Together with

Good Morning,

Stocks closed green despite a poor GDP print, West Virginia is cutting ties with several large banks, Instagram is rolling back recent changes after user pushback, Jack Ma is giving up control of Ant Group, Xi got chippy with Biden, and Amazon took a big quarterly loss on its Rivian investment.

Interested in following real-time prediction markets that provide insights on where investors think interest rate hikes, inflation readings, hurricanes, and other events that impact financial markets? Check out our new free newsletter, Eight Ball.

Let's dive in.

Before The Bell

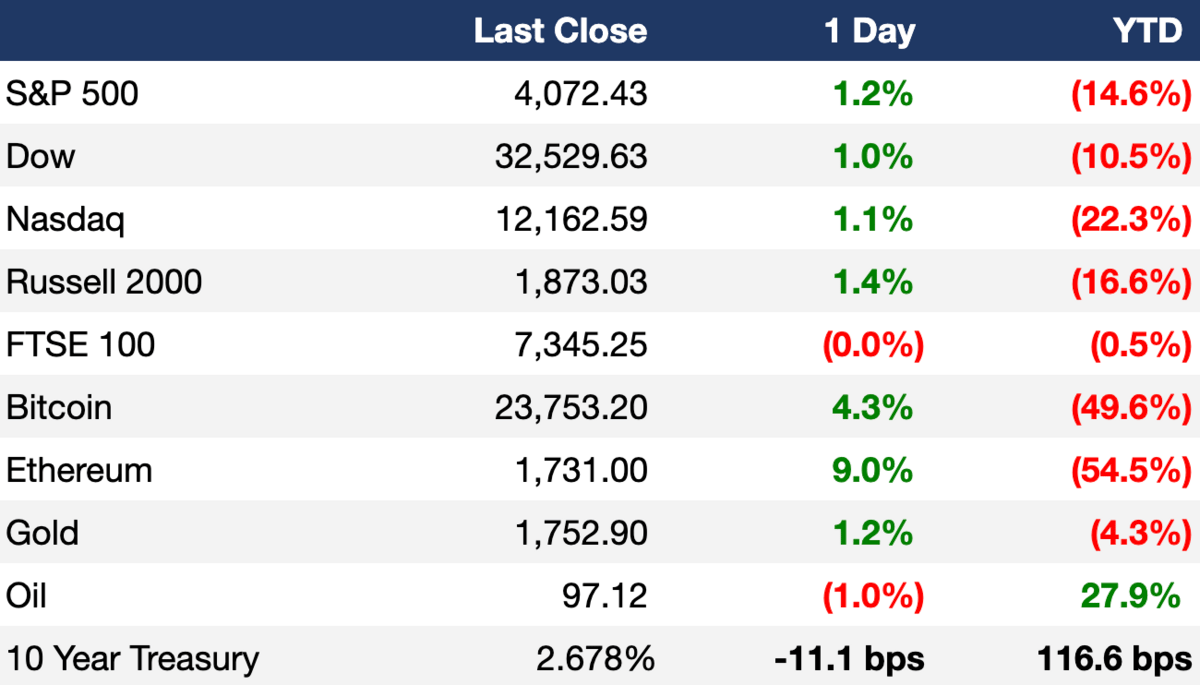

As of 7/28/2022 market close.

Markets

The major indexes closed green Thursday, despite the US economy shrinking for two quarters in a row and economists / politicians debating whether we're in a recession or not (lol)

Stronger-than-expected earnings performances from Apple and Amazon have the S&P 500 poised to open in the green this morning

Stocks have shrugged off another rate hike and a poor GDP print so far this week, and the S&P may close the week above 4,000 for the first time in over a month

Earnings

Pfizer beat Q2 expectations as revenue grew by 47% to $27.7B and net income increased by 78% to $9.9B. The company maintained its sales guidance for H2 2022 (CNBC)

Southwest beat earnings expectations and posted record quarterly revenue but issued mixed guidance for Q3. Their stock fell 6.8% on Thursday (BA)

Apple beat expectations to post a record $83B revenue, but saw a 10.5% YoY decrease in net income. Their stock climbed over 3% after the report (YHOO)

Amazon shares rose more than 13% in extended trading on Thursday after posting better-than-expected Q2 revenue of $121.23B and issuing optimistic Q3 guidance (CNBC)

Intel shares sank ~10% in extended trading on Thursday after reporting poor Q2 earnings and issuing gloomy full-year guidance (CNBC)

What we’re watching today: ExxonMobil, Chevron

Full calendar here

Headline Roundup

The US economy shrank for the second straight quarter, with GDP falling at a 0.9% YoY rate in Q2 (AX)

Janet Yellen said the economy is in a state of transition, not recession (CNBC)

China may miss its annual growth target this year, but will continue with their zero-tolerance Covid policy (WSJ)

US jobless claims held near the highest level of the year last week (WSJ)

Carlyle Group's credit business overtakes private equity in terms of assets for first time in 35 years (FT)

West Virginia is cutting ties with JPMorgan, Goldman Sachs, BlackRock and others, citing their stance on coal and climate change (WSJ)

Chinese President Xi warned Biden not to 'play with fire' on Taiwan during their fifth phone call (AX)

Twitter warned that governments are demanding user info at an alarming rate (AX)

Amazon recorded a $3.9B Q2 loss on its Rivian investment, bringing their markdown to $11.5B this year (CNBC)

Instagram will roll back its latest update changes after the Kardashians accused them of being like TikTok (CNBC)

Hershey may fail to meet Halloween and Christmas candy demand this year (RT)

Meta will no longer fund US news publishers (AX)

Jack Ma will relinquish control of his fintech Ant Group to ease scrutiny from Chinese regulators; he currently owns 50.52% of the company's shares (WSJ)

Former Goldman Sachs VP Brijesh Goel pleaded not guilty to federal insider trading charges brought against him this week (BBG)

A Message From Eight Ball

A Macro Newsletter with Skin in the Game

In Skin in the Game, Nassim Taleb said, "Don’t tell me what you think, tell me what you have in your portfolio."

Every day, economists and talking heads give their predictions about the economy, interest rates, and the stock market. "We are going into a recession!" "Oil is going to $150 per barrel!" And every day, most of these predictions are wrong. The problem is that none of these economists put their money where their mouth is, so their accuracy doesn't matter.

We launched Eight Ball to solve this problem. With our new newsletter, Eight Ball, we use data provided by real-time prediction markets to see where investors are forecasting interest rates, oil prices, GDP growth, and more.

Our forecasts are determined by investors who put their real money on the line, not media personalities looking for air time.

If you want economic forecasts that have "skin in the game," subscribe to Eight Ball here!

Deal Flow

M&A / Investments

Indian telecommunication giants Bharti Airtel and Vodafone Idea submitted bids worth over $18.6B in India's first government auction for 5G airwaves (WSJ)

JetBlue Airways agreed to acquire Spirit Airlines in an all-cash deal for $3.8B (the adjusted enterprise value for Spirit was $7.6B) (CNBC)

Steel producer ArcelorMittal agreed to buy Brazilian steelmaker CSP for $2.2B (BBG)

Abu Dhabi real estate developer Aldar Properties will buy four commercial towers from Abu Dhabi wealth fund Mubadala Investment Company for $1.2B in one of the Middle East's biggest real estate deals (BBG)

Hong Kong property developer CK Asset placed a $1.5B bid for Chinese real estate giant Evergrande Group’s Hong Kong HQ (BBG)

PE firm Ardian signed an option to buy control of renewable energy provider GreenYellow from French grocery retailer Casino Group for $1.12B (BBG)

Panopto, a video platform for enterprise business, offered to buy rival video platform provider Kaltura at a $383M valuation (BBG)

Amancio Ortega's family office Pontegadea will pay ~$27.5M for a 49% stake in energy company Repsol's solar plant Kappa (BBG)

The retailing unit of UAE-owned Abu Dhabi National Oil Company bought a 50% stake in French energy company TotalEnergies' fuel distribution business (BBG)

HarbourView Equity Partners bought a stake of under-investigation hip-hop star Prakazrel 'Pras' Michel's music catalog (BBG)

VC

Singapore-based online property platform 99 Group raised a $52M Series C led by Gaw Capital Partners (BT)

Edge computing solutions Fly.io raised a $25M Series B led by a16z and also revealed a 2021 $12M Series A led by Intel Capital (TC)

Videoconferencing and digital whiteboarding app Switchboard raised a $25M Series A at a $200M valuation led by Icon Ventures (TC)

Ultra-efficient and sustainable AC innovator Blue Frontier raised a $20M Series A led by Bill Gates' Breakthrough Energy Ventures, 2150 Urban Tech Sustainability Fund and VoLo Earth Venture (PRN)

Financial data management solution Leapfin raised a $12M Series A from Crosslink Capital, Work-Bench and Uncorrelated (TC)

Evabot, an AI-based gift vendor for businesses, raised $10.83M in a funding round led by Comcast Ventures (TC)

Digital fantasy sports world maker Stadium Live Studios raised a $10M Series A led by KB Partners and Union Square Ventures (TC)

Sage, a healthtech platform for old age care, raised a $9M seed round led by Goldcrest Capital (PRN)

Healthcare fintech payments platform PayGround raised $5.5M in a funding round led by FCA Venture Partners and Lewis & Clark Ventures (PRN)

De Soi, a line of premium non-alcoholic aperitifs founded by Katy Perry, raised a $4M seed round led by Willow Growth (PRN)

At-home health diagnostics company Senzo raised a $2M equity funding round led by BioAdvance (TC)

IPO / Direct Listings / Issuances / Block Trades

SPAC

German EV maker Next.e.GO Mobile will go public via a merger with Athena Consumer Acquisition in a $913M deal (BBG)

Debt

Fundraising

Crypto venture firm Variant raised $450M across two funds: a $150M seed fund for web3 projects and a $300M opportunity fund to double-down on projects with demonstrated traction in their portfolio (CD)

Crypto Corner

The Fed and FDIC ordered bankrupt crypto brokerage Voyager Digital to cease false marketing about being FDIC insured (WSJ)

US Senators wrote a letter to Fidelity Investments condemning them for offering Bitcoin in 401(k) retirement plans (BM)

Ex-CFTC chief Chris Giancarlo believes the EU's lead on crypto regulation will hurt US regulators' ability to create rules of their own (CD)

Exec's Picks

Are you a current or former investment banker / PE investor looking for a reliable financial data service that won't cost an arm and a leg like a Bloomberg Terminal, CapIQ, or FactSet? Koyfin is a platform I recently started using to perform fundamental analysis and track my personal portfolio. They've got several affordable plans for current and former professionals and a sleek, modern interface that's easy to navigate. Check them out here.

The Hiring Block 💼

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We aim to curate jobs across IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We'll sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

If you're a company looking to hire candidates and want to list a job opening on our board and feature on Exec Sum, click the button below:

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.