Together with

Good Morning,

NFL will meet to discuss PE ownership, SEC was accused of censoring research, RBC countersued their ex-CFO, global stocks capped off a mega week, and US start-up failures are surging.

Check out our new opportunity with Chicago Atlantic Digital Mining Fund, an exciting entryway investment into the digital asset space.

Let's dive in.

Before The Bell

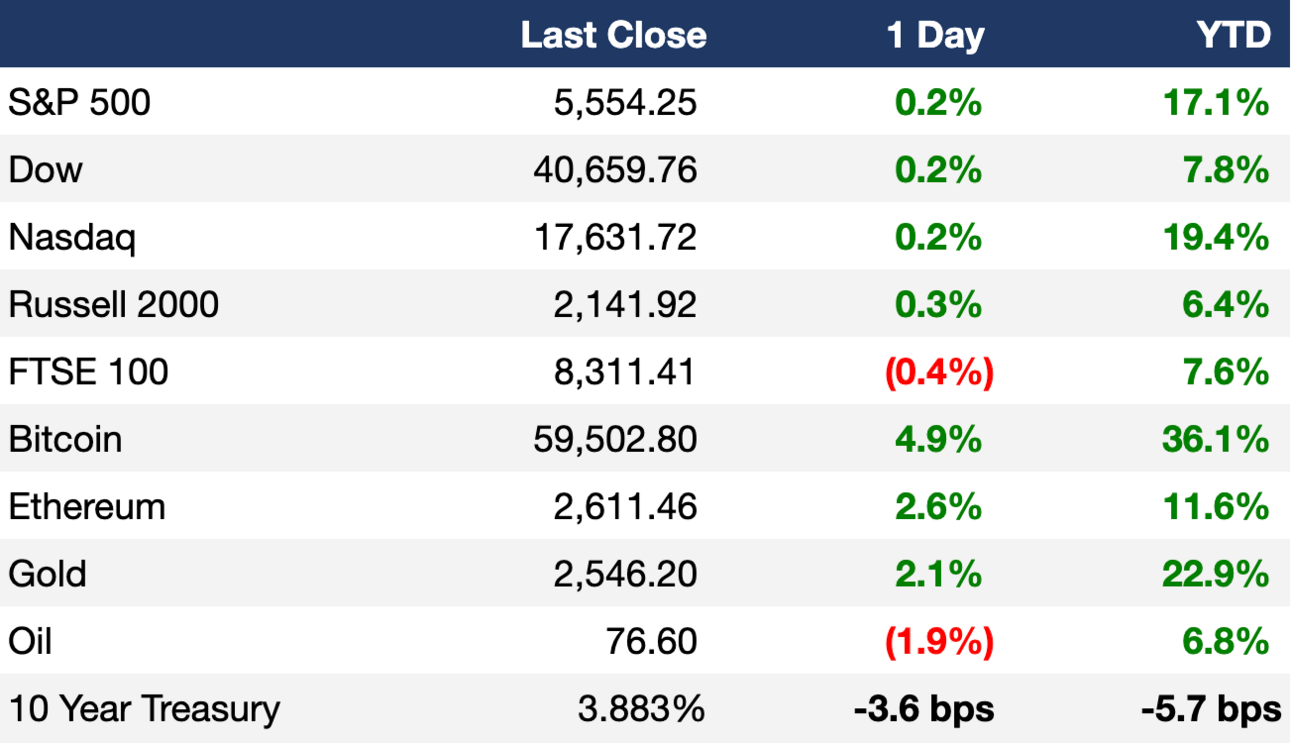

As of 08/16/2024 market close.

Markets

US stocks rose on strengthened expectations of a 'soft landing'

All three major indexes clinched their best week since October

S&P and Nasdaq rose for a seventh-straight day

S&P and Nasdaq posted their first winning week in five

MSCI World index had its best week since November

Europe's Stoxx 600 posted its best week since May

Canada's TSX added 3.3% in its biggest weekly gain in ten months

Japan's Nikkei 225 rallied 3.6% to its best week since Covid

China’s CSI 300 is trading near six-month lows

China 10Y futures saw the largest two-week drop in a year on central bank intervention

Gold surged to a new record high

Iron ore plunged to their lowest in two years on China demand woes

Earnings

What we're watching this week:

Today: Palo Alto Networks

Tuesday: Lowe's

Wednesday: Target, Macy’s

Thursday: TD Bank Group, Cava

Full calendar here

Headline Roundup

US start-up failures are up 7x since 2019 (FT)

NFL execs will vote next week on allowing PE ownership (BBG)

PE firms increasingly using dividend recaps in desperation for cash (WSJ)

US equity funds see biggest weekly outflow in two months (RT)

European fund performance significantly lags US peers after T+1 (FT)

Goldman cut US recession risk to 20% following economic data (BBG)

ExodusPoint's AUM dropped by $1B in H1 (RT)

PwC was hit with a record $19M fine in UK (FT)

Goldman conviction highlights quandary in policing staff behavior (FT)

SEC accused of 'censorship' after forcing scholar to delay research (FT)

Plunging iron ore price wipes $100B off leading miners' market value (FT)

Cash sweep scrutiny is threatening banks credit ratings (RT)

Foreign investors are trading Japan stocks like never before (JT)

Aussie earnings season 'positive surprise' so far (RT)

Banks are becoming the next club promoters (WSJ)

56% of Fortune 500 firms see AI as risk to business (FT)

A US judge blocked Disney, Fox and Warner Bros' sports streaming JV (FT)

Mastercard is cutting 3% of its workforce (RT)

RBC countersued ex-CFO Nadine Ahn (RT)

X is closing operations in Brazil (RT)

One in ten US homes are now worth over $1M (WSJ)

A Message From Chicago Atlantic

Beyond Bitcoin

We're Chicago Atlantic, an alternative investment management firm with over $1.7 billion in assets under management. Our approach capitalizes on niche strategies where demand for capital exceeds traditional supply. We serve institutions, family offices and private clients.

Today, in partnership with Exec Sum, we've opened our new Digital Mining Fund to all accredited investors.

What's the Opportunity?

A de-risked investment in the crypto space with monthly cash flow distributions, tax depreciation benefits, attractive returns and potential capital appreciation.

Since inception, we have distributed annualized returns of 36 percent.

Why Invest?

Infrastructure for miners is in high demand. With the Digital Mining Fund, you are investing in real assets with bonus depreciation and in data center infrastructure with significant electrical power availability and applications beyond the crypto landscape. These investments in a fund structure offer less volatility and higher potential for growth than simply buying and holding Bitcoin.

Want to Learn More?

Submit your interest here and a Chicago Atlantic advisor will share the opportunity.

Deal Flow

M&A / Investments

Sierra Space is in talks to acquire Boeing and Lockheed Martin rocket-launching JV United Launch Alliance for $2B-$3B (RT)

Repligen, a provider of drug manufacturing equipment, approached $2.5B-listed Maravai LifeSciences with an acquisition offer (RT)

Medical device maker Nova Biomedical is exploring a sale for over $2B (BBG)

TA Associates and Silversmith Capital Partners are exploring a 60% stake sale in collaboration software maker Appfire at an over $2B valuation (RT)

EQT will take private property search firm PropertyGuru in a $1.1B all-cash deal (BBG)

US conglomerate Koch Industries,will acquire Swedish telecom-equipment maker Ericsson’s US call-routing business Iconectiv for $1B cash (BBG)

Audax Private Equity will acquire Avantor's clinical services business in a $650M deal (WSJ)

New Zealand freight-forwarding firm Mondiale VGL is preparing to kick off a $600M sale (BBG)

Chile's Empresas Copec will acquire Spanish oil company Cepsa's LNG unit Gasib in Spain and Portugal for $302M (RT)

Bryant Riley, the co-founder and largest shareholder of B. Riley Financial, offered to take the company private at a ~$210 equity valuation (BBG)

Entertainment Network India will acquire Indian music streaming platform Gaana, once valued at $580M, for $30k (ISN)

Korean AI chip makers Rebellions and Sapeon agreed to merge (RT)

UBS will divest its Quantitative Investment Strategies business to Manteio Partners (RT)

Indian conglomerate Tata expressed interest in buying some of India's debt-laden, power distribution companies (FT)

VC

IPO / Direct Listings / Issuances / Block Trades

Debt

Bankruptcy / Restructuring

German battery maker Varta reached a restructuring agreement to reduce debt and grant ownership to Porsche and billionaire Michael Tojner (RT)

Fundraising

PE FoF HarbourVest Partners raised $18.5B across two funds to invest in PE secondaries (WSJ)

Crypto Corner

Binance and others are restarting operations in India (BBG)

Exec’s Picks

If y'all are in the market for some premium coffee, Cometeer is a brand I've exclusively been drinking lately. They come in flash frozen pods to protect the beans' rich flavors and they'll have you ready to run through a brick wall. Check 'em out here.

Financial Services Recruiting 💼

If you're currently a junior banker looking to break into the buy side, lateral to another investment bank, or consider new paths amid changing market dynamics, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, debt funds, and investment banking.

To get started, simply head over to Litney Partners and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter