Together with

Good Morning,

The US shot down a suspected Chinese surveillance balloon, US unemployment hit a 53-year low, hedge funds are rushing to offload short bets as markets rally, the Adani crisis has ignited fears of contagion in Indian markets, Twitter will share some ad revenue with creators, Dell is slashing ~6.6k jobs, and the US Senate Banking Committee will hold a 'Crypto Crash' hearing this month.

Want to stay on top of the biggest stories in tech as they develop? Check out and subscribe to The Information.

Let's dive in.

Before The Bell

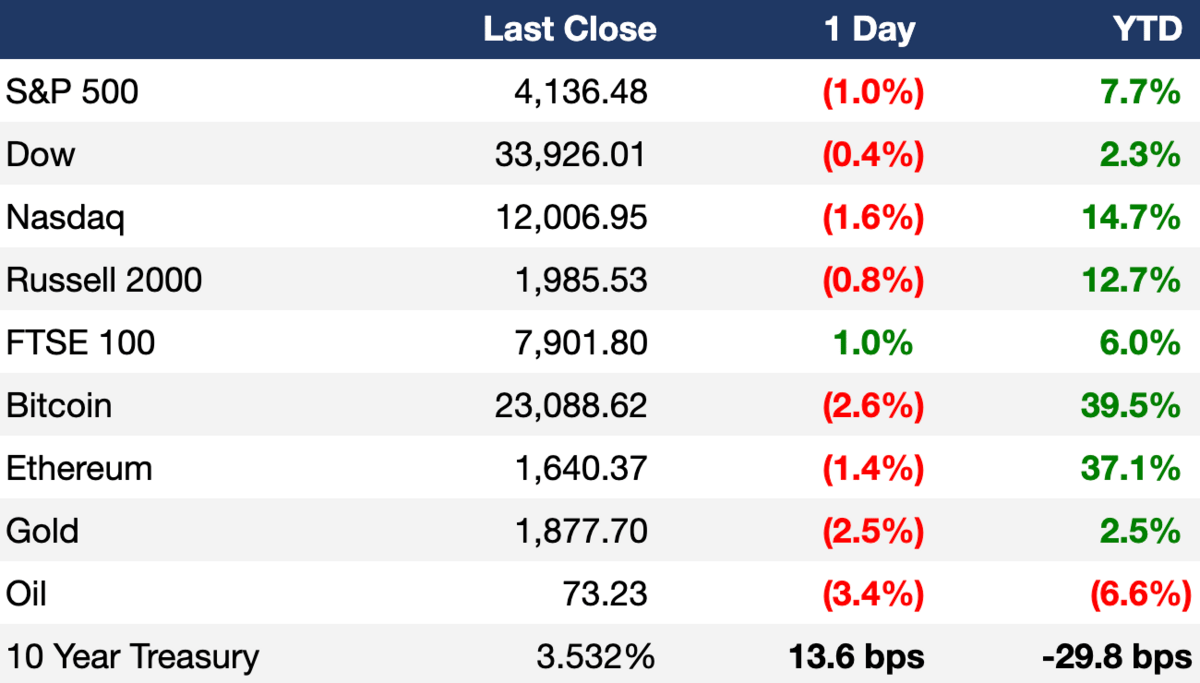

Markets

US stocks fell on Friday after a monster January jobs report raised questions about the Fed's rate policy path

Recent pessimistic tech earnings also served a reality check to January's market rally

The Nasdaq nonetheless posted its fifth straight weekly gain

Oil fell ~3% as strong job numbers sparked rate hike / stronger dollar fears

Brent and WTI dropped ~8% on the week

US dollar index jumped 1.22%

Earnings

What we're watching this week:

Today: Activision Blizzard

Tuesday: KKR, BP

Wednesday: Uber, Robinhood, Walt Disney, Yum! Brands

Thursday: PepsiCo, PayPal

Full calendar here

Headline Roundup

US unemployment hit a 53-year low of 3.4% after January’s jobs report showed 517k new jobs and December's numbers were revised upward (CNBC)

US blue-chips set for first YoY profit drop since Covid crisis (FT)

Banks are borrowing from the Fed funds market at record clip, while deposits flee (WSJ)

US bond funds posted their fourth straight weekly inflow (RT)

Hedge funds rush to unwind bets on falling markets as stocks surge (FT)

VC funding for black entrepreneurs dropped 45% last year (CNBC)

Adani crisis has ignited Indian contagion fears and credit warnings (RT)

Adani's UK entities ditched Deloitte as auditor last year (FT)

Baillie Gifford shed over $120B in assets in 2022 (FT)

Foxconn's January sales surged 48% YoY (RT)

Nestle will hike food prices further this year (RT)

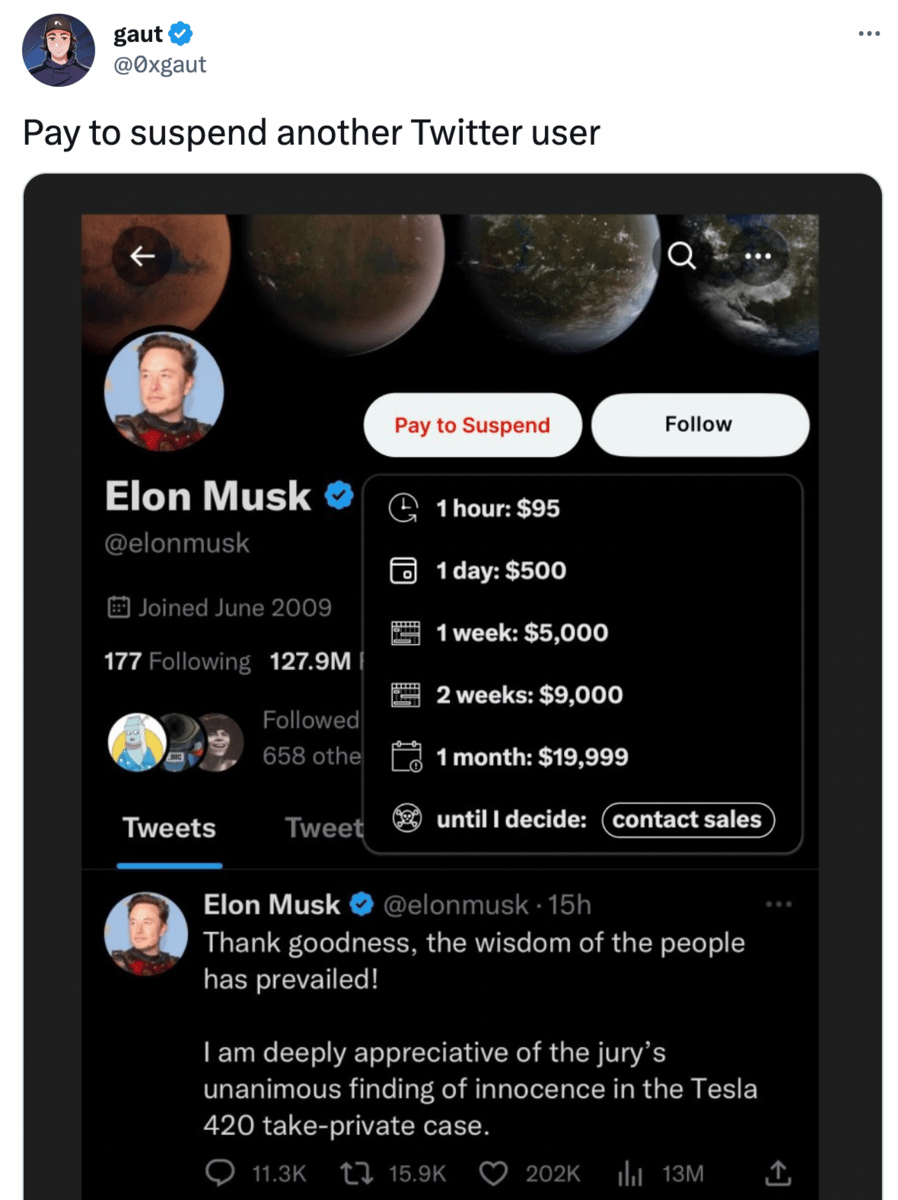

Twitter will share ad revenue with some content creators (RT)

Musk was found not liable in trial over tweets proposing to take Tesla private (WSJ)

Bank of America trimmed CEO Moynihan's pay by 6% to $30M (RT)

Bridgewater named Karen Karniol-Tambour as its third co-CIO (RT)

Dell will cut ~6.6k jobs, battered by plunging PC sales (BBG)

Autodesk will cut ~250 jobs (BBG)

Office occupancy hit a post-pandemic high of 50.4% (AX)

The US shot down a suspected Chinese surveillance balloon on Saturday (AP)

A Message From The Information

The Best Source for the Biggest Stories in Tech

It seems like there’s a new blockbuster story in tech every single day, from Microsoft investing in AI, to crypto firms collapsing, to Elon Musk buying (and regretting his decision to buy) Twitter.

To stay on top of the news each day, I read The Information. Not only do they track the biggest stories in tech and finance, they also break exclusive stories on everything from Gemini’s recent layoffs, to Thoma Bravo’s latest buyouts, to Google’s AI power struggle with Microsoft.

Deal Flow

M&A / Investments

Lone Star Funds agreed to buy industrial shipping repair and fabrication firm Titan from Carlyle and Stellex Capital Management in a ~$2B deal (BBG)

Google acquired a 10% stake in AI startup and ChatGPT rival Anthropic for $300M (FT)

Thungela Resources, South Africa’s largest exporter of coal burned in power-stations, agreed to buy an 85% stake in the Ensham Mine in Australia for $240M (BBG)

Pristine Sun Corporation, a developer of renewable energy projects, announced a $250M capital commitment from strategic private equity and family office investors (BW)

Petroleum company Petronas is completing the purchase of German firm Wirsol’s solar farms and large development pipeline (RT)

CVC Capital Partners is nearing a deal to buy Danish transport company Scan Global Logistics (BBG)

Billionaire investor Ryan Cohen is building a large stake in luxury retail chain Nordstrom (RT)

NY-based Global Emerging Markets increased its stake in the Swiss asset manager GAM to 5% (RT)

Life sciences company Danaher expressed takeover interest in contract manufacturer Catalent (BBG)

German health care company Medbase agreed to buy online drug retailer Zur Rose’s Swiss business (RT)

VC

Voyager Space, a startup building a private space station, raised $80.2M in funding from NewSpace Capital, Midway Venture Partners, and Industrious Ventures (TC)

Grocery deliverer JOKR raised a ~$50M Series C at a $1.3B valuation led by G Squared (TC)

Capcon, an advanced packaging solution provider for the semiconductor industry, raised a ~$50M Series B-2 from existing investors (BW)

Rebellyous, a plant-based chicken startup, raised $20M in funding from YB Choi of Cercano Management, Mike Miller of Liquid2 Ventures, and Owen Gunden (TC)

IPO / Direct Listings / Issuances / Block Trades

Indonesia’s Pertamina Geothermal Energy, a unit of state energy company Pertamina, has narrowed the price of its IPO to a valuation of up to $611M (RT)

Chinese sensor maker Hesai Group is seeking to raise up to $171M in a US IPO (RT)

Italian luxury yacht maker Ferretti is seeking Hong Kong regulatory approval for its planned Milan share sale, in first-ever dual listing between the two cities (BBG)

Debt

Adani Enterprises shelved plans to raise up to $122M via its first-ever public bond sale (BBG)

Bankruptcy / Restructuring

SBF’s Emergent Fidelity Technologies, an offshore entity that owns $590M in Robinhood shares, filed for bankruptcy (BBG)

Fundraising

Morgan Stanley Investment Management raised $2.5B for its Ashbridge Transformational Secondaries Fund II, which invests exclusively in sponsor-led secondary deals focused on a single company (PEN)

March Capital raised a $650M+ fourth fund to make early growth investments in cloud software, cybersecurity, and cloud / data infrastructure (BW)

UK-based Hanover Investors raised $181M for a third $362M PE fund (PEW)

Kapor Capital, a VC firm focused on diverse tech-driven early stage companies, raised a $50M opportunity fund (TC)

Crypto Corner

SBF is in talks with US prosecutors to resolve a dispute over his bail conditions (RT)

London emerges as world’s most crypto-ready city for business (CT)

US Senate Banking Committee will hold ‘Crypto Crash’ hearing this month (CD)

UK is looking to TradFi to inform crypto regulations (BBG)

A new FTX documentary will spotlight SBF and CZ's relationship (CT)

Protocol Labs will lay off 21% of its staff (AX)

Exec's Picks

Eight Sleep is a high-tech smart bed system that has taken Silicon Valley by storm. With a built-in heating and cooling system, multiple foam layers to deliver comfort, and analytics tracking to help you optimize your sleep and recovery, Eight Sleep is the complete package. Upgrade your mattress game here, and use code "LIT" at checkout for a great discount!

The Wall Street Journal covered the retreat of amateur investors, featuring one trader who gained and lost $1.5M speculating in the market.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.