Together with

Good Morning,

Taylor Swift is now a billionaire thanks to her Eras tour, the US economy had a blockbuster Q3, BlackRock thinks private debt will double by 2028, Fidelity wants to expand its reach in the ETF market, WeWork’s creditors are fighting for control of the company, and Apple might face a watch import ban.

Is your old mattress lumpy, uncomfortable, and ready to bite the dust? Upgrade your sleep with today's sponsor, Eight Sleep.

Let’s dive in.

Before The Bell

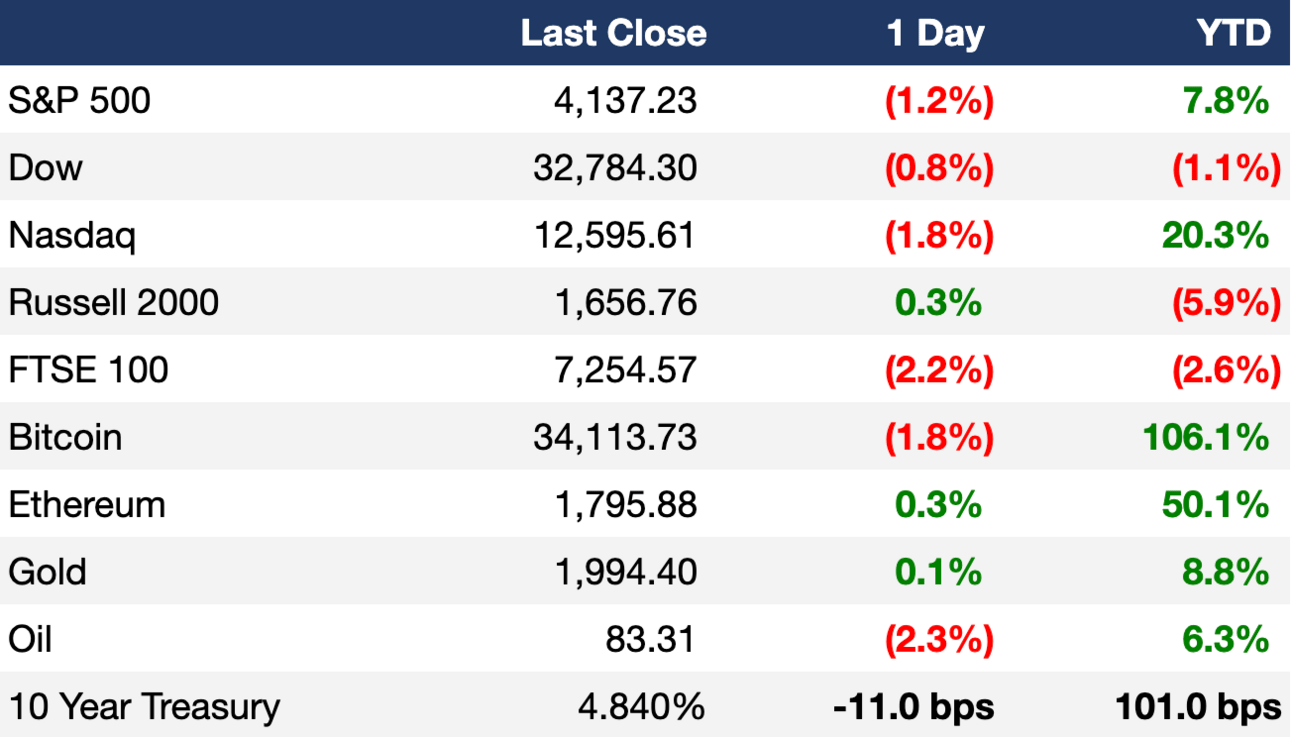

As of 10/26/2023 market close.

Markets

US stocks continued their fall today after disappointing tech earnings

The Nasdaq led indices with a 1.75% decline

Asian stocks fell to 11-month lows amid Treasury yield fears

Earnings

Amazon shares rose 5% after it reported better-than-expected Q3 earnings and revenue; AWS revenue was slightly below expectations (CNBC)

Comcast shares dropped 9% despite beating Q3 earnings and revenue expectations due to its losses in broadband customers and a slump in NBCUniversal’s advertising revenue (CNBC)

Ford shares fell 6% after it missed both Q3 earnings and revenue expectations due to the UAW labor strike, which cost the automaker $1.3B (CNBC)

UPS shares fell 6% despite beating earnings estimates due to a larger-than-expected revenue decline and a cut in its full-year revenue guidance due to economic uncertainty (CNBC)

Intel shares climbed 8% after it beat Q3 revenue and earnings expectations, although overall revenue declined; the chipmaker expects revenue to grow again in the current quarter (CNBC)

What we're watching this week:

Today: Exxon, Chevron, AbbVie, Piper Sandler, T. Rowe Price

Full calendar here

Headline Roundup

US economy delivers blockbuster performance in third quarter (RT)

Taylor Swift vaults into billionaire ranks with blockbuster Eras tour (BBG)

BlackRock says private debt will double to $3.5T by 2028 (BBG)

Fidelity aims to break into an ETF market dominated by Vanguard (BBG)

WeWork’s creditors are fighting over control of the restricted company (BBG)

Global hedge funds are boosting their presence in the long-shunned Indian market (RT)

Xi Jinping is looking for someone to blame for China’s property bust (WSJ)

Apple faces potential watch import ban after Federal Trade ruling (WSJ)

Musk tells X staff new products will challenge YouTube, LinkedIn (BBG)

Core inflation in Japan’s capital unexpectedly accelerates, BOJ in spotlight (RT)

Healthcare companies counter investor worries over Wegovy effect (RT)

‘Grandpa Google’: Search head testifies that young users see it as out of style (CNBC)

Home prices in Canada to fall 5% as rates curb activity (BBG)

Hasbro, Mattel shares plunge as toymakers forecast a lackluster holiday season (CNBC)

Manhunt underway after Maine shootings leave at least 18 dead (WSJ)

A Message From Eight Sleep

Invest in your sleep.

Humans spend roughly one-third of their lives sleeping. A good night’s sleep is vital for every human to survive. So why not get the best out there? Enter Eight Sleep.

Eight Sleep is a high-tech smart bed system that has taken Silicon Valley by storm. With built-in heating and cooling system, multiple foam layers to deliver comfort, and analytics tracking to help you optimize your sleep and recovery, Eight Sleep is the complete package.

Eight Sleep has also given the Litquidity community the best offer on the market for their products. Just use code "LIT" at checkout to apply the discount, and you'll get a nice discount.

So what are you waiting for? Order your Eight Sleep today by clicking below 👇🏼

Deal Flow

M&A / Investments

ConocoPhillips is weighing an offer for privately held Permain Basin energy producer CrownRock, which is valued at $10B-$15B, after Exxon and Chevron expressed interest in participating in the sale process for CrownRock (RT)

Western Digital and Japan's Kioxia Holdings broke off talks to create one of the world's biggest chipmakers; Japan’s top banks were set to commit $12.6B financing to support the merger (RT)

Stellantis will invest $1.6B to acquire a 21% stake in Chinese EV maker Zhejiang Leapmotor Technologies (RT)

SolarWinds, a $1.5B market cap software company controlled by PE firms Silver Lake Management and Thoma Bravo, is exploring options, including a potential sale (BBG)

Marcolin, an eyewear maker for brands including Tom Ford, is considering a sale; a deal could the company at $1.4B (BBG)

Air France-KLM announced a new $1.4B financing agreement with Apollo Global (RT)

PE firm Hg is weighing options, including a potential sale, for F24 next year; the German software business could be valued at up to $1.1B (RT)

The Restaurant Group received a request for information from PizzaExpress Group owner Wheel Topco to evaluate a possible offer weeks after it agreed to a $611M acquisition offer from Apollo Global (RT)

Alternative asset manager Fortress Investment Group approached $459M retail landlord Whitestone REIT about a takeover (BBG)

Shareholders of Hipgnosis voted against the music royalties fund’s $440M deal to sell 29 catalogues to a private Blackstone vehicle (RT)

Financial services technology firm Wex agreed to acquire contractor software company Payzer for ~$250M (BBG)

Canaccord Genuity explored a potential acquisition of Close Brothers Group's wealth management operations (RT)

UPS will acquire logistics company Happy Returns from PayPal for an undisclosed sum (RT)

VC

Ola Electric, an India-based electric vehicle startup, raised $384M in a round including $240M in debt at a $5.4B valuation led by Temasek (TC)

Triveni Bio, a biotech company developing functional antibodies for immunological and inflammatory disorders, raised a $92M Series A led by Atlas Venture and Cormorant Asset Management (PRN)

AgentSync, a Denver-based modern insurance infrastructure company, raised a $50M round led by Craft Ventures and Valor Ventures (FN)

Cloud-like functionality on-prem startup Oxide raised a $44M Series A led by Eclipse (TC)

Arteria AI, a startup using data to overhaul corporate financial documents, raised a $30M Series B led by GGV Capital US (TC)

Abridge, a startup using generative AI to create clinical documentation, raised a $30M Series B led by Spark Capital (BW)

Cranium, an enterprise AI security and trust software firm, raised a $25M Series A led by Telstra Ventures (PRN)

Omnidian, a solar asset management startup, raised a $25M round from Activate Capital, WIND Ventures, and more (BW)

Moreh, a Seoul-based startup building AI software tools, raised a $22M Series B led by AMD, KT, and Smilegate Investment (TC)

Traba, a Miami-based marketplace platform for light industrial staffing, raised a $22M round led by Founders Fund (FN)

Betteromics, a clinical-grade compliant SaaS platform, raised a $20M Series A led by Sofinnova Partners and Triatomic Capital (BW)

Eco-fintech platform The Landbanking Group raised $11M in seed funding led by BonVenture (EU)

Web3 Pro, a marketing SaaS company for businesses, raised $10M in funding from P101 (PRN)

FlyGuys, a Lafayette, LA-based reality data-capturing technology company, raised a $10M Series A from Mitchell Capital and Advantage Capital (FN)

Cyber security and insurance platform Upfort raised an $8M Series A led by SYN Ventures (BW)

Iron and salt grid battery startup Inlyte Energy raised an $8M seed round led by At One Ventures (PRN)

Account Labs, a Singapore-based company created by the merger of smart contract wallet provider UniPass and hardware wallet developer Keystone, raised $7.7M in funding led by Amber Group, MixMarvel DAO Ventures, and Qiming Ventures (FN)

Algenesis, a plant-based material science company, raised a $5M seed round led by First Bight Ventures (PRN)

Credal.ai, a startup allowing enterprises to connect their internal data to text-generating AI models, raised a $4.8M seed round led by Spark Capital (TC)

l’école AI, a startup creating machine teaching technology, raised a $3M seed round led by Sofinnova Partners (FN)

Social commerce startup Nectar AI raised a $2M pre-seed round led by Flying Fish Ventures (TC)

Diversity, equity, and inclusion measurement startup 50inTech raised a $1.6M seed round from Inco Investissements, Evolem, Super Capital, and more (TC)

Assureful, an insurance provider for e-commerce sellers, raised a $1.5M pre-seed round led by Markd (PRN)

IPO / Direct Listings / Issuances / Block Trades

Debt

Billionaire Gautam Adani’s Adani Group is seeking to raise as much as $4B from banks to help develop manufacturing plants (BBG)

GOJO Industries, the maker of Purell hand sanitizer, refinanced ~$500M of debt through a transaction with investment firm Silver Point Capital (RT)

Spanish football club Real Madrid FC is set to raise $390M from instutional investors in the private debt market to finance the renovation of its iconic Santiago Bernabeu stadium (BBG)

Bankruptcy / Restructuring

Bankrupt crypto lender Genesis Global is pursuing a Chapter 11 liquidation plan that abandons a previous settlement proposal to restructure the $1.7B in loans it extended to its parent company Digital Currency Group (WSJ)

Fundraising

Fortress Investment Group is targeting $8B for its Fortress Credit Opportunities Fund VI which will invest in areas ranging from distressed debt to structured credit (BBG)

Consumer-focused buyout shop Brynnwood Partners raised $750M for its Brynwood Partners IX (WSJ)

A unit of AXA Investment Managers is raising a new fund that will provide net-asset-value loans; the fund has raised $400M from institutional investors (BBG)

Crypto Corner

Exec’s Picks

Kyla Scanlon wrote about the history of the “9-5” and why it might be time to rethink work.

EV stock performances over the last few years provided an excellent case study on avoiding big market delusions, according to Larry Swedroe and Ben Henry-Moreland.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter