Together with

Good Morning,

The House is poised to vote on McCarthy and Biden’s debt ceiling proposal, Nvidia joined the $1T valuation club, Goldman is planning more job cuts, Twitter is now worth 33% of Musk’s purchase price, AI experts are worried about “extinction threats,” and Elizabeth Holmes is in prison.

Looking for a resilient asset class to diversify your portfolio? You can invest directly in farmland through today’s sponsor, AcreTrader.

Let’s dive in.

Before The Bell

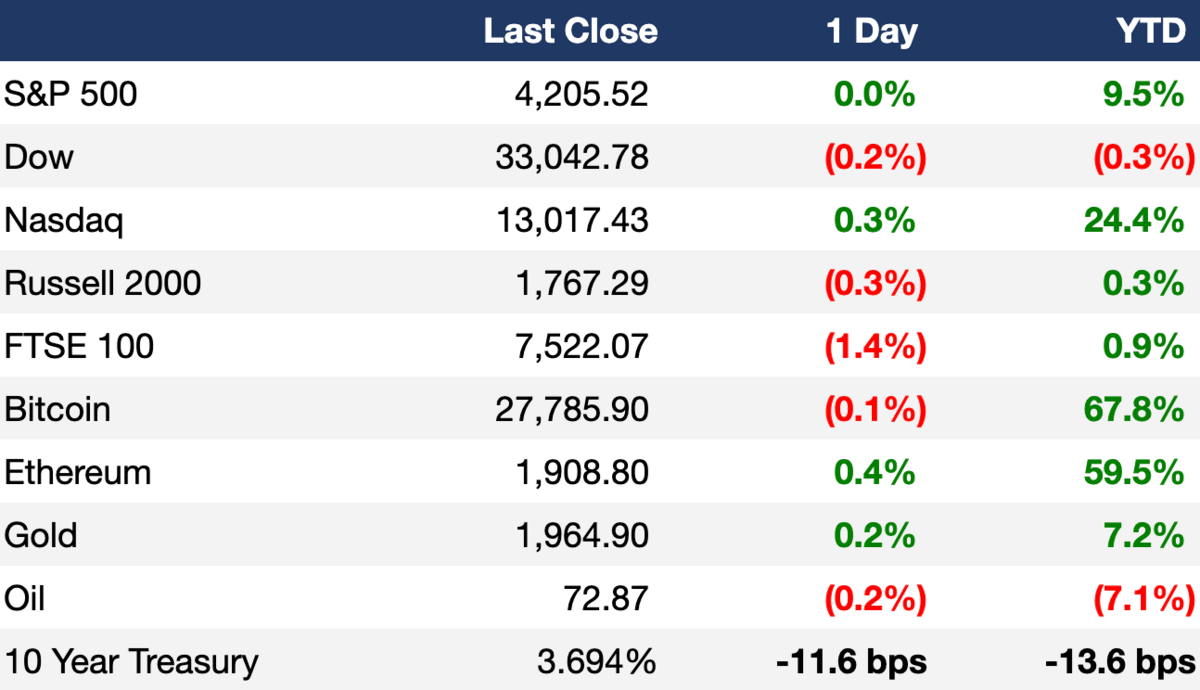

As of 5/30/2023 market close.

Markets

US stocks closed flat as House Speaker Kevin McCarthy and President Joe Biden agreed on a deal to raise the debt ceiling beyond next year’s elections in exchange for a cap on federal baseline spending for two years

The Nasdaq led gains among Wall Street's main indexes

The S&P 500 index hovered near its highest level since August 2022

The dollar index hit a 10-week high

The South African rand hit a record low on the back of a strengthening dollar and souring local investor sentiment

Earnings

HP beat Q2 earnings after overcoming pressure in its PC and printing segments by implementing various cost cutting efforts over the past year, keeping margins intact (YF)

What we're watching this week:

Today: Salesforce, Chewy, CrowdStrike

Thursday: Broadcom, Macy’s, Dollar General, Lululemon, Dell

Full calendar here

Headline Roundup

US House poised to vote on urgently needed debt ceiling suspension (RT)

Debt ceiling bill to cut $1.5T from deficit over decade: CBO (YF)

Nvidia briefly joins $1T valuation club (RT)

China leads the world in preparing for extreme weather threats to power supplies (BBG)

US slaps sanctions on Chinese, Mexican entities in fentanyl action (RT)

Boeing 737 MAX victims’ families can seek compensation for suffering (WSJ)

Goldman Sachs plans to cut under 250 jobs in coming weeks-source (RT)

Twitter is now worth just 33% of Elon Musk’s purchase price (BBG)

Chinese tech entrepreneurs keen to 'de-China' as tensions with US soar (RT)

Japan’s factory output drops in weak start to second quarter (BBG)

A judge has ruled that Purdue Pharma can shield its owners from opioid lawsuits in exchange for a $6B contribution to the company’s bankruptcy lawsuits (RT)

JPMorgan builds unit for world’s richest families in wealth bet (BBG)

Top AI CEOs, experts raise 'risk of extinction' from AI (RT)

Theranos founder Elizabeth Holmes reports to Texas prison (WSJ)

A Message From AcreTrader

Fertile Grounds for Investing

When economic challenges arise, so-called "growth stocks" in your investment portfolio may not live up to their name.

Real, tangible assets such as farmland have shown greater resilience in the face of economic headwinds. Farmland* has an impressive track record:

3 decades of historically consistent positive returns (ending in 2022)

Low volatility

Low to negative correlation to equities

AcreTrader enables accredited investors to invest in the $2.7T farmland asset class in the US, offering potential passive income from annual rent and land appreciation upon sale.

They handpick each parcel to line you up with rigorously evaluated farms across the U.S.

*According to data from NCREIF Total Farmland Index. You cannot invest directly in an index.

*AcreTrader Financial, LLC, member FINRA/SIPC. Farmland investing is speculative and involves high degree of risk, including complete loss of principal and not suitable for all investors. Past performance does not guarantee future results and there is no guarantee this trend will continue.

Deal Flow

M&A / Investments

Mexican Coke bottler Femsa is looking to decrease its stake in Heineken Group and plans to sell $3.5B worth of shares (BBG)

Asda agreed to buy UK and Ireland gas-station company EG Group in a move to create a convenience store retail empire worth $2.8B (BBG)

Singapore’s GIC is acquiring a “less than 25% stake” in German industrial gas maker Messer at an implied $12.9B valuation (BBG)

Macquarie Group is weighing a sale of South Korean gas firm DIG Airgas at a $2B valuation (BBG)

Fleetcor, a provider of fuel cards to vehicle fleets, is exploring a sale of their prepaid card business for $500M-$1B (BBG)

Apollo Global Management is purchasing UK affordable housing maintenance and construction provider United Living for ~$370M+ (BBG)

Bacardi, the global liquor conglomerate, is nearing a deal to acquire Ilegal Mezcal for less than $200M (BBG)

Daimler Truck and Toyota Motor are planning to merge their truck manufacturing subsidiaries Mitsubishi Fuso Truck & Bus and Hino Motors to improve margins and develop new technologies (BBG)

VC

Carrum Health, a value-based healthcare company, raised a $45M Series B led by OMERS Growth Equity (TC)

eXmoor pharma, a UK-based cell and gene therapy manufacturing partner, raised a $35M Series A led by Kineticos Ventures (FN)

Plant-based food group Neat Burger raised an $18M Series B led by B-Flexion (PRN)

Qflow, a startup helping companies de-carbonize construction, raised a $9.1M Series A led by Systemiq Capital (TC)

Proxima Fusion, a startup developing power plants via optimized stellarators, raised a $7.5M pre-seed round led by Plural and UVC Partners (FN)

VRfy, a mining communications technology platform, raised a $6M Series A led by RCF Jolimont Innovation and Beedie Capital (FN)

Dental marketplace Wellplaece raised a $5.5M seed round led by Eniac Ventures and Bee Partners (PRN)

British climate tech startup Cur8 raised a $5.4M pre-seed round led by Google Ventures (FN)

AI-based research assistant Copilot raised a $3.5M Series A led by Building Ventures (TC)

UnifyWork, a workforce intelligence platform, raised $3M in funding from NorthCoast Ventures, JumpStart, and OVO Fund (PRN)

CO2 management SaaS startup zero44 raised a $2.7M round led by Atlantic Labs (FN)

zkMe, a Hong Kong-based zero-knowledge identity provider, raised a $2M pre-seed round from Circle Venture, Spartan Group, CMS Holdings and more (FN)

IPO / Direct Listings / Issuances / Block Trades

Romanian utility company Hidroelectrica’s IPO is garnering strong interest from local pensions and could raise up to $2.1B (BBG)

Saudi Arabia’s First Milling saw $18B of institutional orders for its IPO, allowing it to raise $266M at a $900M valuation (BBG)

Agri-food giant Olam Group’s dual listing in Saudi Arabia and Singapore is expected to be delayed due to regulatory issues (BBG)

SPAC

Anew Medical, a developer of disease therapies, is merging with Redwoods Acquisition Corp. in a $94M deal (BZ)

Debt

Mitsubishi UFJ Financial Group raised $4B worth of debt in Japan’s biggest yen bond deal so far this year (BBG)

Fundraising

Italy is planning to create an investment fund backed by state lender Cassa Depositi e Prestiti to invest in AI startups and promote Italian AI research (RT)

Crypto Corner

Bitcoin prices on crypto exchange Binance Australia were at a 20% discount compared to rival exchanges, a sign customers were looking to exit positions quickly (RT)

Crypto exchange Bybit is exiting Canada, citing recent regulatory developments (CD)

Binance is exploring a proposal to let some of its institutional clients keep their trading collateral at a bank instead of on its platform (BBG)

Exec’s Picks

Executives and early investors sold $22B worth of shares in companies that went public through SPAC deals, according to The Wall Street Journal.

Financial Times broke down the story of a former Centerview partner who has sued the bank, claiming that they wrongly took equity from him works hundreds of millions.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter