Together with

Good Morning,

US and China agreed to a TikTok deal, PE is pouring billions into failing firms, private markets exposure is rising at top pension funds, BlackRock named twenty members to its top executive committee, and Swiss National Bank has quietly become one of the world's biggest tech investors.

The same VCs who invested in eBay, Uber, and Venmo before they got big are now backing another up-and-comer: Pacaso. Founded by a former Zillow exec, Pacaso brings co-ownership to the $1.3T vacation home market. And you can invest in Pacaso as a private company today. Check out the offering.

Let's dive in.

Before The Bell

As of 9/16/2025 market close.

Click here to learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks eased from ATHs yesterday as traders awaited a crucial Fed rate decision

MSCI all-country index hit an ATH ahead of major global central bank rate decisions

Europe's Stoxx 600 slid over 1% to a one-week low

Gold's 40% YTD rally is its best in forty-five years

Dollar fell to a four-year low vs euro

Earnings

What we're watching this week:

Today: General Mills, Cracker Barrel, Bullish

Thursday: FedEx, Darden Restaurants

Full calendar here

Prediction Markets

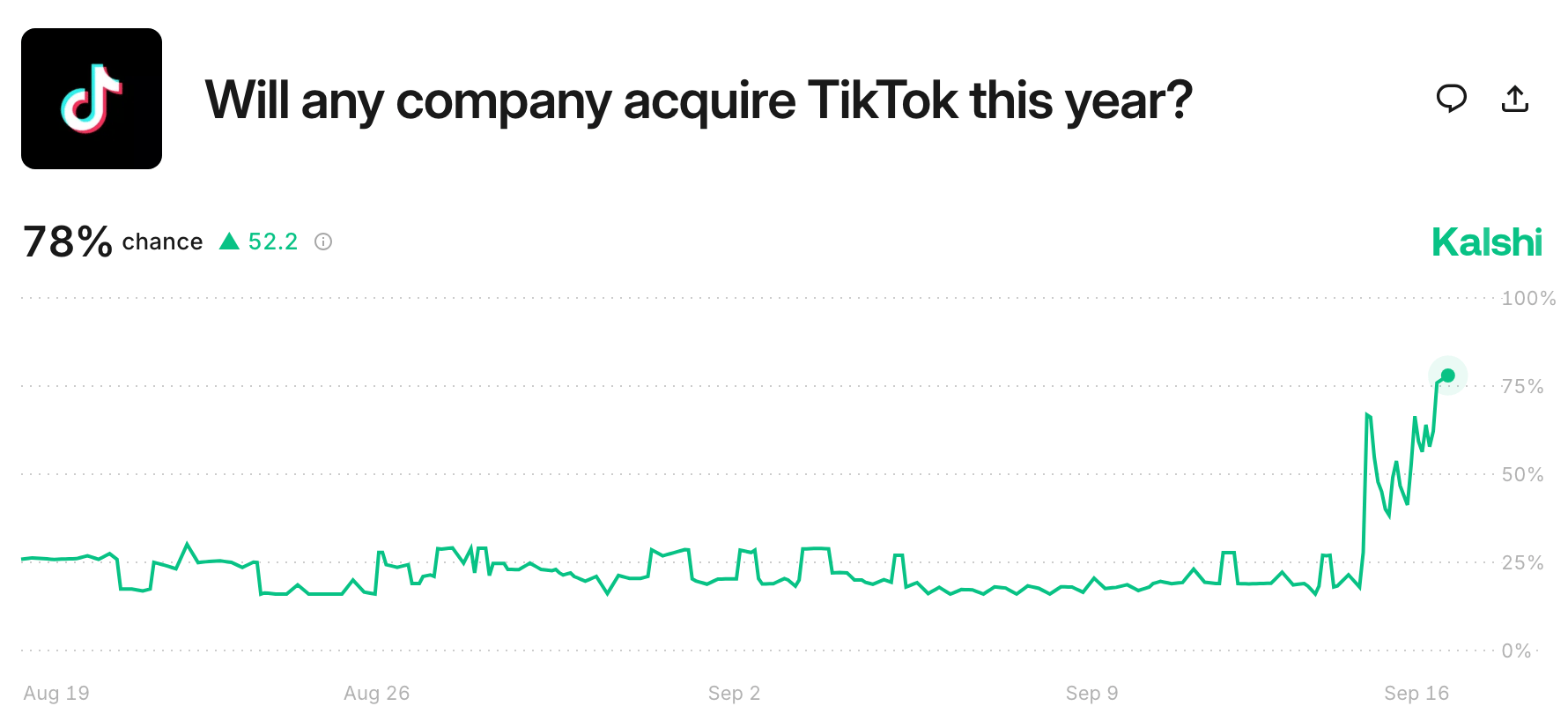

Wonder what the breakup fees looks like for the TikTok US deal.

Headline Roundup

Switzerland's central bank is one of the world's biggest tech investors (FT)

US again extended TikTok sale deadline with deal terms in place (BBG)

US begins review of USMCA trade deal with Canada and Mexico (FT)

PE is pouring billions into troubled firms that fail (BBG)

Private markets exposure rises at top pension funds (BBG)

Europe's PE-owned staffing firms are getting squeezed (BBG)

Trump's SEC is tilting balance of power from investors to CEOs (FT)

Hedge funds asked SEC to ease short seller rule on public offerings (BBG)

US firms' euro bond sales hit a record $100B YTD (RT)

US retail sales rose for third-straight month (BBG)

BlackRock named 20 new members to global exec committee (FT)

Texas is investigating proxy advisers amid ESG backlash (RT)

Barclays is planning a $1B revamp of trading floors at its NYC HQ (BBG)

OpenAI hired xAI's ex-CFO Mike Liberatore (BBG)

Goldman and Morgan Stanley defeated Archegos insider trading appeals (RT)

Nestlé chair Paul Bulcke stepped down amid CEO turmoil (FT)

US is seeking 12 years for Charlie Javice in JPMorgan fraud case (BBG)

Augusta National added Amazon Prime to broadcast 2026 Masters (BBG)

Trump sued New York Times for $15B (FT)

US mortgage rates dropped to a three-year low (CNBC)

NY indicted five RCI Hospitality execs in fraud and bribery scheme (CNBC)

A Message from Pacaso

Major investors bet big on this "unlisted" stock

When the former Zillow exec who sold his last company for $120M starts a new venture, people notice. Take some of the early investors in Uber, Venmo, and eBay. They're each investing in Pacaso.

Disrupting the real estate industry once again, Pacaso's streamlined platform offers co-ownership of premier properties, revamping the $1.3 trillion vacation home market.

And it works. By handing keys to 2,000+ happy homeowners, Pacaso has already made $110m+ in gross profits in less than 5 years. They even recently reserved the Nasdaq ticker PCSO & secured a $100M private credit facility.

And you can join them as an investor for just $2.90/share. But there's no time to waste.

This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving the ticker symbol is not a guarantee that the company will go public. Listing on the Nasdaq is subject to approvals.

Deal Flow

M&A / Investments

A consortium of Oracle, VC firm a16z, and PE firm Silver Lake are in talks to acquire an 80% stake in TikTok US from Chinese-owner ByteDance under a US-China framework where the app will retain its Chinese algorithm

French telecoms tycoon Patrick Drahi is set to relaunch a sale of his 50.01% stake in French broadband network XpFibre at a potential $12B valuation with KKR, BlackRock's GIP, French PE firm Ardian, Australian infrastructure investor IFM, and Canada's La Caisse as interested parties

Abu Dhabi AI investment firm MGX joined PE firm Silver Lake's buyout group in acquiring a 51% stake in Intel's programmable chip business Altera for $8.75B

Japan's top power generator JERA is in advanced talks to acquire US natural gas production assets from a JV between Blackstone-backed GeoSouthern Energy and Williams Companies for $1.7B

Apollo is exploring a sale of internet pioneer AOL at a $1.5B valuation

HR software firm Workday agreed to acquire workplace AI firm Sana for $1.1B

Australia's Macquarie, Manila Electric Company and Stonepeak Partners are exploring a sale of telecoms tower firm PhilTower at a $1B valuation

File-sharing website LimeWire acquired infamous festival brand Fyre Festival for $250k

Rithm Capital is nearing an acquisition of NYC and San Francisco office landlord Paramount Group

Italian shipbuilder Fincantieri is in talks to acquire some robotics and underwater assets from Italian O&G services firm Saipem ahead of its merger with Norway peer Subsea7

India's Jindal Steel submitted a non-binding offer to acquire German industrial engineering group Thyssenkrupp's European steel operations

VC

Robotics startup Figure AI raised a $1B Series C at a $39B post-money valuation led by Parkway Venture Capital

Smartphone startup Nothing raised a $200M Series C at a $1.3B valuation led by Tiger Global

Chestnut Carbon, a nature-based carbon removal developer, raised a $90M Series B extension from Canada's CPPIB

SEON, an AI platform to prevent fraud and money laundering, raised an $80M Series C led by Sixth Street Growth

CodeRabbit, an AI code review platform, raised a $60M Series B led by Scale Venture Partners

Energy management solutions startup ENTOUCH raised a $50M round led by Respida Capital

PayNearMe, a payment experience management fintech, raised a $50M Series E from AVP

Conceivable Life Sciences, an AI-powered IVF lab, raised a $50M Series A led by Advance Venture Partners

Modern Animal, a veterinary startup reimagining pet care, raised $46M in funding led by Addition, True Ventures, and Upfront Ventures

WorkFusion, a startup using AI agents to help financial compliance, raised $45M in funding led by Georgian

AI-native restaurant management platform Nory raised a $37M Series B led by Kinnevik

Virtual fencing agritech Nofence raised a $35M Series B led by European Circular Bioeconomy Fund

DRUID AI, a Romanian AI 'agentic' platform, raised a $31M Series C led by Cipio Partners

Battery storage startup Sympower raised a $22.5M Series B-1 led by PGGM

Fourth Power, a startup building thermal batteries for energy storage, raised a $20M Series A+ led by Munich Re Ventures

Spara, a startup combining voice, chat, and email into a single platform, raised a $15M seed round led by Radical Ventures and Inspired Capitalt

Metalbear, a startup allowing developers to run local code in cloud environments, raised a $12.5M seed round led by TLV Partners

Nutrium, an all-in-one corporate nutrition solution, raised a $12M Series A led by Vesalius Biocapital

Noble Mobile, a mobile virtual network operator that resells wireless service, raised a $10.3M seed round led by Corazon Capital

Plumerai, a UK startup developing AI solutions for cameras, raised an $8.7M Series A led by Partech and OTB Ventures

AI-powered crypto wallet Senpi raised a $4M seed round led by Lemniscap and Coinbase Ventures

LatAm data and AI consultancy Indicium raised a minority investment from Databricks Ventures

IPOs / Direct Listings / Issuances / Block Trades

Malaysia's MMC Port Holdings is in talks to raise $2B at a $7B valuation in what could be Malaysia's biggestIPO since 2012

China's Chery Automobile is seeking to raise $1.2B in a Hong Kong IPO

China's medical devices giant Mindray Bio-Medical Electronics picked banks for a $1B Hong Kong listing

Cybersecurity firm Netskope raised its IPO offering to $908M at a $7.3B valuation

Indonesian gold miner Merdeka Gold Resources is seeking to raise $284M in what could be Indonesia's largest IPO this year

Carlyle-backed Japanese beer maker Orion Breweries is set to raise $183M in an IPO priced at the top of the range

Fertilizer producer Oman India Fertilizer begun preparing for an Oman IPO

SPAC / SPV

AI cloud infrastructure firm Boost Run agreed to merge with Willow Lane Acquisition Corp. at a $614M valuation

Debt

Chemicals giant DuPont plans to buy back $2.16B of debt with its bond exchange

Honeywell's specialty materials business Solstice raised $2B in high yield debt ahead of its spinoff

Chinese tech giant Tencent raised $1.3B in its first Dim Sum bond sale in four years

German auto parts maker ZF Friedrichschafen upsized its bond sale to $1.25B

HPS Investment Partners and Blue Owl Capital are providing $1.2B in private credit to support GTCR's $2.5B acquisition of residential security company SimpliSafe from H&F

JPMorgan and Nomura led a $588M debt financing package for Canada's OTPP's $1.2B acquisition of Spanish dental provider Donte Group

SoftBank-backed rewards startup Fetch raised its private credit facility with Morgan Stanley to $110M

Bankruptcy / Restructuring / Distressed

US International Development Finance Corp. is in talks with Orion Resource Partners to establish a $5B JV fund to invest in mining and critical minerals

Creditors in a US court began examining experts, advisers, and an Elliott exec as its Elliott-affiliate Amber Energy leads bidding at $5.9B for Citgo Petroleum's parent

Liquidators of collapsed Chinese developer Evergrande were appointed to identify and preserve assets of founder Hui Ka Yan

Fundraising / Secondaries

A Hong Kong real estate industry group is urging Hong Kong to set up a $2.5B distressed properties fund to help prevent systemic financial risks

UK private credit firm Pemberton raised $1.7B for a debut NAV fund

Greece's new innovation and infrastructure fund is seeking to invest $1.2B over next four years

Aspire11, an investment platform for pension fund LPs, launched a $593M debut Europe-focused VC fund

Abu Dhabi AI investment firm MGX is looking to raise a debut fund with minimum $500M commitments

European PE firm EQT launched a new private markets fund for retail investors

Crypto Sum Snapshot

US-UAE mega investment deal involved crypto riches for Trump family

UK crypto market maker LMAX will offer 100x-leveraged crypto bets for institutions

DeFi firm Centrifuge tokenized Apollo's private credit fund

Santander’s online bank Openbank started offering retail crypto trading

Subscribe to our dedicated Crypto Sum newsletter for the most important stories on everything crypto.

Exec’s Picks

Think fast: crosswords are too long, Wordle's too basic. Triplit is the daily puzzle you'll actually stick with—quick, clever, and growing like an IPO pop. Join thousands already playing free on web and mobile.

OpenAI released a figure breaking down what people use ChatGPT for.

Joe Wiggins explores a few reasons for why high-yield spreads are near historic lows.

Emelia Fredlick wrote a great piece analyzing the 150-year historic performance of the 60/40 portfolio.

Of all nations, Saudi Arabia is emerging as a solar power ahead of others.

Finance & Startup Recruiting 💼

Litney Partners

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting venture between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm), Litney Partners places talent at leading firms in PE, hedge funds, VC, growth, credit, IB, and fintech and is currently recruiting for some incredible roles. Head over to our website to drop your resume and we'd love to get in touch!

Next Play

If you're down bad, realizing finance isn't for you, and want to explore the world of startups (BizOps, chief of staff, strategic finance, etc.), fill out this form. Next Play will reach out to schedule a 1:1 video call if they think they can help as your own, personal startup matchmaker. They've grown their community to over 50k talented professionals and have deep relationships across the tech ecosystem.

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.