Together with

Good Morning,

The US economy contracted slower than expected in Q2, Peloton lost $1.2B in Q2, mortgage rates rose to 5.55%, the ECB is concerned with long-term inflation, Amazon is shutting down its telehealth business, Sony is bumping up PS5 prices, and Texas is banning ESG funds.

Today is Friday (*cue the Rebecca Black jam*) and Jerome Powell is center stage in Jackson Hole, where everyone will be awaiting his speech at 10am ET. Should be an interesting day in the markets!

Btw, we updated our sell-side comp survey. Here's the link. Let us know if you have any comments / questions. We're always looking for more context and datapoints to refine the analysis.

Have a great weekend y'all.

Let's dive in.

Before The Bell

If you want to learn more about crypto trading strategies and the world of DeFi, check out our Foot Guns newsletter.

Markets

Stocks rallied late on Thursday to end the day in the green as investors reviewed fresh economic data and the Fed’s annual Jackson Hole symposium began

The Fed was noncommittal about the size of its September interest rate increase but emphasized it will drive rates up and keep them there until inflation has been squeezed from the economy

All eyes will be on Jerome Powell’s speech occurring today

Earnings

Peloton reported a $1.2B loss for its fiscal Q4 and forecasted further revenue declines, causing its stock to plummet 18.3% on the day (YHOO)

TD Bank rose 1.2% after it posted a drop in Q3 profits but exceeded expectations as it set aside money for potential loan losses ahead on a worsening economic outlook (GN)

Full calendar here

Headline Roundup

US economy contracted 0.6% in Q2, as opposed to the original 0.9% estimate (RT)

US weekly jobless claims dropped 2k to 243k (RT)

Mortgage rates rose to 5.55%, a two-month high (WSJ)

Blackstone's single-family landlord to halt home purchases in 38 cities (BBG)

The ECB is getting increasingly concerned about high inflation getting entrenched (RT)

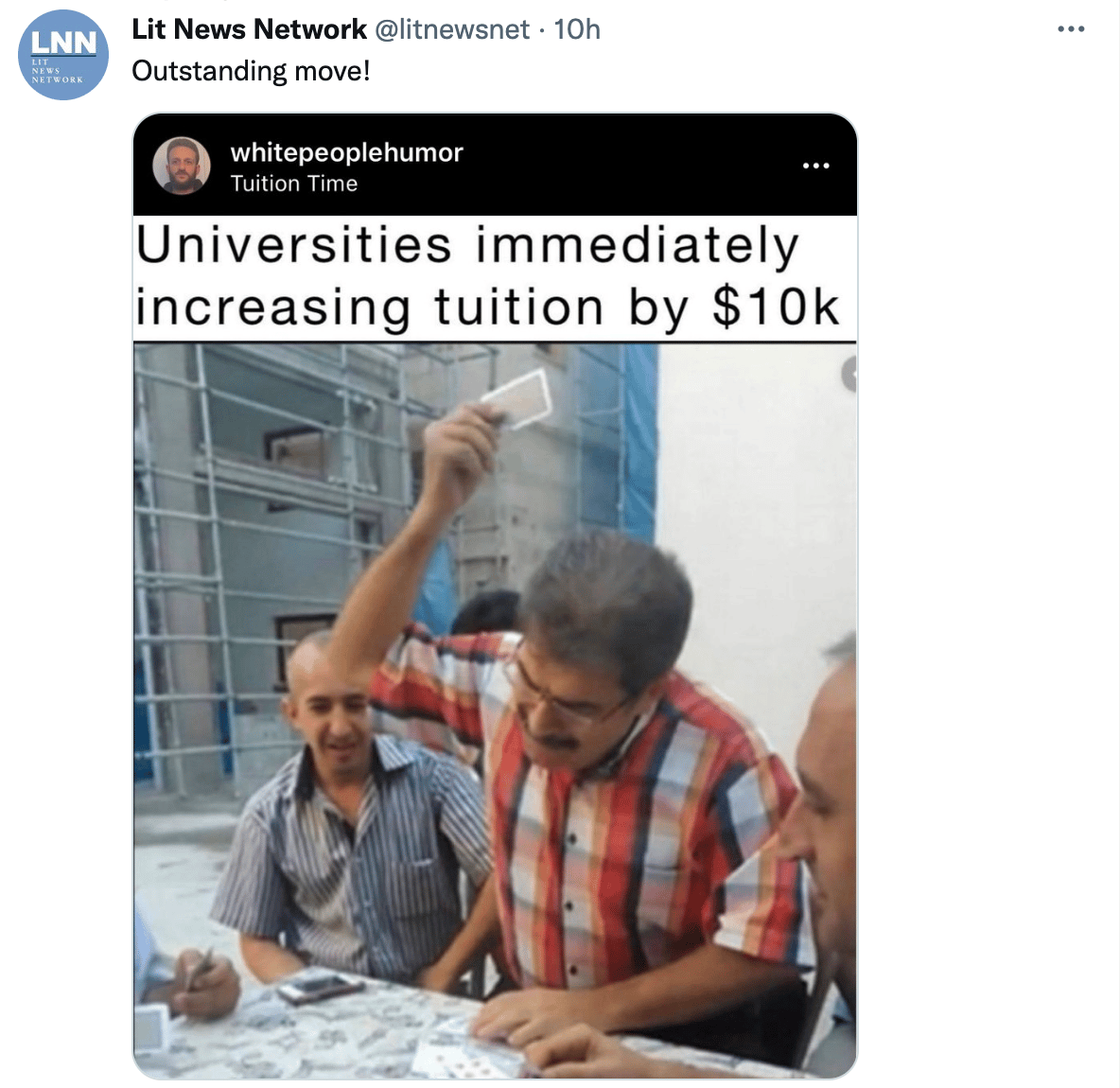

Biden student-loan forgiveness raises inflation concerns again (WSJ)

US and China are nearing agreement to allow US regulators to travel to Hong Kong and inspect audit records of US-listed Chinese companies (WSJ)

US shipping ports are struggling despite lower Chinese container volumes (CNBC)

Texas banned 348 ESG funds and 10 firms including BlackRock, UBS and Credit Suisse from doing business with the state citing their stance on energy (AX)

Amazon will shut down its Amazon Care telehealth service (CNBC)

Plug Power signed a deal with Amazon to supply ~11k tons of green hydrogen annually starting 2025 (YHOO)

SpaceX, T-Mobile to connect satellites to cellphones in remote areas (WSJ)

Sony will raise the price of its PlayStation 5 console across all major non-US markets by up to 20% (WSJ)

BetMGM signed a multi-year broad base omni-channel content deal with Almost Friday Media (EGR)

A Message From Eight Ball

A Macro Newsletter with Skin in the Game

In Skin in the Game, Nassim Taleb said, "Don’t tell me what you think, tell me what you have in your portfolio."

Every day, economists and talking heads give their predictions about the economy, interest rates, and the stock market. "We are going into a recession!" "Oil is going to $150 per barrel!" And every day, most of these predictions are wrong. The problem is that none of these economists put their money where their mouth is, so their accuracy doesn't matter.

We launched Eight Ball to solve this problem. With our newsletter, Eight Ball, we use data provided by real-time prediction markets to see where investors are forecasting interest rates, oil prices, GDP growth, and more.

Our forecasts are determined by investors who put their real money on the line, not media personalities looking for air time.

If you want economic forecasts that have "skin in the game," subscribe to Eight Ball here!

Deal Flow

M&A / Investments

Pharma giant Novartis will spin off its ~$25B Sandoz unit next year to create Europe's largest generic and biosimilar drug company (BBG)

Healthcare company Ramsay rejected a KKR-led alternative bid to its original $14B takeover offer (BBG)

French PE firm Ardian is shelving their planned majority stake sale in Italian health IT firm Dedalus citing concerns on their $3B+ valuation (BBG)

Monumental Sports & Entertainment and Carlyle co-founder David Rubenstein are both weighing a bid for MLB team Washington Nationals (valued at $2.23B) and interested in acquiring Baltimore Orioles (valued at $1.63B) (BBG)

Australian wealth manager Perpetual will merge with funds business Pendal in a $1.72B deal (BBG)

India-based Bharti Telecom will buy 3.3% of Singapore Telecommunications' 33% direct stake in their Airtel telecom subsidiary for ~$1.6B (BBG)

Enterprise software company Everbridge is exploring strategic options including a sale. The company's shares rose 3.7% to close at $35.77 (~$1.4B market cap) and rose an extra 17% after-hours (BBG)

Shipping giants China International Marine Containers and Maersk abandoned a ~$987 merger deal amid US regulatory probe (RT)

PE firm Rohatyn Group is considering a majority stake sale in digital services company Ness at a potential ~$800M valuation (BBG)

PE firm Francisco Partners is in advanced talks to acquire music-publishing and technology service Kobalt Music for between ~$750M to $1B (BBG)

PE firm Silver Lake acquired 10 Minor League Baseball teams from talent agency and live-events business Endeavor Group for $280M; teams include affiliates of the Yankees, Dodgers and Braves (BBG)

VC

Alma, an API-driven membership-focused mental health care network, raised a $130M Series D led by Thoma Bravo (PRN)

Aktis Oncology, a biotechnology company developing novel targeted alpha radiopharmaceuticals, raised an $84M Series A extension from Cowen Healthcare Investments, MRL Ventures Fund, ArrowMark Partners and others (PRN)

Tridge, a startup matching buyers and sellers in the food and agriculture space, raised a $37.2M Series D at a $2.7B valuation led by DSAsset (TC)

Online rental marketplace Zumper raised a $30M Series D-1 led by Kleiner Perkins (TC)

B2B event marketer platform Goldcast raised a $28M Series A led by WestBridge Capital (PRN)

Cloud-based space communications solutions startup Atlas Space Operations raised a $26M Series B led by Mitsui (BW)

Web3 developer platform thirdweb raised a $24M Series A at a $160M valuation led by Haun Ventures (PRN)

NFT marketplace and experience startup NFT Genius raised a $10.5M Series A at a $150M valuation led by Dapper Labs, Spartan Labs, Commonwealth Asset Management, and Fundamental Labs (PRN)

Avenda Health, a startup creating personalized prostate cancer care, raised a $10M Series B led by VCapital (PRN)

AI-powered video conferencing platform Headroom raised a $9M round led by Equal Opportunity Ventures (TC)

VIAVIA, a video-first e-commerce platform for Gen Z, raised an $8M seed round led by NEA and Basis Set Ventures (PRN)

Subscription and recurring revenue management platform SubsBase raised a $2.4M seed round led by Global Ventures (TC)

IPO / Direct Listings / Issuances / Block Trades

SPAC

Crypto ATM firm Bitcoin Depot will merge with GSR II Meteora Acquisition Corp. in Q1 2023, raising ~$320M in an $885M deal (CT)

Fundraising

Sandeep Nailwal, founder of Ethereum layer 2 scaling platform Polygon, raised $50M for his new Symbolic Capital VC fund to back companies building consumer-facing dApps (TC)

Crypto Corner

Exec's Picks

Close out the summer by upgrading your shoe game with a new pair of Del Toro shoes. From Milanos, to Chukkas, to Sardegna Sneakers, they have kicks for everyone. Check out the Del Toro collection here.

For the sports betting readers who live in New Jersey (or NYC, because it takes 20 minutes to cross the river) that want $1,000 in free play for their first bet, check out BetMGM's new online sportsbook here!

"No one wants to work anymore" has been a common statement lately, but it couldn't be further from the truth. The real problem is that we have removed "work" from most jobs, leaving behind unnecessary, unfulfilling roles. Check out Jack Raines's latest piece On Meaningless Careers for more about this.

Tired of all the ESG bullsh*t? We know Texas is lmao. Want to gain exposure to historically recession resistant industries? The BAD ETF (NYSE:BAD) holds the largest companies in the Betting, Alcohol, and Drug (pharma & biotech) industries. Check them out here.

The Hiring Block 💼

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We aim to curate jobs across IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We'll sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

If you're a company looking to hire candidates and want to list a job opening on our board and feature on Exec Sum, click the button below:

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.