Together with

Good Morning,

Metals tumbled from historic highs and stocks pulled back in a mostly uneventful Twixmas Monday. Though geo-politics was at the forefront as Trump met with both Zelensky and Netanyahu over peace talks.

New years means it's time for a wardrobe upgrade…and there's no better way than to start with some fresh pairs of amberjacks.

Let's dive in.

Before The Bell

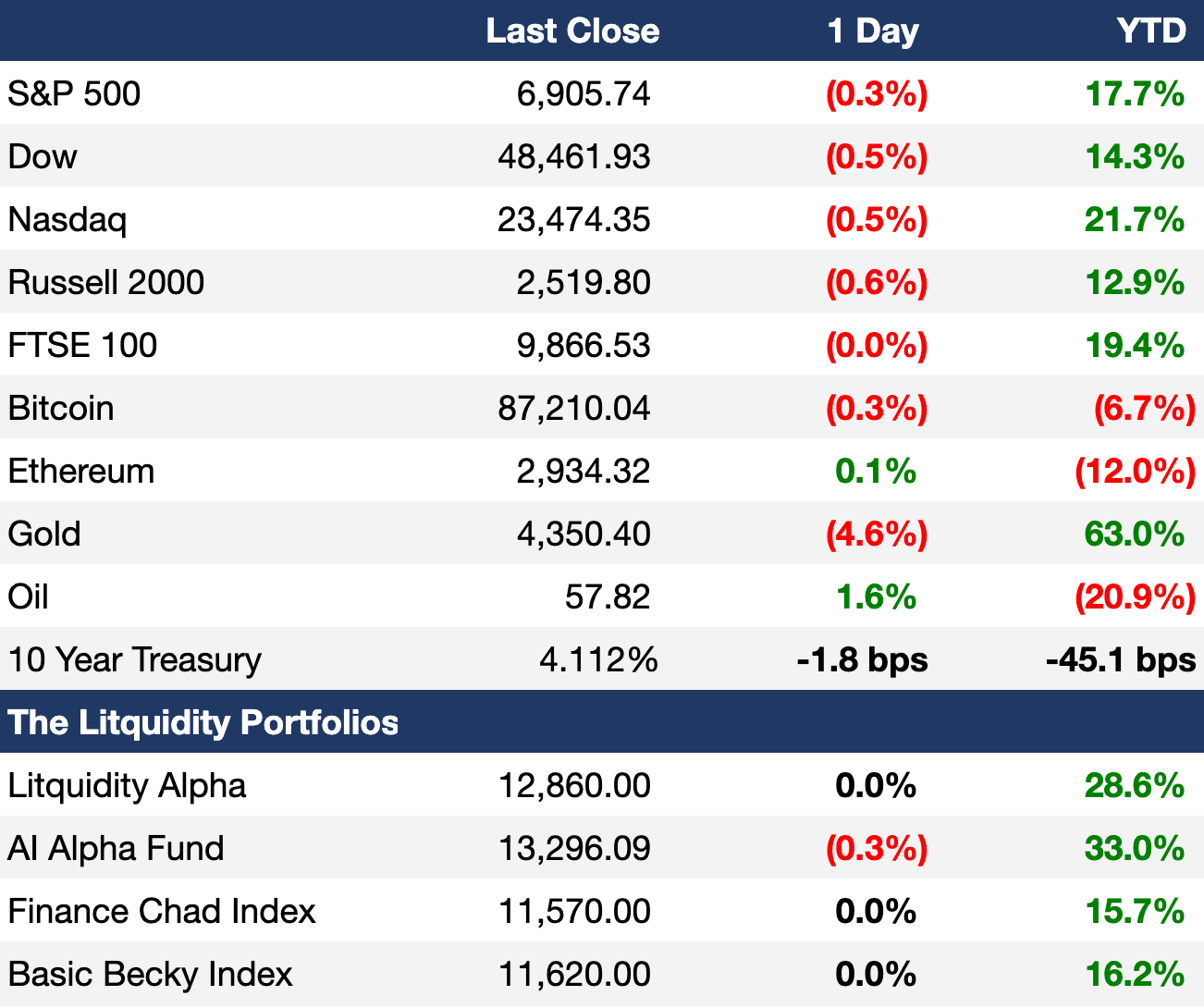

As of 12/29/2025 market close.

Learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks slipped yesterday as investors sold tech following ATHs last week

US bond market volatility fell to a four-year low in its steepest annual decline on record

Precious metals tumbled from record highs following a historic Christmas rally

Silver fell 7% in its worst day in five years

PBOC fixed Chinese yuan at 7.03$ at its strongest level in fifteen months

Earnings

Full calendar here

Prediction Markets

Hearing rumors of a

pod shopbank blowing upTrack and trade odds of a bank collapse in 2026 on Polymarket

Headline Roundup

US offered a 15-year security guarantee to Ukraine (WSJ)

Trump met with Netayahu over Middle East talks (BBG)

Tax changes loom large for US economy in 2026 (RT)

US economy is expected to ride tax cut tailwind but faces risks (RT)

Banks tapped Fed standing repo for $26B in third-most since 2021 (RT)

Bankruptcies soar as companies grapple with inflation and tariffs (WP)

Private credit BDC stocks are set for their worst year since 2020 (BBG)

Canada's Maple 8 will reduce PE directs in PE overhaul (BBG)

Europe defense giants are set to return $5B to shareholders this year (FT)

US is using a fraud law to target companies pushing DEI (WSJ)

Agri-commodities giants will abandon their Amazon forest protection pact (RT)

Andersen, the accounting firm led by execs linked to Enron, disclosed weak internal accounting controls in its IPO (WSJ)

People are using dating apps to find jobs (BBG)

ACCA scrapped remote exams to combat cheating (FT)

A Message from amberjacks

New year, new shoes

With 2026 around the corner, it's time to upgrade your dress shoes. And what better place to start than with a pair of fresh amberjacks.

amberjack is the modern footwear brand started by execs from Adidas, Cole Haan, and McKinsey. They've created the world's most advanced dress shoes, made with proprietary athletic materials that deliver incredible comfort and A-grade leather vertically sourced from one of the world's leading tanneries.

They've been featured in Forbes, GQ, and Wall Street Journal and Men's Health named them the most comfortable business casual shoe just last year. The only downside is they constantly sell out – get yours today before they're gone!

Deal Flow

M&A / Investments

SoftBank will acquire digital infrastructure-focused PE firm DigitalBridge at a $4B valuation, including debt, representing a 15% premium

Aussie PE firm BGH Capital will acquire non-China APAC assets from African pharma giant Aspen Pharmacare for $1.6B

Specialty finance group BasePoint agreed to acquire UK lender International Personal Finance in a $732M deal

KKR received first negotiation rights to take $500M-listed Japanese herbal health tonic maker Yomeishu private

Swiss asset manager GAM is opposing Indian auto parts maker Samvardhana Motherson's $173M takeover of Honda subsidiary Yutaka

Meta acquired Chinese-led agentic AI startup Manus

VC

Pet emotional-intelligence startup Traini raised a $7.5M round led by Banyan Tree, Silver Capital, ZhaoTai Group, and NYX Ventures

Access the complete VC deal flow on Fundable.

IPO / Direct Listings / Issuances / Block Trades

GSM, the EV taxi group linked to Vietnamese EV maker VinFast, is weighing a Hong Kong IPO at a $20B valuation

Blackstone-backed Australian data center operator AirTrunk is eyeing a Singapore REIT IPO that could raise over $1B

Founder Chip Wilson launched a proxy fight at athleisure retailer lululemon by nominating three independent directors to the board; the firm just fired its CEO and is also under pressure from activist Elliott

Debt

Nigerian state-owned energy firm NNPC is in talks with pipeline infrastructure lender Nexus Alliance for $2B in financing

Bankruptcy / Restructuring / Distressed

Real estate firm Summit Properties struck a $450M deal to acquire dozens of NYC apartment buildings put into bankruptcy by owner Pinnacle Group

Platinum Equity-backed construction site solutions firm United Site Services filed for Chapter 11 bankruptcy with plans to wipe out $2.4B of debt and hand control to lenders

Fundraising / Secondaries

Singaporean secondaries specialist Aquilius raised $1.1B for a second APAC real estate secondaries fund

Crypto Sum Snapshot

Trump-linked crypto fintech Alt5 Sigma fired its auditor after Financial Times inquired about its lack of a license

Crypto Sum compiles the most important stories on everything crypto. Read it here.

Exec’s Picks

It's that time of the year again. See how some major stock markets and asset classes performed in 2025 here.

Bloomberg published an interesting piece on how banks are re-gaining ground on private credit amid a wave of de-regulation.

FT published a deep dive on the Capital of Capital: Abu Dhabi's rise to a sovereign wealth power.

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting firm established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, credit, and investment banking.

We're currently seeking talent for some incredible roles. Head over to Litney Partners to drop your resume / create your profile and we'd love to get in touch!

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.