Together with

Good Morning,

S&P 500 buybacks are expected to eclipse $1T this year, US pending home sales surged 8.1% in January, supply chains are back to pre-Covid performance, Carlyle co-CIO Peter Clare is retiring, and Elon is back to being the richest mf on the planet.

If you're looking for a great book about investing written by a legendary financier, check out David Rubenstein's latest book: How To Invest.

Let's dive in.

Before The Bell

Markets

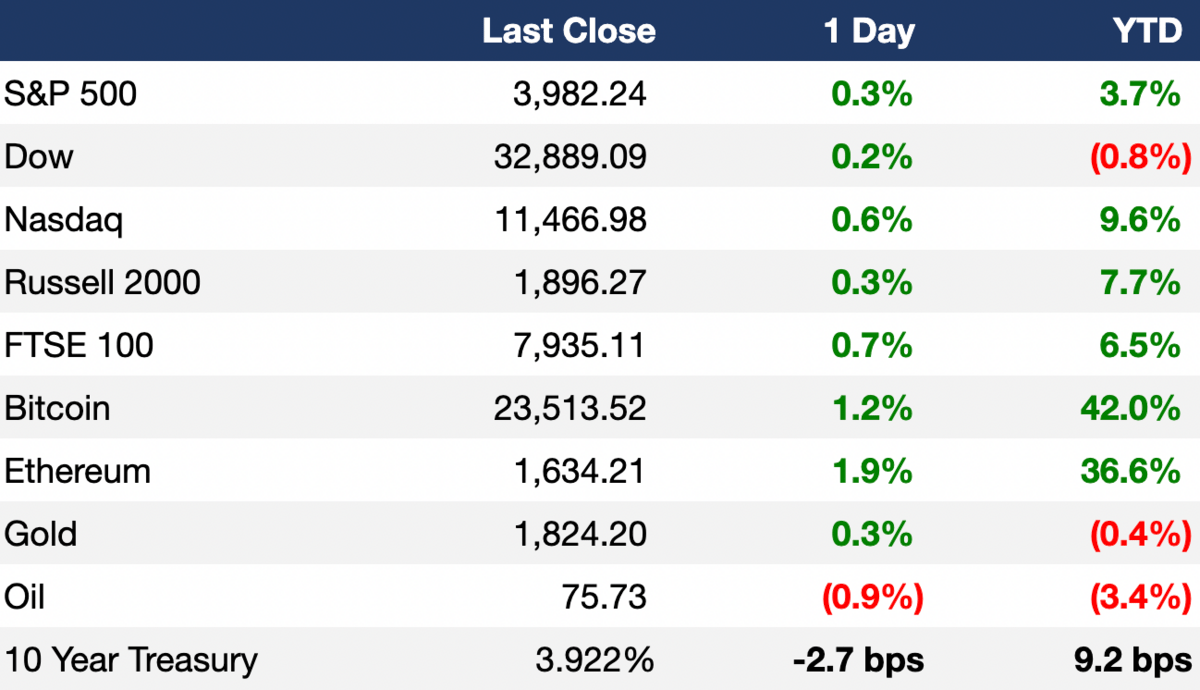

US stocks inched upward yesterday after a brutal past week as investors digested more economic data and prospects for the Fed's rate path

Traders are now pricing US rates to peak at 5.4% this year, compared with ~5% just a month ago

Fed Reserve Governor Philip Jefferson firmly stood by the central bank's 2% inflation goal yesterday

The pan-European Stoxx 600 rose 1.1% yesterday for a 7.9% YTD gain, marking its best performance against the S&P since 2017

The dollar index retreated 0.5%

Investors are bracing for another big week of retail earnings

On Thursday, we'll receive eurozone's February inflation numbers

Earnings

Berkshire Hathaway's Q4 operating profit fell 8% YoY to $6.7B on inflationary pressures, while cash holdings increased by ~$20B to $128.6B; the firm will continue to hoard cash and US T-Bills (CNBC)

Zoom beat Q4 EPS and revenue estimates on steady demand for its video-conferencing service amid the shift to hybrid work and cost cuts, while providing a rosy FY profit outlook; their stock rose 7.5% AH (CNBC)

Workday posted widened Q4 losses but saw a 20% YoY growth in revenue on strong demand for its enterprise cloud applications (MS)

What we're watching this week:

Today: Target, Rivian

Wednesday: RBC, Salesforce, Lowe's, Kohl's

Thursday: TD Bank Group, Costco, Best Buy, Dell, Broadcom, Nordstrom, Victoria's Secret

Full calendar here

Headline Roundup

US pending homes sales surged 8.1% in January for largest gain in 2.5 years (CNBC)

Record-breaking 2023 global bond rally reversed gains this month (FT)

S&P 500 stock buybacks are projected to top $1T this year for the first time (WSJ)

Highly rated US firms are turning to convertible bonds to raise funds amid rising rates (RT)

Supply chains are back to pre-Covid performance, but still fueling inflation (BBG)

Apartment rents fell across the US over last six months (WSJ)

Musk is building an OpenAI rival to fight 'woke AI' (TI)

Insurer RSA will offload $7.8B worth of pension liabilities to Pension Insurance Corporation in UK's biggest such transaction (FT)

JPMorgan is proposing a new Asia credit index with lower China weighting (RT)

Twitter's latest cuts affected 200, with workforce now below 2k (NYT)

Elon Musk regains his spot as the richest person in the world (CNN)

French defense group Thales will hire record high 12k staff this year (RT)

Carlyle co-CIO Peter Clare will retire after 30+ years with the firm (RT)

Union Pacific will replace its CEO amid investor pressure (FT)

Firms are leaning on attrition to downsize (WSJ)

Laid off oil/gas workers are transferring skills to renewable industry (NYT)

SCOTUS will consider constitutionality of Consumer Financial Protection Bureau (AX)

A Message From Simon & Schuster

David M. Rubenstein, cofounder of The Carlyle Group, speaks with some of the most successful, forward-thinking investors across a range of finance disciplines.

Conversations with financiers such as Stan Druckenmiller, Larry Fink, Mike Novogratz, Seth Klarman, and many more reveal deep insights into the principles of investing, portfolio growth, decision making, and indispensable wisdom from the world’s leading investors.

How to Invest is an authoritative guide to the world of finance, private equity, and more, one that can transform your own approach to investing.

Deal Flow

M&A / Investments

The US Federal Trade Commission is expected to challenge financial services company Intercontinental Exchange’s $13B purchase of mortgage software company Black Knight (RT)

PE firm CD&R agreed to buy wealth-management firm Focus Financial Partners in a $7B+ deal (BBG)

Marlboro maker Altria is in advanced talks to buy e-cigarrette startup NJOY for $2.75B+, and plans to divest its stake in Juul Labs (WSJ)

Insurer Elevance Health agreed to buy peer Blue Cross Blue Shield of Louisiana for $2.5B (RT)

Canadian oil and gas producer Baytex Energy is nearing a deal to buy US peer Ranger Oil for ~$2.5B (RT)

Auto parts maker LKQ agreed to buy aftermarket auto parts distributor Uni-Select in a ~$2.06B deal (RT)

An investor group led by PE firm EQT is nearing a deal to buy Radius Global Infrastructure at a ~$1.33B valuation (RT)

Bain Capital and KKR are among suitors selected for next round of bidding for cooling system maker Fujitsu’s ~$1.3B AC manufacturing unit (BBG)

Hospice company Gentiva agreed to buy the hospice and home-care assets from not-for-profit healthcare system ProMedica in a $710M deal (BBG)

Italian payments firm Nexi agreed to buy Spanish bank Sabadell’s payments business for ~$370M (RT)

Carmaker Stellantis agreed to invest $155M for a minority stake in a copper mine in Argentina as part of its push to secure raw materials for EV batteries (RT)

VC

Drone startup Skydio raised a $230M Series E at a $2.2B valuation led by Linse Capital (TC)

Typeface, a generative AI application for enterprise content creation, raised a $65M round from Lightspeed Venture Partners, GV, M12, and Menlo Ventures (PRN)

CodaMetrix, an AI tech platform improving healthcare revenue cycle management, raised a $55M Series A led by SignalFire (PRN)

Ophthalmic biotech company Eluminex Biosciences raised a $40M+ Series B led by Cenova Capital (PRN)

Payment intelligence infrastructure startup Pagos raised a $34M Series A led by Arbor Ventures (TC)

Italian biomedical startup Angiodroid raised a $7.4M Series A (PRN)

Fantasy sports app Champions Round raised a $7M Series A led by Point72 Ventures and Goodwater Capital (TC)

Vouched, an identity verification platform, raised $6.3M in financing led by BHG VC and SpringRock Ventures (PRN)

Inarix, a startup helping farmers determine the quality and value of crops, raised a $3.3M seed round from Ankaa Ventures, Label Investment, Newfund Alliance, and more (PRN)

IPO / Direct Listings / Issuances / Block Trades

Chinese fintech firm Ant Group and Japan's SoftBank are seeking to sell their 25% and 13% respective stakes in Indian fintech Paytm in the open market (RT)

Debt

Fund managers are lining up to buy $3.95B of some of the riskiest slices of debt backing the $16.5B LBO of software maker Citrix from banks led by Goldman Sachs (FT)

Utility companies PPL and Southern Co raised a total of $2.4B via convertible bonds, in a first such raise for investment-grade utilities in 20 years (RT)

Budget Indian airline SpiceJet swapped over $100M of debt owned by aircraft lessor Carlyle Aviation into equity and CCDs and will raise $300M in fresh capital (DSA)

Fundraising

Real-estate tech focused VC Fifth Wall raised $1.5B for three new funds: $866M for their Real Estate Tech Fund III, $149M for their European Fund and $500M for their Climate Fund (PRN)

Real estate investment firm BentallGreenOak raised $100M for a $500M US-focused value-added debt fund (PER)

Czech VC Orbit Capital raised $45M for a $210M+ fund to invest in Central European tech scaleups (SFT)

Blockchain Founders Fund closed its $75M Fund II to invest in pre-seed and seed stage Web3 and blockchain startups (PRN)

Ireland-based Sure Valley Ventures raised $32M to invest in high-growth AI firms in Ireland (SR)

Crypto Corner

Binance moved $1.8B in stablecoin collateral to HFs including Alameda last year in behavior similar to FTX (FRB)

Coinbase will suspend Binance's stablecoin, saying it doesn’t meet listing standards (CD)

SEC subpoenaed Robinhood over their crypto business (BBG)

Crypto exchanges have been allowing Russians to circumvent sanctions (BTC)

Exec's Picks

Have a big idea but struggling to find the right engineers to make it a reality? Meet Lemon.io, your one-stop marketplace for accessing over 1,000 on-demand developers. Lemon.io only offers handpicked developers with 3 or more years of experience and strong proven portfolios, ensuring that you get only the highest-quality talent, and your engineer can start working on your project within a week! Visit Lemon.io to learn more and find your perfect developer.

The Atlantic's Maria Konnikova wrote an interesting piece on George Santos, psychology, and how lying to yourself can increase self-confidence.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.