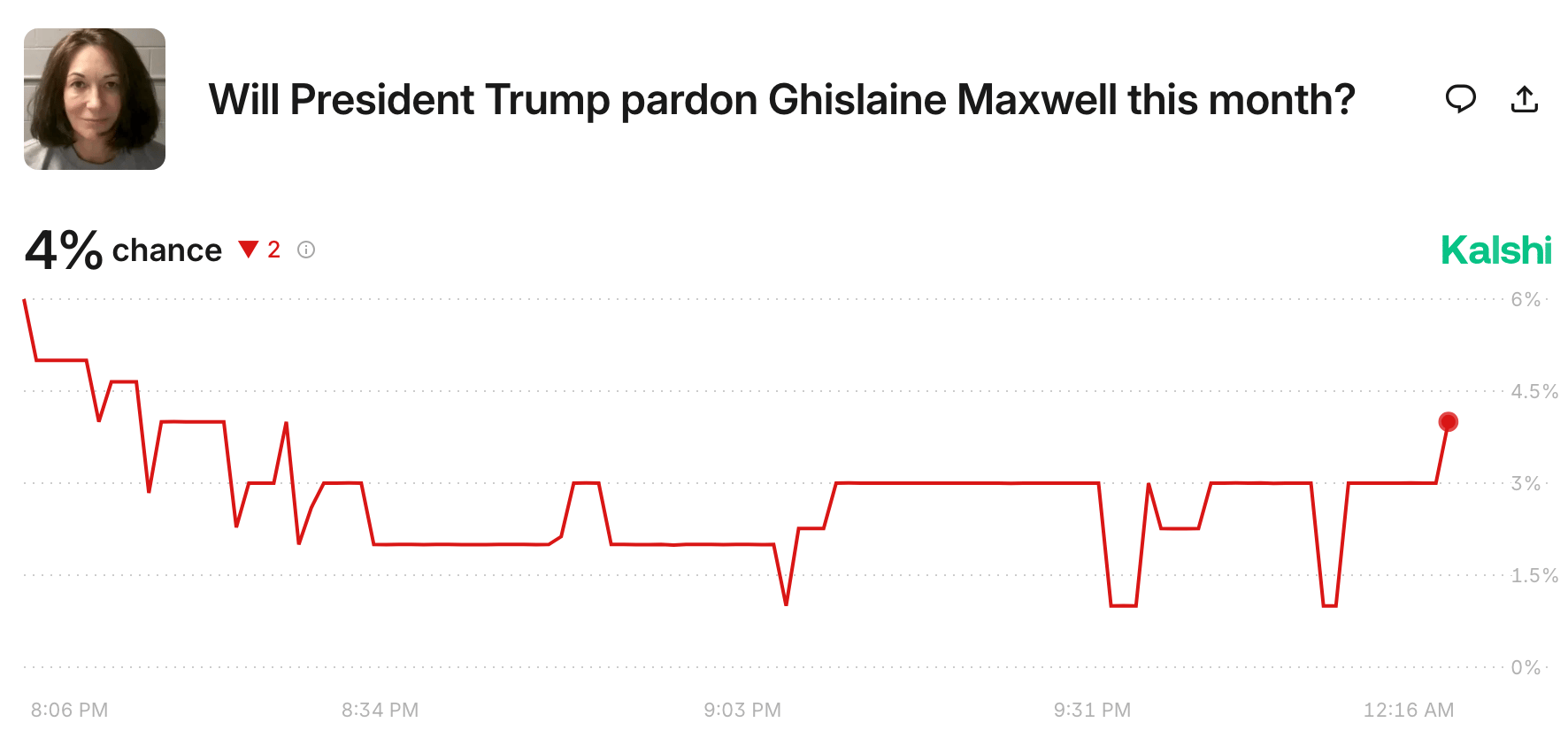

Prediction Markets

At this point, nothing about the Epstein Files should surprise anyone.

Headline Roundup

Goldman will forgo second round of job cuts as outlook improves (FT)

Trump is in the Epstein files (WSJ)

Bessent called Fed forecasts 'politically biased' (RT)

US will impose broad reciprocal tariffs from 15%-50% (BBG)

US and EU are close to a trade deal that would set a 15% tariff (BBG)

China price wars hit IB as underwriters charge $100 fees (FT)

JPMorgan's global head of M&A sees more mega deals in the offing (RT)

PE continuation fund exits shattered records in H1 (FT)

Brookfield is missing out on PE secondaries boom it once predicted (BBG)

Meme stock revival stretched into a second day (BBG)

Bright spots emerge in earnings as tariff uncertainty lingers (RT)

US upstream O&G M&A tumbles as volatility rattles investors (RT)

New analysis finds PE funds are more volatile than suspected (II)

FTSE 100 has outperformed over half of S&P 500 stocks over two years (TN)

China long bonds join global drop as US trade tensions ease (BBG)

Green bond issuance fell by one-third amid ESG pullbacks (RT)

Japan 40Y bond auction saw the weakest demand since 2011 (BBG)

China 30Y bond auction drew its highest yield since March (BBG)

McKinsey banned its China unit from consulting on GenAI (FT)

Congress subpoenaed JPMorgan and BofA execs over CATL IPO (BBG)

Macquarie shareholders challenge exec pay as regulatory, earnings stress mount (RT)

UK regulators are investigating Deloitte's audits of Glencore (BBG)

Neuralink is targeting $1B revenue by 2031 (BBG)

TD Bank Group ordered staff back to office four days a week (BBG)

Starbucks will open free study rooms in China to lure customers (BBG)

US is investigating Harvard's foreign scholars program (BBG)

US blocks AI groups with 'ideological bias' from government work (FT)

A Message from Pacaso

The Stock Popping Up in Big-Name Portfolios

Maveron. Greycroft. Fifth Wall. These aren't just notable venture capital firms. They've all invested in Pacaso (Nasdaq ticker reserved: PCSO).

Now everyday investors like you have the opportunity to join them.

Pacaso created the vacation home co-ownership category in 2020. Today, over 2,000 people have owned a home through their platform, helping Pacaso generate $110M+ in gross profits to date (including 41% YoY growth last year).

And they have no plans to slow down – they have their eyes on expanding to locations like Italy and the Caribbean.

You can share in that growth potential as they scale in this $1.3T market. This is your chance to invest like a venture capitalist. Become a Pacaso shareholder here.

Deal Flow

M&A / Investments

One Rock Capital remains a leading bidder for BP's lubricants business Castrol, which could be valued at $6B-$8B

Payments firm Corpay agreed to acquire UK-based peer Alpha in a $2.2B cash deal

5C, an AI infrastructure and data center solutions provider, raised $835M in funding led by Brookfield

NFL played Bobby Wagner acquired a minority stake in the WNBA team Seattle Storm at a $325M valuation

Sony is exploring a sale of its cellular chipset unit Sony Semiconductor Israel

Botswana wants a controlling stake in De Beers, casting another shadow over the sale of Anglo American's diamond producer

VC

Gupshup, a global conversational AI platform, raised a $60M round led by Globespan Capital Partners

Bitfount, a federated AI platform transforming clinical research collaboration, raised an $8M Series A from Parkwalk Advisors, Ahren Innovation Capital, and more

AI-powered trust management platform Vanta raised a $150M Series D at a $4.15B valuation led by Wellington Management

Embedded tax platform April raised a $38M Series B led by QED Investors

ValGenesis, a startup providing AI-powered digital validation solutions to the life sciences industry, raised a $16M round led by Bridge Bank

Kadence, a workplace operations platform, raised a $20M Series A led by High Alpha

IPOs / Direct Listings / Issuances / Block Trades

Spanish renewable energy giant Iberdrola raised $5.9B in Europe's largest share sale YTD

IndusInd Bank, the private Indian lender of Indian conglomerate Hinduja, is seeking to raise $3.5B in a share sale as it seeks to navigate fallout from a suspected fraud and spate of exec departures

Tata Capital, the financial services unit of Indian conglomerate Tata, is aiming to raise ~$2.2B at an $18B-$20B valuation in its India IPO

Uzbekistan's SWF UzNIF is exploring a potential dual listing in London and Tashkent

Advent and KKR-backed consumer intelligence data firm NIQ raised ~$1.05B at a $6.35B valuation in its IPO

Insurance data analytics platform Accelerant is expected to price its IPO above a marketed range to raise ~$608M

Platinum Equity-backed education publisher and software firm McGraw Hill raised $415M at a $3.25B valuation in its IPO

Mexican REIT Fibra Next raised $431M in Mexico's largest IPO in seven years

Temu's parent PDD switched to a Hong Kong-based auditor signaling a likely Hong Kong dual listing

SPAC

Reusable rocket developer Innovative Rocket Technologies agreed to merge with BPGC Acquisition Corp. in a $400M deal

Debt

Walgreens Boots Alliance launched a $6.1B multi-currency bond tender after banks offloaded a $4.5B debt package used to finance Sycamore Partners' buyout of Boots

Caribbean mobile network operator Digicel began a $2.7B junk debt sale to refinance upcoming maturities

India's largest natural gas importer Petronet is seeking a ~$1.4B local loan to fund a new petrochemical plant and LNG terminal

Mara Holdings, one of the largest publicly traded crypto mining firms, plans to raise $1B in convertible senior notes to fund Bitcoin purchases

India's second-largest private airport operator GMR Airports is considering a $579M local-currency bond sale

Hong Kong developer Lai Sun Development is seeking additional bank support for a $446M loan refinancing

Wholesale grocer C&S is seeking to raise $400M in a leveraged loan sale to help finance its ~$1.8B acquisition of food distributor SpartanNash

UK fashion retailer Boohoo is close to securing a $237M refinancing from investment firm TPG, which once took the firm private over twenty years ago

Tata Power Renewable Energy and Tata Communications, two unit of Indian conglomerate Tata Group, are planning to raise ~$230M each via bond sales

Bankruptcy / Restructuring / Distressed

Creditors of packaging firm Ardagh Group are set to pay billionaire owner Paul Coulson ~$300M as part of a deal to hand over the keys to the company

Austrian packaging firm Adapa is in talks to restructure debt just three years after being acquired by credit firms led by Apollo

Distressed energy firm New Fortress Energy tapped Houlihan Lokey in anticipation of creditor talks amid a bond rout

Fundraising / Secondaries

Blackstone raised ~$5B for its latest infrastructure secondaries fund

KR Capital, the equity L/S fund of ex-Marshall Wace PM Ravi Naresh, raised $3B from hedge fund giant Millennium

Optimas Capital Management, the Asian equity L/S fund of Thomas Wong, raised $1.2B from Millennium

Great Rock Capital raised a $1.1B senior secured leverage facility led by Capital One

Portuguese PE fund Fortitude Capital raised ~$585M to invest in Portugal's soccer stadium infrastructure

Activist hedge fund Third Point raised $400M for its first dedicated structured private credit fund for insurance companies

Italian PE firm Progressio raised $364M for its fourth fund

Life sciences investor RA Capital raised $120M for a 'Planetary Health' fund

Crypto Sum Snapshot

Goldman Sachs and BNY partnered to tokenize money market funds

SEC halted approval of Bitwise's ETF just hours after signing off

Check out our Crypto Sum newsletter for the full stories on everything crypto!

Exec’s Picks

Still spending more time cleaning data than using it? BMLL delivers clean, ready-to-use historical market data for trading and research.

Download their free guide to learn what matters when choosing a data provider.

Hedge fund legend and Baupost CEO Seth Klarman sat down with Goldman Sachs president John Waldron to discuss his investing philosophy in the current market environment and how his approach to leading Baupost has evolved in his long hedge fund career. An insightful conversation with one of the best value investors in the game…

Finance & Startup Recruiting 💼

Litney Partners

If you're a junior banker looking for your next career move, check out our recruiting firm, Litney Partners. Established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm), Litney Partners has placed strong candidates across leading firms spanning private equity, hedge funds, venture capital, growth equity, private credit, investment banking, and fintech. Head over to our website to drop your resume / create your profile and we'd love to get in touch!

We are able to move faster than most firms due to our paralleled reach, decades of industry expertise, and ability to attract top caliber candidates.

Next Play

If you're down bad, realizing finance isn't for you, and/or are curious to explore the world of startups (BizOps, chief of staff, strategic finance, etc.), fill out this form. Next Play reviews every submission and will reach out to schedule a 1:1 video call if they think they can be helpful as your own, personal startup matchmaker. They’ve grown their community to over 50k talented individuals and have strong relationships across the tech ecosystem.

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.