Good Morning,

BLS canceled the October CPI report, Trump met with Mamdani, hedge funds are scrambling to cover shorts, PE firms are turning to dividend recaps at record pace, McLaren bottled it again, and software engineers were hit the hardest in Amazon layoffs last month.

Let's dive in.

Before The Bell

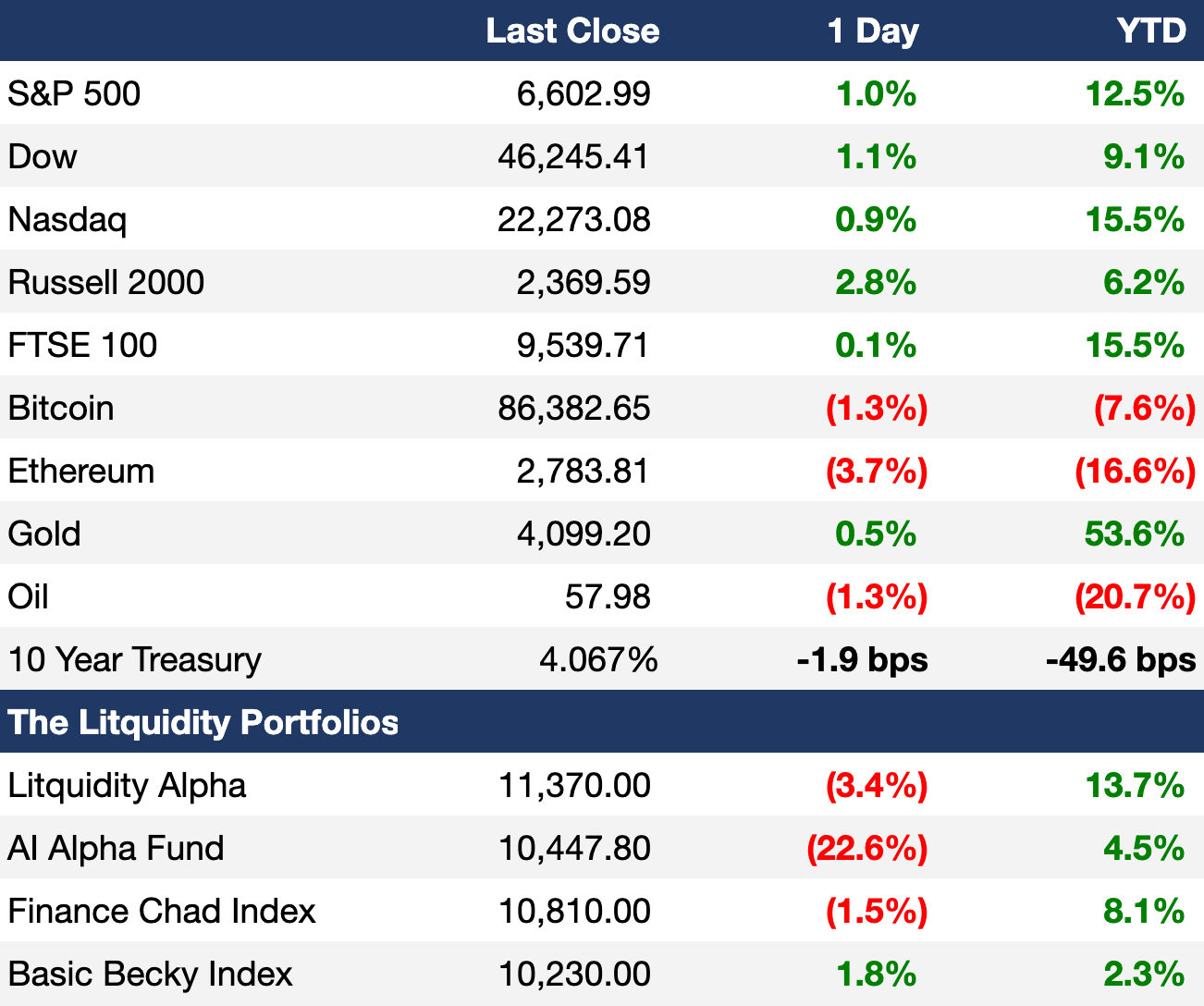

As of 11/21/2025 market close.

Learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks rallied on Friday to recover some losses from last week's steep tech-driven selloff

MSCI EM index slumped 2.7%, in its worst day drop since April

MSCI FX index fell 0.4% in its worst day since April

European natural gas hit an 18-month low on Ukraine-Russia peace talks

Crypto markets lost $1.2T in value last week

Bitcoin is on track for its worst month since the 2022 crypto crash

Earnings

What we're watching this week:

Today: Zoom

Tuesday: Alibaba, Dell, Best Buy, Abercrombie & Fitch, Workday, Kohl's

Full calendar here

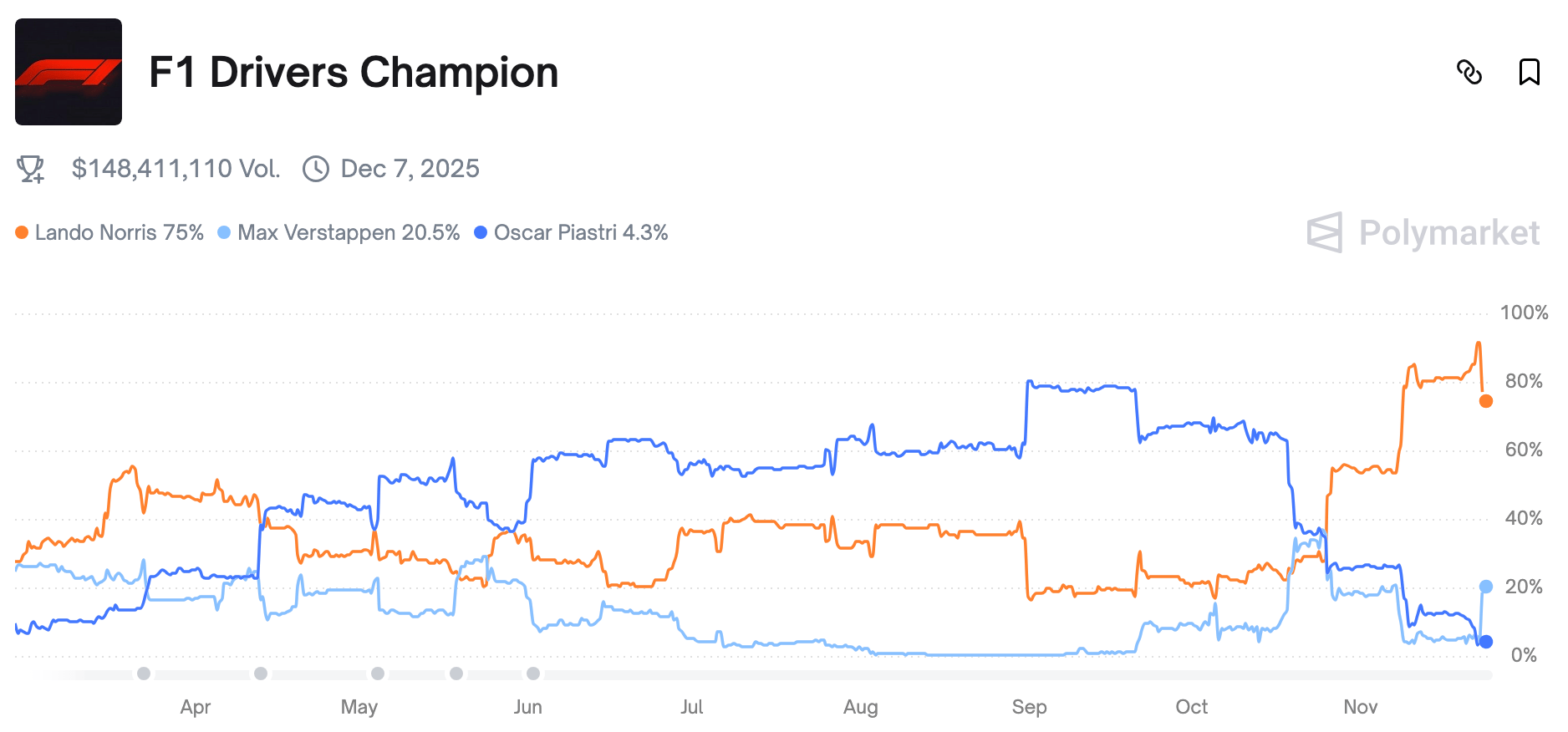

Prediction Markets

Strategia? Verstappen needs-a no strategy! It's-a very simple. You start the race, wait for McLaren to choke, pass him, then win. Verstappen always-a wins. It's-a boring.

Track and trade live odds on Polymarket.

Headline Roundup

Wells Fargo whistleblower won right to sue over sham DEI interviews (BBG)

Trump met with Mamdani at the White House (CNBC)

US, Ukraine, and Europe report progress in Ukraine-Russia peace talks (FT)

BLS canceled October CPI report (CNBC)

US consumer sentiment hit a record low (BBG)

US business activity expanded by the most in four months (BBG)

Bessent sees no recession risk after $11B shutdown hit (RT)

Canada will resume US trade talks 'when appropriate' (RT)

Hedge funds scramble to cover shorts as stocks rebound (BBG)

US equity funds saw a fifth week of inflows on robust earnings (RT)

Investors eye holiday season turbulence amid AI and rate cut doubts (RT)

PE firms are turning to dividend recaps at record pace (BBG)

Private credit defaults is expected to drive 2026 stress (BBG)

Bond rally of 2025 faces new data vacuum as waiting game begins (BBG)

Proxy firm Glass Lewis mulls RIA registration to ease criticism (RT)

Deutsche Bank's DWS dismissed its Asia private credit team (BBG)

Robinhood is expanding into sports prediction markets (BBG)

Eli Lilly became first pharma company to hit a $1T market cap (RT)

Moderna is the most shorted S&P 500 stock (FT)

Amazon mass layoffs last month hit software engineers the hardest (BBG)

Bulge brackets' client data was likely exposed in hack (NYT)

Japan's new PM unveiled a $135B stimulus package (FT)

China's private REITs offer new funding path for developers (RT)

Klimt painting sold for a record $236M in Sotheby's auction (CNBC)

A Message from Elf Labs

The Vault Just Opened on a $2T Market Opportunity

Elf Labs owns 100+ priceless trademarks for icons like Cinderella & Snow White. They’ve already earned $15M+ in royalties, and are now using AI to turn these legends into living, interactive worlds for the next generation. With patented tech & a $2T market opportunity ahead, the next chapter of entertainment is being written in real time.

This is a paid advertisement for Elf Lab’s Regulation CF offering. Please read the offering circular at https://www.elflabs.com/

Deal Flow

M&A / Investments

Mining giant BHP's bid to acquire rival Anglo American, aimed at blocking its $60B merger with Teck, was rejected by Anglo, halting plans for a potential $170B mining powerhouse

Paramount Skydance, Comcast, and Netflix submitted preliminary offers for $57B-listed Warner Bros. Discovery

Abu Dhabi conglomerate IHC joined a consortium of suitors interested in buying Russian oil group Lukoil's $20B of foreign assets

Australia's Macquarie submitted a non-binding offer to acquire logistics company Qube at a $7.5B valuation

Philippines' Metro Pacific Investments' 30% stake purchase in Philippine hospital group Metro Pacific Health from KKR and Singapore SWF GIC stalled after a $3.2B valuation price target was not achieved

French waste-management company Veolia agreed to buy US hazardous-waste specialist Clean Earth from Enviri in a $3B cash deal, including debt

EQT agreed to acquire a majority stake in European environmental service company Desotec from Blackstone for $2.3B, including debt

Spanish telecom Telefónica secured broadcasting rights for Europe's top soccer competitions from UEFA in a $1.7B deal

UK media firm Daily Mail & General Trust agreed to acquire the Telegraph Media Group at a $655M valuation, days after PE firm RedBird withdrew its offer

TPG and Warburg Pincus are in early talks to acquire a $500M stake in Partners Group-backed software firm Sirion

Specialty finance firm InterVest agreed to acquire subprime auto lender Flagship from Perella Weinberg; the firm was seeking bids of $400M last year

Australia blocked US-based Cosette Pharmaceuticals' $387M takeover of medical supplies manufacturer Mayne Pharma

Plantro, the investment firm controlled by ex-Dye & Durham exec Matt Proud, submitted a fresh proposal to take Canadian legal software firm Dye & Durham private for $275M at a 111% premium

Shares of Australia's Monash IVF Group soared 40% to a $213M market cap after rejecting a takeover bid from Genesis Capital and Soul Patts

Spanish soccer club Real Madrid is seeking to sell a ~5% stake to gauge its valuation

British Airways-owner IAG submitted a formal expression of interest to acquire a minority stake in Portugal's flag carrier TAP

Investment firm American Industrial Partners is weighing options to sell or list France's largest aluminum plant Aluminium Dunkerque

UK-listed PPHE Hotel Group plans to invite bids as it launches a strategic review

VC

UK energy startup Fuse Energy is in advanced talks to raise a round at a $5B valuation led by Lowercarbon Capital

Humanoid-robot software startup Flexion raised a $50M Series A led by DST Global Partners

Indian small-satellite launch startup Agnikul raised a $17M round from Advenza Global Limited, Atharva Green Ecotech, HDFC Bank, and more

dtcpay, a fiat-and-crypto payments startup, raised a $16.5M pre-A round led by Pontiac Land chairman Kwee Liong Tek

Physical Intelligence, an AI robotics software startup, raised a $600M round led by Alphabet's CapitalG

Eros Innovation, an AI-focused media and entertainment company, raised $150M led by Plenitude Capital

AI life-sciences platform Sorcero raised a $42.5M Series B round led by NewSpring Growth

Tailor, a composable headless ERP startup for retail and e-commerce, raised a $37M Series A led by NEA and Y Combinator

Access the most comprehensive VC deal flow on Fundable.

IPO / Direct Listings / Issuances / Block Trades

Australian graphic design platform Canva is eyeing an IPO; the firm was recently valued at $42B

Bill Ackman is planning a simultaneous 2026 IPO of his hedge fund Pershing Square and a separate investment vehicle; the hedge fund was valued at ~$10B last year

Hong Kong conglomerate CK Hutchison is considering raising over $2B in a Hong Kong and UK dual IPO of health and beauty retailer A.S. Watson Group

UK insurer Prudential is planning to raise $300M in a share placement in ICICI Prudential Asset Management before an IPO of the Indian JV

Japan's state-backed chip venture Rapidus is seeking a 2031 Japan IPO

Mexican industrial REIT Fibra Next raised $400M in a share sale

South African chemicals firm Sasol may spinoff its international chemicals business as soon as 2028

Figma dipped below its IPO price less than four months after debuting

Debt

Carlyle-backed defense contractor ManTech scrapped a $2.3B leveraged loan sale

A mortgage loan for Chicago's Bank of America Tower is being refinanced with $700M in bonds

Indian lender Axis Bank plans to raise $560M in debt in a private placement

Poland sold $510M of bonds, with payouts linked to a new money-market benchmark

Distressed state-backed developer China Jinmao Holdings is planning its first overseas bond in over three years

SoftBank priced $290M in bonds, bringing its record issuance this year to $2.5B

Bankruptcy / Restructuring / Distressed

Failed Brazilian lender Banco Master denied accusations of $2.4B in fraud that led to its liquidation

Germany's largest office complex Squaire is seeking to extend $587M of loans secured against the building for a second time

LVMH will inject $173M into its loss-making newspaper Le Parisien to help improve finances

Creditors to bankrupt auto-dealership lender PrimaLend won permission to block loan payments to a firm controlled by the firm's CEO

Liquidators of collapsed Chinese developer Evergrande are seeking an asset freeze on its ex-CEO's ex-wife

French video game giant Ubisoft agreed to use money from a Tencent investment to pay off debt after it breached a loan agreement

Finland fuel retailer Teboil filed for corporate restructuring as US sanctions on Russia's Lukoil left it unable to conduct business

Fundraising / Secondaries

Korean PE firm MBK Partners raised $5.5B for a downsized Asia fund

Nordic FOF investor Cubera raised $576M across two new funds

Kuwait-based Global Capital Management plans to raise $350M for its maiden Turkey dedicated PE fund

Carlyle is launching a $300M India fund to operate along its sixth pan-Asia fund

F1 champion Nico Rosberg's VC firm Rosberg Ventures is looking to raise another $100M VC FOF

Blue Owl is considering reviving a merger of two private credit funds if the share price of the larger fund improves

Crypto Sum Snapshot

Crypto crash is eroding wealth for Trump's family and followers

IRS crackdown on popular crypto 'tax cheat' begins with 2025 filing year

Binance CEO sees Bitcoin volatility in line with most asset classes

Wall Street's crypto engine loses power as ETF flows reverse

Crypto's brutal month triggers a stress test for Wall Street

Crypto Sum compiles the most important stories on everything crypto. Read it here.

Exec’s Picks

CNBC published a profile on BDT & MSD Partners-founder Byron Trott, exploring his path to becoming the favorite banker of Warren Buffett and America's wealthiest families.

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting firm established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, credit, and investment banking.

We're currently seeking talent for some incredible roles. Head over to Litney Partners to drop your resume / create your profile and we'd love to get in touch!

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.