Together with

Good Morning,

Activist hedge funds are getting involved in the Netflix-WBD-Paramount saga, a judge ruled Texas' anti-ESG law as unconstitutional, Polymarket unveiled 'attention markets,' and wealth manager stocks sunk as the latest AI victim.

We're partnering with Ramp for a Female Founders Wellness Happy Hour on Tuesday, March 3 at a penthouse on Billionaires' Row. It's a well-deserved opportunity to destress and mingle with other women founders all while overlooking some stunning views! If this sounds like you or anyone you know, RSVP below.

Plaid published their highly popular Fintech Predictions 2026 report. It's a literal cheat code for anyone following the fintech industry. Read it here.

Let's dive in.

Before The Bell

As of 2/10/2026 market close.

Learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks ticked lower yesterday as AI fears weighed on financial stocks

Dow hit a third-straight record close

Thailand stocks surged 3.5% to a one-year high after elections

Earnings

Coca-Cola beat Q4 earnings estimates but missed on revenue and forecast modest growth on softening demand from budget-conscious consumers, though its water, sports, coffee, and tea portfolio outperformed (CNBC)

Robinhood beat Q4 earnings estimates but missed on revenue as strong retail trading and a lift in prediction markets offset a 38% drop in crypto trading revenue (RT)

CVS beat Q4 earnings and revenue estimates but only reaffirmed FY profit guidance on steady, but not accelerating, progress in its turnaround (CNBC)

Spotify crushed Q4 earnings and revenue estimates on 11% MAU growth, 10% paid subscriber growth, and its most successful Spotify Wrapped ever, with over 300M users engaging (CNBC)

Lyft missed Q4 earnings and revenue estimates on a surprise operating loss and issued a disappointing profit outlook as global expansion and new products weigh on near-term margins (BBG)

Ford posted its worst earnings miss in four years on an unexpected ~$900M tariff hit but beat Q4 revenue estimates and gave an improved FY outlook with traditional growth expected to offset a $4.5B EV hit (CNBC)

Zillow beat Q4 earnings and revenue estimates to swing to a profit as growth in both for-sale and rentals segments boosted results (WSJ)

Marriott missed Q4 earnings estimates but beat on revenue and gave an optimistic outlook on strong international travel and luxury demand and higher credit card fees (WSJ)

What we're watching this week:

Today: McDonald's, Shopify, AppLovin, Cisco, Kraft Heinz

Thursday: Coinbase, Brookfield, Rivian, DraftKings, Applied Materials

Friday: Moderna, Wendy's

Full calendar here

Prediction Markets

We cannot keep going on like this. 2030 will be different.

Trade event contracts on Polymarket, the world's largest prediction market.

Headline Roundup

China deflation pressures continue for third year (CNBC)

US daily stock turnover topped $1T amid trading surge (BBG)

Latest AI trade is 'dump any stock in AI's crosshairs' (BBG)

Anything-but-tech trade shakes up US stock market (FT)

Picks and shovels still rule the AI tech trade (WSJ)

Wealth manager stocks sink as traders flee next AI casualty (BBG)

AI‑led software selloff may pose risk for $1.5T US loan market (BBG)

Bond dealers raise private credit BDC trading costs amid software slide (BBG)

Prediction markets logged $1.2B in Super Bowl trading volume (BBG)

Goldman Sachs expects financial sponsors to boost dealmaking activity (RT)

Goldman CEO expects Trump's populist policies to aid growth (FT)

Barclays boosted CEO Venkatakrishnan's pay to $20M (RT)

US says Nvidia must live with regulations on AI chip sales to China (RT)

Judge ruled Texas anti-ESG law as unconstitutional (RT)

Blackstone founder Schwarzman aims to build a top 10 foundation (WSJ)

Tesla named Europe head Joe Ward as top sales exec (BBG)

Polymarket will offer attention markets in partnership with Kaito AI (TD)

Vatican City launched two new Catholic equity indexes (RT)

Healthcare is propping up the job market (WSJ)

A Message from Plaid

6 Huge Fintech Trends for 2026

Gather round, dear readers, for a rare chance to peer into the Future of Fintech…

Instead of firing up the time machine, we defer to the experts: Plaid – and can you blame us? They've got a seriously impressive track record of nailing upcoming trends, which is why we’re so excited to check out their latest and greatest:

This report is basically a cheat code for anyone involved or interested in Fintech, giving you rich insights into where the industry is headed.

In it, Plaid unpacks 6 of the biggest trends for 2026 and how you can stay ahead of the curve… making it a must-read for anyone in the business looking to onboard more users, create better financial experiences, and fight fraud head on.

Deal Flow

M&A / Strategic

Paramount Skydance sweetened its $108B hostile offer for Warner Bros. Discovery to include a $2.8B breakup fee, $650M / quarter ticking fee, and a debt financing backstop and related fees

Uniform-maker Cintas renewed talks to acquire $4.3B-listed rival UniFirst in an all-cash deal

UK PE firm CapVest entered exclusive talks to acquire a majority stake in energy infrastructure firm TSG from PE firm HLD at a $2.1B valuation, including debt

Brookfield is nearing a deal to to acquire global ad agency Dentsu's Tokyo HQ building from Japanese real estate firm Hulic for $1.9B

Inflexion Private Equity is exploring a sale of UK specialist insurer Acorn at a $1.4B valuation

Brookfield is in exclusive talks acquire Spanish residential real estate company Fidere from Blackstone at a $1.2B valuation

French holding company NJJ and Luxembourg-based Millicom agreed to acquire Spanish telecoms giant Telefonica's Chile mobile unit for $1.2B

Dutch AI cloud computing firm Nebius agreed to acquire AI agent search company Tavily for $275M

Carlyle will acquire a 73% stake in Indian mortgage lender Nido Home Finance, including a 45% stake from Edelweiss Financial Services, in a $232M deal

Toy maker Mattel agreed to acquire a 50% stake in its mobile-gaming JV from partner NetEase for $159M

South African PE firm Harith General Partners agreed to acquire local budget airline FlySafair

Coca-Cola is exploring strategic options for the China unit of its Costa Coffee brand

German media group Bertelsmann acquired an 80% stake in Indian logistics platform Lets Transport

VC

Blackstone raised its stake in Anthropic to $1B at a $350B valuation

AI video generation startup Runway raised a $315M Series E at a $5.3B valuation led by General Atlantic

Solace, a healthcare advocacy platform, raised a $130M Series C at an over $1B valuation led by IVP

AI cybersecurity startup Vega raised a $120M Series B at a $700M valuation led by Accel

Doctor-ranking startup Garner Health raised a $118M Series D at a $1.35B valuation led by Kleiner Perkins

Bretton AI, an AI-driven financial crime compliance platform, raised a $75M Series B led by Sapphire Ventures

Entire, an open-source AI coding infrastructure startup, raised a $60M seed round at a $300M valuation led by Felicis

Industrial automation AI startup Trener Robotics raised a $32M Series A co-led by Engine Ventures and IAG Capital Partners

Physical-intelligence industrial automation startup Trener Robotics raised a $32M Series A co-led by Engine Ventures and IAG Capital Partners

Blended-wing aircraft startup Natilus raised a $28M Series A led by Draper Associates

AI customer-conversation startup Newo raised a $25M Series A round led by Ratmir Timashev

Matia, a unified data operations platform, raised a $21M Series A led by Red Dot Capital Partners

Digital youth mental-health platform Somethings raised a $19.2M Series A led by Catalio Capital

Backslash Security, a vibe-coding security startup, raised a $19M Series A led by KOMPAS VC

Hauler Hero, an AI waste-management software startup, raised a $16M Series A led by Frontier Growth

Voice AI startup Simple AI raised a $14M seed round led by First Harmonic

Industrial robotics safety startup Algorized raised a $13M Series A round led by Run Ventures

Project Omega, an advanced nuclear recycling company, raised $12M from The Chainsmokers' Mantis Ventures, Buckley Ventures, Slow Ventures, and others

Access the complete VC deal flow on Fundable.

IPO / Direct Listings / Issuances / Block Trades

Egyptian premium grocer Gourmet Egypt surged 40% after raising $1.8B in Egypt's first IPO of the year

Brazilian fintech Agibank raised $240M at a $1.9B valuation in a ~65% downsized US IPO priced at the bottom of a marketed range that was revised lower

Activist investor Ancora built a $200M stake in Warner Bros. Discovery and plans to oppose WBD's deal to sell its studio and HBO Max streaming business to Netflix

Chinese luxury retailer Icicle is planning a Hong Kong or Paris IPO at a $1.2B valuation

Debt

Alphabet raised $12B in record-breaking pound and Swiss franc-denominated bond sales, one day after raising over $20B in US markets

Banks are gauging interest for a $7.7B debt package to support Volkswagen's potential $6.6B sale of its heavy diesel-engine unit Everllence, with numerous megafunds weighing bids

EQT and Silver Lake-backed European veterinary services provider IVC Evidensia shelved a $5.5B leveraged loan sale

Walt Disney raised $4B in its first bond sale since 2020

Ares is providing $2.4B of debt financing to fund Vantage Data Centers' infrastructure build-out supporting Oracle's partnership with OpenAI

Barclays, Credit Agricole, Goldman Sachs, and HSBC are underwriting $1.6B of debt to back European PE firm CVC's $2.7B acquisition of Smiths Detection, the security unit of UK engineering group Smiths Group

JPMorgan kicked off a buyback offer for $1.5B of Electronic Arts bonds amid its historic $55B LBO

US O&G producer Presidio Investment Holdings is working with Goldman on a first-of-its-kind debt facility worth $1B to fund M&A ahead of its SPAC debut

Dutch lender ING is seeking to sell $273M in soured loans at its Spanish unit

Jefferies is pitching a $188M bond backed by thousands of personal crypto loans underwritten by crypto lender Ledn

Bankruptcy / Restructuring / Distressed

Venezuela's international bond holders hired Houlihan Lokey ahead of a potential $60B debt restructuring following Maduro's arrest

Bankrupt luxury retailer Saks Global is shutting nine more US stores as part of efforts to emerge from bankruptcy as a smaller operator

Bankrupt television shopping network QVC is negotiating a voluntary restructuring agreement with creditors ahead of a Chapter 11 bankruptcy filing

Creditors holding $1B of bonds in bankrupt fast food franchise operator FAT Brands dropped their push to suspend CEO Andrew Wiederhorn for a court-appointed trustee instead

Funds / Secondaries

Investment firm Neuberger Berman will acquire control of McKinsey's $20B in-house wealth manager

Ares raised an over $1.3B CV for a 2018-vintage private credit portfolio led by secondaries firm Coller

Primary Ventures raised $625M for its fifth fund to invest in seed rounds nationwide

Viola Credit launched a $300M fund to finance customer acquisition for B2C startups

Eight Roads, a VC firm backed by Fidelity's billionaire Johnson family, shelved plans to sell holdings in dozens of Chinese tech companies as geopolitics and valuations improve

Insurer Liberty Mutual's asset management arm will anchor sustainable investment firm Ara Partners' new energy fund and back its infrastructure strategies

Crypto Sum Snapshot

SBF filed for a new trial over FTX fraud citing bogus bankruptcy

SafeMoon CEO John Karony was sentenced to eight years for crypto fraud

Kraken fired its CFO ahead of its long-awaited IPO

EU seeks to ban all Russian crypto transactions in sanctions evasion crackdown

Crypto Sum compiles the most important stories on everything crypto. Read it here.

Upcoming Events👩💻💆♀️

Litquidity and Ramp's women founder community are getting together for an after-work destress on Tuesday, March 3 at a penthouse on Billionaires' Row. Featuring a self-care 'happy hour' of mini facials, vitamin shots, pop-up wellness brands, and epic views, this is a great excuse to destress and meet other NYC women entrepreneurs! RSVP here.

A special shoutout to Manhattan Laser Med Aesthetics and Chelsea Bizub for contributing to the experience.

Powered by Palm & Park

Exec’s Picks

There is one and only one company doing better than the AI titans in a field completely unrelated to AI: OnlyFans. Ed Elson published a breakdown of this 'company of the year' as well as its astonishing economics. Read it here.

Also, Stanford invented arranged marriages from first principles. Read how Date Drop is taking Stanford by storm.

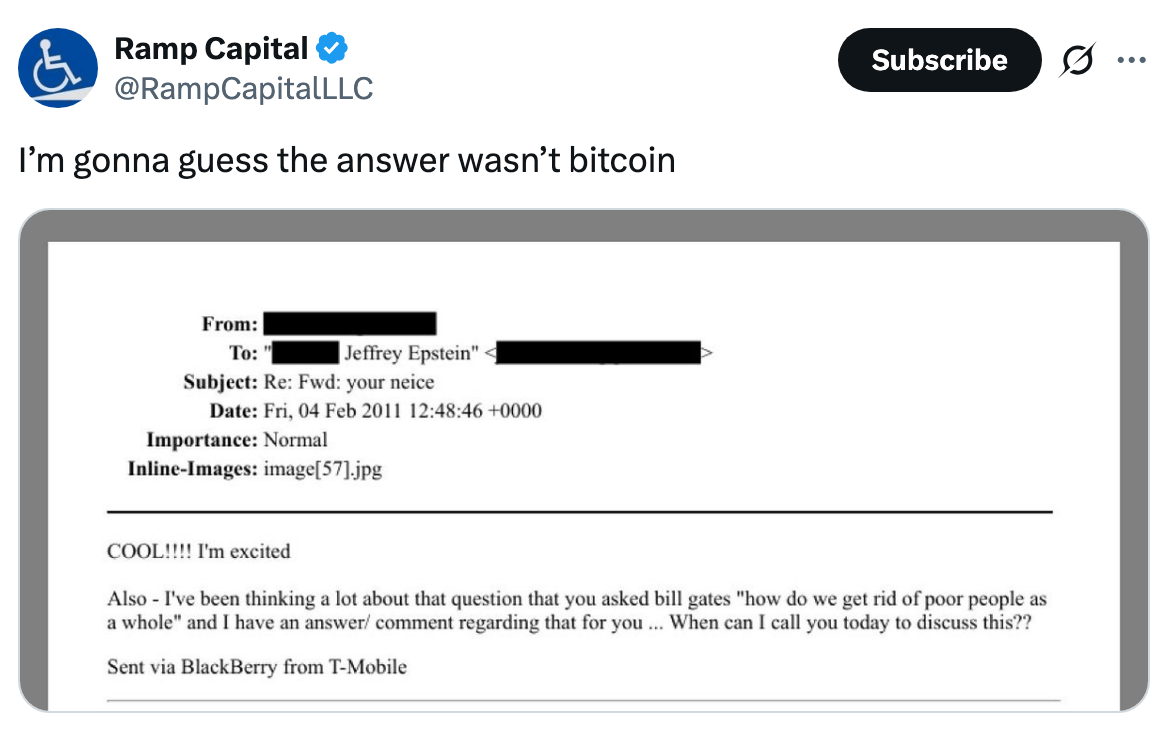

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.