Together with

Good Morning,

KKR wants PE in 401(k)s, Blackstone expects US PE exits to double next year, Wall Street sees the hottest money in private markets, Goldman expects 2025 dealmaking to surpass 10-year averages, and SpaceX's latest tender made it the world's most valuable private startup.

With private markets being the hottest topic on the street, it's time to check out 10 East, a membership-based investment platform offering targeted exposure to PE, VC, and more.

Let's dive in.

Before The Bell

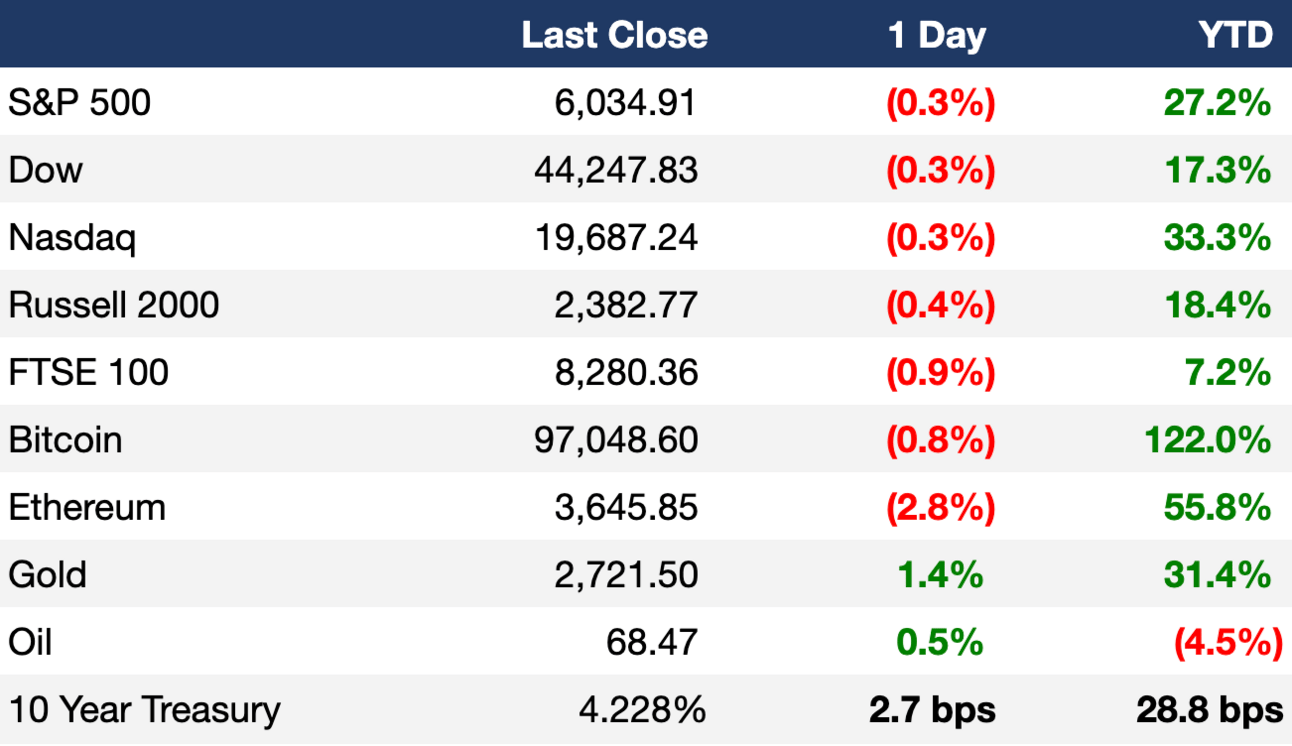

As of 12/10/2024 market close.

Markets

US stocks slipped further yesterday as investors awaited today's CPI report

Dow notched a four-day losing streak

Short interest on the Nasdaq dipped 0.8% in late November

UK's FTSE 100 suffered its worst day in four weeks

Europe's Stoxx 600 broke an eight-day win streak

Aussie dollar hit a four-month low on expectations of a dovish central bank

Crypto volatility picked up as Trump-fueled rally starts to wear

Earnings

AutoZone missed Q1 EPS and revenue estimates due to higher raw material prices and a stronger dollar (RT)

GameStop reported a surprise Q3 profit, though it missed revenue estimates with a 20% YoY sales decline (BRN)

What we're watching this week:

Today: Adobe, Macy's

Thursday: Costco, Broadcom

Full calendar here

The Litquidity Portfolios

Litquidity recently released three thematic portfolios that give retail investors the ability to seamlessly copy them in their personal accounts (via Autopilot's technology).

The three strategies are:

1) Litquidity Alpha - portfolio of Lit's highest-conviction stock holdings, positioned to benefit from the incoming US administration and advances in emerging technologies such as AI, defense tech, and crypto

2) The Basic Becky Index - captures the latest consumer trends, pop culture staples, and investment preferences of the "everyday Gen Z / millennial"; a basket of stocks spanning consumer & retail, e-commerce, tech, media / social, and more

3) The Finance Chad Index - curates companies that professional men consume and engage with on a regular basis; a basket of stocks spanning AI, financial institutions, consumer goods, food & bev, transportation, and productivity tools

To invest alongside Litquidity's strategies, head on over and subscribe on Autopilot. They'll handle the rest!

Headline Roundup

US regulator warned remote work could hurt audit quality (FT)

US small business sentiment surged to a 3.5-year high (RT)

Australia left rates unchanged at 4.35% (RT)

Goldman expects 2025 dealmaking to surpass 10-year averages (RT)

Goldman expects more large-scale strategic M&A in 2025 (RT)

Blackstone expects US PE exits to double next year (RT)

KKR CEO makes case for private assets in 401(k)s (BBG)

Wall Street wealth chiefs see hottest money in private markets (BBG)

Abu Dhabi's $1T SWF seeks more innovation in private credit (BBG)

Texas Stock Exchange will open a temporary HQ in Dallas next year (BBG)

US high-yield credit is set for best returns in eight years (RT)

Volume of structured finance deals hit the highest since 2007 (FT)

BlackRock sees investors shifting from cash despite 'modest' rate cuts (RT)

Munis ETF launches hit a record high (BBG)

Jefferies co-head of IB Alejandro Przygoda will depart (BBG)

JPMorgan expects IB fees to rise 45% in Q4 (RT)

Government debt glut could rock bond markets in 2025 (RT)

Apollo is expanding its 'hybrid' credit, equity business (BBG)

Trump named Andrew Ferguson as FTC chair (BBG)

PNC sees banks with core retail deposits as M&A targets (RT)

UBS overhauled its US wealth business to include less-wealthy clients (WSJ)

CPPIB's Asia PE head becomes latest to leave for Middle East (BBG)

Google is making its biggest bet on search AI (RT)

Amazon entered car sales (TC)

GM will wind down its robotaxi business (BBG)

Trump has named seven billionaires to his administration (BBG)

A Message from 10 East

Where Sophisticated Investors Access Private Markets

10 East is a co-investment platform where sophisticated investors access private market investments alongside a veteran team with a 12+ year track record of strong performance across over 350 transactions. The firm is led by Michael Leffell, former Deputy Executive Managing Member of Davidson Kempner.

Members have the flexibility to participate on a deal-by-deal basis across private equity, credit, real estate, and venture capital.

Benefits of 10 East membership include:

Flexibility – members have full discretion over whether to invest on an offering-by-offering basis.

Alignment – principals commit material personal capital to every offering.

Institutional resources – a dedicated investment team that sources and diligences each offering.

There are no upfront costs or commitments associated with joining 10 East.

Exec Sum readers can join 10 East with complimentary access here.

Deal Flow

M&A / Investments

A judge blocked Kroger's $24.6B acquisition of Albertsons

US plans to formally block Japan's Nippon Steel's $14.1B acquisition of US Steel on national security grounds

Saudi Arabia's PIF is nearing a deal to acquire a 6% stake in PGA's commercial arm PGA Tour Enterprises at a $12B valuation

PE firm Sycamore is in talks to acquire $9B-listed struggling pharmacy chain Walgreens Boots Alliance

Japan's Nippon Life Insurance plans to buy global peer Resolution Life for $8.2B from shareholders including Blackstone

Denmark's largest mortgage lender Nykredit Realkredit agreed to buy rival Spar Nord Bank in a $3.5B cash deal

Prudential is considering selling a 30% stake in its Singapore-based asset manager Eastspring Investments at a $3B valuation

Advent, Apollo, and CD&R are exploring bids for $2.2B-listed uniform maker Vestis

Cybersecurity giant Gen Digital agreed to acquire fintech MoneyLion in a $1B cash deal

PE firm Story3 Capital Partners made a ~$1B takeover offer for medical-apparel maker Figs

Brookfield acquired a US student-housing portfolio for $893M

Infrastructure investor I Squared is looking to make an offer for $880M-listed Hong Kong Broadband Network

German remote-work software firm TeamViewer agreed to buy autonomous DEX firm 1E from Carlyle for $720M

China's Fosun Tourism offered to buy back shares from minority shareholders at a $640M valuation as part of plans to delist

Domino's and PE firms KKR, Sixth Street and TSG Consumer Partners are bidding for Wingstop's UK franchise which could fetch a $511M valuation

Food investment firm McWin Capital Partners is in talks to buy UK bakery chain Gail's

Italy is preparing to sell a minority stake in rail operator Ferrovie dello Stato

European discounter Pepco is considering options for its struggling Poundland chain in UK

VC

Musk's SpaceX will buy back employee shares at a $350B valuation

Clean energy firm Intersect Power raised an $800M round led by TPG Rise Climate

Speak, an AI language learning startup, raised a $78M Series C at a $1B valuation led by Accel

CarDekho, a Singaporean auto financing service platform, raised a $60M round at a $300M+ valuation from Navis Capital Partners and Dragon Fund

Astrix Security, an identity security platform for the AI era, raised a $45M Series B led by Menlo Ventures

TruVideo, an AI and AR-driven communication platform for the transportation industry, received a $40M growth investment from TZP Growth Equity

AQEMIA, a startup combining quantum mechanics and AI for drug discovery, raised a $38M round led by Cathay Innovation

Raptor Maps, a startup building an integrated OS for the solar industry, raised a $35M Series C led by Maverix Private Equity

WeaveGrid, a software company enabling EV adoption on the electric grid, raised a $28M round led by Toyota's growth fund Woven Capital

Stainless, an AI software startup building SDKs for GenAI firms, raised a $25M Series A led by a16z

Thoughtful AI, an AI-powered revenue cycle transformation startup, raised a $20M Series A led by Drive Capital

Ask Sage, a GenAI platform for government and commercial use, raised a $17M Series A led by Sapphire Ventures

Gavan, an Israeli food tech startup, raised an $8M Series A led by MoreVC

Partful, a UK startup specializing in interactive 3D technology, raised $6M in funding led by Northern Gritstone

GovSignals, a startup leveraging data across the government to generate compliant proposals, raised a $5.5M seed round led by Unusual VC

Mainframe, a startup designing generative productivity software, raised a $5.5M seed round led by Stellation Capital

DeFi platform Smardex raised a $4.5M public seed round led by RA2 TECH

Contextual AI and data loss protection startup Wald raised a $4M seed round from Inventus Capital, Entrada Ventures, and others

IPO / Direct Listings / Issuances / Block Trades

Home services software firm ServiceTitan raised its IPO price, now seeking to raise $590M at a ~$6B valuation

Chinese cosmetics firm Mao Geping jumped 85% in its trading debut after its $300M Hong Kong IPO

Egypt's state-owned United Bank raised $90.5M in a local IPO

Portuguese bank Novo Banco is ready to explore an IPO

Food outlet operator SSP Group is planning an Indian IPO of airport lounge operator Travel Food Services

SPAC

Japanese crypto exchange Coincheck will list in US in a $1.3B merger with Thunder Bridge Capital Partners IV

Debt

Mars is seeking to raise $1B in investment-grade private credit to help finance its $36B acquisition of food maker Kellanova

Bank of America sold $1B of bonds as part of Ecuador’s debt-for-nature swap

London's Canary Wharf district will raise $777M from Apollo to repay debt

Bankruptcy / Restructuring / Distressed

Party City is planning a second bankruptcy filing in just two years

Fundraising

J.F. Lehman & Company, a MM PE firm focused on aerospace, defense, and the environment, closed its sixth flagship fund at $2.2B

Crypto Corner

If you want to stay up to speed on crypto, subscribe to our crypto-focused newsletter. The same Exec Sum format, dedicated to crypto news.

Exec’s Picks

Check out OLarry, a personalized tax service for individuals and businesses with emerging wealth or high net worth. Providing a level of service previously only accessible to the ultra-high net worth, OLarry gives unlimited access to tax advice and strategy supported by industry experts and modern technology. Book a free consultation today and see why thousands have turned to OLarry to tame their taxes.

Kevin Joey Chen posted an insightful thread about Google's quantum computing breakthrough: the Willow chip that solved a problem that would otherwise outlast the universe – in 5 minutes.

Charlie Bilello shared seven lessons all investors can take away from 2024.

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting firm established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, credit, and investment banking.

We're currently seeking talent for some incredible roles. Head over to Litney Partners to drop your resume / create your profile and we'd love to get in touch!

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.