Together with

Good Morning,

Trump named hedge fund titan Scott Bessent as Treasury secretary, Japan approved a mega stimulus package, US stocks are leaving global peers in the dust, and TikTok's CEO sought Musk's advice after Trump's win.

Tired of manual finance ops and outdated tech stacks? Automate your portfolio companies' financial busywork, maximize productivity, and cut wasteful spending with Ramp's all-in-one financial operations platform.

Let's dive in.

Before The Bell

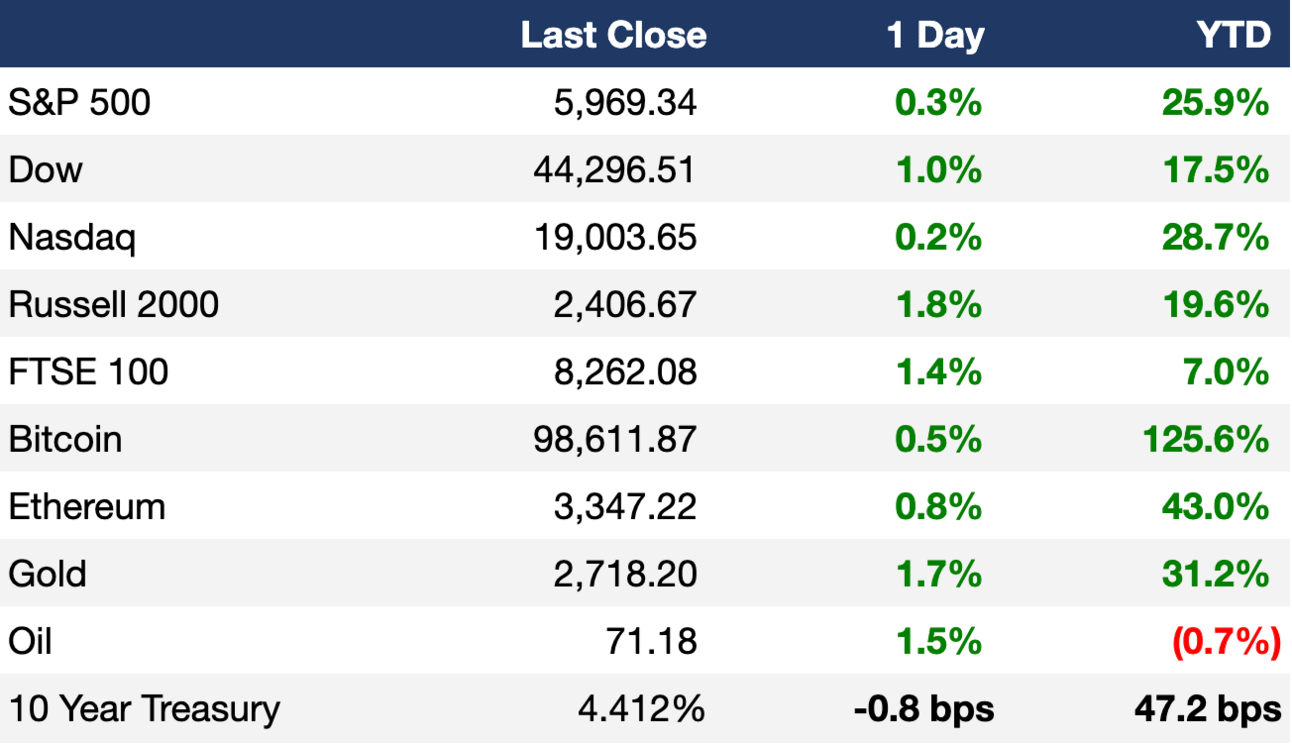

As of 11/22/2024 market close.

Markets

US stocks rallied on Friday as investors continued to rotate from tech to cyclical in a post-election trend

Dow notched a new ATH

UK's FTSE 100 posted its best week in six months

Europe's Stoxx 600 jumped 1.2% in its best day in two months to break a four-week losing streak

China's CSI 300 dropped over 3% on a broad tech selloff amid poor earnings

Australia's ASX 200 hit an ATH

Germany 10Y Bund swap spreads turned negative for the first time as investors bet on end to 'debt brake'

Pound dropped to a six-month low versus the dollar

Euro fell to a two-year low on bets of a dovish ECB

Earnings

What we're watching this week:

Today: Zoom

Tuesday: Dell, CrowdStrike, Best Buy, Macy's, Abercrombie & Fitch

Full calendar here

Headline Roundup

US business activity rose to a 31-month high (RT)

Japan approved a $140B stimulus package (WSJ)

PE firms use Trump rally to cut borrowing costs and fund dividends (FT)

Global equity returns are disappearing as US markets rocket higher (CNBC)

Leveraged hedge funds magnified the August market selloff (FT)

Trump named hedge fund titan Scott Bessent as Treasury secretary (CNBC)

China startups suffer as IPO freeze prompts investors to exercise redemption rights (RT)

Goldman Sachs PE funds will take a $900M hit on Northvolt stake (FT)

TikTok CEO sought Musk's advice amid Trump election (WSJ)

Banks weigh halting fresh credit to Adani amid US indictment, sending bonds to year-lows (RT)

Starbucks slashed coffee hedging despite soaring prices (FT)

US will reduce Intel's federal CHIPS grant (NYT)

NY Fed paper challenges notion of discount window stigma (RT)

Sony is working on a handheld PS5 to rival Switch (BBG)

A Message from Ramp

Your portfolio companies are done wasting time and money on manual expenses, out-of-policy spending, and outdated tech stacks.

It's time to introduce them to Ramp.

A modern finance platform that saves teams time and money through:

Corporate Cards

Expense Management

Accounts Payable

Travel

Procurement

All powered by automation. All under one roof.

Offer your portfolio finance leaders 20x higher lines of credit, customizable spend controls, and streamlined workflows to make their lives, and your lives easier.

Deal Flow

M&A / Investments

The founding family of 7-Eleven-owner Seven & i sounded out KKR, Bain Capital and Apollo over its potential $58B MBO

Lattice Semiconductor and PE firms Francisco Partners, Bain Capital and Silver Lake are exploring a potential acquisition of Intel's multi-use telecom chip unit Altera, which Intel values at $17B

Altas Partners and Leonard Green & Partners are considering a sale of commercial roofing company Tecta America at a potential $3B-$4B valuation, including debt

CVC and an unidentified European broadcaster are studying potential bids for all or parts of $3.2B-listed UK broadcaster ITV

Halozyme Therapeutics withdrew its $2.1B bid for German drug developer Evotec

KKR, VTTI Energy Partners, and Japanese shipping giant Mitsui OSK Lines are bidding for $1.6B bulk liquid storage company LBC Tank Terminals, which is owned by APG Asset Management, Ardian and PGGM

Protective Industrial Products, a portfolio company of PE firm Odyssey, will acquire Honeywell International's PPE unit for ~$1.3B

Aramco Digital is in talks to take a $1B stake in US telecom software maker Mavenir at a ~$3B valuation

Asian investment firm PAG will acquire Indian packaging company Manjushree Technopack from Advent International in a ~$1B deal

Goldman Sachs Asset Management will acquire Maltese broadband service provider Melita from EQT in a $782M deal

Pacific Equity Partners proposed a takeover of Australian mobility solutions firm SG Fleet for $780M

Ally Financial is exploring a sale of its credit card arm, which it acquired for $750M in 2021

Perella Weinberg Partners Capital Management and Innovatus Capital Partners are exploring a sale of auto lender Flagship Credit Acceptance which could fetch $400M

Affinity Equity Partners is in talks to acquire Malaysian seafood supplier Golden Fresh for ~$290M

Azerbaijan's state energy company Socar is in talks to sell natural gas distribution business Socar Turkey for several hundred million dollars

DirecTV scrapped its proposed merger with rival Dish Network due to objections from creditors

VC

OpenAI-rival Anthropic raised another $4B from Amazon

Zepto, an Indian quick-commerce startup, raised a $350M round at a $5B valuation from Motilal Oswal, Raamdeo Agarwal, and more

AI chip startup MatX raised an ~$80M Series A at a ~$300M+ valuation led by Spark Capital

Wordware, a full-stack OS for AI development, raised a $30M seed round led by Spark Capital

Indian insurtech Zopper raised a $25M Series D led by Elevation Capital and Dharana Capital

Podium, a Singaporean cloud platform to streamline the design-to-supply process for building production, raised a $14.8M Series A-1 led by Autodesk

Energy management startup METRON raised a $13.1M round led by GET Fund

Mexican trucking finance startup Solvento raised a $12.5M Series A led by Cometa

Fondo, an AI bookkeeping service for founders, raised a $7M seed round led by Money Forward

IPO / Direct Listings / Issuances / Block Trades

AI cloud computing startup CoreWeave plans to raise $3B at a $35B valuation in a Q2 2025 US IPO

Apax Partners and Warburg Pincus are exploring an IPO of Dutch telecom Odido, which could be valued at $7.3B

Abu Dhabi's ADNOC is considering an additional 3%-5% stake sale of ADNOC Gas, which could fetch up to $3.5B

India's NTPC Green Energy, the renewable energy arm of state-owned NTPC, garnered $1.8B worth of bids for its $1.2B IPO

SPAC

Battery EV solutions provider Aiways Automobile Europe will merge with Hudson Acquisition I Corp. in a $410M deal

Debt

Advance Magazine Publishers plans to establish a credit facility against a $1.2B stake in Reddit

Brookfield wil provide ~$1.1B to backstop for Canary Wharf's refinancing

A group of banks led by Deutsche Bank is seeking to sell a $700M term loan to pay for the acquisition of protein bar brand FitCrunch

D.E. Shaw is seeking to sell a $402M portfolio of Spanish non-performing loans and real estate assets

Chinese conglomerate Wanda is seeking to extend a $400M bond amid liquidity strains

Bankruptcy / Restructuring / Distressed

Hearthside Food Solutions, a snack producer owned by Charlesbank Capital Partners and Partners Group, filed for Chapter 11 bankruptcy

Fundraising

Early-stage software VC Theory Ventures closed its second fund at $450M

Crypto Corner

Exec’s Picks

Financial Times explored the phenomenon of padel, a booming sport which is taking over the world.

In his latest piece, Tom Morgan reflects on a few experiences that led to an incredible new perspective on the real value of money.

F.D. Flam published a really insightful piece revealing how over-quantification of information actually hinders our judgement and decision-making.

Long Angle: A Vetted Community for High-Net-Worth Entrepreneurs and Executives

Long Angle is a private, vetted community for 30-55 year-old entrepreneurs and executives with a net worth of $5M to $100M.

Engage in confidential discussions, live meetups, peer advisory groups, and get access to curated alternative investments.

No membership fees.

Hedge Fund Analyst Opportunity 💼

We are working with Pantera Capital to hire an Investment Analyst for their Liquid Token Fund, an open-ended fund focused primarily on liquid tokens.

With $5B total firm AUM, Pantera was the first US institutional asset manager focused exclusively on blockchain technology.

If you are crypto native and have deep fundamental analysis skills with 1-4 years of investment banking, private equity, hedge funds, consulting, or equity research experience, this is the perfect opportunity for you!

Bonus points if you manage your own portfolio of digital assets and can discuss your investment strategy.

Learn more and apply below:

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.