Together with

Good Morning,

Texas sued Meta over facial recognition practices, US closed its Kyiv embassy, US-Canada traffic is picking back up, Microsoft plans to reopen some offices, avocados are getting more expensive, US inflation outlook finally falls, DoorDash is bumping up fees on slow McDonald's restaurants (so all of them?), the Coinbase QR code had 20M hits, and oil keeps climbing higher.

No Big Swinging Decks podcast episode today, stay tuned for it later this week 🤝 We've got a special episode for y'all.

If you're looking to get your taxes done professionally, check out today's sponsor Picnic.

Let's dive in.

Before The Bell

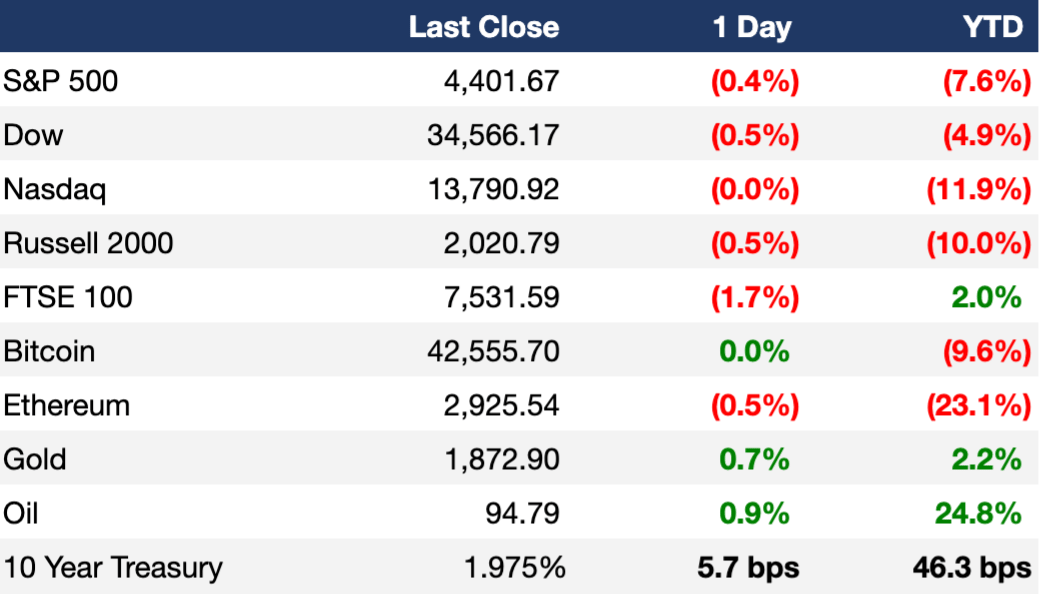

As of 2/14/2022 market close.

If you want to learn more about crypto trading strategies and the world of DeFi, check out our Foot Guns newsletter.

Markets

US stocks retreated again on Monday as investors digested more headlines from the Russia-Ukraine conflict

WTI crude oil futures rose above $95/barrel

The Cboe VIX hovered above 30 intraday, showing increased fear and volatility across Wall Street

Investors will continue monitoring market reactions to the conflict to determine whether or not this general risk-off move will continue throughout the week

Earnings

What we’re watching today: Roblox, Airbnb

Wed: Shopify, Nvidia

Thurs: Palantir, Walmart

Fri: DraftKings

Full calendar here

Headline Roundup

Texas sues Meta over Facebook’s facial-recognition practices (WSJ)

Fed’s Bullard says ‘credibility is on the line,’ Fed needs to ‘front-load’ rate hikes (CNBC)

US closes embassy in Kyiv (CNBC)

Putin signals talks with US and allies to go on as some military drills end (BBG)

US-Canada traffic picks up as bridge reopens after trucker blockade ends (WSJ)

Microsoft is reopening its Washington and Bay Area offices this month (CNBC)

Avocados to get even more expensive as US halts imports (BBG)

US inflation outlook falls for first time since October 2020 (BBG)

A-Rod, once scorned by Trump, in group buying his DC hotel (BBG)

Top investor urges Siemens Energy to take full control of wind turbine business (RT)

3M sees falling mask demand slowing its sales growth (WSJ)

DoorDash to bump up its fees on slow McDonald's restaurants (WSJ)

Roark seeks more time, capital for parent of restaurant brands like Arby’s and Dunkin’ (BI)

A Message From Picnic

Haven’t done your taxes because you were too busy betting on the Super Bowl? Check out Picnic Tax.

Picnic Tax is the new premium online tax product on the block.

It’s not a DIY product like TurboTax - you’ll be paired with an expert accountant to help you through the filing process. They’re rigorously pre-vetted so you can save time doing DD.

If you're a PE/VC investor, degenerate YOLO day trader, real estate landlord, or, better yet, all the above... Picnic has a network of hundreds of accountants that can handle anything from simple W-2s to more complex returns that include K-1s, rental or freelance income, multi-state, day trading gains/losses, crypto, you name it.

Don’t stress over your taxes and check out Picnic here.

Deal Flow

M&A / Investments

Apollo agreed to buy a majority stake in packaging company Novolex at a ~$6B valuation (BBG)

Intel is nearing a deal to buy Israeli firm Tower Semiconductor for ~$6B (RT)

Axis Bank is in talks to buy Citigroup’s India retail banking business in a potential $2.5B deal (BBG)

Specialty pharmaceutical company Norgine is exploring a sale at a potential $2B valuation (BBG)

Norwegian salmon farmer Salmar offered to buy rival NTS in a potential $1.7B deal (BBG)

Shares of UK podcast group Audioboom surged amid reports that Amazon and Spotify are considering bids (BBG)

Activist investor Jana Partners sold 84% of its holdings in Macy’s after prodding the retailer to consider alternatives for its online unit (RT)

VC

Financial health data analytics startup RapidRatings received a $200M investment from Spectrum Equity (BW)

Tripledot, a London based startup behind the popular Solitaire app and wood-block/sudoku hybrid Woodoku, raised a $116M round at a $1.4B valuation led by 20VC (TC)

Evolve, a vacation rental and hospitality management platform, raised a $100M round led by Durable Capital Partners (PRN)

Prospera, a governance platform and charter city developer, raised $100M in funding via a fractional ownership raise on Securitize’s blockchain (BW)

Papier, a startup bringing non-tech products to market, raised a $50M Series C led by Singular (TC)

Databook, a company providing consultative sales intelligence, raised a $50M Series B at a $550M valuation led by Bessemer Venture Partners (BW)

Robocast, a startup that owns the IP for the AutoPlay feature on streaming apps, raised a $35M Series B led by 2 NRP Managers (BW)

ProArch, a managed services business focused on digital transformation, received a $25M growth investment from MSouth Capital (BW)

PriorAuthNow, a real-time prior authorization network for providers and payers, raised $25M in funding led by Insight Partners (BW)

Banked, a startup providing an alternative to credit cards that rely on lots of private information, raised a $20M Series A led by Bank of America and Edenred Capital Partners (TC)

Fertility treatment startup Gaia raised a $20M Series A led by Atomico (TC)

Taxfyle, an online accounting service and workforce, raised a $20M Series B led by Fuel Venture Capital and IDC Ventures (BW)

3D social network BUD raised a $15M Series A+ led by Qiming Ventures Partners (TC)

Embedded finance platform Stitch raised a $21M Series A led by The Spruce House Partnership (TC)

Plastic waste upcycling startup Novoloop raised an $11M Series A led by Envisioning Partners (TC)

Minterest, a DeFi lending and borrowing protocol, raised a $5.52M token sale at a $514M valuation (PRN)

Remedial Health, a Nigerian startup helping digitize and eliminate substandard products at pharmacies, raised a $1M pre-seed round led by Global Ventures and Ventures Platform (TC)

Lovewick, a new app helping couples bridge the gap between dating apps and couples therapy, raised a $1M pre-seed round led by Corazon Capital (BW)

IPO / Direct Listings / Issuances / Block Trades

Chinese e-commerce platform Huitongda Network raised ~$284M in Hong Kong IPO priced at bottom of marketed range (BBG)

SPAC

Security services firm Allied Universal is in talks to merge with Warburg Pincus Capital Corp I-A, Warburg Pincus Capital Corp I-B, and a SPAC affiliate of JAWS Estates Capital, Barry Sternlicht’s family office, in a rare three-way potentially $20B deal (BBG)

Travel tech company HotelPlanner, online booking platform Reservations.com, and Astrea Acquisition Corp. have mutually ended their $688M deal (RT)

Crypto Corner

Exec's Picks

Arrived makes it easy to buy shares of rental homes, so that anybody can obtain passive income and participate in property value appreciation starting with $100. Arrived takes care of the management & operations, so you can sit back and build wealth. The company is backed by world class investors including Jeff Bezos & Marc Benioff. View available investment properties here

The Hiring Block

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We've got 40+ jobs spanning IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

Meme Cleanser

Catch the latest episode of our Big Swinging Decks podcast on Spotify and Apple Music 🤝