Together with

Good Morning,

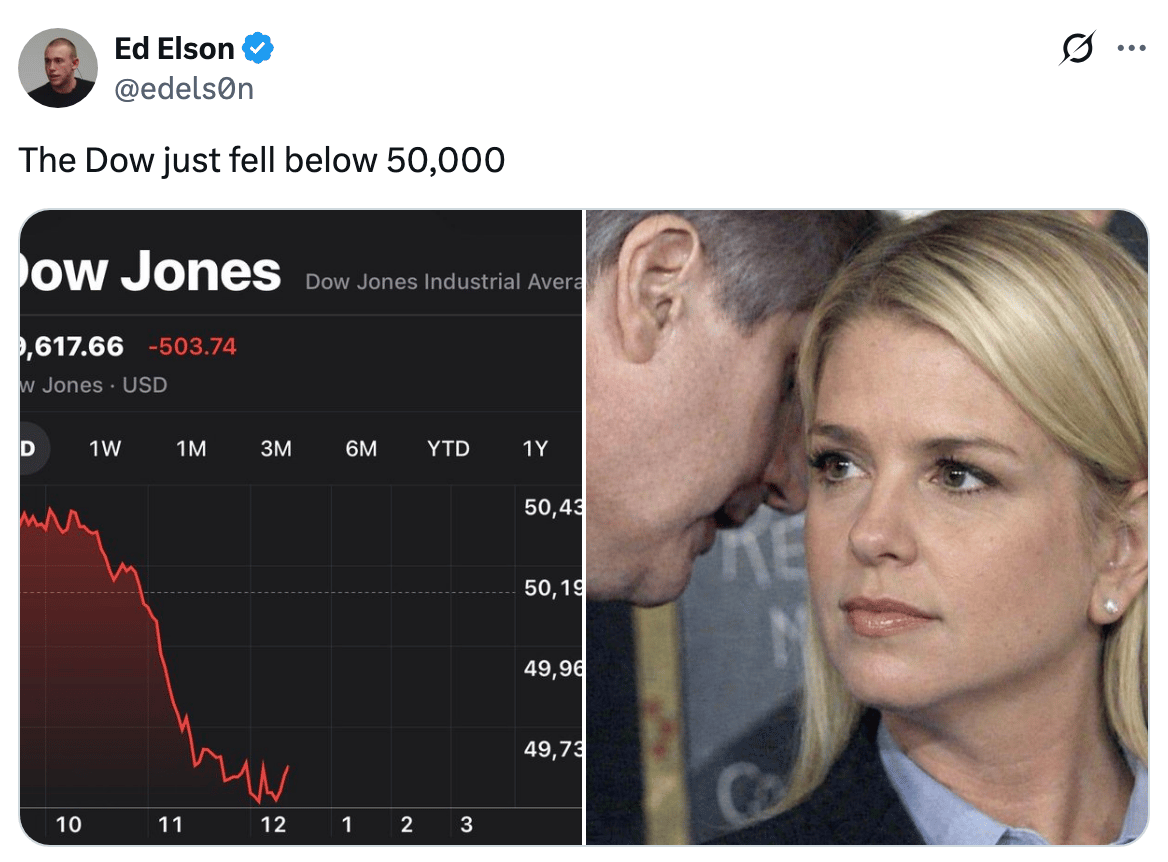

AG Pam Bondi went on a stock market rant in response to a Congressional grilling on the Epstein files. The stock market fell. A good top indicator in hindsight…

If you actively trade derivatives alongside your buy-and-hold investments, check out tastytrade. Their platform is tailored towards individual traders and is highly regarded for their low commissions and experienced trade desk team.

Let's dive in.

Before The Bell

As of 2/12/2026 market close.

Learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks plunged yesterday as AI's existential threat continued to spread across markets

S&P fell for a third-straight day to turn negative YTD

Korea's KOSPI index surged 3% to take YTD gains near 30%

The index gained 75% in 2025

Oman's MSX 30 index is up 9% on track for its best week since 2014 on hopes of securing EM status

The index is up 20% YTD, almost double of the MSCI EM index

Indonesia 10Y yield premium climbed to 230 bps on market governance woes

El Salvador CDSs rose to five-month highs on a Bitcoin rout

Sugar prices tumbled to their lowest since Covid in new Ozempic-era

Earnings

Coinbase missed Q4 earnings and revenue estimates by a landslide on a 20% revenue plunge and surprise $677M loss due to cooling crypto markets (BBG)

Brookfield beat Q4 earnings and revenue estimates buoyed by strong results in its asset and wealth management unit (BBG)

Rivian beat Q4 earnings and revenue estimates but expects to sustain losses amid rapid increase in EV production (CNBC)

DraftKings beat Q4 earnings and revenue estimates on its first FY profit but issued a cautious forecast on rising prediction market competition (BBG)

Applied Materials issued a Q2 beat-and-raise on soaring demand for AI computing infrastructure (BBG)

SoftBank beat Q3 earnings and revenue estimates on aggressive AI bets including a $4.2B unrealized gain on its OpenAI stake and $2.4B gain in its Vision Fund (CNBC)

Instacart issued a Q4 beat-and-raise on its strongest gross transaction value in three years as its enterprise platform gains momentum (CNBC)

Pinterest missed Q4 earnings and revenue estimates and issued weak guidance just weeks after announcing layoffs and a pivot towards AI (BBG)

What we're watching this week:

Today: Moderna, Wendy's

Full calendar here

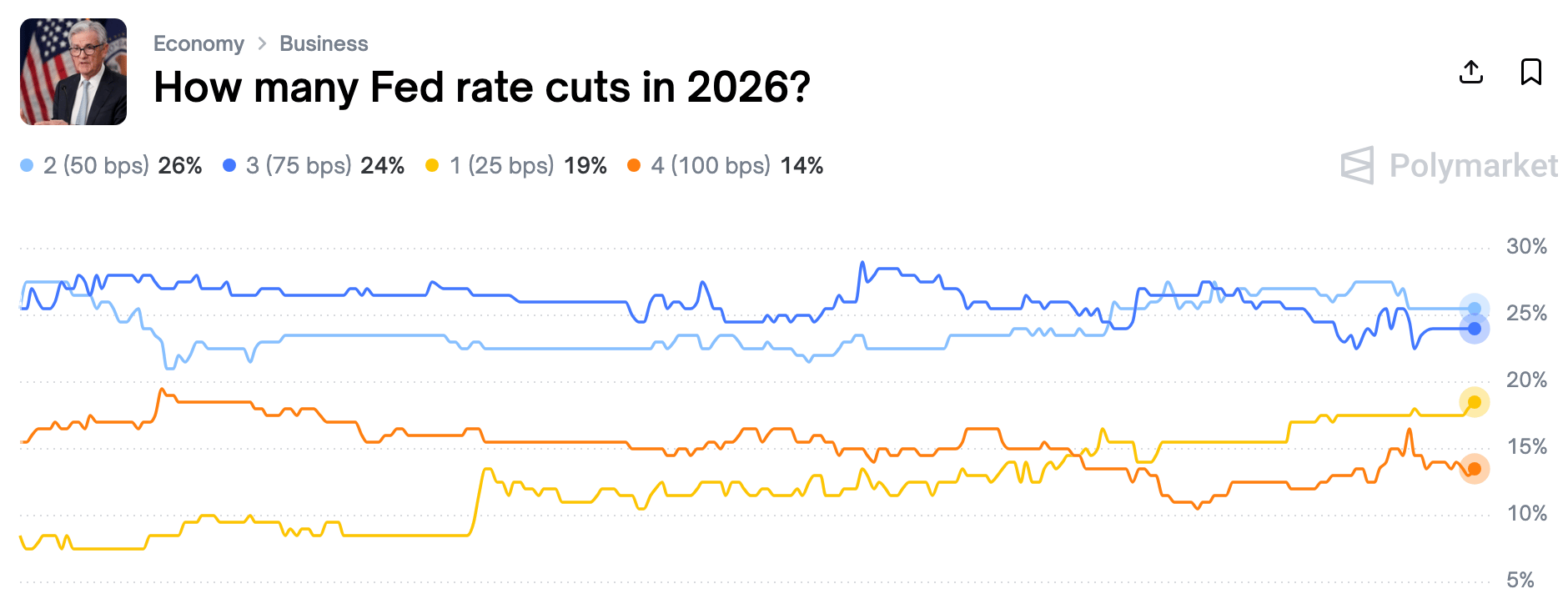

Prediction Markets

So much for Trump's new Fed chair pick.

Trade event contracts on Polymarket, the world's largest prediction market.

Headline Roundup

AG Bondi touts stock rally in response to Epstein questions (CNBC)

US crackdown on Minnesota fraud sends banks scrambling (BBG)

US labor market is stabilizing with housing sector still subdued (RT)

Logistics stocks became the latest AI Grim Reaper victim (BBG)

Prospect of $1T in debt sales drown out tech IPO hype (CNBC)

Record low corporate bonds spreads prompt 'bubble' fears (FT)

Alphabet's 100Y sterling bond raises new fears over AI debt spree (CNBC)

Secondaries were the largest on average among funds raised last year (PEI)

Chinese banks face talent crunch test in Hong Kong IPO boom (RT)

Four of GIP's six co-founders launched family offices since BlackRock's purchase (BBG)

Citigroup boosted CEO Jane Fraser's pay by 22% to $42M (RT)

Four partners quit EY after breaching independence rules (FT)

Spotify developers have written zero code since December (TC)

ByteDance's new video AI model went viral in China (RT)

Polymarket opened NYC's first free grocery store (BBG)

Palo Alto chose didn't blame China for hacking for fear of retaliation (RT)

Hermes CEO Axel Dumas called Jeffrey Epstein a 'financial predator' (RT)

US will end Minnesota ICE blitz (BBG)

Ghislaine Maxwell pleaded the fifth in Congressional testimony (WSJ)

A Message from tastytrade

You, me, and volatility

Staying on top of markets, a never-ending news cycle, and volatility that's...volatile is a lot of work. Let alone knowing what to do with your portfolio once you’re caught up.

No matter what the market is doing, tastytrade has the tools you need to stay up-to-date and trade your way through it.

With tastytrade you get advanced charts, in-feed news, and smart tools to help you quickly adapt your strategy when the market shifts. You can manage your entire portfolio (stocks, options, futures, FX, and crypto) all on one platform with low commissions.

tastytrade, Inc. and Litquidity are separate and unaffiliated companies that are not responsible for each other's products, services, or policies.

Deal Flow

M&A / Strategic

Toyota Group extended their $35B take-private tender offer for Toyota Industries after falling 9% short of a 66% threshold in a shareholder vote; activist Elliott is rallying against the deal

Saudi's Midad Energy agreed to acquire Russia's sanctioned Lukoil assets in a $22B contest against rivals including Carlyle

Mercedes-Benz plans to sell part of its 35% stake worth $14.2B in truck maker Daimler Truck

Insurance firm TIAA's asset manager Nuveen agreed to acquire UK asset manager Schroders in a $13.5B deal to create a $2.5T AUM entity

Blackstone and EQT agreed to acquire Spanish waste management company Urbaser from Platinum Equity in a $6.6B deal

Infrastructure investor I Squared Capital and Canada's CPPIB agreed to acquire Peruvian power producer Inkia Energy for $3.4B, including debt

Health insurance firm Humana is in advanced talks to acquire primary care clinic operator MaxHealth from Arsenal Capital at a $1B valuation

Commodities trader Mercuria bought back 4.99% of shares held by Chinese state-backed fund CNIC

VC

Anthropic raised a $30B Series D at a $380B post-money valuation led by ICONIQ, Dragoneer, Founders Fund, D. E. Shaw Ventures, and MGX

Talkiatry, a tech-enabled psychiatry provider, raised a $210M Series D led by Perceptive Advisors

AI health-plan workflow startup Anterior raised a $40M round from NEA, Sequoia, FPV, and Kinnevik

Alva Energy, a startup retrofitting existing nuclear plants, raised a $33M Series A led by Playground Global

Ever, an AI-driven EV marketplace, raised a $31M Series A led by Eclipse

Uptiq, an AI platform for financial services, raised a $25M Series B round led by Curql

The Biological Computing Co., a neuron-based AI compute startup, raised a $25M seed round led by Primary Ventures

Opaque Systems, a confidential AI infrastructure startup, raised a $24M Series B at a $300M valuation led by Walden Catalyst

Electric Twin, a UK AI synthetic-audience platform, secured a $10M round led by Atomico

Brain-inspired AI startup Stanhope AI raised an $8M seed round led by Frontline Ventures

Bracket, a UK AI-based treasury intelligence startup, raised a $7M seed round led by Macquarie and Blackfinch Ventures

Get real-time updates on any startup, VC, or sector on Fundable.

IPO / Direct Listings / Issuances / Block Trades

$113B-listed cybersecurity giant Palo Alto Networks is planning a dual listing in Israel

SoftBank sold over $3.5B of T-Mobile shares amid plans to go all in on OpenAI

SoftBank-backed Japanese payments app PayPay filed for a US IPO to raise $2B at a $10B valuation

Arko Petroleum raised $200M at an $808M market value

Pakistan International Airlines plans to IPO of a 5%-10% stake; the firm was recently privatized at a $642M valuation

Finnish financial group OP Pohjola raised its stake in Swedish lender Noba Bank in a $560M block trade ordered by Nordic Capital and Sampo

Wall Street brokerage fintech Clear Street postponed its downsized IPO that planned to raise $364M citing market conditions

Debt

SoftBank raised an additional $27B in debt to fund its OpenAI investment

AI infrastructure investor Tract Capital raised $3.8B in a junk bond sale to finance the construction of a data center to be leased by Nvidia

Goldman Sachs Alternatives, Ares, Blue Owl, Antares, and Apollo are providing $3.5B of private credit to support PE firms Permira and Warburg Pincus' $8.4B LBO of software firm Clearwater Analytics

HIG Capital-backed prison-food vendor TKC borrowed $2.3B in a junk bond and leveraged loan deal to fund a dividend recap

Mexico's state-owned oil firm Pemex is seeking to raise $1.8B in a peso debt sale

Blue Owl, Goldman Sachs Alternatives, Golub, HPS, and Blackstone are providing $1.4B of private credit to support PE firm Hg's $6.4B LBO of enterprise finance software firm OneStream

Data center startup Nscale raised $1.4B in private credit from PIMCO, Blue Owl, and Luminarx

Chicago is seeking to sell $1B in high-yield munis

Hong Kong's West Kowloon Cultural District is seeking $1B in its first bond sale to fund operations

Citadel kicked off a two-part US bond sale

Silver Lake, Affinity Partners, and Saudi's PIF are engineering a below-par debt buyback for Electronic Arts' bonds as part of its historic $55B LBO; bondholders are fighting back

Republic of Congo is planning a eurobond sale

Bankruptcy / Restructuring / Distressed

Troubled UK utility Thames Water is seeking to unlock $1.1B in additional emergency funding from creditors as rescue talks drag on, tapping an accordion facility from its $4B court-approved package

German cosmetic products seller LR Health & Beauty agreed to a restructuring with Swedish bondholders that will see a third of its $154M Swedish debt written off for a $24M capital injection

Distressed Brazilian energy firm Raízen's bondholders hired Moelis as financial pressures mount

Funds / Secondaries

US and Japan are closing in on the first three projects to be funded by Japan's $550B investment vehicle

Millennium committed an additional $300M to quant hedge fund Engineers Gate, lifting Millennium's total backing to $3.6B

Swiss secondaries specialist Montana Capital Partners raised $1.4B for its first secondaries fund since being acquired by PGIM

French investment firm Raise is seeking to raise $360M for its second impact PE fund

Sustainability-focused LatAm VC SP Ventures plans to raise $100M for its third fund

Crypto Sum Snapshot

Bitcoin rout exposes El Salvador's crypto gamble

The crypto wallet linked to Nancy Guthrie's kidnapping is traceable

Downbeat crypto sector looks to AI for rescue

Crypto Sum compiles the most important stories on everything crypto. Read it here.

Exec’s Picks

Bloomberg published a detailed profile on China's rising billionaires.

FT published a highly informative piece on how AI is derailing PE's big bet on software.

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting firm established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, credit, and investment banking.

We're currently seeking talent for some incredible roles. Head over to Litney Partners to drop your resume / create your profile and we'd love to get in touch!

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.