Together with

Good Morning,

Short seller Andrew Left was criminally charged, SPAC deals are poised for a comeback, Hudson Bay accused the Fed of engineering lower long-end yields, and Bill Ackman delayed the IPO of his new closed-end fund.

Wharton Online & Wall Street Prep are back with their flagship Private Equity Certificate Program. Learn more below and level up your career with the world's most recognized private equity investing program.

Let’s dive in.

Before The Bell

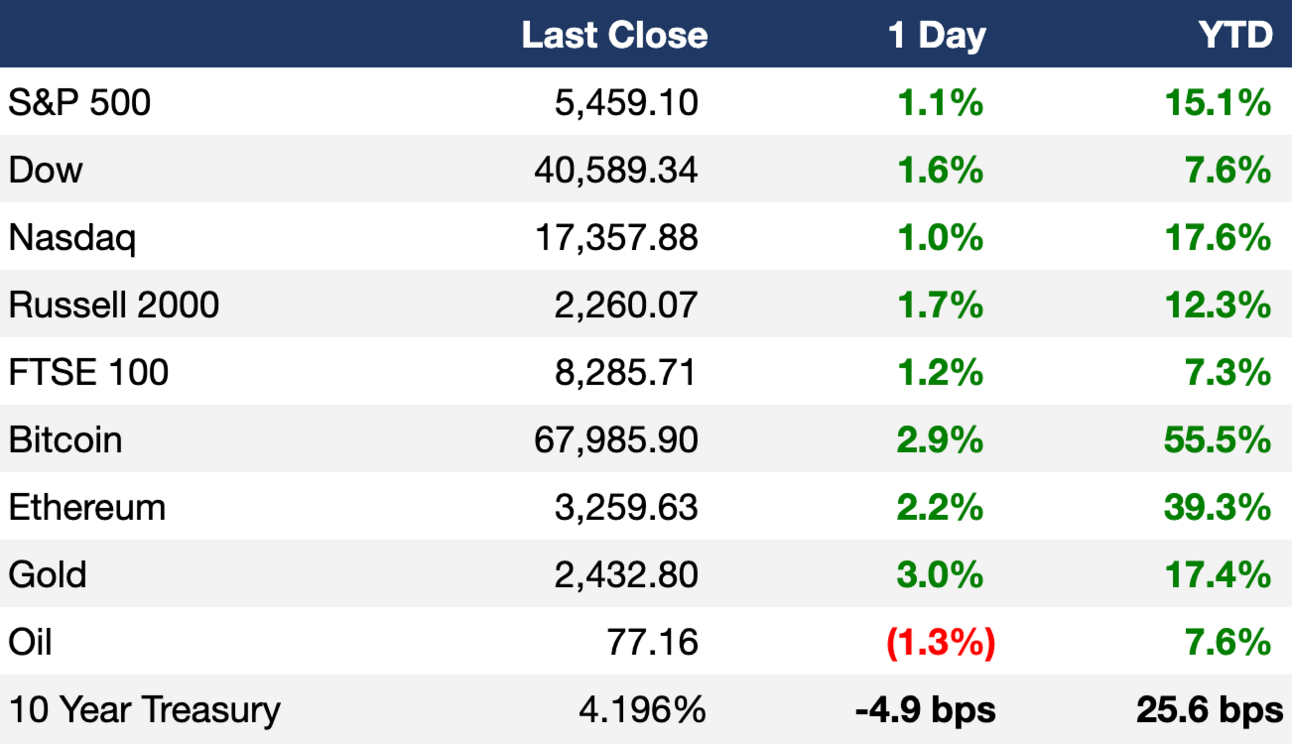

As of 07/26/2024 market close.

Markets

US stocks bounced back up on Friday after an optimistic inflation report

S&P and Nasdaq posted consecutive weekly losses for the first time since April

Dow notched its fourth-straight winning week for the first time since May

Russell 2000 posted its first three-week win streak since May

Nasdaq 100 is down 8% from its July ATH

Oil fell for a third-straight week as China demand raises concerns

Markets are looking ahead to another week of Big Tech earnings and clues from the Fed's rate decision this week

Earnings

What we're watching this week:

Today: McDonald's

Tuesday: Microsoft, AMD, PayPal, Starbucks, P&G

Wednesday: Meta, Qualcomm, Boeing

Thursday: Apple, Amazon, Intel, Coinbase

Friday: ExxonMobil, Chevron

Full calendar here

Headline Roundup

Short seller Andrew Left is facing criminal charges (CNBC)

PCE index growth slowed to 2.5% YoY (CNBC)

High-yield is outperforming high-grade EM debt amid US election uncertainty (BBG)

US equity funds drew inflows last week despite a massive tech selloff (RT)

Global equity funds drew inflows for a fifth-straight week (RT)

Funding surge for SPACs are pointing to a bounceback (FT)

Dealmaking revival hands bumper profits to UK 'magic circle' law firms (FT)

Investors have saved ~$100B in fees by investing in index funds (FT)

US consumers are showing signs of flagging (FT)

Home insurers suffered their worst loss since 2000 last year (FT)

Vanguard warned investors over company stake limits (FT)

Hudson Bay's study on US Treasury issuances sparked a debate (RT)

US Treasury will likely keep auction sizes steady for now (RT)

Yellen said the energy-transition requires $3T/year (RT)

Nine banks settled for $120M over European bond price fixing (RT)

Apple's will delay the launch of Apple Intelligence (BBG)

Howard Schultz opposed Starbucks' settlement with activist Elliott (FT)

Online sports betting adds to consumer credit stress (BBG)

Deadpool & Wolverine blew past a box office record (WSJ)

A Message From Wharton Online & Wall Street Prep

Dive into the world of Private Equity with Wharton Online and Wall Street Prep!

Our acclaimed Private Equity Certificate Program is back, offering a comprehensive 8-week online journey designed for those looking to upskill their PE knowledge or those aspiring to break into the industry.

Beyond learning the technical skills from the top instructors on Wall Street, you’ll hear from top industry executives like David Rubenstein, co-founder of The Carlyle Group, and Martin Brand, Sr. Managing Director at Blackstone.

While the course ends after 8 weeks, you can continue to grow your network through exclusive networking opportunities, LinkedIn groups, and targeted recruitment events with leading firms.

Enroll by August 12th and save $500 with code LITQUIDITY. Start your journey into private equity—click below to get details about the curriculum, speakers, and exclusive networking opportunities!

Deal Flow

M&A / Investments

Apollo agreed to buy International Game Technology's gaming division and gambling machines firm Everi in a $6.3B cash deal (BBG)

Sports PE firm Arctos Partners is in advanced talks to back a management buyout of BCI's majority stake in European private credit giant Hayfin at a $1.3B valuation (FT)

Convenience store chain Casey's General Stores will acquire gas station operator Fikes Wholesale in a ~$1.2B cash deal (RT)

Vital Energy is nearing an all-cash deal to acquire PE-owned Point Energy Partners for $1.1B (RT)

Regional lender WesBanco will acquire smaller rival Premier Financial in a $959M all-stock deal (RT)

Apollo Global invested $700M in Sony Music (RT)

German media group ProSiebenSat.1 is seeking buyers for its online businesses Verivox and Flaconi, with Verivox being potentially valued at $543M (RT)

Indonesia-based Yupi Indo Jelly Gum attracted takeover interest from TPG, Blackstone, and KKR for a potential ~$500M deal (WSJ)

Qatar Airways is in talks to buy a 20% stake in South African airline Airlink (BBG)

China-owned Sinochem is in talks to sell a minority stake in a Brazilian offshore oil and gas field to independent producer Prio (BBG)

VC

Egyptian fintech MNT-Halan raised $156M at a $1B+ valuation from DPI, Lorax Capital Partners, and more (TC)

Cowbell, a startup providing cyber insurance for SMEs, raised a $60M Series C led by Zurich Insurance (FN)

Maurten, a sports nutrition company, raised $21.6M in funding led by Iris Ventures (FN)

Fractile, a startup building a new AI chip, raised a $15M seed round led by Kindred Capital, NATO Innovation Fund, and OSE (EU)

ZeroTier, a startup building secure network connectivity software, raised a $13.5M Series A led by Battery Ventures (TC)

Passionfruit, a UK platform for businesses to collaborate with independent workers, raised a $9M Series A led by Seaya (FN)

Energy management platform Greenely raised an $8.7M Series A led by Korys (TC)

Primary Portal, a platform digitizing ECM processes or banks and asset managers, raised a $7.5M Series A led by DB1 Ventures (EU)

IPO / Direct Listings / Issuances / Block Trades

Indian electric scooter company Ola Electric's IPO is targeting a ~$4.3B valuation in its India IPO this week (RT)

PE firm Thoma Bravo is seeking $2.7B from a sale of half its stake in Nasdaq (BBG)

Spot work startup Timee rose ~30% in its Tokyo debut, earning a ~$1.1B valuation (RT)

Latam Airlines climbed 2.9% in its trading debut after its $456M US IPO (BBG)

Chinese driverless technology startup WeRide filed for a US IPO (BBG)

Debt

British lender NatWest will buy a portfolio of prime residential mortgages from Metro Bank for $3.1B (CNBC)

A group led by Morgan Stanley will provide a $2B debt package to finance KKR's acquisition of edtech Instructure (BBG)

India’s Mankind Pharma selected Barclays and Deutsche Bank to arrange financing for its proposed $1.6B acquisition of Bharat Serums & Vaccines (BBG)

Bankruptcy / Restructuring

Apollo Global and banks led by Bank of America and Barclays are in restructuring talks for telecom Brightspeed's debt that would require $3.5B in new financing (BBG)

Fundraising

Crypto Corner

Exec’s Picks

Bloomberg Businessweek published an interesting piece on the $12,000 Harvard class celebrities are fighting to get into.

Financial Services Recruiting 💼

If you're currently a junior banker looking to break into the buy side, lateral to another investment bank, or consider new paths amid changing market dynamics, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, debt funds, and investment banking.

To get started, simply head over to Litney Partners and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter