Together with

Good Morning,

We're headed into the final stretch of 2025 with AI bubble jitters catching on to rallying stock markets. But traders are looking to a 'cleaner' month ahead with a Fed rate decision, a re-opened government, and calming volatility.

Also, a data center outage at CME disrupted global markets for ten hours on Friday. But who really noticed anyway? 🦃

Wall Street Prep is offering 20% off their flagship Financial & Valuation Modeling Certification Program. This is the same course that Wall Street bulge brackets and elite boutiques use to train their new hires. Use code CYBER2025 before the offer expires!

Let's dive in.

Before The Bell

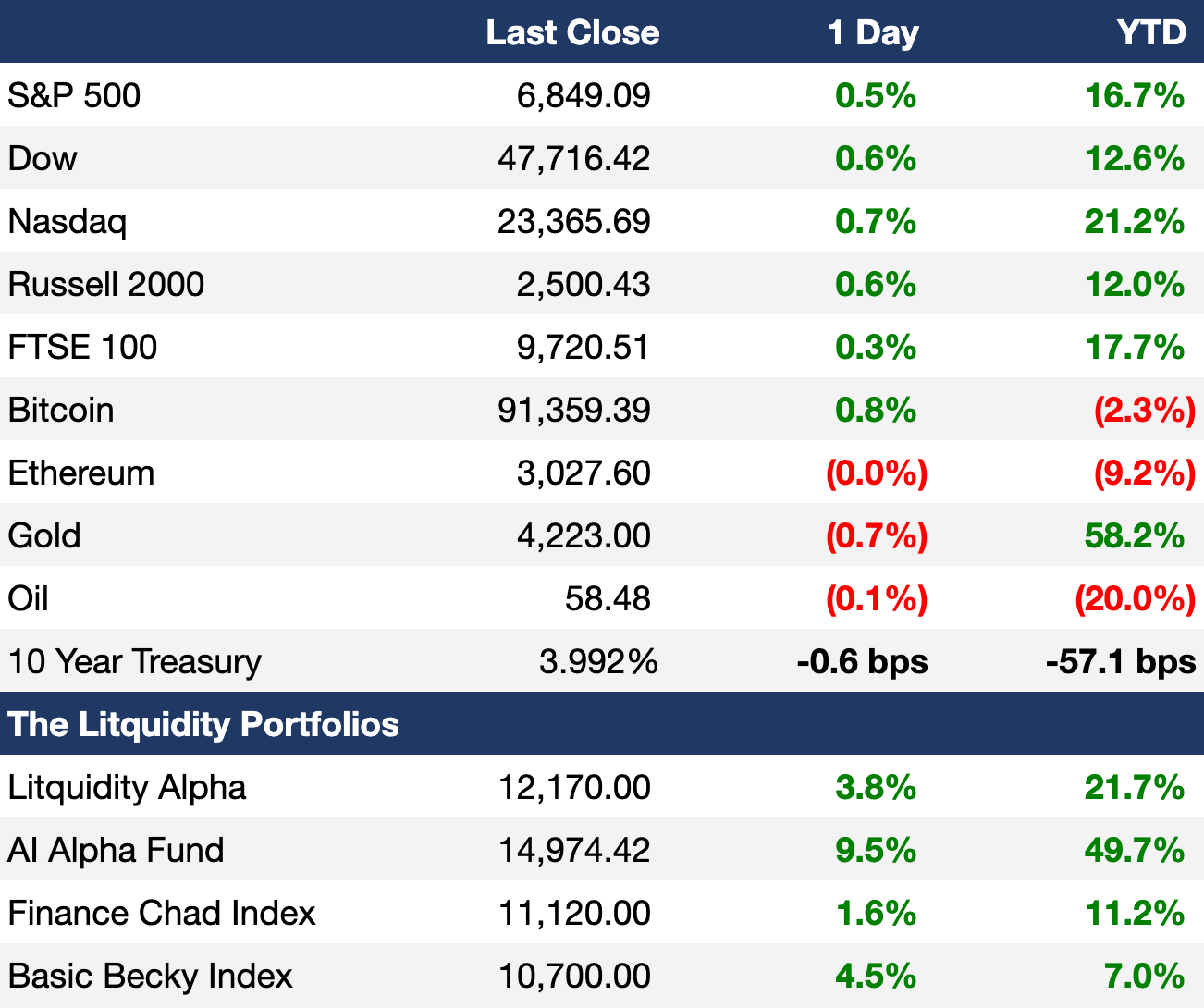

As of 11/28/2025 market close.

Learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks rose on Friday to cap strong gains in a low-volume holiday trading week

S&P and Dow rose for seventh-straight month

Nasdaq posted its first monthly loss since March

UK gilts snapped a five-day rally as traders digested the new fiscal budget

EM rally paused in a low-volume trading session amid US holidays

Korea's small-caps KOSDAQ index jumped 3.7% while the benchmark KOSPI index fell 1.5% for its biggest outperformance since 2001 on potential new tax incentives

Silver jumped 4.2% to a new record

Silver is up 90% YTD

Dollar posted its worst week in four months on rising rate cut bets

Indian rupee weakened to a new low

Rupee is Asia's worst-performing currency YTD and on track for its worst year since 2022

US stock and bond markets were closed on Thursday for Thanksgiving

Earnings

What we're watching this week:

Tuesday: CrowdStrike, American Eagle

Wednesday: Salesforce, Macy's, Dollar Tree

Thursday: Dollar General, TD Bank Group, Docusign

Friday: Victoria's Secret

Full calendar here

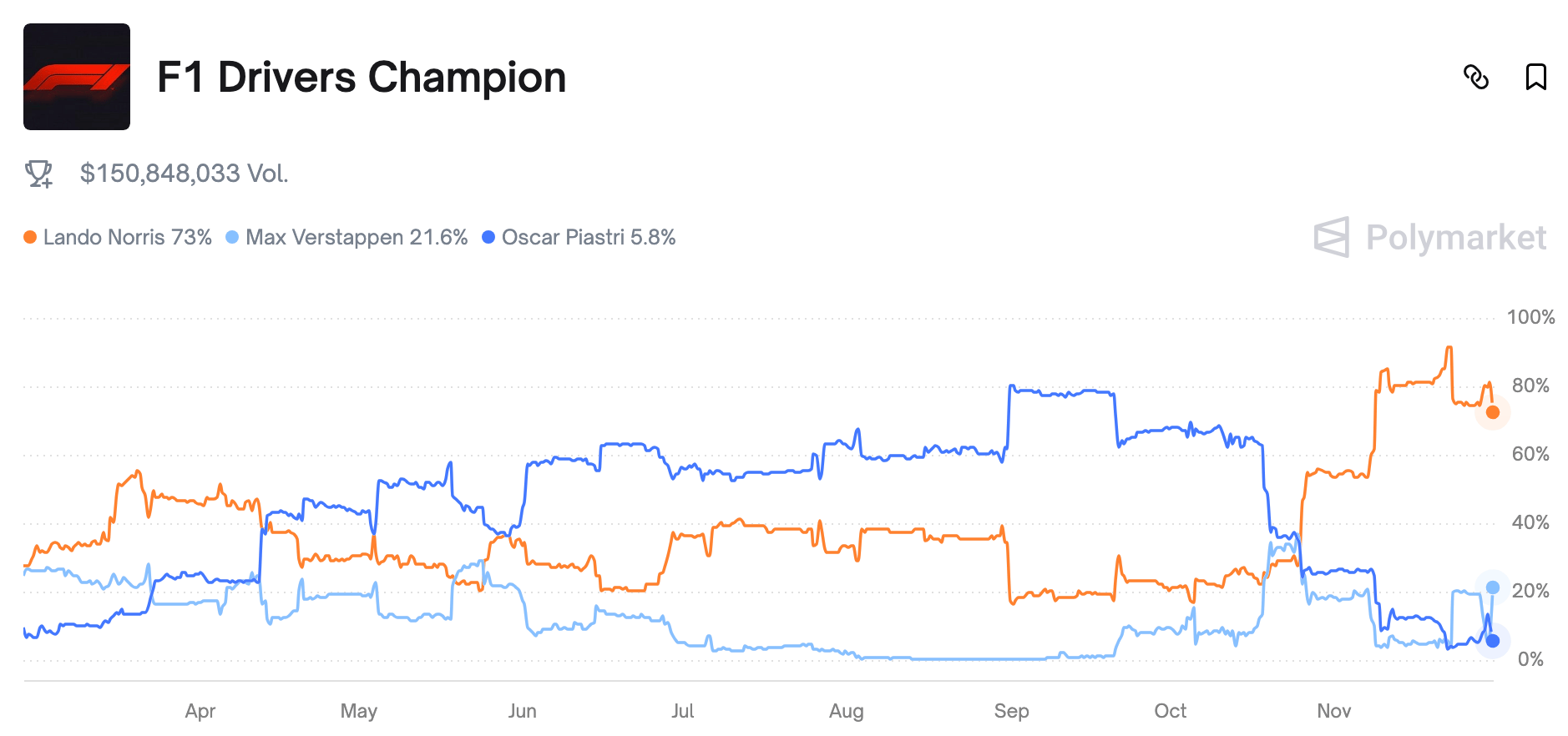

Prediction Markets

McLaren bottled another race weekend to set the stage for a three-way title decider in Abu Dhabi, in the first time since 2010

Verstappen can clinch the title without leading the championship at all this year, also in the first since 2010

It's all to play for with all at stake. Trade the F1 Drivers' Championship on Polymarket

Headline Roundup

Trump has made his choice for Fed chair (BBG)

Canada Q3 GDP grew 2.6% YoY (RT)

Europe rules global stock leaderboards in rare dominance (BBG)

Corporate M&A is surging under Trump 2.0 (WSJ)

Market enters December with 'cleaner' setup (BBG)

Hedge funds are rotating out of tech and into healthcare (BBG)

Apollo's co-head of PE sees end of 'low-quality' returns (BBG)

PE exec warned PE push into US savings risks bailouts (FT)

Infrastructure investors push for deals with O&G giants (FT)

Bond investors see some EM as safer than developed peers (BBG)

Global equity funds saw their first weekly outflow in ten weeks (RT)

Morgan Stanley and Goldman are dominating Hong Kong ECM (FT)

OpenAI partners have amassed a $100B debt pile (FT)

China blocked TikTok-owner ByteDance from using Nvidia chips (RT)

PE firm PAG is making a big contrarian bet on China CRE (BBG)

JPMorgan plans to build a new London HQ (BBG)

Italy is investigating BMPS CEO for market manipulation (BBG)

Ex-Jefferies banker was charged with insider trading (BBG)

Sergey Brin donated $1.1B in Google stock after AI rally (BBG)

Job market for C-suite execs is booming (BBG)

CME trading outage disrupted global markets on Friday (FT)

Litigation finance hits a wall after bets falter (BBG)

80% of Swiss voted to reject 50% inheritance tax on super-rich (FT)

A Message from Wall Street Prep

The only thing breaking faster than your models? Your career trajectory.

Wall Street Prep just dropped 20% off their Financial & Valuation Modeling Certification Program.

It's the same training new hires get at Goldman Sachs, Morgan Stanley, JPMorgan, and other top firms.

If you've been meaning to level up your DCF/M&A/LBO game (or finally stop relying on that one sketchy old Excel template), this is your chance.

You get:

Real-world case studies

Lifetime access to materials

Support from real instructors when you need it

A certification that actually carries weight

Use code CYBER2025 by December 7 midnight ET.

Don't sleep on this offer – your future VP self will thank you. Save 20%

Deal Flow

M&A / Investments

Eldridge Industries-founder Todd Boehly joined a UAE-based consortium seeking to acquire Russian energy giant Lukoil's $22B of foreign assets

Korean tech firm Naver agreed to acquire Dunamu, the operator of Korea's biggest crypto exchange Upbit, in a $10.3B all-stock deal

Germany is seeking to acquire a 25.1% stake in the German unit of Dutch state-owned power grid operator TenneT for $6.7B

German exchange operator Deutsche Boerse is in exclusive talks to acquire European fund distribution platform Allfunds in a $6.1B cash-and-stock deal at a 33% premium

Data center REIT Digital Realty Trust and a consortium including peer REIT Equinix are among bidders vying for Partners Group-owned Nordic data center operator atNorth, which could fetch a $5.2B valuation

French state-owned utility EDF is now considering a full sale of its US renewables business, which could be valued at $4.6B

Blackstone is nearing an acquisition of utility-parts maker MacLean Power Systems from Centerbridge Partners for $4B

Saudi SWF PIF's gaming and esports investor Savvy Games is in talks to acquire video game studio Moonton from Chinese tech giant ByteDance; ByteDance acquired Moonton for $4B in 2021

Brookfield and Singapore SWF GIC offered to acquire Australia-listed National Storage REIT for $2.6B

PE firm Warburg Pincus agreed to acquire a majority stake in school safety software firm Raptor Technologies from Thoma Bravo at a $1.8B valuation

Energy trading giants Mercuria and Vitol are among final bidders for a refinery and hundreds of gas stations in Argentina from LatAm energy giant Raizen which could fetch $1.6B

Brazilian PE firm Patria agreed to acquire LatAm health insurer Banmedica from UnitedHealth Group for $1B

Italian state-owned mint and security-printing group IPZS and postal service and bank Poste Italiane agreed to fully acquire state-owned digital payments platform PagoPa for $580M

US broadcaster E.W. Scripps adopted a shareholder rights plan to give its board time to evaluate rival Sinclair's $540M bid

Professional services giant WTW is in talks to acquire an 85% stake in workplace pension provider Cushon from UK lender NatWest at an over $200M valuation

Polish state-owned refiner Orlen agreed to buy out the remaining shares in its utility unit Energa to take full control for $190M

Dutch insurer Aegon is exploring selling some of its non-US operations

Mining giant Rio Tinto is seeking to divest its boron-producing US assets

Singapore SWF Temasek subsidiaries Pavilion and Seviora agreed to merge to form a $72B AUM asset manager

BlackRock and shipping giant MSC's bid for Hong Kong infrastructure conglomerate CK Hutchinson's Barcelona terminal is facing an EU antitrust probe

Chinese drone parts supplier Shenzhen Minghuaxin acquired a 5% stake in leading Russian drone manufacturer Rustakt

PIF is in advanced talks to invest in Italian defense and aerospace giant Leonardo's aero structures unit

VC

Data analytics software platform Databricks is in talks to raise a $5B round at a $134B valuation

Function Health, a startup consolidating health data and making it usable for its customers, raised a $298M Series B at a of $2.5B valuation led by Redpoint Ventures

Quantum Systems, a dual-use unmanned systems startup, raised a $210M Series C extension led by Balderton Capital

Privacy-computing startup Zama raised a $150M funding round led by Pantera Capital and Multicoin Capital

Embodied-intelligence robotics startup Robotera raised a $140M Series A+ round led by Geely Capital

Consumer exoskeleton startup Hypershell raised a $70M combined pre-B and Series B round co-led by Photosynthesis Venture Capital and 5Y Capital

Autonomous earthmoving startup Gravis Robotics raised a $23M equity round co-led by IQ Capital and Zacua Ventures

AI-driven enterprise automation startup Automat raised a $15.5M Series A led by Felicis

UAE sports-focused blockchain Atleta raised a $15M investment from Bolts Capital

Whitespace, a sovereign AI OS startup for defense and other regulated sectors, raised a $13M Series A round led by Beach Equity

BHub, an AI-enabled back-office accounting startup, raised a $10M extension round led by Next Billion Capital Partners

SpaceComputer, a satellite-based anti-attack encryption startup, raised a $10M seed round co-led by Maven11 and Lattice

On-chain infrastructure startup Maha raised a $9.5M round led by Polychain Capital and an earlier $7.5M round co-led by Hashed, Tribe Capital, and Portal Ventures

Powered by Fundable

IPO / Direct Listings / Issuances / Block Trades

$25B-listed Chinese ride-hailing giant Didi reported a 67% profit jump ahead of its potential Hong Kong listing

SoftBank-backed Indian e-commerce platform Meesho is seeking to raise $605M in an India IPO

General Atlantic-backed specialty eye-care chain ASG is weighing an India IPO that could raise ~$400M at a $2.6B valuation

PIF sold $253M of shares in property developer Umm Al Qura in a block trade

Vietnam retail giant Mobile World is planning a 2026 IPO for its electronics and mobile store chain Dien May Xanh

Debt

A group of banks are in talks to lend another $38B for Oracle and data center builder Vantage to fund further sites for OpenAI

Japan plans to sell $75B of bonds to fund a stimulus program

Poland plans to raise over $26B in FX bond sales in Q1

IMF reached a new $8.2B financing deal with Ukraine

SoftBank is seeking to raise $3.2B in a yen-denominated senior bond sale to retail investors

Bank of America and UBS are leading a $3.1B debt financing backing Lone Star Funds' $3.8B take-private of equipment company Hillenbrand

An affiliate of Arizona nonprofit Community Finance will acquire two resorts on St. Thomas, USVI from Fortress Investment Group in a deal financed by $465M in munis

Credit fintech Pagaya raised yields on a $400M ABS sale tied to subprime auto loans amid heightened investor scrutiny

Jefferies is leading a $125M financing deal for fintech Erad in its first foray into Saudi private credit

Bankruptcy / Restructuring / Distressed

A Hong Kong court strengthened an injunction blocking the ex-wife of the founder of collapsed Chinese developer Evergrande from accessing $220M in private assets, giving liquidators more leverage to recover $6B in creditor claims

French automotive supplier Forvia is looking to sell part of its car interiors unit, valued at $4B, as part of an ongoing corporate restructuring

Telecoms giant Altice designated Altice Portugal and Altice Caribbean Sarl as unrestricted subsidiaries and raised $870M in new debt, with plans to raise $2.3B more

Distressed Chinese developer Vanke proposed delaying repayment on a $280M yuan bond for the first time

SEC is investigating Jefferies over its relationship to bankrupt auto-parts supplier First Brands

PIMCO sold its entire 20% stake in troubled Brazilian telecom operator Oi

Car sensor supplier Luminar Technologies appointed an executive to lead a debt workout after missing several interest payments

UK PE firm Permira's private credit unit is in advanced talks to take over German tour operator Berge & Meer from German PE firm Genui

Aviation firm Avia Solutions will speak with its bondholders after a steep selloff in the company's debt

Fundraising / Secondaries

Asian investment firm Hillhouse Investment plans to raise $7B for its latest PE fund as Asia PE revives

China's $1.3T SWF CIC is finalizing a sale of $1B US PE LP stakes in Carlyle, Hellman & Friedman, and Welsh Carson, with French PE firm Ardian among final bidders

European deep tech growth investor Jolt Capital raised $695M for its fifth flagship fund

Lower MM PE firm O2 Investment Partners is seeking to raise $550M for its fifth flagship fund

Indian investment firm Motilal Oswal Alternates plans to raise $350M for a debut private credit fund

Asset manager Federated Hermes raised $320M for its sixth PE co-investment fund

Heartwood Partners raised a $245M continuation fund for sustainability-focused waste solutions provider The Amlon Group led by Apogem Capital

Crypto Sum Snapshot

S&P cut Tether stablecoin rating to 'weak' on disclosure gaps

Nasdaq filed to quadruple daily trading limit for BlackRock Bitcoin ETF options

PBOC vowed crackdown on virtual currency and flagged stablecoin concerns

Stock exchanges say SEC must not let crypto firm 'bypass' rules

Crypto crash is putting Lutnick's and Pomp's SPAC deals to test

CoinShares pulled plug on select crypto ETFs ahead of US listing

Crypto Sum compiles the most important stories on everything crypto. Read it here.

Exec’s Picks

WSJ did a profile on the four insiders who could soon succeed Tim Cook as Apple CEO.

CNBC released their official NHL team valuations of 2025. See how the 32 franchises stack up.

Litquidity Merch Sale

We're thankful for everyone who's been a part of Litquidity, whether you've been here since the early meme days or just show up for the ugly Christmas sweaters. Every order helps us keep the lights on, the memes flowing, and the group chat alive.

FOR CYBER MONDAY, we're offering 25% off every order on site-wide merch today AND FREE SHIPPING on orders over $100. Snag something cool for yourself or your favorite colleague or maybe even your grandma if she's still pretending she understands what you do.

If you're a fan of what we do at Litquidity, buying some apparel from our shop is one of the easiest ways to support us.

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.