Together with

Good Morning,

George Soros is turning over control of his empire to his son, the Fed is set to pause rate hikes, Sunak wants the UK to embrace AI, UBS will impose restrictions on CS bankers, Netflix subscriptions are rising as the streaming platform cracks down on password sharing, and Egypt’s inflation hit 40% in May.

Breakthrough the research noise faster. Tegus has 60k+ expert interview transcripts, and the most robust benchmarking, charting and comps tooling. You can trial the platform right now, for free!

Let’s dive in.

Before The Bell

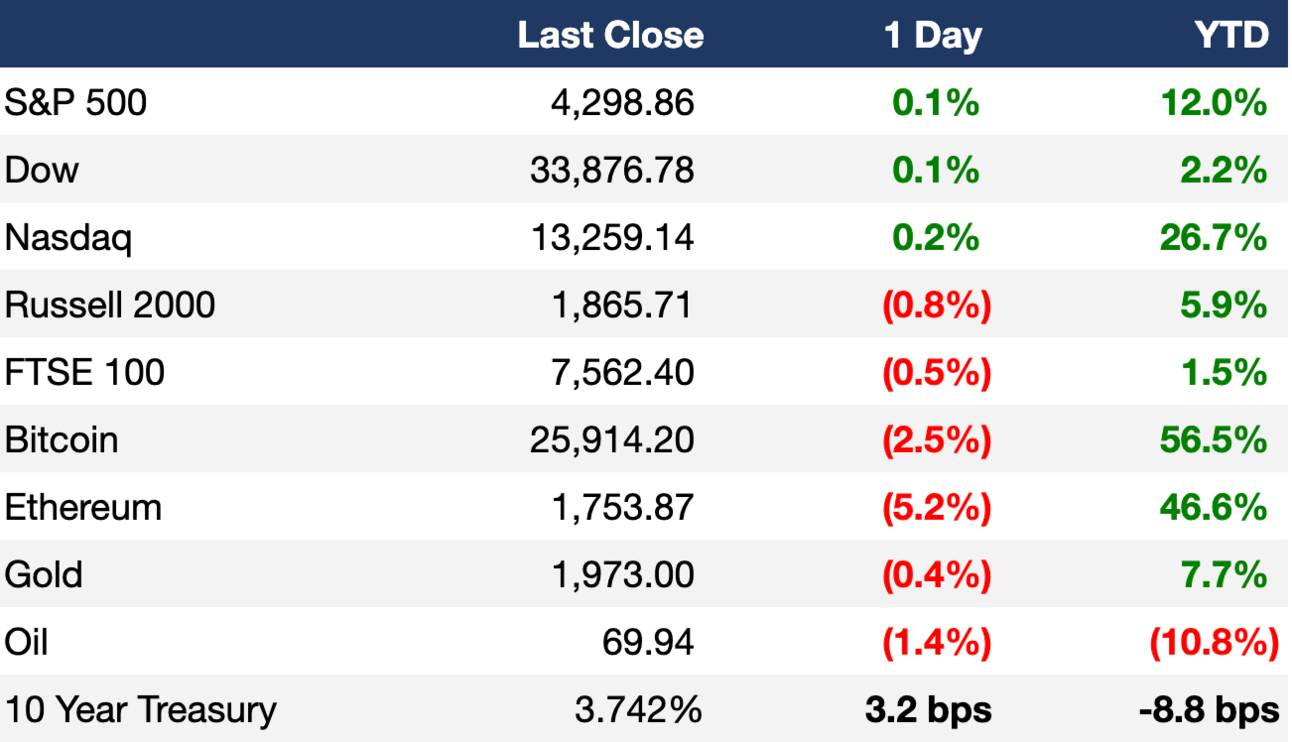

As of 6/9/2023 market close.

Markets

Stocks rose to close the week as investors prepare for the Fed’s next decision on rate hikes

The S&P 500 closed up more than 20% from its October lows on Thursday, marking the start of a new bull market, while the Nasdaq has risen for seven straight weeks

Tuesday morning will bring investors the CPI report for May, a release that will come just hours before the start of the Fed's two day FOMC meeting

Earnings

Headline Roundup

Fed is set to pause and observe effects of rate hikes (BBG)

Billionaire George Soros hands control of empire to son Alex (RT)

BioNTech faces first German lawsuit over alleged COVID vaccine side effects (RT)

Illumina CEO Francis deSouza resigns after battle with Icahn (RT)

UK must seize opportunities of AI to remain a tech capital - Sunak (RT)

Layoffs hit Colorado space companies as funding remains tight (CNBC)

Germany refused Intel's additional demand for subsidies for chip plant (RT)

UBS to impose restrictions on Credit Suisse bankers after takeover complete (RT)

World Bank must drive private investment in climate transition, new chief says (RT)

US House Republicans unveil broad package of tax cuts (RT)

Bank of Korea warns of financial risk as real estate loans fail (BBG)

Netflix subscriptions rise as password-sharing crackdown takes effect (CNBC)

Activision intervenes in Microsoft challenge to UK regulator's block (RT)

Egypt's core inflation rises to 40.3% in May (RT)

A Message From Tegus

Tegus is your go-to research destination for bold investing.

They curate expert insights, analysis, and financial data to give you a powerful perspective for your investment decisions. With lightning-fast access to over 60,000 transcripts across 20,000 companies, you’ll discover a wealth of unique insights to fuel your fundamental research.

Gain perspectives, synthesize information, and model outcomes—all on Tegus.

For free trial access to Tegus, click here.

Deal Flow

M&A / Investments

Crop trader Bunge is nearing a majority stock deal to acquire Glencore-backed Viterra as early as Monday or Tuesday, creating a $25B-$30B agriculture trading giant (BBG)

KKR has improved its previous bid for the landline grid of Telecom Italia by $2.2B to ~$24.7B (RT)

Commodities giant Glencore approached Canadian miner Teck Resources to purchase its ~$8.2B coal business as an alternative to the previous $23B bid for the whole company (WSJ)

$7B online payroll vendor TriNet Group is exploring a sale of the company (RT)

PE firm Nordic Capital is in talks to potentially acquire Swiss banking software maker Temenos, which has a market value of $6.7B (BBG)

UBS’s $3.4B acquisition of Credit Suisse is expected to close today according to an internal memo by the Credit Suisse CEO (RT)

Brookfield Asset Management has agreed to acquire digital payments service provider Network International Holdings for $2.8B (BBG)

PE firm Permira is weighing options for luxury sneaker maker Golden Goose, including an IPO or potential sale that would value the company at $2.7B (BBG)

AstraZeneca has signed deal potentially worth up to $2B with Quell Therapeutics to develop cell therapies for autoimmune diseases (RT)

Chase, a $1.2B market cap chemicals maker, is considering a sale and has drawn a bid from PE firm Pritzker Private Capital (RT)

Visa is nearing a deal to acquire Brazilian fintech Pismo at a valuation of up to $1B (BBG)

Investment firm EQT gave an unsolicited $773M buyout proposal to UK’s Alfa Financial Software (RT)

Morgan Stanley Infrastructure Partners is in the lead to purchase Spanish construction firm Sacyr's waste management unit Valoriza Servicios Medioambientales in a $645M deal (RT)

Online healthcare portal WebMD is acquiring employee wellbeing company Limeade in a $75M cash deal (RT)

Brazilian petrochemical company Unipar has presented a non-binding offer to acquire a controlling stake in petrochemical giant Braskem (BBG)

French media conglomerate Vivendi’s acquisition of France’s largest publisher Lagardere has been given conditional approval by EU antitrust regulators (RT)

49ers Enterprises, the investment arm of the NFL team San Francisco 49ers, have purchased the remaining 56% stake of relegated club Leeds United from former owner Andrea Radrizzani (RT)

VC

Cybersecurity startup Blackpoint Cyber raised $190M in growth funding led by Bain Capital Tech Opportunities (FN)

Climate impact verification startup Sustaincert raised a $37M Series B from Partech, Hartree Partners, Citizen Capital, Innovacom, and Microsoft’s Climate Innovation Fund (FN)

Shift5, an onboard data company for commercial and military fleets, raised $33M in funding led by Moore Strategic Ventures (FN)

Cultured meat startup Uncommon raised a $30M Series A led by Balderton Capital and Lowercarbon Capital (TC)

Woltair, a Prague-based startup accelerating the deployment of heat pumps and renewable energy, raised a $22M Series A extension from new and existing investors (FN)

Ringover, a Paris-based provider of cloud communication solutions, raised a $21.5M Series B led by Orange Ventures and Bpifrance Large Venture (FN)

Genialis, a computational precision medicine startup, raised a $13M+ Series A led by Taiwania Capital and Debiopharm Innovation Fund (BW)

PartnerSlate, an online marketplace connecting food brands and contract manufacturers, raised a $4M round led by Supply Change Capital (PRN)

Source.ag, an AI provider for greenhouse growers, raised a $4M Series A extension from SK networks and the E14 fund (FN)

Craft beverage management software startup Ohanafy raised a $2.8M seed round led by Cape Fear Ventures (FN)

Battery technology startup About:Energy raised a $1.9M seed round led by HighSage Ventures, Vireo Ventures, and more (FN)

Philter Labs, a startup building tech to eliminate secondhand smoke, raised a $670K round from Atayf Investments (PRN)

IPO / Direct Listings / Issuances / Block Trades

Thyssenkrupp is planning to IPO its hydrogen division Nucera as soon as next week for up to $5.4B (RT)

GE Healthcare Technologies announced the pricing of a $1.95B secondary offering (BW)

Life Sciences company Labcorp is spinning off its clinical development unit Fortrea, which has been approved to list on Nasdaq (RT)

UAE fintech Optasia is weighing options that include either an IPO or potential sale (BBG)

Debt

State Bank of India, the country’s largest lender, plans to raise $6.1B this year through bond issuances to meet the rising demand for credit (RT)

Fortune Brands, a home, security, and commercial building products company, priced a $600M 10-year bond offering at 5.875% (BW)

German photovoltaics leasing firm Enpal received $462M in debt funding from investors including BlackRock, DWS, and ING (RT)

Bankruptcy / Restructuring

Slot machine operator Lucky Bucks has filed for bankruptcy and has reached a deal to cut $500M in debt and turn the company’s equity over to its lenders (RT)

A court dismissed 3M subsidiary Aearo Technologies’ bankruptcy after it attempted to resolve 266,000 lawsuits alleging that 3M earplugs caused hearing loss in veterans (RT)

Fundraising

Crypto Corner

Binance.US set to be cut off from banking system after SEC suit (BBG)

Instagram, YouTube, TikTok and Twitter are targets of an EU crypto advertising complaint (RT)

Nigerian authorities have ordered Binance to cease operations in Nigeria (RT)

Crypto ownership doubled in UK last year before new rules kick in (FT)

Exec’s Picks

Tim Alberta wrote an excellent piece breaking down the meltdown of CNN in The Atlantic.

Steven Sinofsky wrote a thorough piece on “platform businesses,” covering what they are, where they fail, platform life cycles, and everything in between.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter