Together with

Good Morning,

The SEC is cracking down on SPAC sponsors, the S&P hit another record-high close, Tesla is projecting slower growth in 2024, the Bank of Canada is expected to hold rates steady, the FAA halted Boeing 737 Max production expansion, HPE was hacked by the same Russian group who hacked Microsoft, and Chipotle wants to bring in new workers for burrito season.

Looking to upgrade your dress shoe game in 2024? Impress your coworkers with a new pair of Amberjacks.

Let’s dive in.

Before The Bell

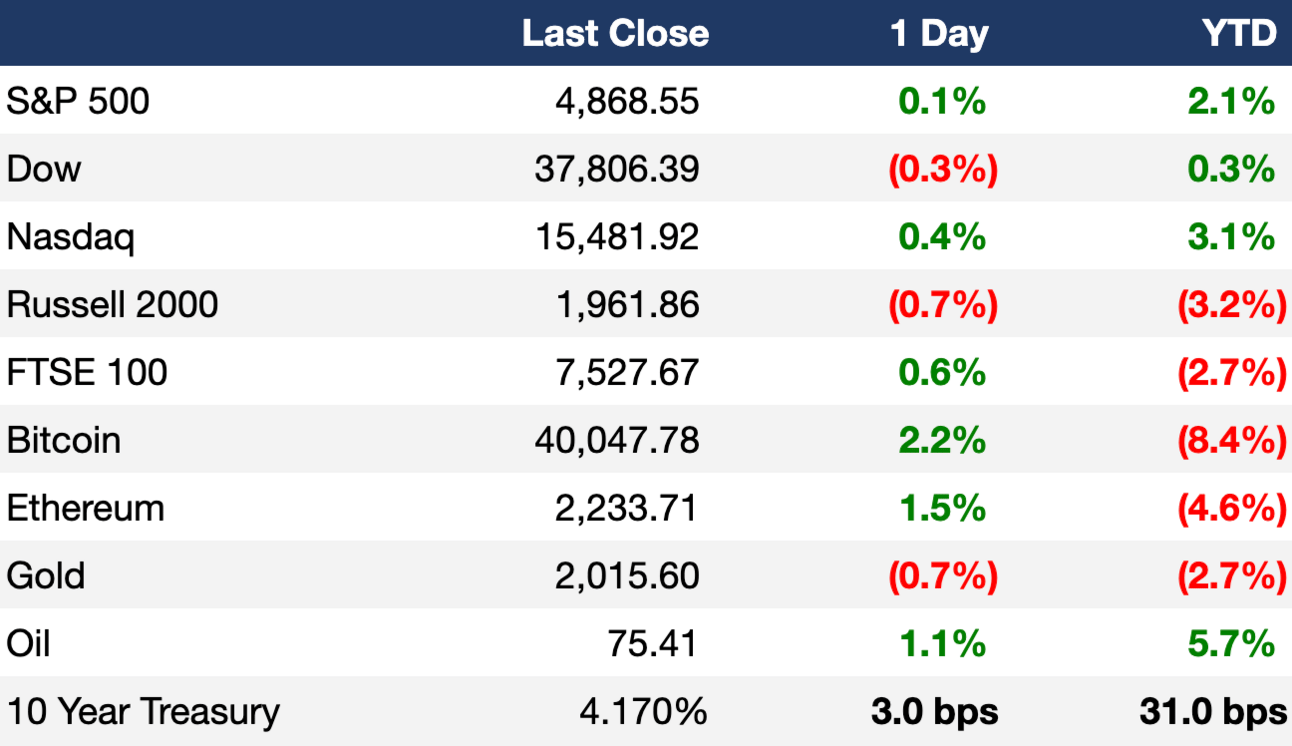

As of 01/24/2024 market close.

Markets

US stocks closed mixed as technology stocks rallied

The Nasdaq rose 0.36%, while the Dow fell 0.26%

Asian stocks mostly rose, led by a jump in Chinese stocks, as investor sentiment improves thanks to a possible Chinese stimulus package

European stocks rose, boosted by upbeat tech earnings

Earnings

Tesla missed Q4 earnings and revenue estimates as auto sales increased 1% YoY; the automaker warned of lower vehicle volume growth in 2024, its share price fell 5.7% AH (CNBC)

ASML shares surged 9% to a record high after beating Q4 earnings expectations and reporting a growing order backlog that points to a recovery in the computer chip market (RT)

AT&T beat Q4 revenue estimates but missed on adjusted earnings; the company’s 2024 earnings outlook also fell short of expectations (WSJ)

IBM shares rose 7% after beating Q4 earnings and revenue estimates partly thanks to demand for its AI products and services as well as hybrid cloud (YF)

What we're watching this week:

Today: Intel, Visa, Blackstone, American Airlines, Comcast, Next Era Energy

Friday: American Express

Full calendar here

Headline Roundup

S&P 500 ekes out another record high as Netflix and chipmakers leap (RT)

SEC imposes new rules on blank-check deals (BBG)

Tesla projects slower growth in 2024 as EV demand softens (WSJ)

Bank of Canada expected to hold rates steady in Wednesday policy decision (WSJ)

FAA halts Boeing 737 Max production expansion, but clears path to return Max 9 services (CNBC)

Alphabet shares flirt with record high on AI hype (BBG)

The Middle East crisis is starting to weigh on the economy (WSJ)

HPE hacked by same Russian intelligence group that hit Microsoft (CNBC)

Slovakia says Ukraine open to Russian gas transit beyond 2024 (BBG)

IBM sees strong 2024 sales, free cash flows; job cuts planned (BBG)

Chipotle to offer new benefits to draw younger workers for burrito season (WSJ)

Ships hauling US government cargo in Red Sea turn back after explosions nearby (BBG)

Tesla will start making new EV model in second half of 2025 (RT)

Cornell donor demands President’s ouster over diversity policies (BBG)

Las Vegas Sands stock rises as Chinese gamblers defy economic worries (BBG)

NATO’s largest military exercise since Cold War kicks off (RT)

Billionaire Reid Hoffman pauses Nikki Haley funding after her New Hampshire loss to Trump, source says (CNBC)

Jim Harbaugh bolts from Michigan to coach the NFL’s Los Angeles Chargers (WSJ)

A Message From Amberjack

Rated #1 Best Overall Dress Shoes

A new year means it’s time to start thinking about upgrading your dress shoes, and there’s no better place to look than Amberjack.

Amberjack is the modern footwear brand started by former executives from Adidas, Cole Haan, & McKinsey. They've created the world's most advanced dress shoes, made with proprietary athletic materials that deliver incredible comfort and A-grade leather vertically sourced from one of the world’s leading tanneries.

They’ve been featured in Forbes, Business Insider, and Yahoo, and Men’s Health named them the most comfortable business casual shoe of 2024. The only downside is they constantly sell out – get yours today before they’re gone (or pre-order to ensure availability). by clicking below:

Deal Flow

M&A / Investments

David Ellison made a preliminary offer to buy National Amusements, the Redstone family’s holding company that controls $8.9B media giant Paramount Global (BBG)

PE firm Yellow Wood Partners is in advanced talks to acquire lip balm brand ChapStick from Haleon, which was hoping to sell the brand for $600M (RT)

Carlyle Group purchased a $415M portfolio of student loans from Truist Bank (RT)

Apollo Global Management will buy a stake of up to 21.9% in Spanish certifications company Applus Services for $326M from a group of shareholders including RWC Asset Management and Harris Associates (BBG)

US aerospace supplier Arconic, which is controlled by Apollo Global, is selling its China business in a deal that could value it at as much as $300M (RT)

French lender Societe Generale is considering a sale of Shine, a digital bank for professional clients from the startup sphere (RT)

Fitness equipment firm WaterRower acquired rival startup CityRow (BBG)

Danish energy company Orsted will acquire Eversource Energy’s 50% stake in their offshore wind farm JV Sunrise Wind (RT)

VC

Bilt Rewards, a startup allowing consumers to earn rewards on rent and daily neighborhood spend, raised a $200M round at a $3.1B valuation led by General Catalyst (TC)

Community solar and distributed renewables platform 38 Degrees North raised $120M in funding from S2G Ventures (PRN)

Synnovation Therapeutics, a precision medicine company developing small molecule therapies, raised a $102M Series A led by Third Rock Ventures (BW)

BillingPlatform, an enterprise revenue lifecycle management platform, raised $90M in growth equity from FTV Capital (PRN)

Sion Power, a developer of next-gen batteries, raised a $75M Series A led by LG Energy Solution (BW)

Vivifi India Finance, a Hyderabad, India-based NBFC fintech company, raised a $75M Series B in debt and equity from undisclosed backers (FN)

MY DR NOW, a leading provider of primary and specialty care in Arizona, received a $50M investment from Kain Capital (PRN)

NPI, a SaaS startup providing data driven intelligence and tech-enabled services for IT procurement, raised $50M in growth financing from Falfurrias Growth Partners (PRN)

CheckSammy, a waste and sustainability operator, raised $45M in funding led by I Squared Capital (PRN)

Browser-based graphic design tool Kittl raised a $36M Series B led by IVP (TC)

Anomalo, a startup using ML to aid data quality, raised a $33M Series B led by SignalFire (TC)

French small launch developer Latitude raised a $30M Series B from Crédit Mutuel Innovation, Expansion, Bpifrance, DeepTech 2030, and UI Investissement (TC)

icotec, a startup advancing spinal tumor implants, raised $30M in growth funding led by MVM Partners (FN)

Elo Life Systems, a startup developing a natural sweetener derived from monk fruit, raised a $20.5M Series A extension led by DCVC Bio and Novo Holdings (TC)

Legal AI startup Spellbook raised a $20M Series A led by Inovia Capital (BW)

CryptoSafe, a blockchain project focused on enhancing capital efficiency in the crypto market, raised a $20M round at a $95M valuation led by VentureX Capital, NexTech Ventures, and Blockchain Innovations Fund (FN)

Motif Neurotech, a neurotechnology startup building minimally invasive bioelectronics for mental health, raised an $18.8M Series A led by Arboretum Ventures (PRN)

Morressier, a Berlin, Germany-based startup which specializes in scholarly communications, raised a $16.5M Series B led by Molten Ventures (FN)

Digital packaging marketplace Packmatic raised a $16.4M Series A led by EQT Ventures (TC)

Aniai, a startup building a burger-grilling robot, raised $12M in funding led by InterVest (TC)

IPO / Direct Listings / Issuances / Block Trades

Debt

HBC, the owner of department store chains including Saks Fifth Avenue, is working on refinancing a $1.3B loan (BBG)

Bankruptcy / Restructuring

Fundraising

Asterion Industrial Partners, Spain’s largest PE firm, is working to raise a new European infrastructure fund worth over $2.2B (BBG)

Crypto Corner

Exec’s Picks

Derek Thompson discussed why US media is in a meltdown on his Plain English podcast.

Jeremy Horpedahl explained how young people have more wealth than we previously thought.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter