Together with

Good Morning,

KKR is preparing for a private credit boom in Japan, Musk's net worth hit $500B, activist investors had their busiest quarter ever, Brown and Northwestern's endowments are turning to secondaries, and SCOTUS will hear argument in Trump's firing of Fed governor Lisa Cook

Let's dive in.

Before The Bell

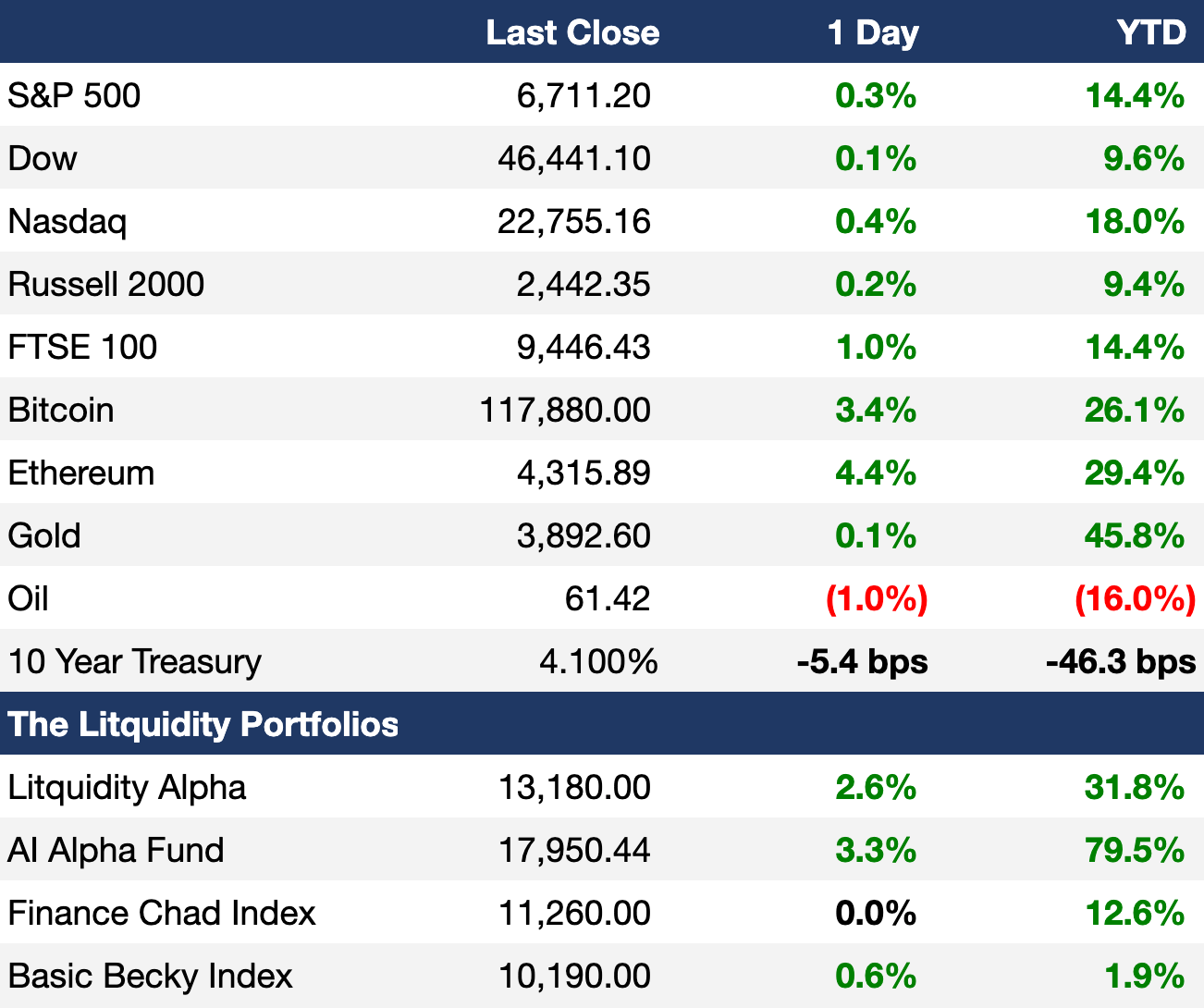

As of 10/1/2025 market close.

Click here to learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks continued to climb on hopes of a short-lived government shutdown

S&P and Dow hit fresh ATHs

Europe's Stoxx 600 hit an ATH

UK's FTSE 100 hit an ATH

AT1 bonds have surged 57% since Credit Suisse's collapse in 2023 for the biggest bull run in the asset's history

Earnings

A rare empty calendar this week. But we've just entered a crucial Q3 earnings season so stay tuned for all the important updates.

Full calendar here

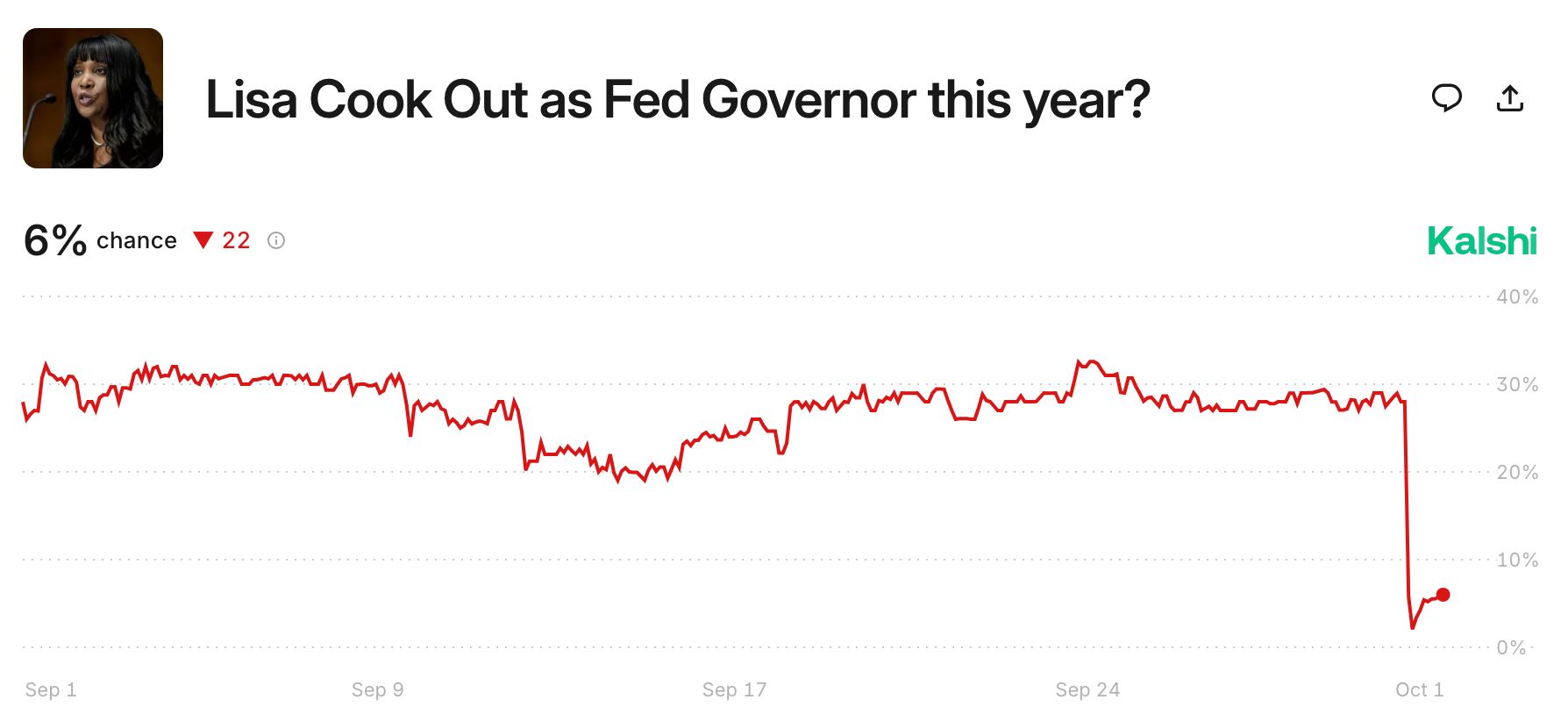

Prediction Markets

SCOTUS will hear arguments on Trump's firing of Lisa Cook in January. A big case for the fate of Fed independence…

Headline Roundup

There are more PE funds than McDonald's in US (BBG)

SCOTUS blocked Trump's firing of Fed governor Lisa Cook (BBG)

Private payrolls declined in 32k in September (CNBC)

US manufacturing contracted for a seventh-straight month (BBG)

Eurozone inflation rose to 2.2% YoY (BBG)

KKR is preparing for a private credit boom in Japan (FT)

PIMCO expects bond returns to outpace cash due to rate cuts (BBG)

Activist investors had their busiest quarter ever with 61 campaigns (RT)

UK is considering tax relief for trading in IPOs (FT)

India is set for its biggest IPO month ever (BBG)

AQR's flagship fund is up 16% YTD (RT)

Singapore SWF Temasek is boosting bets on stocks (BBG)

Private market evergreen funds are in high demand (BBG)

Brown and Northwestern's endowments turn to secondary markets (BBG)

SEC clears way for ETF share classes in challenge to US mutual funds (FT)

Goldman and Carlyle will follow BlackRock with offices in Kuwait (BBG)

Dollar reserves in foreign central banks hit a 30-year low (BBG)

Saudi oil exports hit an eighteen-month high (BBG)

Nubank applied for a US bank charter (RT)

Musk's net worth hit $500B (RT)

Costs at largest US grid rose $7B due to data centers (BBG)

Muslim states pressure Hamas to accept US Gaza plan (BBG)

Fortress co-CEO Josh Pack unexpectedly died at 51 (FT)

Onex Private Equity co-head Nigel Wright unexpectedly died at 62 (BBG)

A Message from Mercor

Earn up to $150 / hr to train AI models

Mercor is seeking folks with 2+ years of investment banking or private equity experience to train AI models for the largest AI research labs.

The work is completely asynchronous, part-time, remote, and on your own terms. They're also offering $1,000 in referral fees for intros to qualified folks.

Learn more here.

Deal Flow

M&A / Investments

Mortgage fintech Rocket completed its acquisition mortgage servicing giant Mr. Cooper for $14.2B, a valuation 51% higher than announced in March

KKR is exploring a sale of its 40% stake in Canadian midstream operator Pembina Gas Infrastructure at a $7B valuation

Semiconductor equipment companies Axcelis Technologies and Veeco Instruments agreed to merge in a $4.4B all-stock transaction

UK PE firm 3i Group is exploring a sale of French IT hardware maintenance firm Evernex at a $1.4B-$1.8B valuation

European app investor Bending Spoons in advanced talks to acquire internet pioneer AOL from Yahoo for $1.4B

Weill Cornell Medicine acquired auction house Sotheby's former Manhattan HQ for $510M

Google once hired Lazard to explore a sale of its advertising exchange unit AdX, with Oracle, Adobe, SAP, Salesforce, The Trade Desk, Centerbridge Partners, GTCR, Blackstone, and GI Partners identified as potential buyers amid Google's years-long antitrust battles

VC

Swiss SME financing platform Teylor raised a $175M round led by Fasanara Capital

Self-driving truck startup Einride raised $100M from EQT Ventures, IonQ, and others

Phaidra, a startup building AI agents for AI factories, raised a $50M+ Series B led by Collaborative Fund

AI health coach Simple Life raised a $35M Series B led by Hartbeat Ventures

Digital sleep clinic Dreem Health raised a $29M round led by Eurazeo

Apiphani, an AI-native platform and managed services company, raised a $25M Series A led by Insight Partners

Endpoint security platform Prelude Security raised a $16M round led by Brightmind Partners

Quantum computing startup NanoQT raised a $14M Series A led by Phoenix Venture Partners

Audio separation startup AudioShake raised a $14M Series A led by Shine Capital

Amplio, a startup helping manufacturers manage surplus inventory, raised an $11.1M Series A led by Hitachi Ventures and Yamaha Motor VenturesNotch.cx, an autonomous AI customer support platform, raised a $7M seed round led by Lightspeed Venture Partners

Data analytics platform Dashmote raised a $6M Series A1 led by Blossom Street Ventures and Rabobank

Mesta, a global fiat and stablecoin payment network, raised a $5.5M seed round led by Village Global

IPO / Direct Listings / Issuances / Block Trades

$40B-listed agri-chemicals giant Corteva plans to split its seeds and pesticide units into separate listed companies

BC Partners and Pollen Street Capital-backed UK SME lender Shawbrook is preparing to IPO at a $2.7B valuation

Dutch pension ABP sold its $455M stake in heavy equipment manufacturer Caterpillar due to Israel's war links

AI data analytics startup Dataiku picked banks for an IPO

Gas producer Diversified Energy will switch its primary listing from UK to US

Debt

Goldman Sachs is leading a $3.75B debt deal to fund materials firm Arclin's $1.8B acquisition of chemicals giant DuPont's Aramids business

DuPont agreed to swap $1.6B of existing debt for new securities

Hedge fund Davidson Kempner acquired $1.4B in bad debt from Abu Dhabi Commercial Bank

Global banks beat out private credit firms with a $475M loan deal for Southeast Asia telecom tower operator EdgePoint Infrastructure

Turkish home electronics giant Vestel Elektronik is in talks with lenders to refinance some loans

Clearlake Capital-backed cybersecurity firm RSA Security resumed debt talks with a consortium of lenders including Veritas Capital and BlackRock

Bankruptcy / Restructuring / Distressed

Beach Point Capital, Diameter Capital, Redwood Capital, and UBS Asset Management agreed to provide $4.4B of rescue financing for bankrupt auto parts supplier First Brands Group to avoid liquidation

Fundraising / Secondaries

Private markets investment firm HarbourVest plans to raise $20B for its twelfth flagship secondaries fund

Brookfield raised $4B for its fourth infrastructure debt fund

Family office LGT Capital Partners raised $3B for its third direct secondaries fund

PE FOF Banner Ridge plans to raise $3.2B for its sixth flagship secondaries fund

Toyota's VC arm Woven Capital raised $800M for its second fund

PE real estate manager Berkeley Partners raised over $610M for its sixth light industrials-focused real estate fund

European real estate credit investor Zenzic Capital launched a new fund with backing from GCM Grosvenor

Crypto Sum Snapshot

Trump's crypto venture is planning to expand into debit cards

Donald Trump Jr. says stablecoin surge will preserve dollar dominance

UK plans to keep $6.7B in Bitcoin seized from money laundering convictions

Crypto Sum summarizes the most important stories on crypto daily. Read it here.

Exec’s Picks

Congressional documents revealed that Wall Street firms kept ties with Jeffrey Epstein until the very end. We summarized the details here.

a16z leaked two LP decks to Newcomer. Check out Newcomer's break down of these decks to see how the most successful VC is performing for its investors.

Upcoming Events🥂

Litquidity × NEXUS The Capital Cup – November-December, $100k in prizes

Palm & Park is hosting the first-ever Litquidity × NEXUS Capital Cup this November-December in NYC with over $100k in prize value! It's going to be an afternoon of competitive play, networking, drinks, and wins among NYC's top finance, tech, and investing pros and we'd love for you to show! Bring your team of four or simply show up for the vibes.

UpSlide × Litquidity Happy Hour – Week of October 20, NYC & London

UpSlide is teaming up with Litquidity once again to host an unforgettable celebration in both NYC and London. Come join of us for some pints, networking and a great time!

Powered by Palm & Park

Finance & Startup Recruiting 💼

Litney Partners

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting venture between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm), Litney Partners places talent at leading firms in PE, hedge funds, VC, growth, credit, IB, and fintech and is currently recruiting for some incredible roles. Head over to our website to drop your resume and we'd love to get in touch!

Next Play

If you're down bad, realizing finance isn't for you, and want to explore the world of startups (BizOps, chief of staff, strategic finance, etc.), fill out this form. Next Play will reach out to schedule a 1:1 video call if they think they can help as your own, personal startup matchmaker. They've grown their community to over 50k talented professionals and have deep relationships across the tech ecosystem.

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.