Together with

Good Morning,

The FTC has a lawsuit set against Amazon later this month, the Bank of Canada plans to hold rates at 5%, Apple inked a new long-term deal with Arm, Musk borrowed $1B+ from SpaceX the same month as his Twitter acquisition, the FAA lifted a brief nationwide ground stop for United Airlines, and Facebook is getting rid of its “News” tab in Europe.

Want to stay on top of the biggest stories in tech as they develop? Check out and subscribe to The Information.

Let’s dive in.

Before The Bell

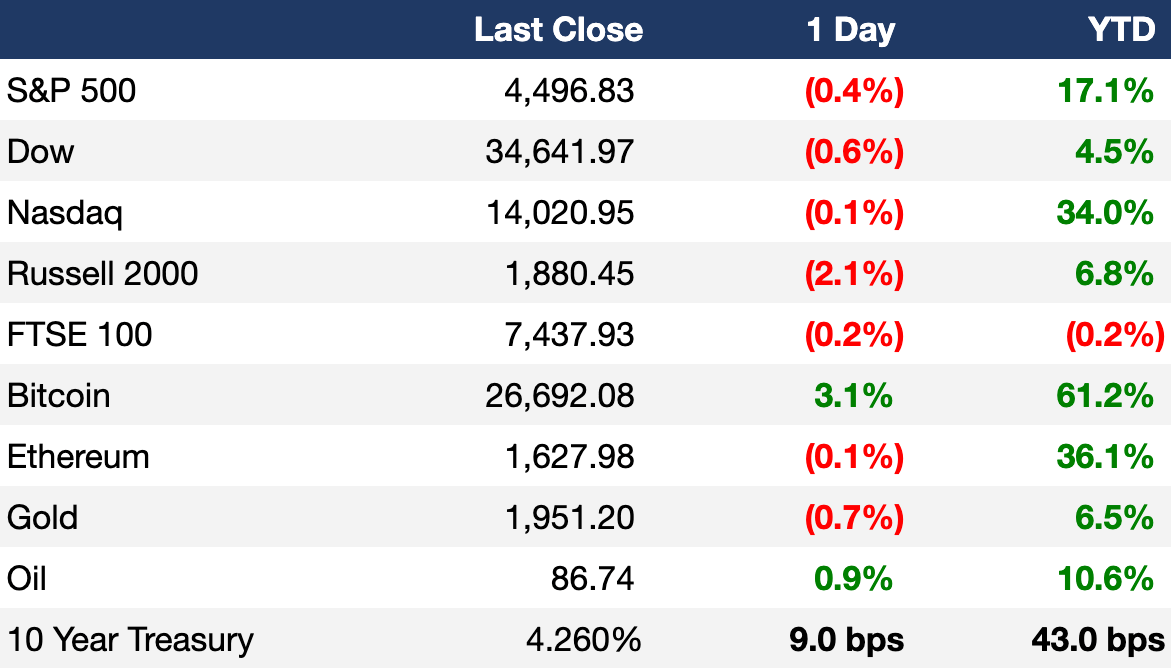

As of 9/5/2023 market close.

Markets

US stocks fell in response to rising oil prices and treasury yields

The Dow led the major indices with a 0.56% decline

Oil prices rose on news that Saudi Arabia and Russia extended voluntary supply cuts

Chinese stocks fell, led by a 2% decline in Hong Kong’s HSI, after China reported poor service sector economic data

Earnings

Headline Roundup

FTC antitrust suit against Amazon is set for later this month after meeting fails to resolve impasse (WSJ)

Meta employees are back in the office three days a week as part of new mandate (CNBC)

Bank of Canada poised to hold rates at 5% but threaten more hikes (BBG)

Saudis, Russia extend their oil-supply curbs to year-end (BBG)

Rising rents are hitting American suburbs hardest (WSJ)

Apple inks new long-term deal with Arm for chp technology (RT)

Money-for-nothing lawsuits against private equity founders get boost (WSJ)

Spotify’s $1B podcast bet turns into a serial drama (WSJ)

Elon Musk borrowed $1B from SpaceX in same month of Twitter acquisition (WSJ)

Taylor Swift’s Eras tour concert movie could make $100M in its first weekend (CNBC)

FAA lifts brief nationwide ground stop for United Airlines (CNBC)

Return to office is a $1.3T problem few have figured out (BBG)

Fed governor Waller agrees the central bank can ‘proceed carefully on interest rates’ (CNBC)

Facebook is getting rid of its News tab in Europe (CNBC)

A Message From The Information

It seems like there’s a new blockbuster story in tech every single day, from chip maker Arm’s IPO, to Nvidia’s rocketing stock performance, to Twitter’s tanking ad revenue.

To stay on top of the news each day, I read The Information. Not only do they track the biggest stories in tech and finance, they also break exclusive stories on everything from Gemini’s recent layoffs, to Thoma Bravo’s latest buyouts, to Google’s AI power struggle with Microsoft.

Deal Flow

M&A / Investments

The FDIC is seeking buyers for $33B worth of commercial property loans from Signature Bank, a majority of which are backed by multifamily properties in NYC (BBG)

Pipeline operator Enbridge will buy three natural gas utilities from Dominion Energy for $9.4B (BBG)

Hungary is in talks to buy a majority stake in Budapest Airport in a transaction that could be valued at ~$4.3B (BBG)

$3.2B market cap Premier League team Manchester United shares fell 18% due to a report that the Glazer Family would take the club off the market after failing to receive offers that matched their asking price (BBG)

Saudi Telecom will take a 10% stake in struggling Spanish telecom Telefonica for ~$2.3B (BBG)

Singapore sovereign wealth fund GIC is considering a sale of a skyscraper in the Shiodome City Center Tokyo business district that may fetch at least $2B (BBG)

Zijin Mining Group, MMG, and Aluminum Corp. of China are three Chinese firms competing for a Botswana copper mine that could sell for as much as $2B (BBG)

PE firm Thoma Bravo is nearing a deal to acquire health records software company NextGen Healthcare, which has a $1.4B market cap (BBG)

Australian packaging company Orora will acquire French high-end glass bottle manufacturer Saverglass from Carlyle Group for $1.4B (RT)

Viper Energy Partners, a subsidiary of Diamondback Energy, will acquire mineral and royalty interests in the Permian Basin from affiliates of PE firm Warwick Capital Partners and energy company GRP Energy Capital for ~$1B cash and stock (RT)

Pipeline and oil and gas processing plant operator Western Midstream Partners will acquire Meritage Midstream Services II for $885M (RT)

The Ontario Teachers’ Pension Plan will acquire UK wealth manager Seven Investment Management, which has $21B in assets, from Caledonia Investments at a ~$565M EV (FT)

Sixth Street invested an additional $400M into a JV with an arm of BP that owns US pipelines (BBG)

British discount retailer B&M will buy 51 stores of collapsed retailer Wilko for up to $16.3M (RT)

Warner Music acquired a majority stake in record company 10K Projects, the label behind Ice Spice, for an undisclosed sum (FT)

Brazilian furniture retailers Mobly and Carlyle-owned Tok&Stok will merge through a stock swap (RT)

VC

E-commerce loan startup Wayflyer received a $1B investment from Neuberger Berman (TC)

In-car holographic tech startup Envisics raised a $100M Series C led by Hyundai Mobis (TC)

Star Therapeutics, a biotech company focused on antibody therapies, raised a $90M Series C led by Sofinnova Investments (BW)

Mujin, a robotics startup, raised an $85M Series C led by SBI Investment (TC)

AI-based anti-money laundering startup ThetaRay raised a $57M round led by Portage (TC)

Ambient Photonics, a low-power solar startup for connected devices, raised a $30M Series A-2 led by Fine Structure Ventures (BW)

Harmonya, a startup using AI to generate product data, raised a $20M Series A led by Bright Pixel Capital (FN)

GenTwo, a Swiss B2B fintech platform specializing in securitization of bankable and non-bankable assets, raised a $15M Series A led by Point72 Ventures (BW)

Trellis, a startup providing a state trial court data platform, raised a $15M Series B led by Top Tier Capital Partners (FN)

Solar energy startup Okra raised a $12M Series A led by One Ventures (TC)

Atomicwork, an AI-powered employee support platform, raised an $11M seed round led by Blume Ventures and Matrix Partners (FN)

e-mobilio, a Munich-based provider of a cloud recommendation and buying platform for drivers to switch to electric mobility, raised a $10.2M Series A led by SET Ventures (FN)

Real-time flight rewards search engine Point.me raised a $10M Series A led by Thayer Ventures (TC)

Vi Aqua Therapeutics, an Israel-based biotech company developing an orally administered RNA-particle platform to prevent aquaculture diseases, raised $8.3M in funding led by S2G Ventures (FN)

Integral, a privacy startup focused on data quality, raised a $6.9M seed round led by Haystack and The General Partnership (BW)

Opna, a startup aiming to help companies hit ‘net zero’ by finding and funding carbon projects, raised a $6.5M seed round led by Atomico (TC)

Vietnamese fintech MFast raised a $6M Series A led by Wavemaker Partners (FN)

Miami-based climate tech startup Kind Designs raised a $5M seed round led by GOVO Venture Partners (BW)

AI governance software startup Enzai raised a $4M seed round led by Cavalry Ventures (FN)

AlixLabs, a semiconductor company, raised $3.6M in funding led by Navigare Ventures, Industrifonden, and FORWARD.one (FN)

Numeral, a startup creating a subledger for high-volume businesses, raised a $3M seed round led by Bienville Capital (BW)

Athena Alliance, a professional development community for women, raised a $2.5M seed extension led by Leonas Capital and Advisory (BW)

Penny Black, a London-based personalized packaging startup, raised a $1.9M seed round led by Douglas Franklin, CEO of AGFA (FN)

IPO / Direct Listings / Issuances / Block Trades

SoftBank Group is seeking to raise up to $4.9B in an IPO that would value chip company Arm at up to $54.5B (BBG)

The IPO of Renault’s EV division Ampere could have a valuation of up to $10.8B (RT)

Pipeline company Enbridge is planning a $2.9B share sale to finance its $9.4B deal with Dominion Energy (BBG)

Japanese chipmaking device manufacturer Kokusai Electric, which is owned by KKR, will list its shares on the Tokyo Stock Exchange as soon as October and could be valued at $2.7B (RT)

SPAC

Computed tomography screening systems company ScanTech Identification Beam Systems is merging with Mars Acquisition Corp. in a $150M deal (MS)

Debt

Bankruptcy / Restructuring

Embattled Chinese property developer Country Garden made two overdue bond-coupon payments totaling $22.5M, allowing it to narrowly avoid default (WSJ)

Fundraising

China plans to launch a state-backed investment fund that will seek to raise up to $40B to back its semiconductor industry (RT)

500 Global, an active early-stage venture investor in Southeast Asia, raised $143M to ramp up investments in the area (BBG)

PhotonVentures, a Netherlands deep-tech VC, raised a $64M fund to invest in early-stage photonic chip startups and scale ups (FN)

Apex, a Portuguese investment firm, launched a $54M Elite Performance Fund to leverage the expertise of athletes to redefine the boundaries of the sports, media, and entertainment industries (FN)

Crypto Corner

India’s finance minister stated that discussions are underway on a global framework to regulate crypto assets (RT)

Coinbase began a crypto lending service to US institutional investors (BBG)

Genesis Global Trading, an affiliate of Barry Silbert’s Digital Currency Group, will halt its spot trading crypto trading service for ‘business reasons’ (BBG)

Exec’s Picks

The Information covered how Midjourney’s founder, David Holz, built an AI winner without raising venture capital.

This Blockworks piece explains how investor behavior might change if and when a spot ETF is approved.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter