Together with

Good Morning,

Tesla sold 75% of its bitcoin holdings for $936M, US home prices keep climbing, investors are cutting back on equities exposure, private credit giants are slowing down lending, Ivy League endowments are bracing for losses, Esports giant FaZe Clan went public through a SPAC, and BlackRock lost $1.7T in the first half of 2022. A lot of OOOOF in this opener.

If you have conviction behind your economic views, you'll wanna check out our new publication, Eight Ball, a macro newsletter where we run down some of the most interesting prediction markets across interest rates, oil prices, GDP growth, and more.

Let's dive in.

Before The Bell

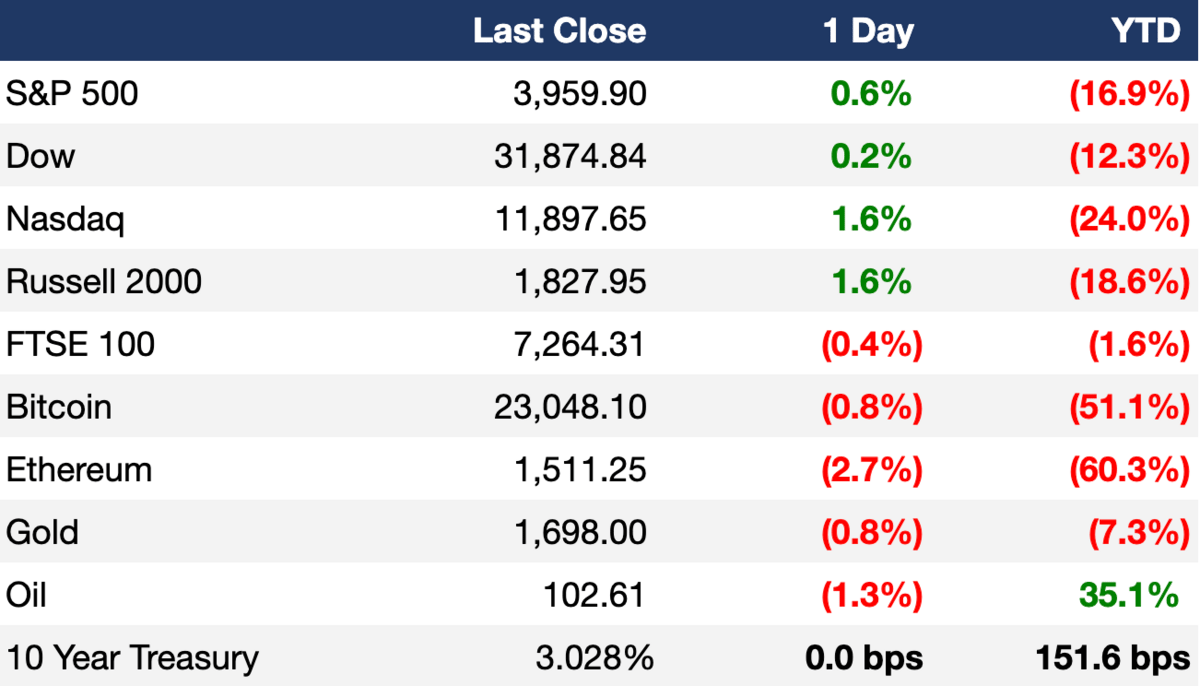

As of 7/20/2022 market close.

Markets

Stocks rose for the second consecutive session as companies continue to release better-than-expected earnings reports

Technology, communications and consumer discretionary stocks led the rally, with Netflix notably up 7.4% during the session and 14% on the week

30-year fixed mortgage rates rose to 5.51%, up from 2.88% a year earlier

The ECB meets today and is expected to raise interest rates for the first time in a decade by either 25 bps or 50 bps

Earnings

Tesla reported a sequential decline in quarterly profit but still exceeded expectations despite supply chain challenges, significantly increasing sales and profit year-over-year (CNBC)

United Airlines reported their first quarterly profit without the aid of government subsidies since the pandemic began, but fell short of earnings expectations and trimmed flight growth projections; its stock fell more than 6% after hours (CNBC)

What we’re watching this week:

Today: AT&T, American Airlines, Snap, Capital One

Friday: Verizon, American Express, Twitter

Full calendar here

Headline Roundup

US home prices hit a record high of $416K as sales continue to slide (WSJ)

The EU told member nations to cut gas usage by 15% amid threats made by Putin (RT)

The US accused the Mexican government of favoring its state-owned energy company at the expense of American businesses, launching what could become a trade fight (WSJ)

Private credit giants curb buyout lending spree on recession fears (BBG)

Investors have cut equity allocations to lowest level since Lehman collapse (FT)

Ivy League endowments are bracing for losses this year as PE values tumble (BBG)

Volvo is moving further into the EV space, with electric and hybrid vehicles making up 31% of Volvo’s total sales in Q2 (WSJ)

$22.3B of VC funding was invested in AI in 2021, just shy of its peak of $22.7B in 2019 (PRN)

US semiconductor manufacturer SkyWater Technology announced plans to invest $1.8B for a chip research and production facility in Indiana (RT)

US lawmakers moved closer to a bipartisan agreement on new legislation that would regulate stablecoins (WSJ)

Lyft laid off ~2% of its employees and dropped its in-house car rental service (TC)

A Message From Eight Ball

A Macro Newsletter with Skin in the Game

In Skin in the Game, Nassim Taleb said, "Don’t tell me what you think, tell me what you have in your portfolio."

Every day, economists and talking heads give their predictions about the economy, interest rates, and the stock market. "We are going into a recession!" "Oil is going to $150 per barrel!" And every day, most of these predictions are wrong. The problem is that none of these economists put their money where their mouth is, so their accuracy doesn't matter.

We launched Eight Ball to solve this problem. With our new newsletter, Eight Ball, we use data provided by real-time prediction markets to see where investors are forecasting interest rates, oil prices, GDP growth, and more.

Our forecasts are determined by investors who put their real money on the line, not media personalities looking for air time.

If you want economic forecasts that have "skin in the game," subscribe to Eight Ball here!

Deal Flow

M&A / Investments

Four bidders including PE firms Bain Capital, CVC Capital Partners, and Brookfield Asset Management advanced to the second bidding round for Japanese conglomerate Toshiba (RT)

Oil giant Shell is exploring a sale of its assets in two Gulf of Mexico oil & gas developments which could raise as much as $1.5B (RT)

BlackRock will acquire renewable natural gas producer Vanguard Renewables in a $700M deal (WSJ)

Ecommerce platform Missfresh is weighing a stake sale of its intelligent fresh market business, the company is seeking a $100M valuation for the unit (BBG)

Bank of Montreal agreed to buy sustainability-advisory firm Radicle Group (BBG)

Software company New Relic is exploring a potential sale following interest from PE firms (RT)

Energy company Hitachi Energy is making an equity investment in Swedish sustainable steelmaker H2 Green Steel (BBG)

Crypto infrastructure provider Blockdaemon acquired Danish digital asset security startup Sepior (TC)

VC

Contentsquare, a digital experience analytics platform for businesses, raised a $600M Series F at a $5.6B valuation led by Sixth Street Growth (TC)

FreshRealm, a provider of fresh meals for retailers nationwide, raised a $200M funding round (PRN)

Fintech startup Airwallex is in talks to raise up to a $100M Series E extension from Visa (BBG)

Crunchbase, a platform for finding business information about private and public companies, raised a $50M Series D led by Alignment Growth (PRN)

Arrenda, a fintech for LATAM's real estate market, raised $25M in debt financing and $1.5M in equity in a pre-seed round led by Fasanara Capital (TC)

Dot Compliance, a ready-to-use quality and compliance platform, raised a $23M Series B led by Israel Growth Partners (PRN)

Conversational commerce startup Charles raised a $20M Series A led by Salesforce Ventures (TC)

Telehealth platform Healthie raised a $16M Series A led by Velvet Sea Ventures (TC)

Valid8Me, a SaaS customer onboarding platform, raised $12.7M from Grant Thornton Ireland (EUS)

Wallife, an Italian insurance technology startup that protects individuals from risks originating from technological and scientific progress, raised a ~$12.2M Series A led by United Ventures (Wallife)

Fitterfly, a digital therapeutics startup focused on diabetes, raised a $12M Series A led by Amazon Smbhav Venture Fund and Fireside Ventures (ET)

Acuamark Diagnostics, an early cancer detection company, raised an $11.3M Series A led by the Del Vecchio Family Foundation (PRN)

Veremark, a pre-employment screening startup, raised an ~$8.4M Series A led by Stage 2 Capital (EUS)

Passionfruit, a London-based freelancing platform, raised a $4.3M seed round co-led by firstminute Capital and Playfair (FSMS)

Tedooo, a social network for the trade world, raised a $3M seed round led by Stardom Ventures (TC)

IPO / Direct Listings / Issuances / Block Trades

SPAC

Esports giant FaZe Clan began trading under ticker FAZE on Wednesday after completing a $725M SPAC merger with B. Riley Principal 150 Merger Corp (TV)

Turkish mobility app Marti is set to announce its planned merger with Galata Acquisition Corp. in the coming weeks; it will be the first IPO by a Turkish company via a SPAC in New York (BBG)

Debt

The lenders led by Bank of America backing the $15B debt sale for the buyout of cloud computing company Citrix Systems will delay their leveraged loan and high-yield bond offerings until after Labor Day weekend, citing market volatility and recession fears (BBG)

Fundraising

Crypto Corner

Crypto exchange platform Coinbase shares jumped 14% after saying it has no exposure to bankrupt crypto firms (CNBC)

Tesla dumped 75% of its bitcoin holdings, one year after touting ‘long-term potential’ (CNBC)

Brazil fintech BEE4 plans to launch the first local marketplace of tokenized stocks in the coming weeks (CD)

House lawmakers prep bipartisan stablecoin bill to unveil next week (TB)

Exec's Picks

Heading to the Hamptons, Nantucket, Amalfi Coast, or Nice? Need to freshen up your swim shorts game? Check out Meriggi, the premium men's swimwear brand inspired by the Mediterranean lifestyle and aesthetic. Their swim shorts are some of the absolute cleanest in the game. You'll also get free shipping if you use this link.

The Hiring Block 💼

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We aim to curate jobs across IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We'll sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

If you're a company looking to hire candidates and want to list a job opening on our board and feature on Exec Sum, click the button below:

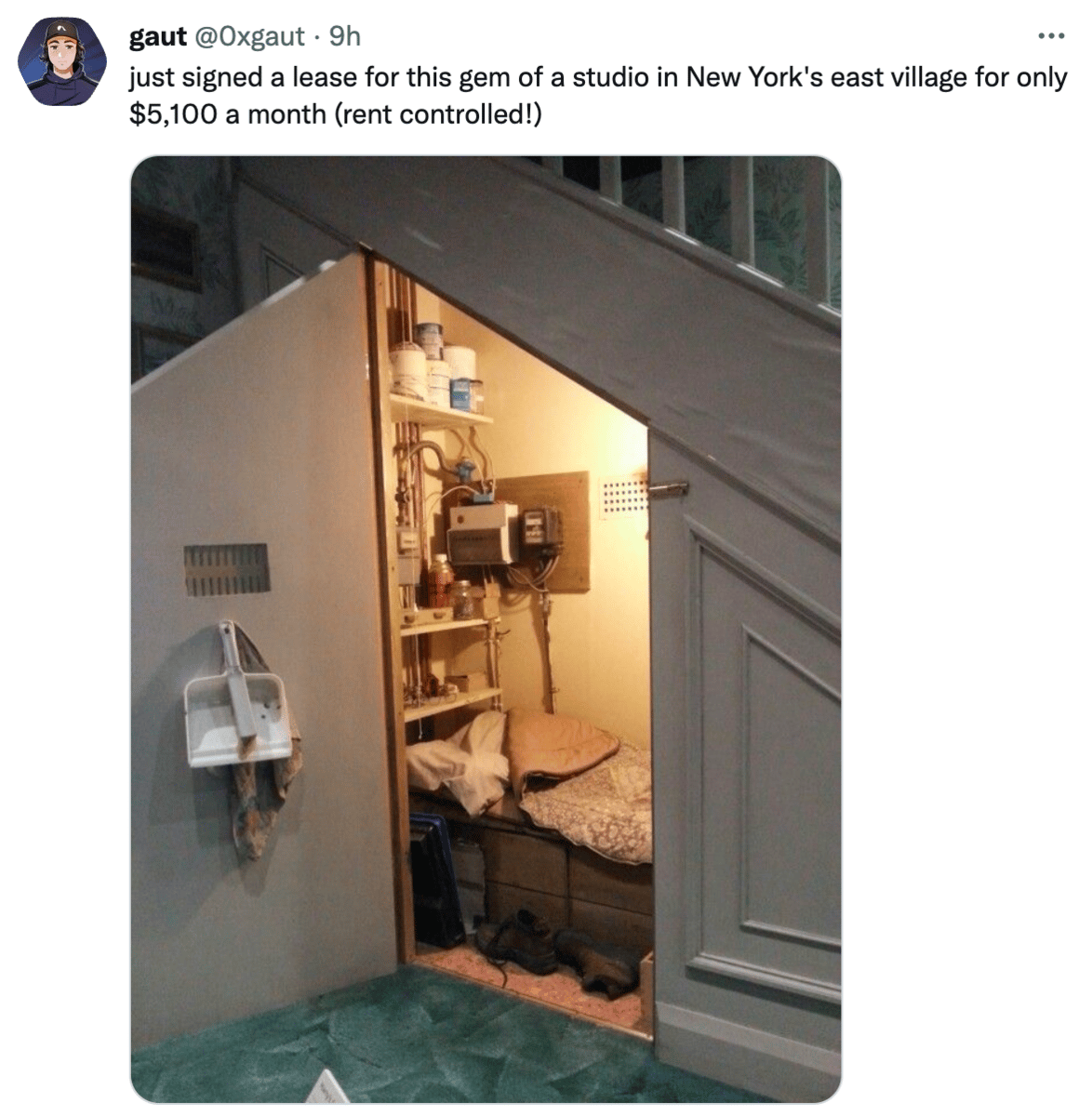

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.