Together with

Good Morning,

Florida accidentally banned banks from doing business, UK's new budget took aim at PE, FOMO is driving gold to historic highs, and EY severed ties with Supermicro on serious 'integrity' concerns.

The once high-flying AI darling has been getting absolutely cooked with a whistleblower lawsuit, a scathing short report, delayed earnings, a federal investigation, and its auditor resigning, all within the last six months. This isn't even their first such controversy, having been delisted in 2018!

Move on from the daily deluge of tedious tasks and streamline all your investment processes with BlueFlame AI, a GenAI platform for alternative investments.

Let's dive in.

Before The Bell

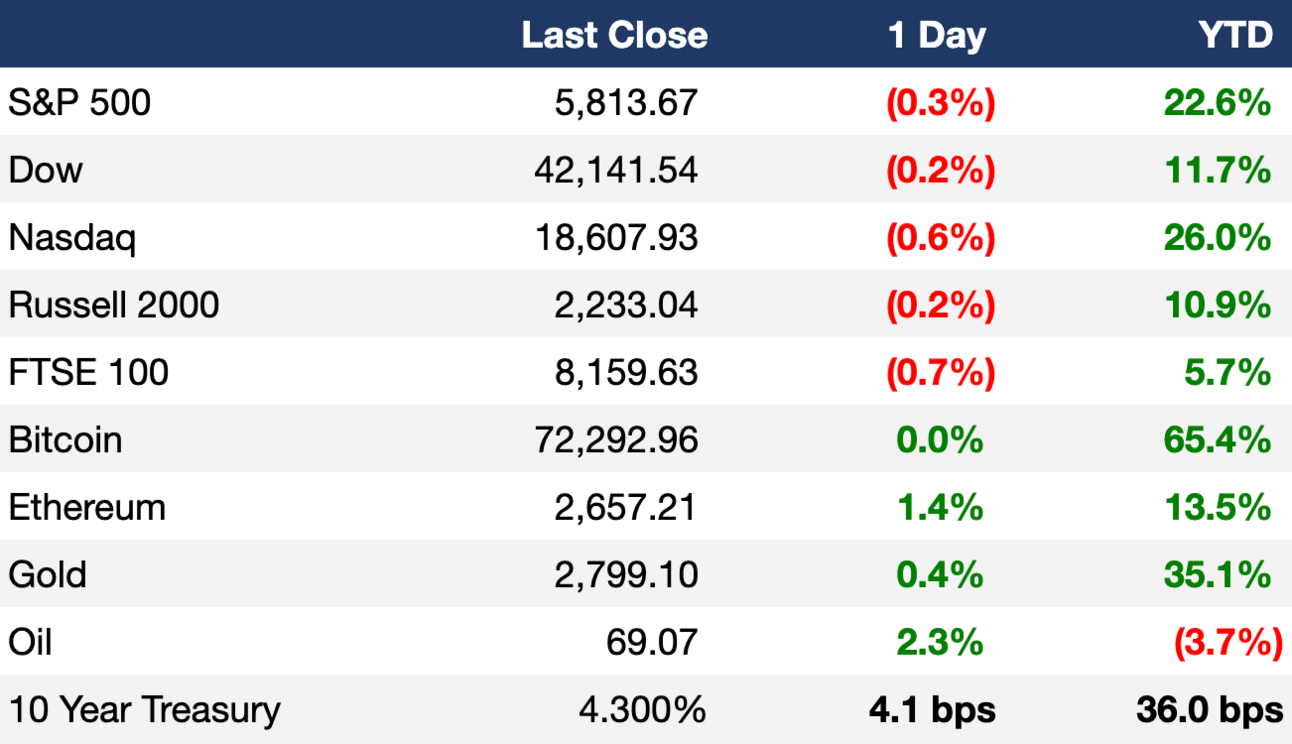

As of 10/30/2024 market close.

Markets

US stocks fell yesterday as investors digested Big Tech earnings and economic data

UK 10Y gilt yield spiked to 4.36% in response to the UK budget

Gold soared to new ATHs

Implied dollar volatility surged to its highest since March 2023 in its biggest one-day rise since 2017 ahead of US elections

Earnings

Microsoft beat Q1 EPS and revenue estimates as AI demand fueled growth in its cloud business, though Q2 guidance fell short of expectations (CNBC)

Meta beat Q3 EPS estimates and posted record revenue but missed on user growth and warned of significant acceleration in AI CapEx (CNBC)

Starbucks missed Q3 EPS and revenue estimates on a third-straight quarterly sales decline, prompting new CEO Niccol to announce fundamental changes in menu, prices and offerings (CNBC)

Coinbase missed Q3 EPS and revenue estimates as low Bitcoin volatility led to muted crypto trading (CNBC)

Eli Lilly missed Q3 EPS estimates and slashed FY guidance amid disappointing sales in its blockbuster weight loss and diabetes drugs (CNBC)

DoorDash beat Q3 estimates on its first-ever profit and gave a strong Q4 forecast as it seeks to capture resilient demand for online delivery (RT)

What we're watching this week:

Today: Apple, Amazon, Intel, Uber

Friday: ExxonMobil, Chevron

Full calendar here

🇺🇸 Election Forecast

Make a deposit now to guarantee trades up until Election Day! Bet the election legally, only on Kalshi.

Headline Roundup

US hiring surged by the most since July 2023 (CNBC)

US GDP grew 2.8% YoY on resilient consumer spending (BBG)

Eurozone GDP grew 1.5% YoY in a two-year high (CNBC)

Treasury will maintain auction sizes for next several quarters (RT)

UK budget reveals £40B tax hikes aimed at PE and wealthy (FT)

Australia inflation fell to 2.8% to its lowest since early 2021 (RT)

Florida accidentally banned banks from doing business (WSJ)

Equal-weight European index funds are seeing record inflows (FT)

Value and volume of gold demand hit record highs (BBG)

AI's $1.3T future increasingly hinges on Taiwan (BBG)

EY resigned as Supermicro's auditor on 'integrity' concerns (CNBC)

Samsung's smartphone crown slips as tech giant faces reckoning (BBG)

Volkswagen profit plunged 64% on China woes (FT)

KKR and ECP will invest $50B in AI data center and power projects (WSJ)

Dropbox laid off 20% of its workforce (WSJ)

Spirit will furlough 330 more pilots (RT)

US cracked down on Russia's facilitators worldwide (FT)

Scott Murray was sentence to prison over a fake $4B Getty Images bid (RT)

US 30Y mortgage rate surged to 6.73%, the highest since July (RT)

A Message from BlueFlame

Unleash the Transformational Powers of BlueFlame AI this Halloween!

BlueFlame AI has conjured a wickedly powerful spell to transform your operations. Our GenAI stalks the deepest, darkest depths of your firm's bottomless data pit, devouring expert network transcripts, CIMs, board decks, emails, and broker research like a ravenous werewolf.

With a wave of our digital wand, we summon templated PowerPoint decks and IC memos from the abyss, saving you from the bone-chilling horrors of manual labor.

But wait, there's more! Our cauldron of tools extends to the entire firm, including the DDQ automation potion that magically slashes hours off your due diligence process, freeing you from the tedious task of battling paperwork demons.

For the truly intrepid souls, summon a demo and behold the bewitching power of BlueFlame AI with your own eyes. But beware – once you've glimpsed the future, there's no turning back from the transformational power of AI!

Deal Flow

M&A / Investments

German engineering group Siemens agreed to buy software maker Altair Engineering for $10B, including debt

The family of Susan Y. Kim, which controls Amkor Technology, is in talks to acquire a minority stake in the NFL's Philadelphia Eagles from Jeff Lurie at an $8B valuation

$2.7B-listed Japanese lift-maker Fujitec is in talks sell to PE

Brookfield acquired a $2.3B stake in four offshore wind farms from Danish energy giant Orsted

Insurers Allianz, Aviva, Sampo, and Ageas are among potential bidders for Bain Capital-owned UK insurer Esure, which could fetch $1.9B

Norway-owned energy giant Equinor will acquire a 60% stake in non-operated natural gas assets in PA from EQT for $1.3B

Francisco Partners will acquire Global Payments' medical software business AdvancedMD for $1.13B

ConocoPhillips is exploring a sale of some of its Permian Basin shale operations for over $1B

Investment firm Aquarian acquired a majority stake in PACE Equity and will invest $1B in the sustainable CRE lender

VC

Chinese data center firm GDS raised $1B Series B led by Coatue and Baupost

Tencent-backed fintech Airwallex is in talks to raise $200M at a $6B valuation

Customer service Ai startup Regal raised a $40M round from Emergence Capital, Founder Collective, and Homebrew

Zenity, a startup securing agentic AI, raised a $38M Series B led by Third Point Ventures and DTCP

Neara, an AI-powered predictive modeling software for critical infrastructure, raised a $31M Series C led by EQT

Specialized bond ETF provider BondBloxx raised a $27M round led by Macquarie

Procurify, a proactive spend management solutions, received $20M in growth capital from CIBC Innovation Banking

Remote sensing startup Matter Intelligence raised a $12M seed round led by Lowercarbon Capital

Databento, a financial data startup, raised $10M from Belvedere Trading, Clear Street, Lightscape Partners, and others

Bifrost, a startup helping industrial companies speed up model training, raised an $8M Series A led by Carbide Ventures

Verax AI, an enterprise-grade software solutions for visibility and control of AI in production, raised a $7.6M seed round led by TQ Ventures

Autonomous GenAI-for-code startup Diffblue raised a $6.3M round led by IP Group, Parkwalk Advisors, and AlbionVC

Hummingbirds, a platform connecting hyperlocal creators with brands, raised a $5.4M round led by Allos Ventures, Ground Game, and others

CREW Carbon, a decarbonization platform for wastewater, raised a $5.3M seed round led by Counteract

IPO / Direct Listings / Issuances / Block Trades

Korea Zinc plans to raise $1.8B in a discounted stock offering equivalent to 18% of outstanding shares

A group of investors led by Emirates Driving will invest over $1B in Vietnamese EV maker VinFast

Debt

Danish logistics giant DSV launched a $5.4B bond sale to fund its $15.5B acquisition of Deutsche Bahn's DB Schenker unit

Bankruptcy / Restructuring / Distressed

BlackRock-owned insurance claims manager Alacrity Solutions is in restructuring talks with private credit lenders Antares, Blue Owl, and KKR

Fundraising

MM PE firm Berkshire Partners closed its eleventh flagship fund at $7.8B

PIMCO raised $2B for its specialty asset-based private lending strategy

European growth equity firm Verdane raised $755M for a second decarbonization fund

PE firm Inverness Graham closed its inaugural high-growth LMM fund with $238M

Crypto Corner

Exec’s Picks

In 2024, there's no reason for your portfolio companies to be wasting time on financial busywork. Ramp's all-in-one platform allows firms to fully automate all financial operations to improve efficiency and profitability across the board. Automate your financial operations with Ramp, the FinOps platform trusted by hundreds of PE and VC firms.

Wilson's got some incredible deals across apparel and equipment this fall. Shop the collection here.

Sujeet Indap wrote a great piece on Callaway's failed acquisition of TopGolf. In other words, a high-performance golf lab's ambitious venture into hospitality real estate.

Jeff Bezos took to his very own Washington Post to defend their rare refusal to endorse a US presidential candidate. A critical opinion in our polarized times…

Luke Kawa explained why US yields seem to be bucking the Fed and the Trump factor may not be the most obvious explanation.

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting firm established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, credit, and investment banking.

We're currently seeking talent for some incredible roles. Head over to Litney Partners to drop your resume / create your profile and we'd love to get in touch!

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity’s brain on business advice, insights, or just chat to say what’s up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.