Together with

Good Morning,

Yellen warned of US default risk, JPM and BofA continue to hire as Goldman cuts jobs, Tesla is slashing its prices, investors are buying billions in emerging market debt, Wells Fargo underperformed its peers in Q4, EVs made up 10% of all new vehicle sales last year, and the SEC brought charges against Gemini and Genesis.

Is your New Year's resolution to finally learn a new language? Kickstart your journey with today's sponsor, Babbel!

Let's dive in.

Before The Bell

Markets

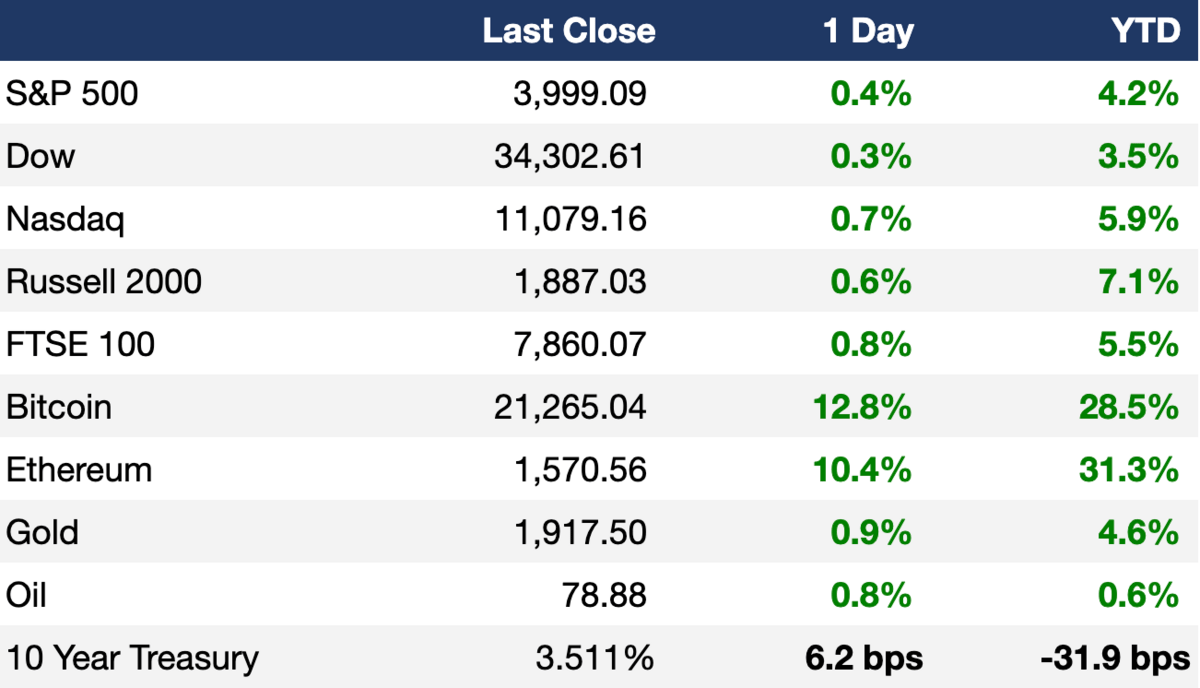

All three major US indexes gained on Friday as investors digested major bank earnings and bet on cooling inflation

The S&P and Nasdaq posted their second consecutive weekly gain and best week since November

The pan-European Stoxx 600 rose 0.7% to its highest level since April 2022

Canada's TSX index rose for a seventh consecutive session to a six-week high ahead of CPI data today

Bitcoin has been on a moon mission the last 10 days

The dollar continued to trade at seven-month lows with all eyes on the yen ahead of BoJ's policy decision today

On Wednesday, we'll receive the UK's CPI data and US's PPI data

Earnings

JPMorgan beat Q4 EPS and revenue estimates on strong trading revenue and a 48% increase in interest income, but continued their poor IBD run and set aside $2.3B for credit losses as it anticipates a 'mild recession' (CNBC)

Bank of America also beat Q4 EPS and revenue estimates on strong trading revenue and high interest income due to rising rates, but saw a 50% drop in IBD fees and set aside $1.1B for credit losses as it sees an 'increasingly slowing' economic environment (CNBC)

Citigroup met Q4 EPS estimates and beat on revenue on similar trends like JPMorgan and BofA, but saw a 21% YoY profit decline amid a costly restructuring program; CEO Fraser expects a 'mild-recession' in H2 2023 (CNBC)

Wells Fargo missed Q4 estimates as profit dropped by over 50% YoY due to lower mortgage originations, a recent $3.7B settlement, and a $957M provision for credit losses; their earnings were the weakest among major peers (RT)

BlackRock reported an 18% drop in Q4 profit on lower fee income, but registered $146B of long-term net inflows as stocks and bonds rebounded (RT)

What we're watching this week:

Today: Goldman Sachs, Morgan Stanley

Wednesday: Charles Schwab

Thursday: Netflix, Procter & Gamble

Full calendar here

Headline Roundup

Janet Yellen warned of US default risk by early-June (RT)

Investors have bought $39B in emerging market debt YTD (RT)

US Treasury yields plunged this year more than they shot upward last January (WSJ)

Global equity funds saw their first weekly inflow in 10 weeks last week (RT)

Global household wealth optimism has collapsed over the last year (RT)

US regulators are cracking down on 'collateralized fund obligations' used by PE groups (FT)

India's insurance regulator will treat green bond purchases as infrastructure investments (RT)

JPMorgan and BofA continue to hire as Goldman cuts (RT)

Credit Suisse will cut 10% of European investment bankers (FT)

BNY Mellon will cut 3% of its workforce this year (RT)

Tesla cuts prices on new models in US (AX)

EVs made up 10% of all new car sales last year (WSJ)

General Catalyst, Spark Capital in talks to back OpenAI rival (TI)

Meme-stock investor Ryan Cohen has taken a stake in Alibaba in rare China activism (BBG)

Goldman Sachs' consumer lending business has lost $3B since 2020 (WSJ)

Microsoft to add ChatGPT to Azure Cloud Services 'soon' (BBG)

Twitter is offering free ads to brands that advertise on its platform (WSJ)

A Message From Babbel

Bolster your resume and start speaking a new language in 3 weeks

As the corporate world, including finance, shifts to a global landscape; multilingual employees have an advantage with the ability to forge relationships across borders.

The good news?

Babbel makes learning easy.

Instead of going back to years of schooling, Babbel has created a platform which streamlines your language learning process.

Why Babbel?

The lessons take 10 minutes. Within 3 weeks, you will be able to have basic conversations in your new language.

Lessons are built by a team of 150+ language experts and voiced by native speakers.

Multiple ways to learn: lessons, podcasts, games, videos, and live online virtual classes with top teachers.

Make learning a new language an actual achievable ‘new year’s resolution’ with Babbel.

For a limited time, you can get up to 55% off your subscription by using the link below. Take advantage of this amazing offer and get your language learning on today!

Deal Flow

M&A / Investments

Warner Bros Discovery is exploring a sale of its music library that could be valued at over $1B (FT)

Chinese crypto entrepreneur Justin Sun is willing to spend $1B of his own funds to buy assets of Digital Currency Group (RT)

Spanish grid operator Enagas agreed to buy German utility Uniper’s 20% stake in the BBL gas pipeline, which links Britain with the Netherlands, for $81M (RT)

BlackRock agreed to buy a minority stake in small business 401k provider Human Interest (WSJ)

VC

Sollum Technologies, an LED lighting solution that mimics the sun’s natural light, raised $30M in financing from Idealist Capital and Fondaction (BW)

Locad, a logistics provider for omnichannel e-commerce companies, raised an $11M Series A led by Reefknot Investments (TC)

India-based OTT platform STAGE raised $4.9M in funding led by Blume Ventures (YS)

Kwara, a Kenyan fintech digitizing credit unions, raised a $3M seed extension round from DOBEquity, Globivest, and others (TC)

IPO / Direct Listings / Issuances / Block Trades

Saudi Arabian automotive services firm Petromin is reviving plans for a domestic IPO that could raise up to $1B (BBG)

Chinese mining firm Zhejiang Huayou Cobalt picked Citic Securities to handle a $500M-$1B GDR sale in Switzerland (BBG)

China's Alibaba sold a 3.1% stake in Indian fintech Paytm for $125M through a block deal (RT)

Bain Capital is considering an IPO of Australian airline Virgin Australia (WSJ)

Solar energy technology provider Nextracker filed for a US IPO (BBG)

SPAC

Stratospheric balloon company World View will merge with Leo Holdings Corp. II in a $350M deal (TC)

Fundraising

UAE VC firms Venom Foundation and Iceberg Capital launched a $1B Venom Ventures Fund to invest in decentralized/web3 startups in the pre-seed and Series A stages (CG)

Fractal Growth Partners, a VC fund founded by two ex-KKR and BII fund managers, plans to raise up to $250M for a new fund to invest in tech-focused startups in India (PEW)

Cleavemoor, a consumer sector investment advisor, launched a hybrid long/short PE fund (PEW)

Crypto Corner

Crypto.com cut 20% of its workforce jobs amid ripple-effects of FTX collapse (TC)

SEC charged the Winklevoss twins’ Gemini crypto exchange and lending partner Genesis with selling unregistered securities that sparked a $900M crisis (BBC)

Binance will allow institutional investors to keep collateral off the platform (CD)

Cryptocurrency retook a $1T market cap (YH)

Bitcoin's surge caused over $500M in liquidations, highest in 3 months (CD)

Congress announced a Subcommittee on Digital Assets, Financial Technology and Inclusion in move to regulate crypto industry (CNBC)

Twitter’s crypto price index now features 30 tokens (CT)

Exec's Picks

ICYMI: we recently conducted a Q&A with Rich Handler (CEO of Jefferies) on Instagram. Rich answered 100 questions from followers looking for career and life advice. We decided to publish list as a blog post for everyone to see and share. Check it out here.

Fellow meme page Ramp Capital published a great piece on everything wrong with the push to move all workers back to the office.

Harvard's Mihir A. Desai wrote a damning opinion piece in The New York Times on the end of the loose money era that infected capitalism.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.